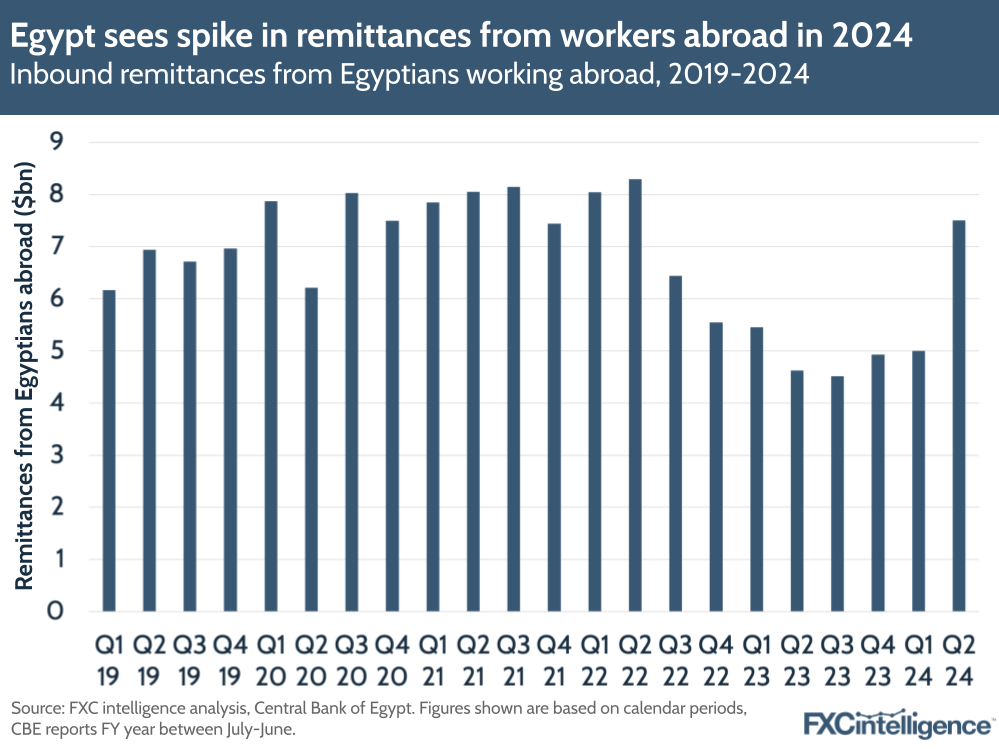

The Central Bank of Egypt (CBE) has reported that remittances from Egyptians abroad surged by 87% YoY in July 2024 to reach $3bn, with the bank calling the rise “unprecedented”. Here’s a closer look at what’s happening in this market and why it matters.

Including its July figures, the CBE reported that in the first seven months of 2024, remittances from Egyptians abroad have risen 32.4% to $15.5bn. Breaking this out on a quarterly basis, the country saw around 62% growth in Q2 2024 to $7.5bn – the most significant quarterly growth in remittances Egypt has seen in the last few years.

The surge follows a period of decline in remittances from Egyptians abroad, some of which has been linked to macroeconomic events, such as decreased tourism and job losses for Egyptian expats during the pandemic; rising inflation and interest rates; the Russia-Ukraine war and supply chain challenges. Some of these factors led to slowing growth and declining remittances from higher-income countries into low and middle-income (LMIC) nations, such as Egypt.

Facing a shortage of foreign currencies (which we’ve seen cause serious problems in Nigeria), some Egyptian banks began restricting foreign currency transactions. The country has also been struggling with a parallel exchange market, which in February 2024 reportedly facilitated transfers into the country at more than double the official exchange rate.

However, Egypt has seen a rebound in remittances after new reforms introduced in March, aimed at targeting international investment and combatting inflation. The country raised interest rates by an unprecedented 6% and floated its currency, the Egyptian pound, which immediately plummeted in value. The currency demand was part of a deal with the International Monetary Fund (IMF) increasing its proposed loan to the country from $3bn to $8bn. Egypt’s government has also been consistently introducing initiatives to boost remittances from Egyptians living abroad, such as new high interest dollar savings certificates that incentivise saving in USD with high returns.

Aside from the IMF deal, Egypt also announced a $35bn cash pledge from the UAE for a new coastal development in February, as well as signing a €7.4bn ($8.1bn) migration deal with the EU in March. Driven by these developments, Egypt’s foreign reserves are flying high, surpassing $46bn in May and continuing to rise in August.

Despite declines during the pandemic, Egypt is still a big receiver of inbound remittances globally (as supported by our market sizing data). While a turnaround in inbound remittances and investment from other countries is welcome, the case demonstrates the potential exposure of Egypt and other emerging players to FX challenges, particularly during periods of economic upheaval.

Who are the main competitors on inbound remittances to Egypt?