Social media platforms and other online marketing pathways are a key part of how brands communicate with their customers. But while consumer strategies are well understood, how are B2B cross-border payments players using social media?

On the consumer side, which social media platforms a brand uses says a lot about the customers they are trying to reach and how. Different mixes of platforms indicate different age groups, dominant genders, regions and even information engagement types. However, for B2B-focused brands, social media and other online communication platforms is more complex, not least in the cross-border payments industry.

Cross-border-focused B2B payments brands are, like all B2B-led brands, looking to reach people who are decision-makers for both their personal life and their business. However, how this translates into the most effective social media platforms and other communication routes is less clear.

To find out which platforms can be effective, we undertook an extensive review into the platforms that major B2B payments players use and how this changes by company age, location and ownership status.

The social media platforms companies use, and the content they post on them, reflect companies’ strategies not only in terms of recruitment, but also the types of customers they are focusing on, making this an insightful picture of the B2B cross-border payments landscape.

Selected B2B payments players

For this report, we reviewed the social media and communications approaches of 18 different cross-border payments companies. In all cases, these companies focused exclusively or primarily on either the B2B payments space or the B2B2X payments space. We intentionally avoided players with a significant consumer offering alongside their business offering, for example Wise, as in these cases social media output is sometimes split between business and consumer audiences.

The resulting companies were:

- Airwallex

- Alpha

- Argentex

- Banking Circle

- CAB Payments

- Convera

- Corpay

- EQ Payments

- Equals

- Flywire

- iBanFirst

- Monex Europe

- Monex USA

- Moneycorp

- Rapyd

- StoneX

- Tipalti

- Veem

In the case of Monex Europe and Monex USA, we reviewed these separately as, although they have a shared parent company, they have entirely separate websites and social media footprints.

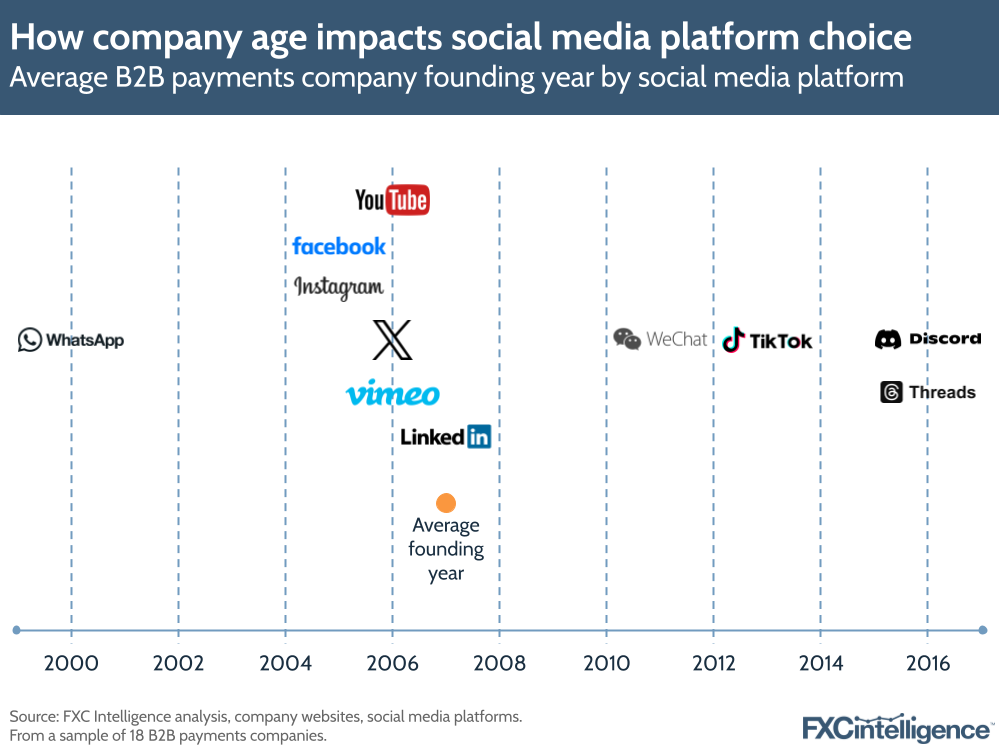

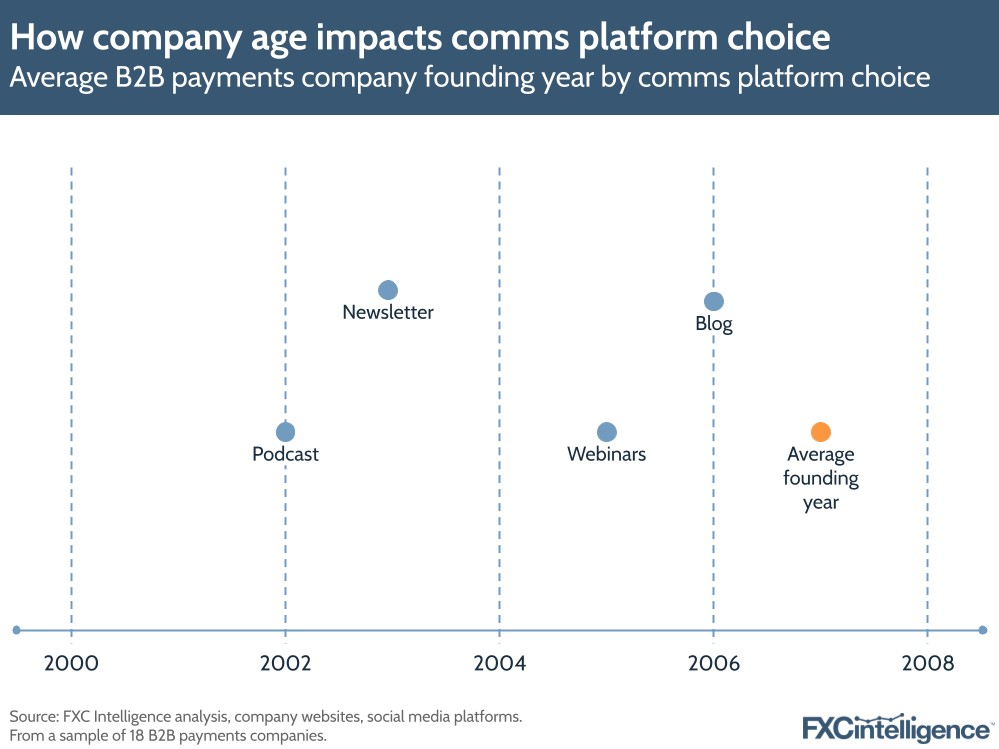

This group gave us a broad range of players from across the industry. While the average year of founding was 2007, this ranged from between 1979 to 2021. Exactly half of the companies are also publicly traded on one of four different stock markets (LSE, NYSE, NASDAQ or the Mexican Stock Exchange).

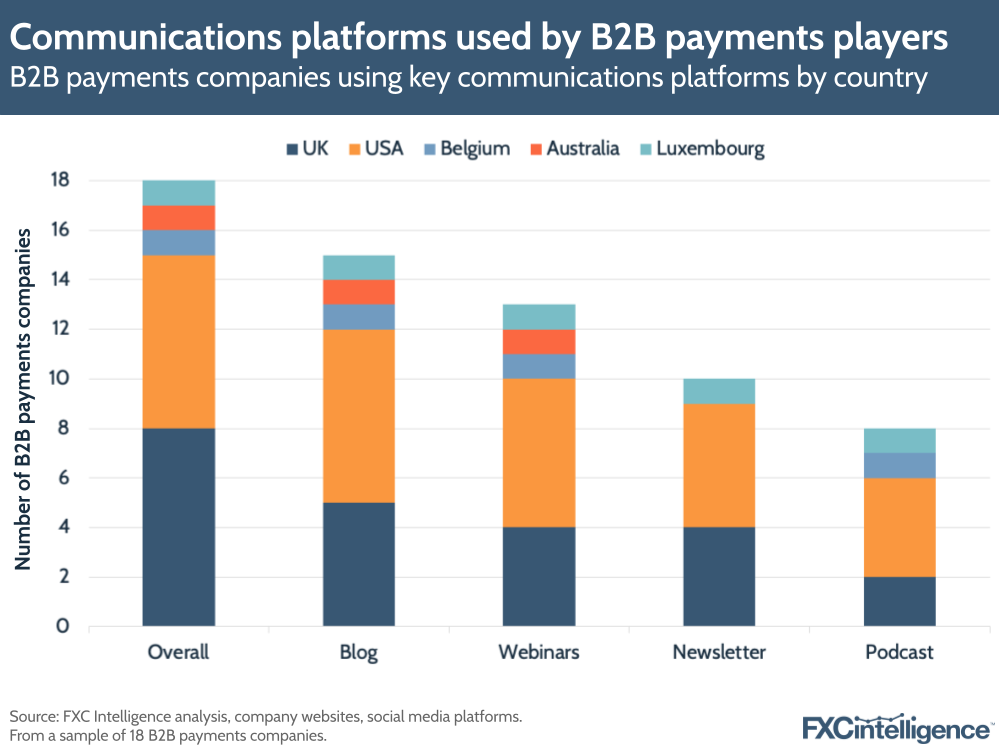

On headquarters, the UK represented the largest percentage of the group at 44% (8 companies), followed by the US at 39% (7 companies). The rest were made up of three companies, headquartered in Belgium, Australia and Luxembourg respectively.

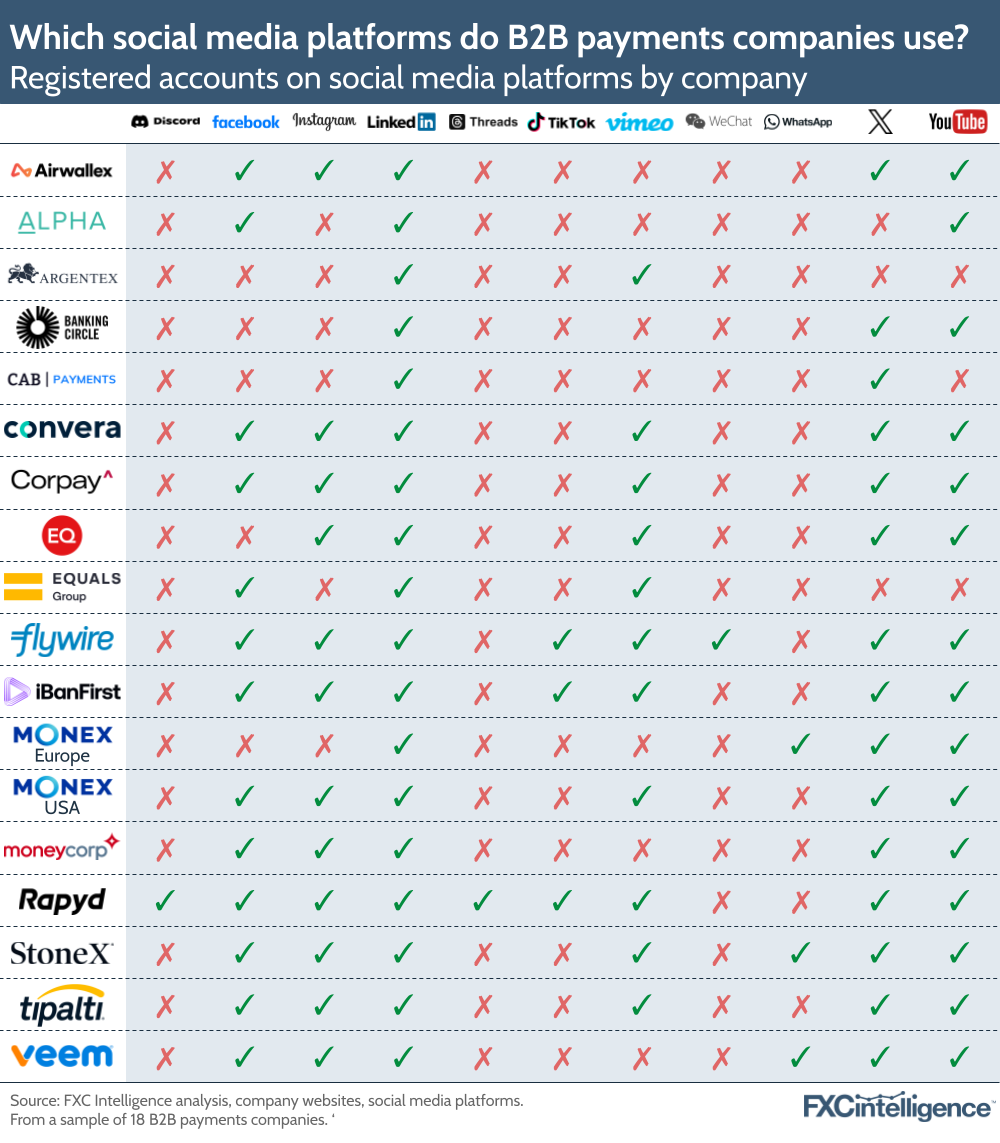

For this report, we identified all social media platforms registered by each company, as well as whether they are directly linked from their websites and if they are still updated – which we interpreted as having been added to in Q4 2023 or later. We also reviewed their use of additional communication channels, in the form of newsletters, blogs, podcasts and webinars.

Social media platform use by B2B payments companies

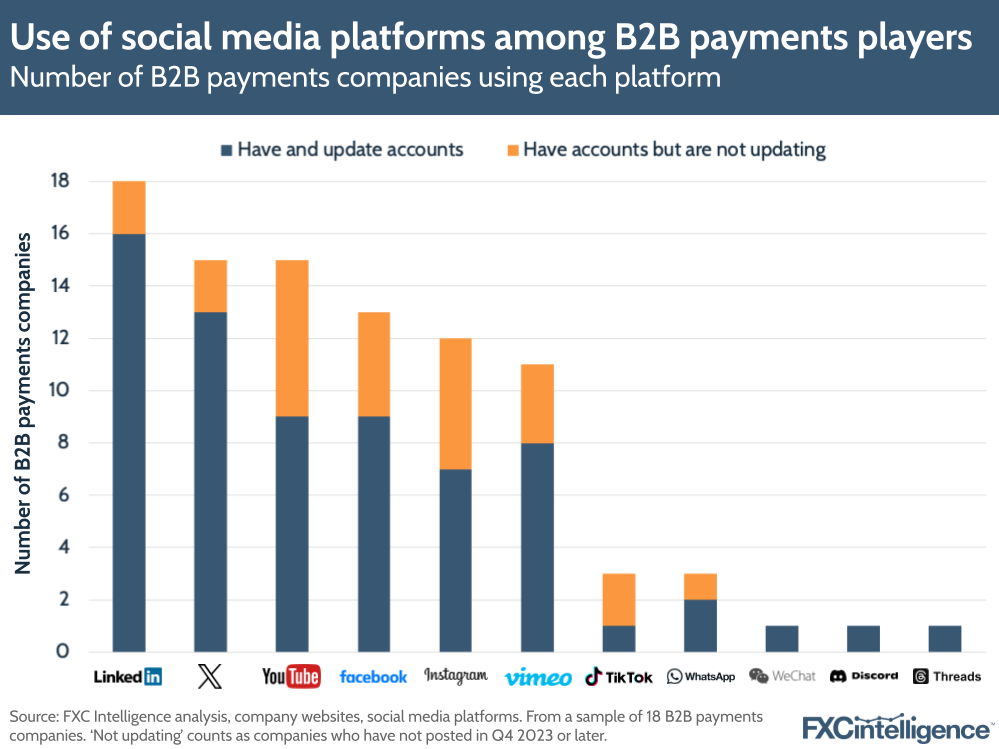

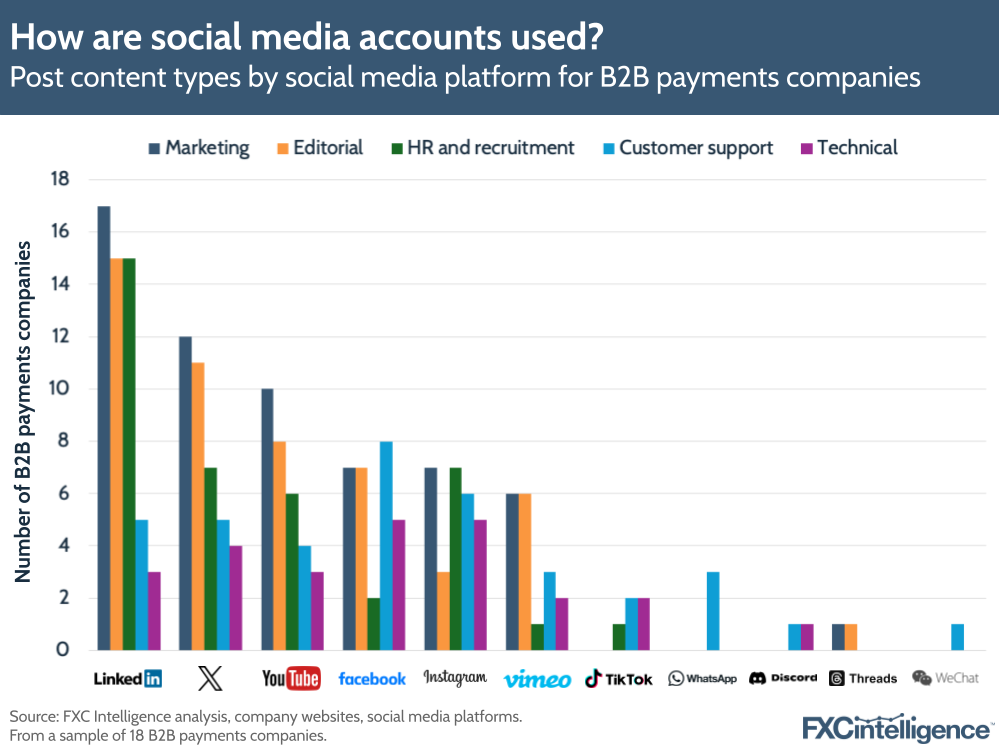

Perhaps unsurprisingly, the most popular platform was LinkedIn, with every company surveyed having an account and all but two updating this regularly. This confirms LinkedIn as the default B2B social media platform, although X, formerly Twitter, was close behind at 15.

More established, higher profile platforms YouTube, Facebook and Instagram were close behind, all with over half of the group of companies having accounts; however, it is notable that some platforms have higher rates of non-updated accounts than others. YouTube and Instagram, for example, were only updated by 60% and 58% of those with an account respectively.

In the case of YouTube, this may be a reflection of the barrier to posting. As a video site, creating new content is time-consuming and may be something companies only opt to do occasionally and embed on their website, rather than treating it as a continuous feed to update as they do with a platform such as LinkedIn.

However, the same is unlikely to apply to Instagram. Instead, this may reflect changes in needs. Instagram is a very consumer-focused platform, making its use by B2B players largely recruitment-focused. As a result, not posting may reflect a company that is currently not prioritising new hires.

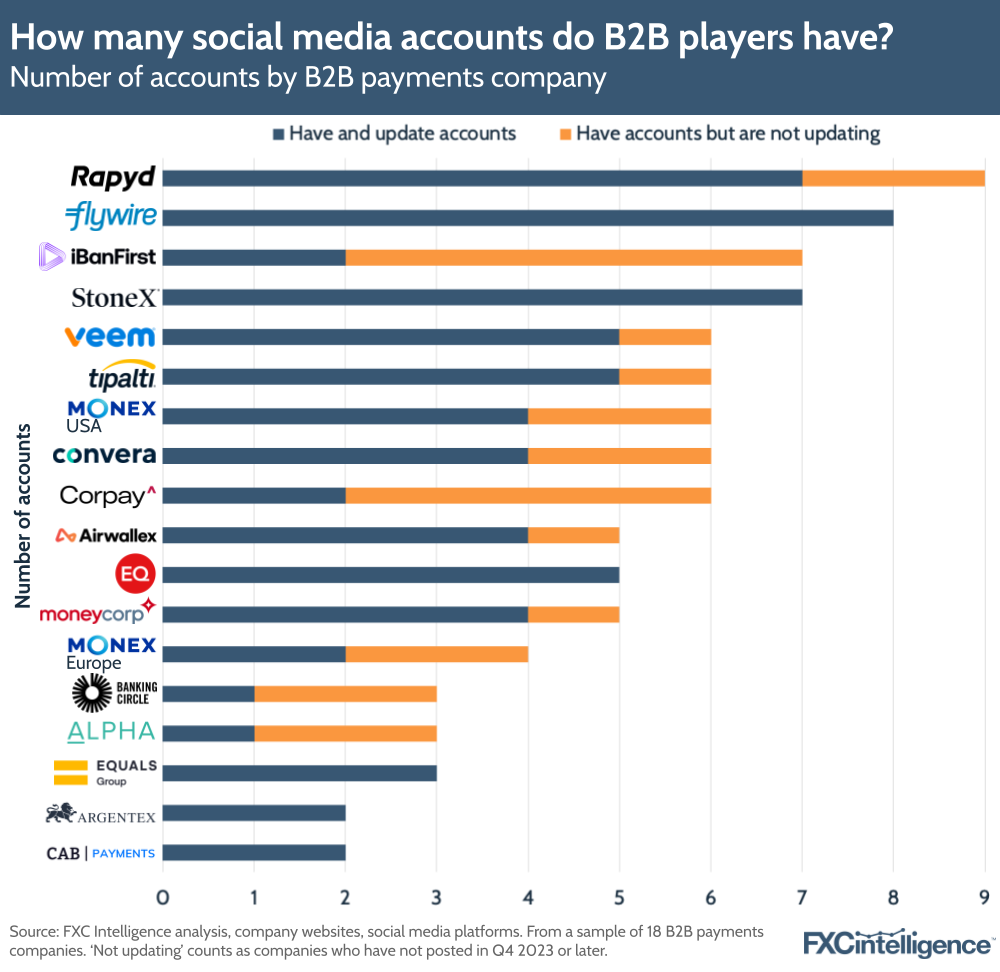

Notably, while the number of accounts held by each company varied significantly, each one had at least two overall, and at least one that they kept updated.

B2B2X-focused Rapyd led for the number of registered accounts, but for accounts that are updated, healthcare, travel and education-focused Flywire was slightly ahead.

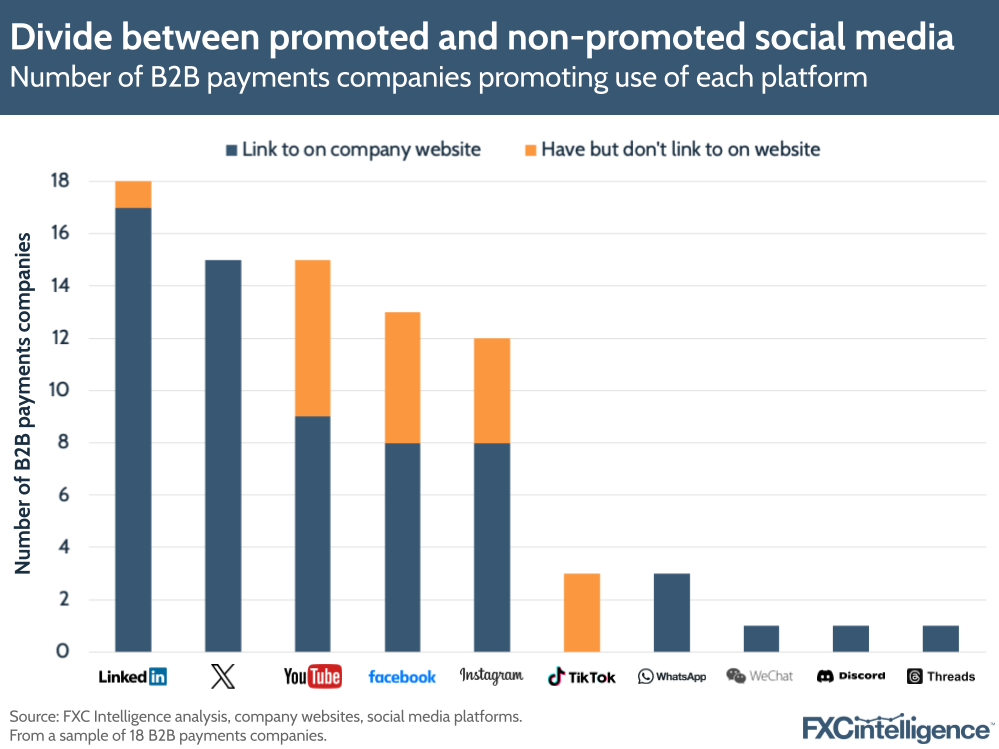

Interestingly, not every company that has a social media presence on a given platform opts to link to it on their company website. In many cases, this aligns with a lack of updates on the social media platform in question, but in some cases companies are updating accounts that they are not directly linking to.

This is more common among more consumer-facing platforms, which suggests that these platforms are more likely to be recruitment-focused for the organisations in question. In these cases, the website is likely to be for a different audience – the customer – suggesting that a link is not always necessary for a social media account to be effective.

Company age’s impact on platform use

Company age had an interesting correlation with the use of different social media platforms. The most popular platforms aligned closely with the overall average founding year: companies using Vimeo, YouTube and X averaged a year older than the overall average, while users of Meta’s brands Facebook and Instagram averaged two years older.

However, platforms that are newer and have more niche consumer users – in particular TikTok, WeChat, Discord and Threads – saw less use overall but what use they did see came from more recently founded companies.

Geography and social media use

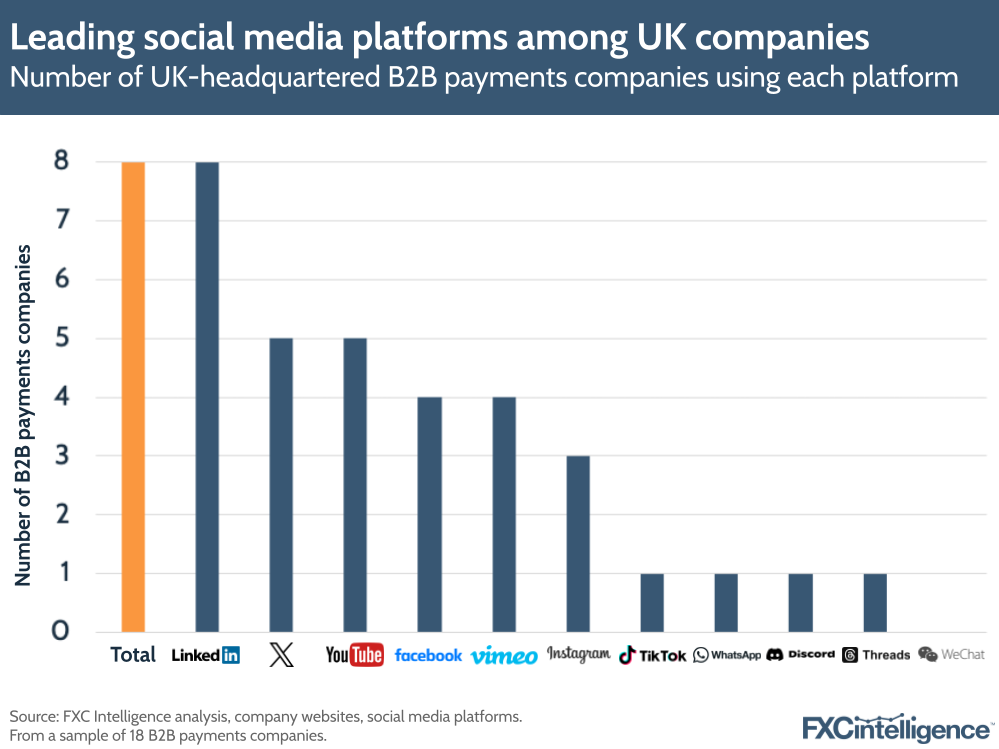

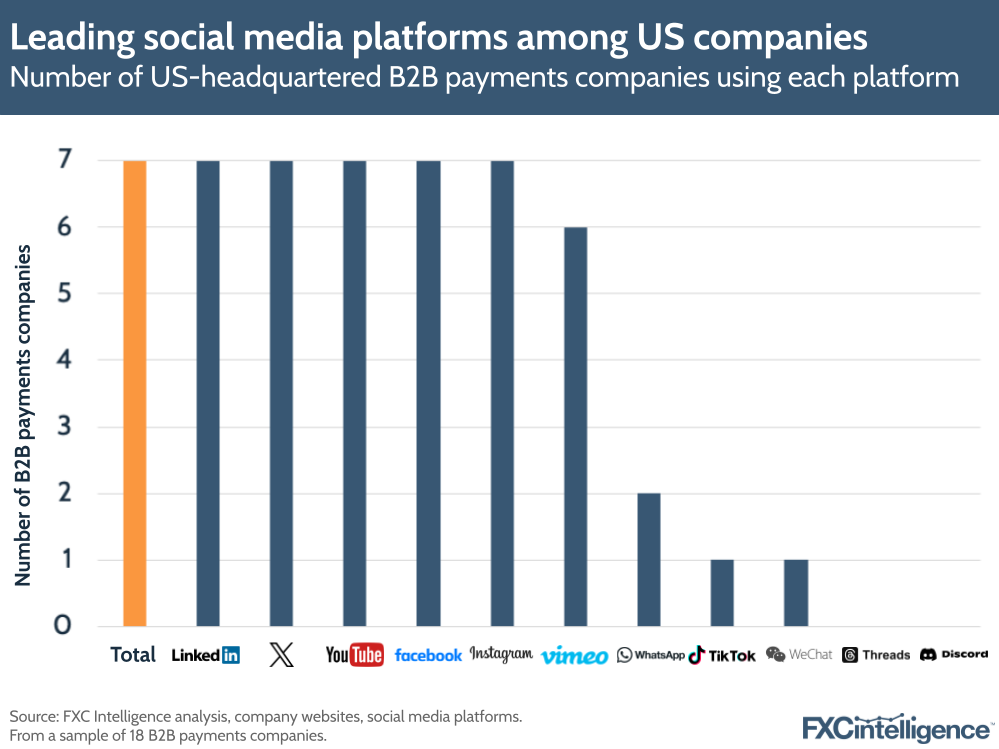

Looking geographically, there was notable variation between the UK and US, where the vast majority of the companies were headquartered.

While the UK had the largest number of companies, its use of social media dropped off relatively quickly. While all use LinkedIn, only five out of eight use X and YouTube and just half use Facebook and Vimeo, the next two most popular platforms.

By contrast, all of the US-based companies used LinkedIn, X, YouTube, Facebook and Instagram, and all but one used Vimeo. This suggests that social media platforms are more important to companies in the US, even if they have a B2B focus, whereas British B2B companies are less likely to use social media beyond LinkedIn.

Meanwhile, for the three companies across Belgium, Australia and Luxembourg, all three used LinkedIn, X and YouTube, while two used Facebook and Instagram and one used Vimeo and TikTok.

Ownership status and social media

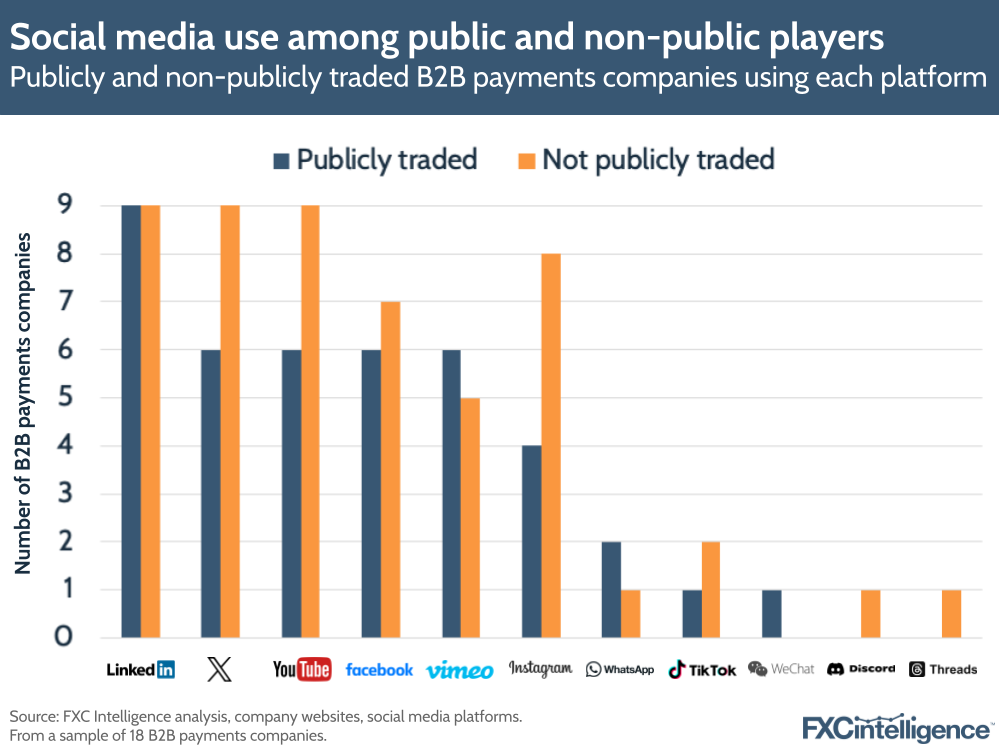

While there was a 50/50 split between publicly traded and private companies in the group of B2B payments players we reviewed, we did observe a notable difference in the levels of social media use.

Non-publicly traded companies were more likely to have more social media accounts, with all having accounts on LinkedIn, X and YouTube and all but one having an Instagram account. By contrast, while all publicly traded companies have LinkedIn accounts, a third did not have accounts on X, YouTube or Facebook, and less than half had an Instagram account.

This difference is likely to be due to the increased regulatory scrutiny publicly traded companies’ communications face, increasing the work required to maintain each account. However, one account that had higher use by publicly traded companies was the video platform Vimeo. This may be because Vimeo is a popular platform to host company earnings calls, increasing its value to publicly traded companies.

Purpose of social media accounts

Most social media platforms are used for a wide variety of purposes across different B2B cross-border payments platforms, but most purposes fall into one of five categories:

- Marketing: client-focused content designed to promote the company and its products.

- Editorial: explanatory or research-based content designed to promote ideas or topics. Not directly marketing the company, but may serve to showcase its expertise indirectly.

- Technical: explanatory content for developers and other technical people who are either using the product or are potential employees of the company.

- Customer support: non-technical information designed to provide assistance to customers.

- HR and recruitment: content designed to either reach and support existing employees or to promote the company as an employer of choice.

While marketing was the most common focus of social media accounts, followed by editorial, we found that many companies will use platforms for more than one purpose. Notably, more niche platforms were more likely to provide customer support, and are likely to have been selected by companies as they reach specific customer bases that the company caters to.

Communication platform use by B2B payments companies

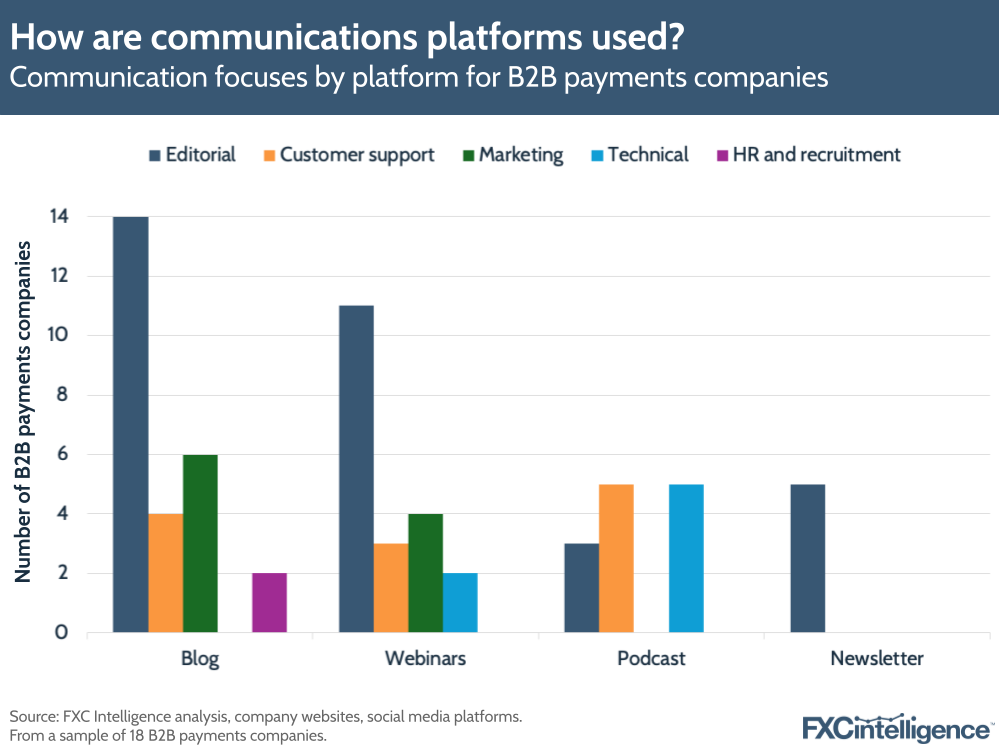

In addition to looking at social media platforms, we also looked at the use of four additional types of communication platforms, namely blogs, webinars, newsletters and podcasts. We included these as they are typically maintained by the same teams that run a company’s social media platforms, and content is often cross-posted between these and social media.

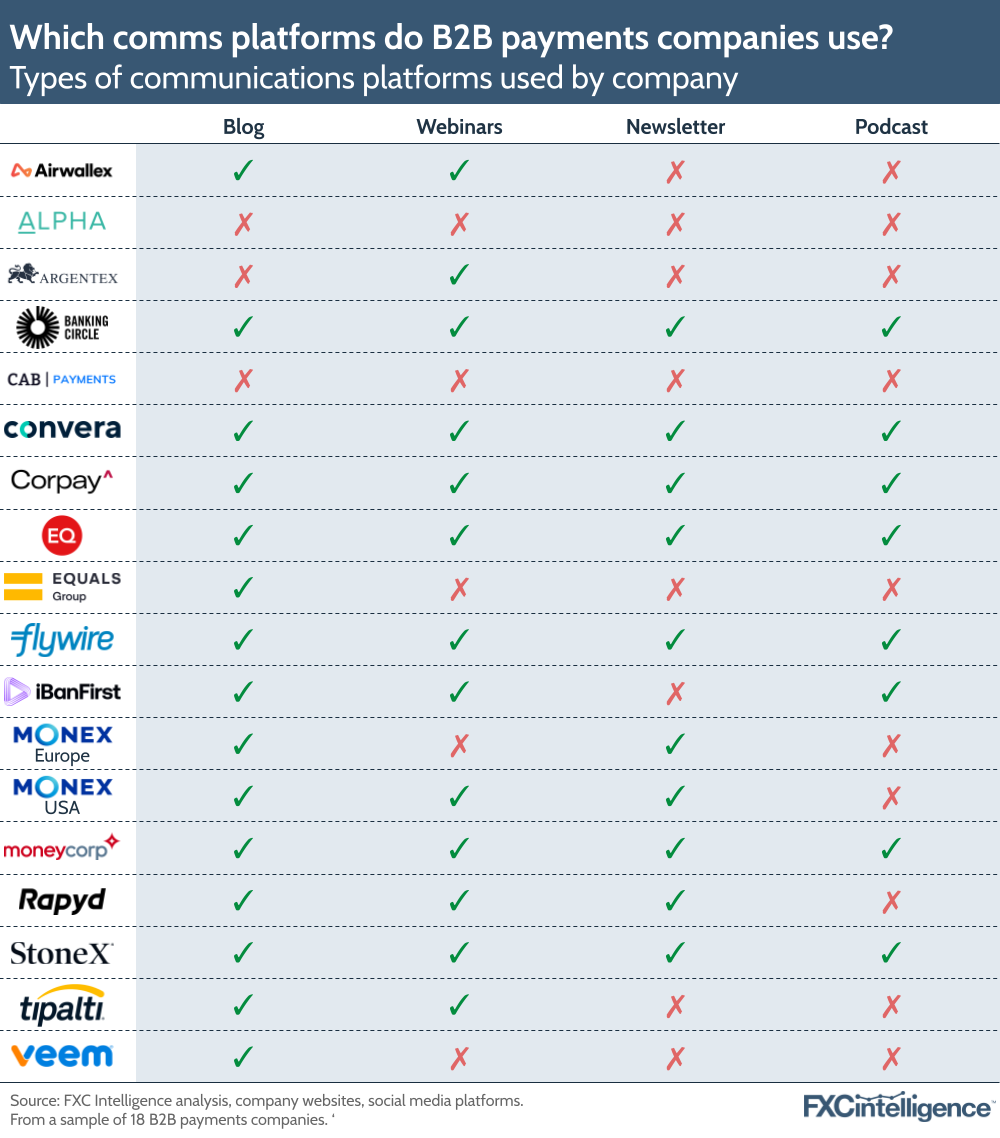

However, we did find some differences in their use compared to social media accounts. Firstly, not all companies had any of the four types of communications platforms. Where they did, almost half had all four. However, a blog was the most common platform type, with all but three companies maintaining one.

Company age’s impact on comms formats

Interestingly, the average age of companies with all four types of communications platforms was above the average age for the 18 companies overall. While for a blog the average company was founded just a year earlier, for webinars this was two years, newsletters four and for podcasts it was five. This suggests that this type of communications system takes longer to establish, and therefore is more commonplace at older companies.

Impact of geography

These comms platforms were also more commonly used by American-headquartered companies than their British counterparts. All US companies maintain a blog, however only 62% of UK B2B payments companies do. This gap widened further for newsletters, with half of UK companies maintaining one versus 71% of US companies. It was most pronounced for multimedia platforms, however, with 25% of UK companies having a podcast and 50% running webinars versus 57% and 86% respectively of US companies.

Purpose of communications platforms

Notably, while marketing was the most common purpose for social media, editorial was much more dominant among communications platforms, with customer support also a common reason across blogs, webinars and podcasts.

Implications for marketing strategies

For marketers in the B2B payments space, it’s clear that, beyond having a LinkedIn account, there is no one set way to use social media and communications platforms; instead, the best approach is to vary output based on the precise needs of the business.

The broad range of different social media platforms suggests that there is potential in going beyond the default option of LinkedIn, although which platforms are most effective is likely to depend on a company’s precise customer base, as well as the types of content they are planning to publish.

For British companies, social media and communications use lags behind players in other parts of the world, suggesting that there is the potential to expand such output to compete more globally and better speak to customers.

The B2B payments space is rapidly growing, but has considerable development and consolidation ahead. Marketing and communications is by no means the only component in its future growth, but it does have a vital role to play as the industry evolves.