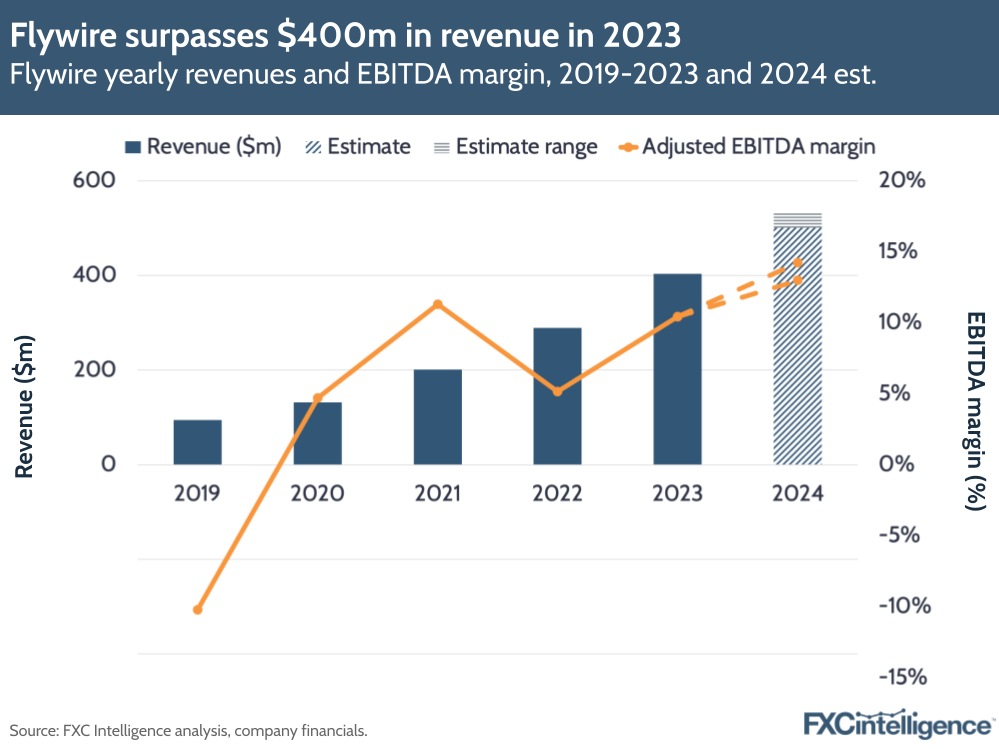

Flywire exceeded its 2023 revenue expectations in Q4 2023, and is now looking to boost its profit share even further in 2024. Revenues rose 37.6% to $100.5m, driving a 39.3% increase to $403.1m over 2023 as a whole. The main revenue driver was its education segment, bolstered by gains in travel and B2B, but the company did note a decline in its healthcare division.

In terms of profits, adjusted EBITDA rose to $7.7m in Q4, compared to $1m in Q4 2022, while Flywire’s adjusted EBITDA margin rose from 1.4% to 7.7%. Over the full year, Flywire’s adjusted EBITDA rose to $42m, up from $14.9m, which gave an adjusted EBITDA margin of 10.42%, compared to 5.15% in 2022.

Net losses also declined, rounding out a much more profitable year for Flywire, which has led it to forecast further growth in 2024. Investors responded positively, with the company’s stock price rising after the report came out.

Flywire also provided guidance for 2024, saying it expects revenues to rise 24-33% to $501m-535m and adjusted EBITDA to rise by 55-81% to $65m-76m. This would put the company’s adjusted EBITDA margin between 13% and 14%.

Flywire key revenue growth drivers in Q4 and FY 2023

Education was still key to Flywire’s growth, with stronger than expected volumes from new UK higher education clients, more use of payment plan capabilities in the US and higher Canadian payment volumes in Q4.

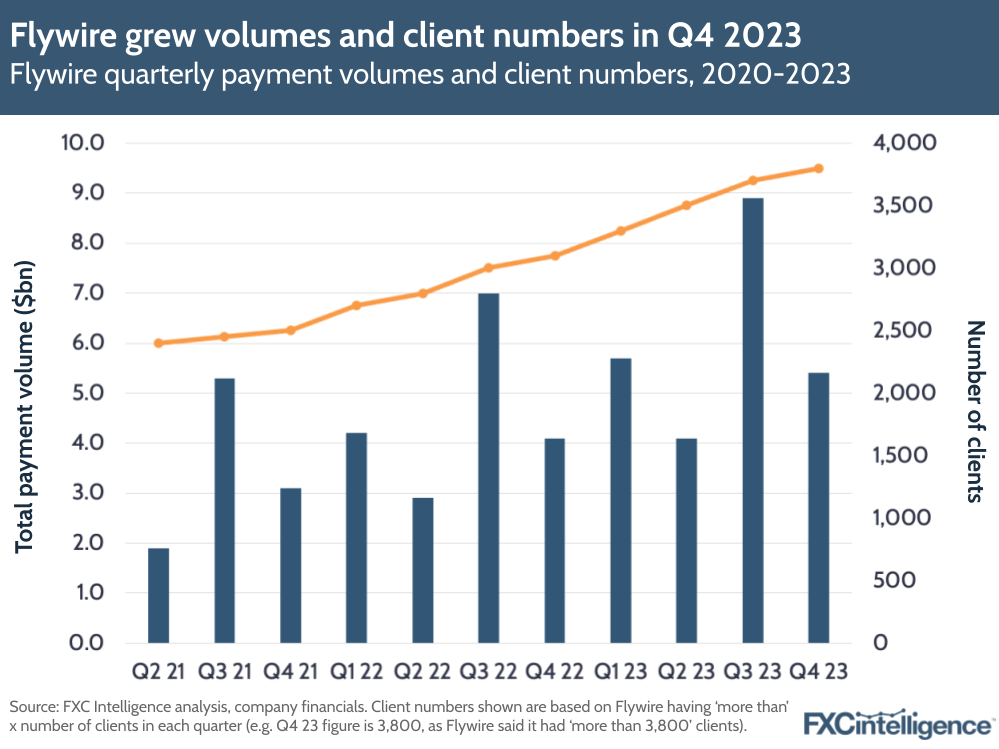

Total payment volume for the quarter was $5.4bn, up 33%, and for the full year was $24bn, also up 33%. Specifically, transaction revenue increased 45% compared to Q4 2022, driven by a 46% increase in transaction payment volume.

Flywire has boosted volumes through new client acquisition, having added over 170 new clients in Q4 and a total of 700 over the course of the year. However, it has also focused on retaining and expanding existing customers. Net revenue retention was 125% in 2023, while the company has managed to maintain client retention at over 95% per annum.

Executives said a key part of its strategy is getting more from its existing clients – for example, by growing the payment network to capture more payments.

Driving higher profits and net income against growing expenses

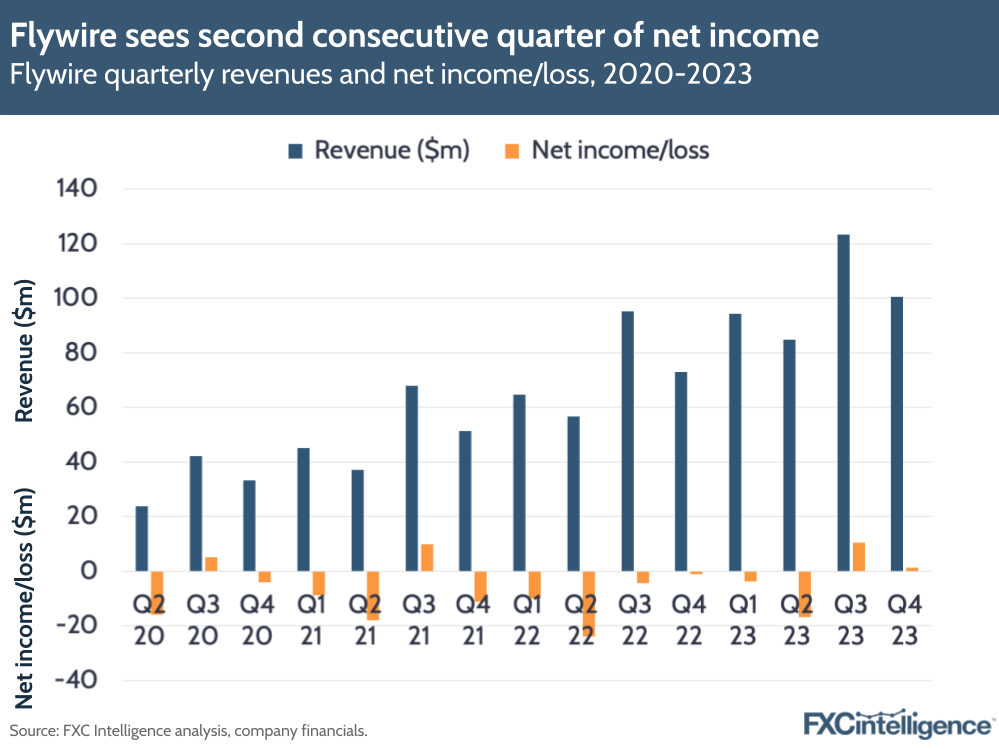

In addition to the profit figures provided above, Flywire noted that its gross margin for Q4 was 66.1%, up from 56.8% last year, while for FY 23 the margin was 61.4%, a 100 bps increase from 2022.

This growth was driven by monetisation rates on transactions and improved economics with payment partners, though the company noted its was offset by strong growth in transaction revenue versus platform-based revenue.

Flywire also saw its second consecutive quarter of net income, at $1.3m, compared to a net loss of $1.1m in Q4 2022. Over the whole year, the company still saw net losses of $8.6m, but this was down significantly from $39.3m in 2022.

This appears to have been partly driven by lower losses from operations and higher interest incomes, despite higher total costs and operating expenses in 2023 than 2022. Also, Flywire noted it had reduced hiring by almost 50% YoY in terms of incremental run rate spending, which is reminiscent of Adyen’s recent hiring reduction.

Breaking down each of Flywire’s verticals

Education in non-US markets accounted for 55% of revenues minus ancillary services (up from 52% in 2022), while in the US education accounted for 24% (down from 30%), highlighting the growth of the company’s international presence. Travel and B2B grew by 123%; education grew by 53% and 19% in non-US and US markets respectively; and healthcare declined by 1%.

Across the segments it serves, the company still sees the biggest total addressable market in B2B at around $10tn, and it is continuing to sign larger deals in this area. In education, the company sees a total addressable market of $660bn, but this remains the key sector for Flywire, particularly with strong growth in the UK and throughout the APAC region, as well as a large number of new clients coming from the education segment. In addition, a number of delayed implementations went live in Q4, giving this sector a boost.

However, Flywire did note that changes in Canadian regulations did affect its revenue guidance for 2024. In particular, Canada announced in January that provinces are not expected to allocate study permits to schools until late Q1 2024 or early Q2 2024, which has already led to a reduction in student applications. Flywire did note this could have an impact on Q1 2024, which highlights the seasonality of education as a payments segment.

In the travel segment, Flywire mentioned a significant increase in clients signed, while on the decline in healthcare, the company is looking to target different segments at the hospital level with more bespoke strategies to help it see a return to growth in 2023.

Flywire’s 2024 strategy

Going forward, Flywire aims to continue to grow its client base while expanding its payment network in the US and abroad.

Its most recent moves towards this have been focused on education in the APAC region, with its acquisition of Studylink; a partnership with WeChat Pay to enable cross-border payments for Chinese students; and a partnership with State Bank of India.

The company wants to bolster its go-to-market strategy with more investment in sales and relationship managers, though outgoing CFO Mike Ellis mentioned Flywire would target ‘disciplined spending’ to help it achieve adjusted EBITDA margin expansion in 2024.