Among the key global transaction banking players, Standard Chartered has long been one of the most openly focused on cross-border payments, and its FY 2024 results only continue to underscore that. In addition to centring cross-border payments in its overall strategy, the bank outlined ambitious targets for its Corporate and Investment Banking (CIB) division.

While the bank overall saw revenue climb 14% on a constant currency basis to $19.7bn for FY 2024, its CIB division, which is responsible for the majority of Standard Chartered’s cross-border income, saw revenue grow 5% YoY to $11.8bn, of which 51% was from financial institution clients.

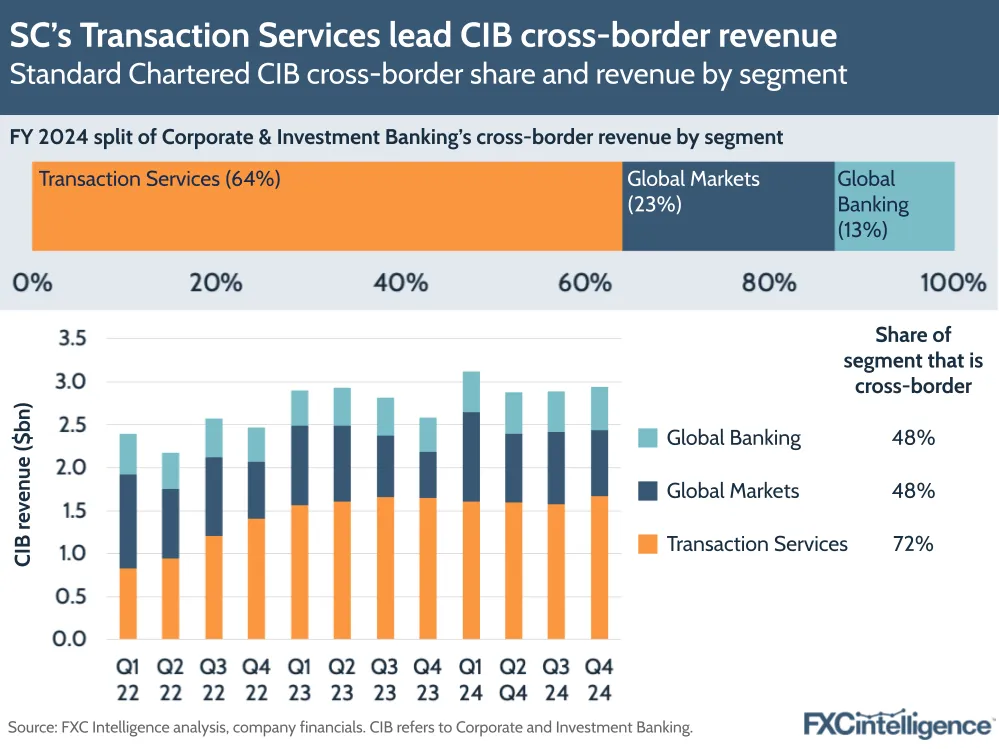

Within this, cross-border revenue, which the company sometimes refers to as network income, accounted for 61% of CIB revenue, retaining its share from 2023 and remaining considerably up on 2022’s 54% share. This means that CIB saw $7.2bn revenue from cross-border in FY 2024, a roughly 5% increase on FY 2023’s $6.8bn.

One third of this was generated from intra-Asia flows, while around 20% is inbound into countries in the Association of Southeast Asian Nations (ASEAN). Standard Charted also noted that only around 1% of CIB total revenue, and around 2% of CIB cross-border revenue, is from flows between the US and China.

Standard Chartered also announced that it is working towards a medium-term cross-border revenue share target for its CIB division of 70%. If it were to reach this in 2027, while retaining the same CIB YoY growth for the next few years that it saw in 2024, this would translate into around $9.7bn in 2027 cross-border revenue for the division – a target that would require cross-border revenue to grow at around 10% a year for the next few years.

While the CIB division sees cross-border payments play a role in all three of its segments, Transaction Services accounts for the majority of cross-border revenue, at 64% of the cross-border total in FY 2024, while Global Markets accounted for 23% and Global Banking 13%. This means that almost three quarters of Transaction Services revenue is cross-border, while just below half of Global Banking and Global Markets is.

However, while the bank expects cross-border to grow over the next few years, in 2024 margin compression saw Transaction Services revenue remain flat YoY on a constant currency basis, although increased FX volumes helped boost Global Markets’ flow income and so drive a 15% YoY revenue increase. Global Banking, meanwhile, also saw 15% growth, driven by greater pipeline execution.

How can my bank more effectively compete in cross-border payments?