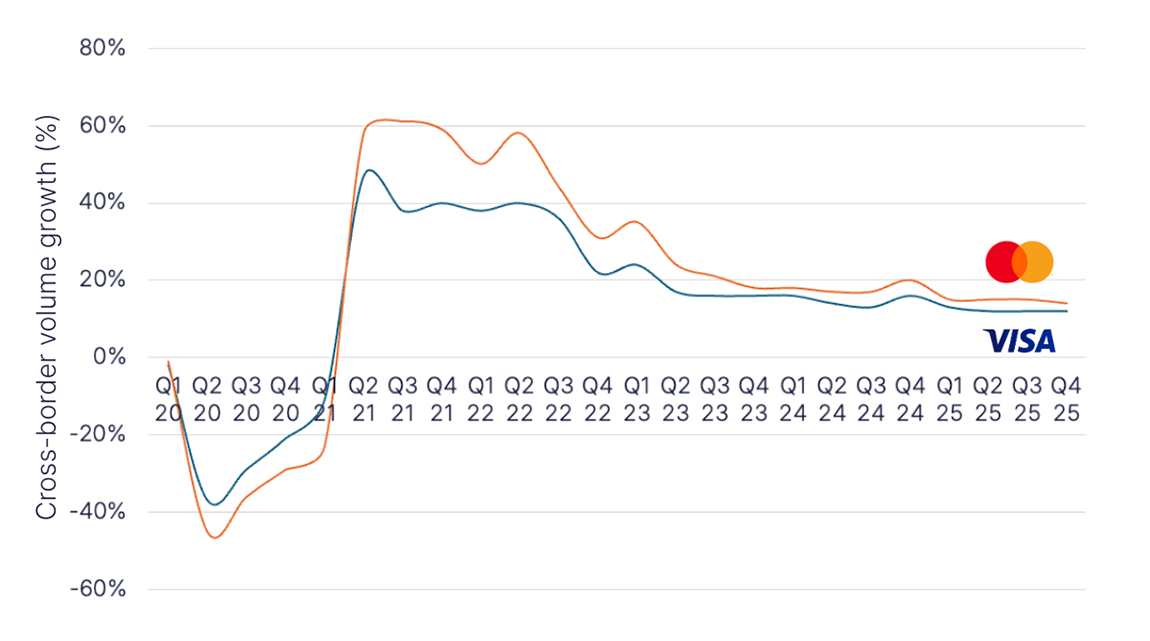

Ecommerce transactions have boomed over the last year, and with them has been a rise in the number of consumers making cross-border transactions by card. But whether they pay in their home currency or a foreign currency can have a significant impact on how much they spend for the same item.

Our recently published report, Understanding the economics of cross-border card payments, tackles this issue and behind this is our cross-border transactions and card data.

We identified the wide variations in amounts charged by card issuers between countries, but also that a foreign currency can be cheaper in some countries, such as Peru, but more expensive in others, such as Brazil. What costs are specific to any card issuer or country – get in touch.