Western Union has reported its Q1 2024 results and though the company only reported top-line revenue growth of 1% on a reported basis, or 3% on an adjusted basis excluding its now-sold Business Solutions segment, this masks stronger growth in key segments across the business.

The quarter was WU’s third strongest in terms of top-line growth in over two years, with the company’s digital business in particular being key to growth, alongside increases in some regions and growth in its Consumer Services segment.

Western Union also saw transactions increase by 6%, while cross-border principal grew by 7% YoY.

However, its GAAP operating margin was 18.3% in Q1 2024, putting it below Q1 2023’s 19.7% as a result of increased operating expense redeployment costs, largely around marketing spend.

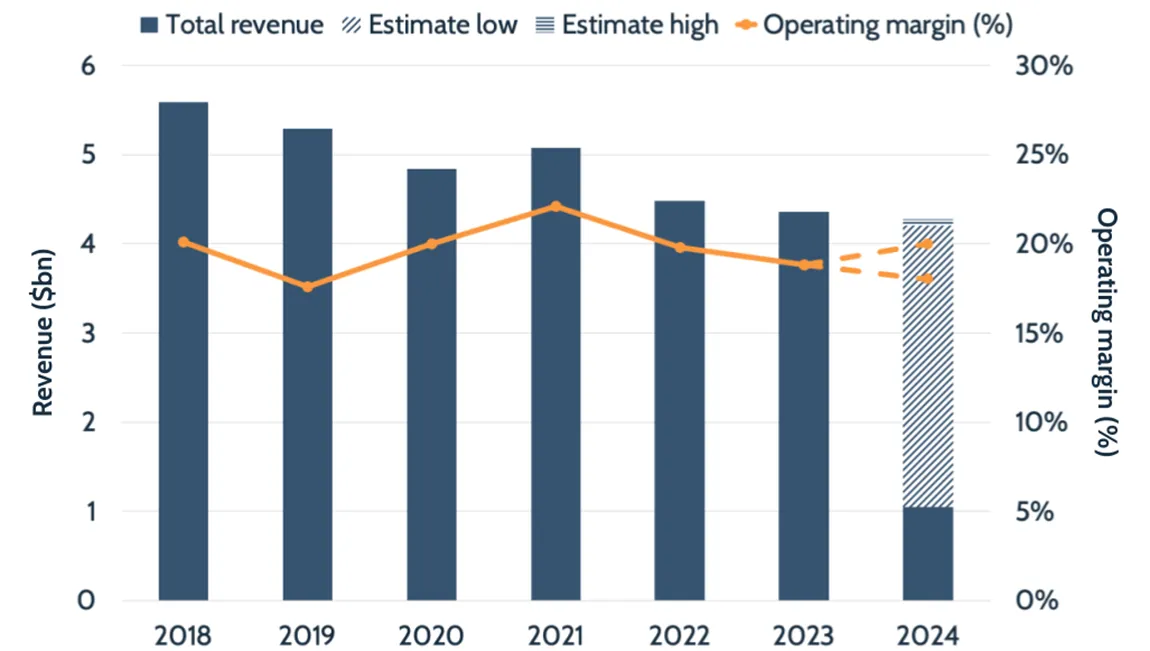

Despite this, the earnings were above expectations, prompting a share price rise, and Western Union has increased its outlook for 2024, with GAAP revenue now expected between $4.13bn and $4.2bn, up from its previous projection of $4.08bn-4.18bn. Operating margin projections remain at 18-20%.

Digital serves as key growth driver for Western Union in Q1 2024

While Western Union saw its C2C revenue increase by 3% in the quarter – up from -1% in Q4 23 – its branded digital revenue growth significantly outpaced this, increasing by 9% on a reported and adjusted basis. This is the segment’s strongest growth since Q4 2021 and is the third consecutive quarter of positive growth following five consecutive quarters of decline. Branded digital revenue now accounts for 23% of all C2C revenue for Western Union.

Digital also outpaced consumer money transfers on transactions. While C2C saw a 6% increase on transactions, branded digital saw transactions increase by 13% in Q1 2024.

The growth of digital represents a critical win for Western Union as the company’s digital business has been increasingly outpaced by fast-growing digital native players Wise and Remitly. It also reflects a key focus on the company’s Evolve 2025 strategy, which is centred around achieving sustainable, profitable revenue growth by 2025.

Other drivers of growth for WU’s C2C business also came from its digital white label business, while its retail business has continued to stabilise. Here the company highlighted growing levels of migration globally, and once again pointed to the importance of its retail business as a gateway to its other digitally focused services. WU in particular sees its retail outlets as key to building an initial relationship with new migrants, before transitioning them to the digital experience.

In support of this, the company has enhanced its retail capabilities, adding a One-Step Refund feature in addition to the previously launched Quick Resend service, and is also expanding the rollout of its Universal Customer ID to enable customers to be alerted when their remittance has been delivered as well as providing recommendations for recipients.

Middle East and the Americas drive WU’s regional growth

Looking geographically, Western Union’s C2C business was very much a story of two halves in Q1 2024. Middle East, Africa and South Asia (reported as MEASA) saw the strongest growth, increasing 16% YoY. This segment now accounts for 21% of the business, up from 19% a year ago.

Second was Latin America and the Caribbean (LACA), which saw 7% YoY growth in the quarter and now accounts for 12% of revenue, up from 11% in Q1 2023. North America (NA) also saw 2% growth in Q1 2024 and now accounts for 38% of revenue.

However, there were also several regions that saw significant drops in revenue. While Europe and the Commonwealth of Independent States (reported as EU & CIS) saw a contraction of -5%, Asia-Pacific (APAC) saw a reduction of -10% YoY. This underscores the fact that while WU has improved significantly compared to much of 2023, it still has some way to go to reach its goal of sustainable growth.

Consumer Services gains key ground

A critical future focus for WU, however, is likely to be Consumer Services, a segment that until recently was reported as ‘Other’ on the company’s balance sheet.

This covers additional consumer-focused products and in the past has largely focused on retail money orders and bill payments. In Q1 2024, Consumer Services saw revenue growth increase 5% year-on-year, or 8% on an adjusted basis, largely buoyed by its retail money order services. It also accounted for 8.3% of Western Union’s revenue – its highest so far.

However, the company is increasingly looking to grow this segment, targeting annual double-digit growth “for the foreseeable future” and has introduced several new services that have begun to contribute to revenue growth. These include foreign exchange, prepaid debit cards and digital wallets.

While WU has been launching such services in some markets over the last 18 months, it gave a number of examples of key recent launches during the earnings call. These included the launch of its digital wallet in Brazil in April. This was its second in the LatAm region and one of the few countries where WU’s digital business is already larger than its retail business in terms of transactions.

It follows WU’s launch of a digital wallet in Argentina under the Pago Fácil brand in late 2023. Here, the company provided some first insights into its performance, with 100,000 wallet-based customers now onboarded. The company reported that 38% of inbound funds in Q1 came from redirects of inbound remittances, while 35% of active monthly users made a bill payment transaction and 28% added or took out cash.

The company sees this type of relationship as key to creating a two-sided network with its customers, and believes that these kinds of approaches are key to improving retention in the future.

How does Western Union’s pricing compare to other money transfer providers?