This week saw the publication of a pair of reports from the Financial Stability Board that have landmark implications for the cross-border payments industry. Focusing on the G20’s targets for cross-border payments, these are the first in what will become a yearly publication and are underpinned by a number of key datasets, including extensive retail market data from FXC Intelligence.

The two reports, Annual Progress Report on Meeting the Targets for Cross-Border Payments: 2023 Report on Key Performance Indicators and its companion, G20 Roadmap for Enhancing Cross-border Payments: Consolidated progress report for 2023, lay out the KPIs for meeting targets in cross-border payments as well as the progress made so far.

Our data is key to two out of the three areas (retail, wholesale and remittances) the report focuses on. While we directly supplied the data for the retail section, the remittances section includes use of the World Bank’s Remittance Prices Worldwide dataset, which we also provide the underlying data for.

While the KPIs are primarily targeted at the G20, and were the focus of discussion at the latest meeting of the G20 Finance Ministers and Central Bank Governors this week in Morocco, the report highlights that the private sector has a significant part to play in reaching the goals laid out for 2027, making this key for all banks and payments companies in the industry.

Key takeaways from the FSB’s cross-border payments reports

Here are some of the key takeaways from the inaugural reports:

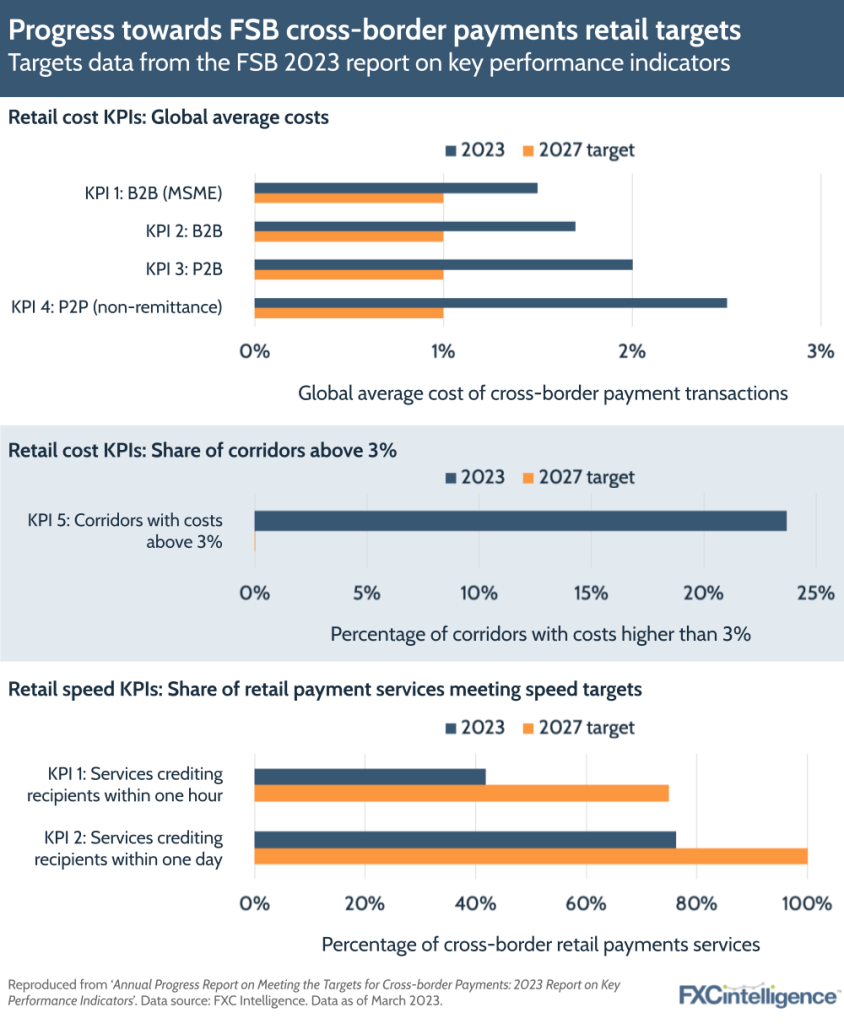

- There is some way to go to achieve all of the targets laid out for 2027. In the retail space, all cost KPIs are currently above the targeted average of 1%, with non-remittance P2P cross-border transactions the highest – at 2.5%. Almost a quarter of corridors are also above the targeted maximum average cost of 3%. Speed targets are also significantly below their goals for the retail sector.

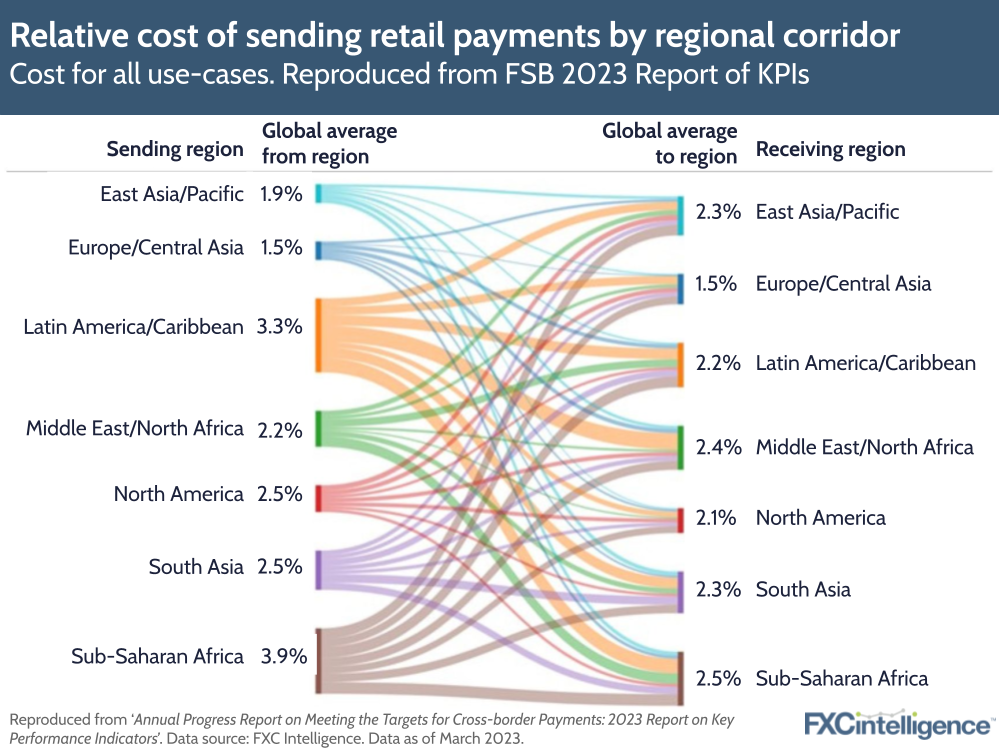

- User experiences are highly varied across regions, regardless of the market segment involved. For example, costs vary significantly by sending region, with Sub-Saharan Africa seeing retail FX costs more than three times those of Europe and Central Asia, while Latin America and the Caribbean saw retail fee costs more than twice as high as the Middle East and North Africa. In general, lower income regions were the furthest from cost and fee targets across wholesale, retail and remittances.

- The industry is already taking steps towards the targets, although how much varies by region and area. For example, adoption of the ISO 20022 payments messaging standard has been enacted by over 100 jurisdictions, and institutions in over 200 countries and territories are receiving payment messages using the standard. Over a dozen countries are also making improvements to their real-time gross settlement systems to improve access or times of operation.

- Collaboration between the private and public sector has a key role to play in achieving the targets. The CPMI payment interoperability and extension taskforce, which focuses on public-private collaboration, has already been set up to focus on this, and other local efforts will also be required. Meanwhile the Legal, Regulatory and Supervisory Frameworks taskforce is designed to help the public sector to combat regulatory frictions while improving regulatory effectiveness.

- Reaching the 2027 targets will require efforts beyond the G20 alone. This is being supported by efforts from the International Monetary Fund and the World Bank through their technical assistance programme, while the CPMI has also established a community of central banks that extends beyond the G20 – focusing on their role as payment system operators.

How are FXC Intelligence’s global indices products helping organisations?