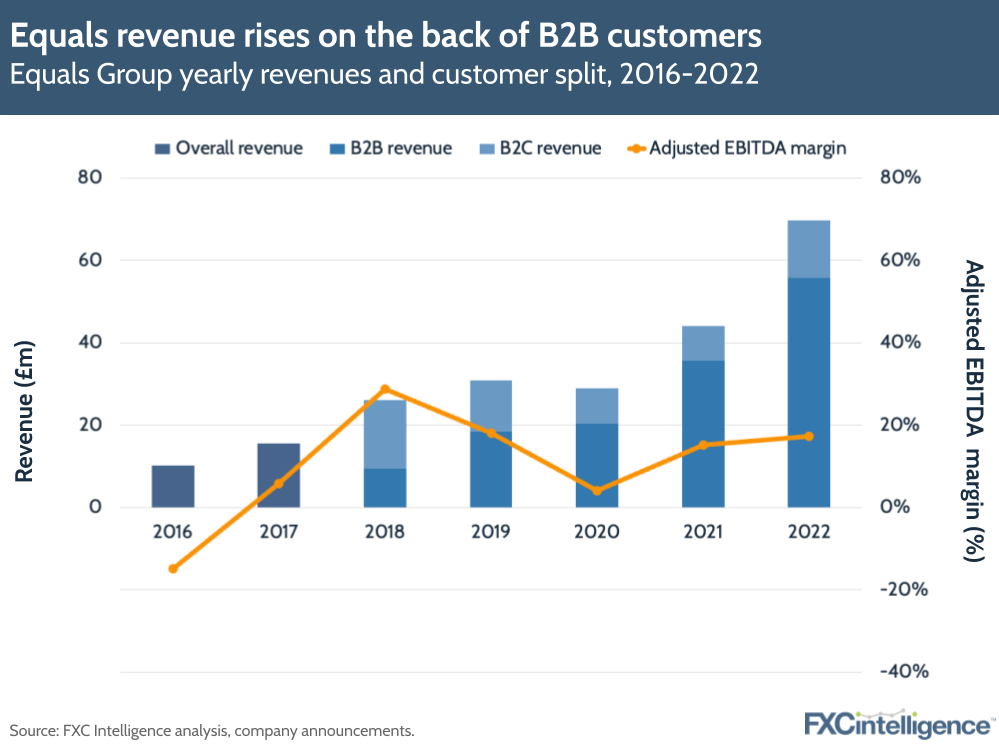

Corporate payments provider Equals continued its growth run in FY 22, with revenues rising 58% to £69.7m. Having shifted to a B2B focus in recent years, the company’s platforms are growing more profitable, with adjusted EBITDA rising 81% to £12.1m, bringing adjusted EBITDA margin up to 17.4%.

Revenue was once again driven by Equals’ B2B transactions, which had an 80% share in revenues, while transactions executed across all platforms grew 41% to £9.2bn. Equals is carving out a piece of the B2B payments market through Equals Money, its broader bank account product pitched at SMEs, and Equals Solutions, its international payment network for large enterprises.

Equals’ international payments segment grew 33% to £34.4m and card-based revenues grew 45% to £12.5m. Equals Solutions grew 333% to £15.6m, meaning its overall share of revenues grew from 8% to 22%, while its transaction values grew by 137%.

The figures indicate that the company is growing on the back of bigger businesses and larger transactions. Large corporates contributed 23% of revenues, up from 12% in 2021, while combined consumer and SME share declined from 28% to 24%.

To bolster B2B revenues further, Equals recently sold its travel cash business and is acquiring payments provider Roqqett, which will allow the company’s customers to acquire payments from customers through open banking methods.

As well as integrating Roqqett and other acquisitions, the company mentioned a number of projects for 2023, including offering multi-currency corporate accounts in the US; providing a full white label solution for Equals Money; and automating outbound payments via SWIFT, FasterPayments and the Single Euro Payments Area (SEPA) system.