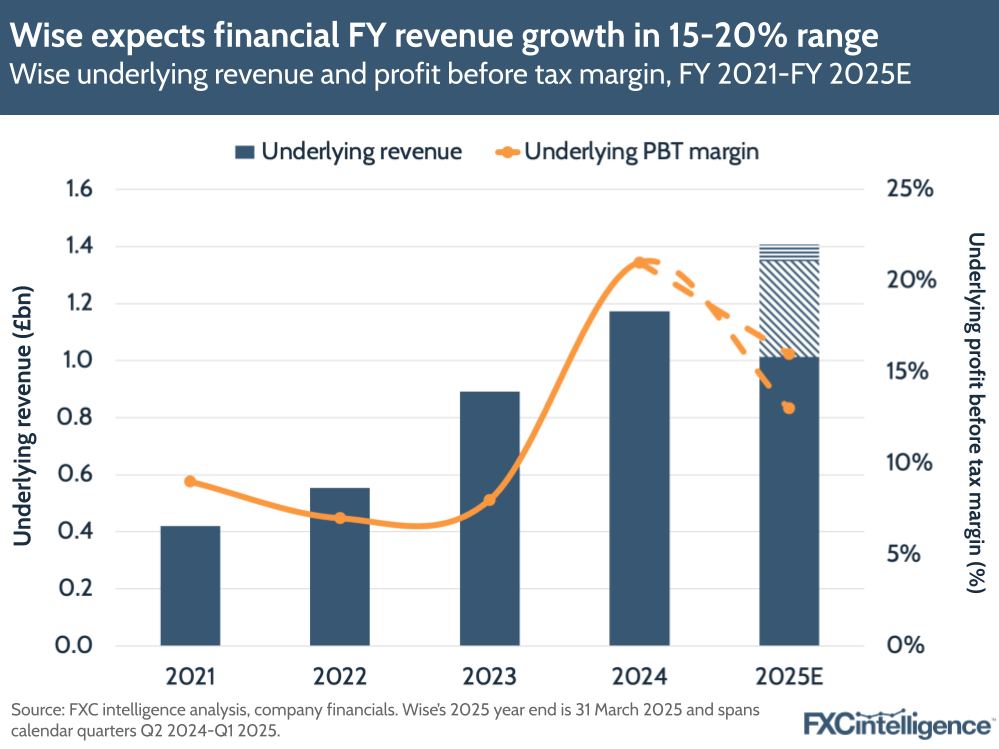

Growing customer account balances have contributed to a continued shift in Wise’s revenue mix in calendar Q4 2024 (Wise’s Q3 2025), during which it saw underlying revenue grow 13% YoY to £349.5m, or 20% on a constant currency basis. The company’s share price fell in the wake of its update, in which it stated that FX impacts meant it now expects full-year revenue growth at the low end of its 15-20% forecast.

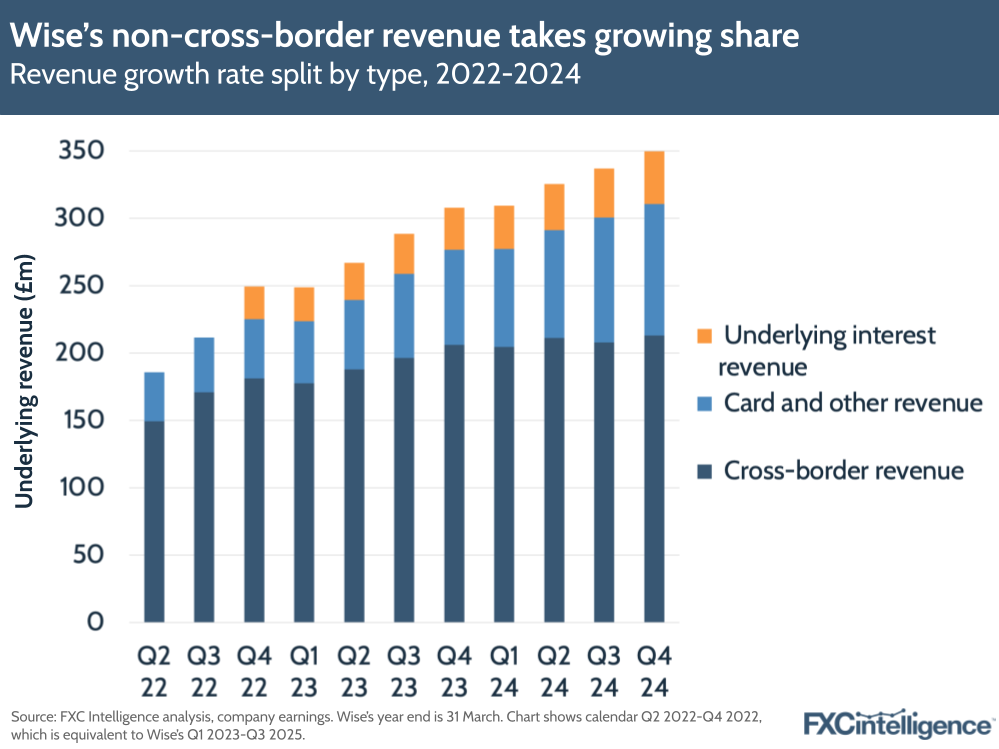

Revenue excluding interest rose 12% to £311m, which is notably the company’s slowest growth for this metric since its IPO. However, Wise continues to front-load its underlying revenue – consisting of cross-border revenue and revenues related to cards and other revenue (i.e. including interchange fees), as well as interest revenue, which the company has accrued as customers hold money in Wise accounts. Aside from the growing share of revenue attributed to interest, the metric is also a reflection of Wise’s diversification into arenas beyond money transfers – namely cards.

Wise’s cross-border volumes rose significantly, by 24% to £37.8bn, driven by active customers passing nine million and delivering strong growth in consumer and business volumes (23% and 26%) respectively. However, cross-border revenues grew just 3% YoY, with the company seeing a YoY dip in cross-border business revenues.

Meanwhile the biggest growth continues to be seen in the Cards and Other segment, which grew 39% and was 28% of Wise’s underlying revenue. Cross-border still maintains the highest share of revenue at 61%, but this has consistently moved down over the last couple of years (it accounted for 80% in the company’s Q1 2023 results).

Continued adoption of the Wise Account drove a 26% rise in customer balances to £16.2bn, with consumer balances rising 31% to £9.8bn while business balances jumped 19% to £6.4bn. Brazil has seen particularly strong adoption, with Wise also launching new services for microbusinesses based in the country during the quarter. Higher customer balances meant interest revenue grew 9%, though notably this growth has also slowed significantly compared to previous quarters.

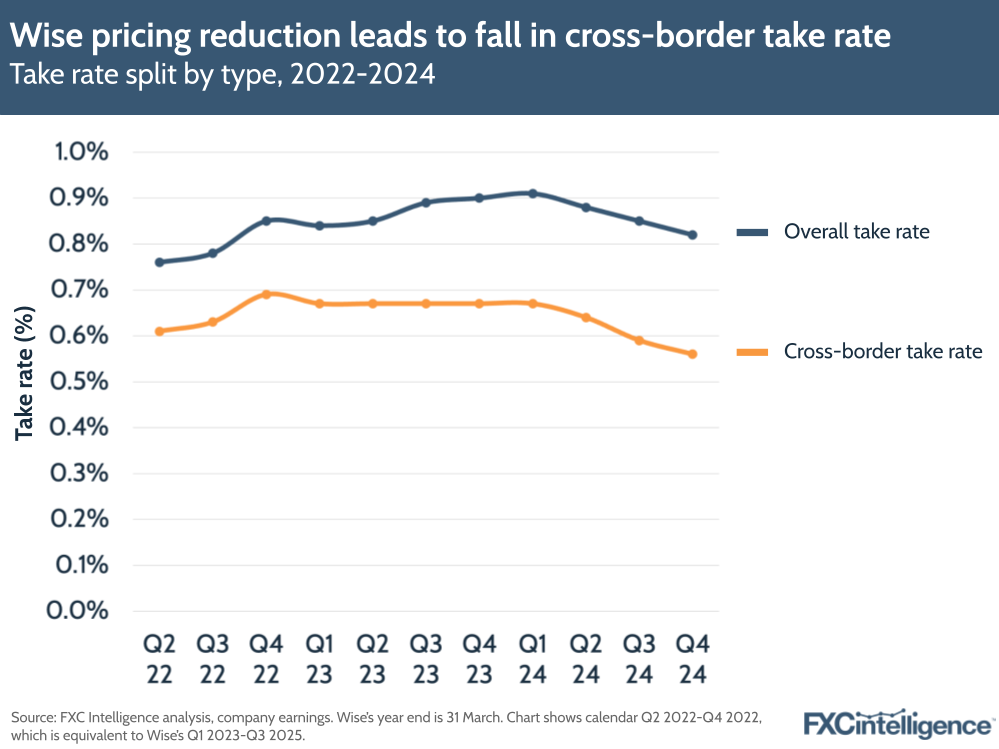

Wise has also continued to see a decline in its cross-border take rate over time, with this falling by 11 bps YoY to 56 bps in Q3. This is due to the company dropping its prices earlier in FY 2025, a key focus for driving customer loyalty alongside speed improvements, with the number of transfers taking place instantly up by four percentage points to 65% in Q4 2024 (Q3 2025).

Wise’s shifting mix reflects a company that has evolved significantly from serving money transfers. Excluding interest, the split of revenues being delivered by businesses and consumers stayed relatively the same as the previous period, with 78% of revenue delivered by consumers against 22% for businesses. However this could change in the future as the company continues to drive its international white label Wise Platform product, which is now being used by Morgan Stanley and Standard Chartered.

The impact of FX changes, further expected drops in interest rates and growing competition from similar players in the market (e.g. Revolut) mean that Wise’s moves to diversify will prove increasingly important as it goes into its final quarter for FY2025.