As part of Sibos, Swift announced two partnerships that speak to the organisation’s future strategy in a marketplace increasingly crowded with competing networks: one with Wise Platform and another with Visa. We look at the two partnerships and their potential impact for the participants.

Swift and Wise Platform

An extension of an existing collaboration between the two companies, the announcement of Swift and Wise’s partnership included Wise CEO Kristo Käärmann taking a break from his sabbatical to appear onstage in a keynote with Swift’s CEO Javier Pérez-Tasso to discuss the move.

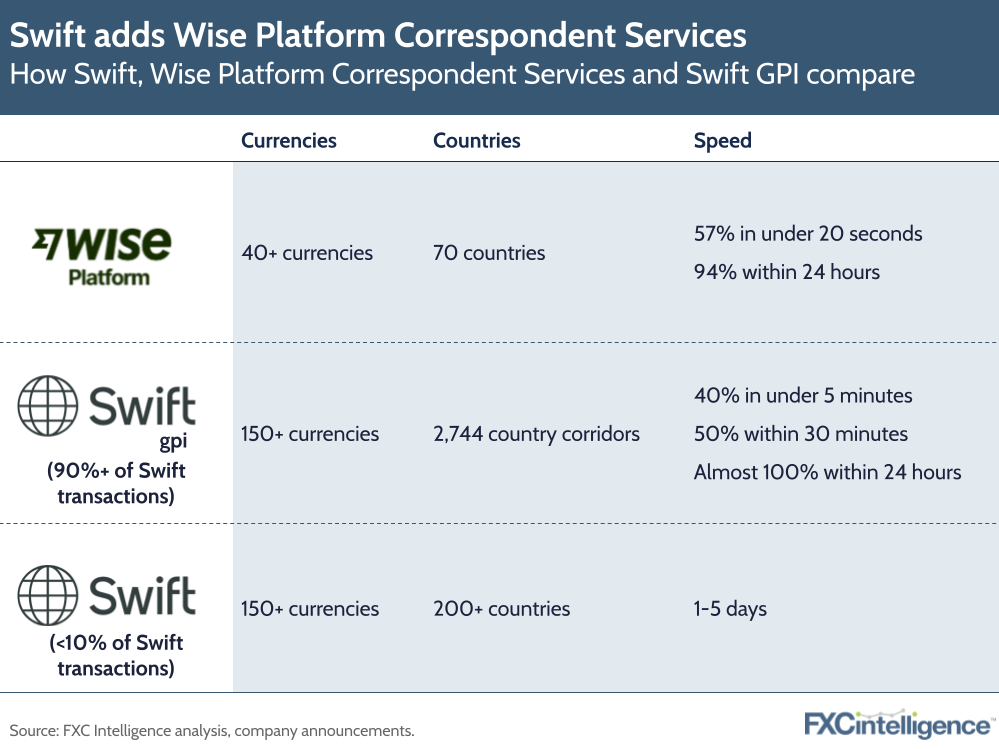

Through the partnership, financial institutions will be able to route Swift payment messages through Wise’s white-label service Wise Platform via its new Correspondent Services solution. This will enable them to continue to initiate payments via Swift with the same MT or MX messages, but have them sent via Wise.

Whilst Wise has been working with Swift for many years, this announcement was really about Wise Platform and how this capability has now become a full part of the product. It is hoped (for Wise Platform) that it can help some potential partners integrate with them in a week as opposed the alternative of a longer full API integration.

Such an approach enables Wise to support more high-value payments, while Swift customers have access to a network that may be faster in many cases. At present, Wise Platform Correspondent Services sees 57% of payments delivered instantly and 94% within 24 hours, at a potentially lower cost than other services.

The solution enables Swift to continue to serve customers that may otherwise have been lured away to Wise or other players, while for Wise this allows the company to serve more customers without needing to onboard them directly. This also speaks to Wise’s long-term strategy for its Platform product, which CFO Matt Briers previously told us includes enabling companies to build competitors to its Wise Account using the company’s infrastructure.

This announcement probably received the most attention at the whole event. Lots of positive views with many seeing this as the evolution of the sector. Others saw it as business as usual as Wise already worked with Swift. But not every bank was happy, with some seeing this as enabling a competitor to benefit from Swift but not have to use the Swift correspondent network (i.e., the banks).

Swift and Visa

Focusing on streamlining cross-border B2B payments, the partnership between Visa and Swift sees the companies improve the connectivity between their networks and increase the number of endpoints.

As part of the collaboration, Visa B2B Connect payments will be able to have upfront checks using Swift Payment Pre-Validation, while both networks will receive increased end-to-end visibility aided by Swift GPI.

For both parties, the collaboration provides incremental but key enhancements to their existing offerings, and echoes the wider collaboration-focused mindset that both companies have increasingly embraced.

Access FXC’s data on the segments of B2B cross-border growing fastest