Some of the world’s biggest banks are investing in cross-border payments players as part of a wider focus on the financial services space, but what are their priorities? We’ve tracked how banks’ investments in cross-border payments have changed over time to analyse their ongoing approach to this sector.

As shown by our recent report on banks’ public earnings, cross-border payment services continue to play a major role for banks, but as these are often playing a role connected with their wider business, it’s not always clear where the banks’ payment priorities lie.

Tracking the types of companies that banks are investing in helps provide useful insights about how banks are thinking about the cross-border space, and in some cases hints at where they are thinking about expanding later. See Goldman Sachs, which invested in consumer finance platform GreenSky before acquiring it in 2021 to help the bank scale its well-known consumer arm Marcus. Or Visa, which invested in Currencycloud in 2019 and acquired it in 2021 to help leverage its Cross-Border Solutions division.

In this report, we’ve crunched the data on over 3,600 investments across 19 of the world’s biggest banks, from the start of 2019 up until the end of September 2024, to explore how banks’ investments have changed over time. This data highlights a number of trends that provide more information about where banks are placing their focus when it comes to investment.

Methodology for report

For this report, we used Crunchbase to identify all the investments made by 19 banks featured on FXC’s Cross-Border Payments 100 for 2024, from the start of 2019 until the end of September 2024. This includes both investments made prior to a public market entry, such as seed and series A rounds, as well as those often made after, including debt financing. This five-year period was chosen to include a year prior to the pandemic, while providing a long enough time range to analyse trends in the types of companies banks have invested in over time as well as their recent activity in 2024.

We then categorised these investments based on whether they are going towards providers of payment services, spanning payment processing, B2B payments, infrastructure, crypto and blockchains solutions and more. Out of this bucket of investments for companies that we have deemed ‘payment providers’, we identified whether they are targeting cross-border payments companies, or companies that have cross-border payments as a significant part of their business.

Because the number of investments from banks has been vast, trying to pinpoint every company with some relation to payments is a difficult task. While we have tracked the number of investments marked as financial services, for example, a great deal of these companies are unrelated to facilitating payments specifically. We have therefore included companies that are marked on Crunchbase as one of at least three payments-related categories that are more attuned to our target area: payments (which includes mobile payments), fintech and banking.

Though the Top 100 includes 21 banks, we excluded two from the dataset. These are American Express, which is better known as a card issuer and therefore isn’t as clearly comparable to other banks on the list, and Mexican bank Banorte, for which there appears to be substantially less information available on Crunchbase.

In addition to pulling data from bank’s profiles, we have also included investments from relevant subsidiaries in order to ensure the report captures banks’ broader geographical activities. For ease, we’ve included subsidiaries and associated companies that include the same name as the bank. For example, in the case of Barclays, we have also included investments from Barclays Corporate Banking and Barclays Ventures.

In cases where the same investment appeared to be duplicated across two different profiles on Crunchbase, we removed these so as not to skew the results. However, we have kept additional investments that have been made in the same company over time, including funding round extensions, debt financing and post-IPO fundraises, as these still indicate a level of commitment to the company, their target area and region.

How often are banks investing in cross-border payments?

Pulling together all the data, we found that banks in our dataset made a total of 3,620 investments across 2,401 companies from the start of 2019 up to the end of September 2024.

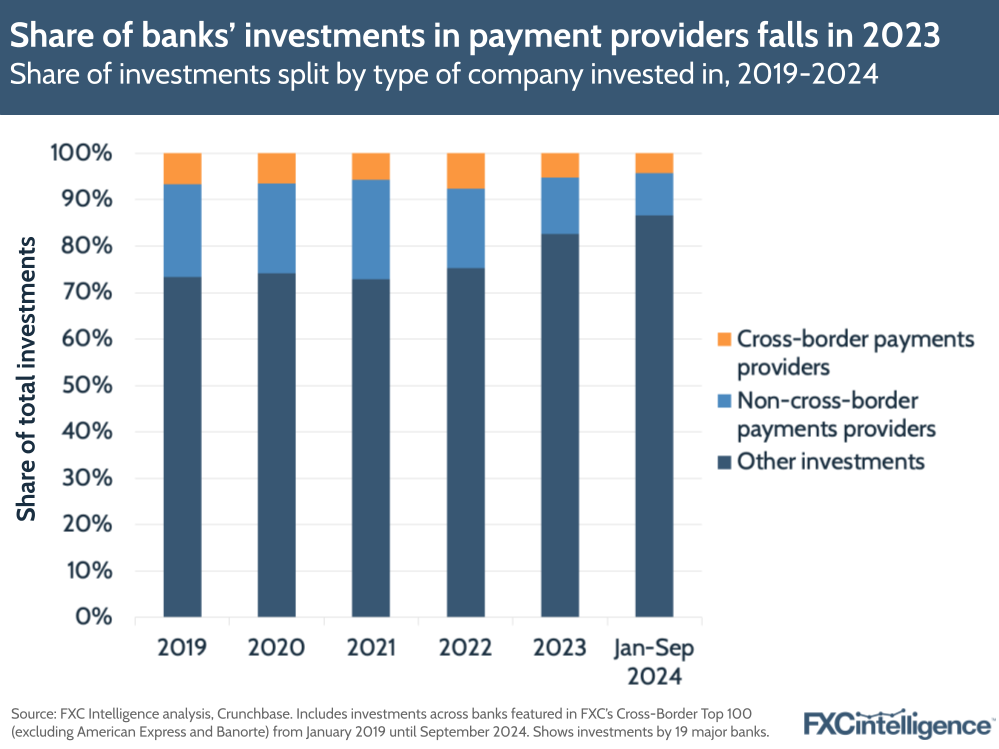

Focusing specifically on the number of investments made (i.e. including repeat investments in the same company), 784, or around 22% of total investments, were made in payment providers, with 212, or 6% of the total, being made in cross-border payments providers.

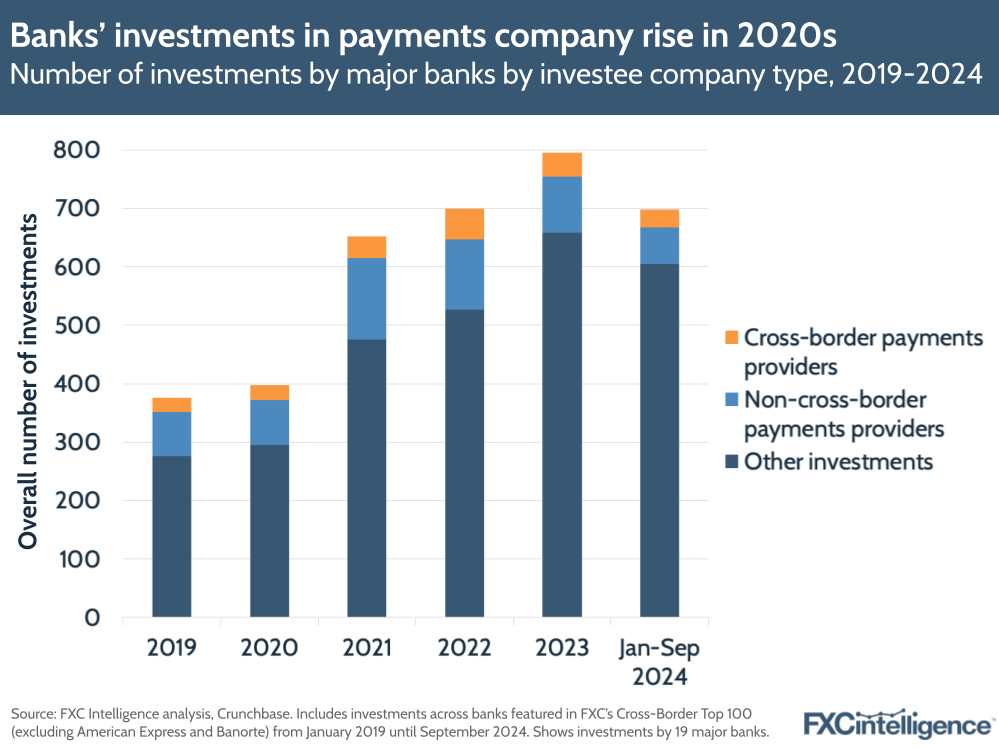

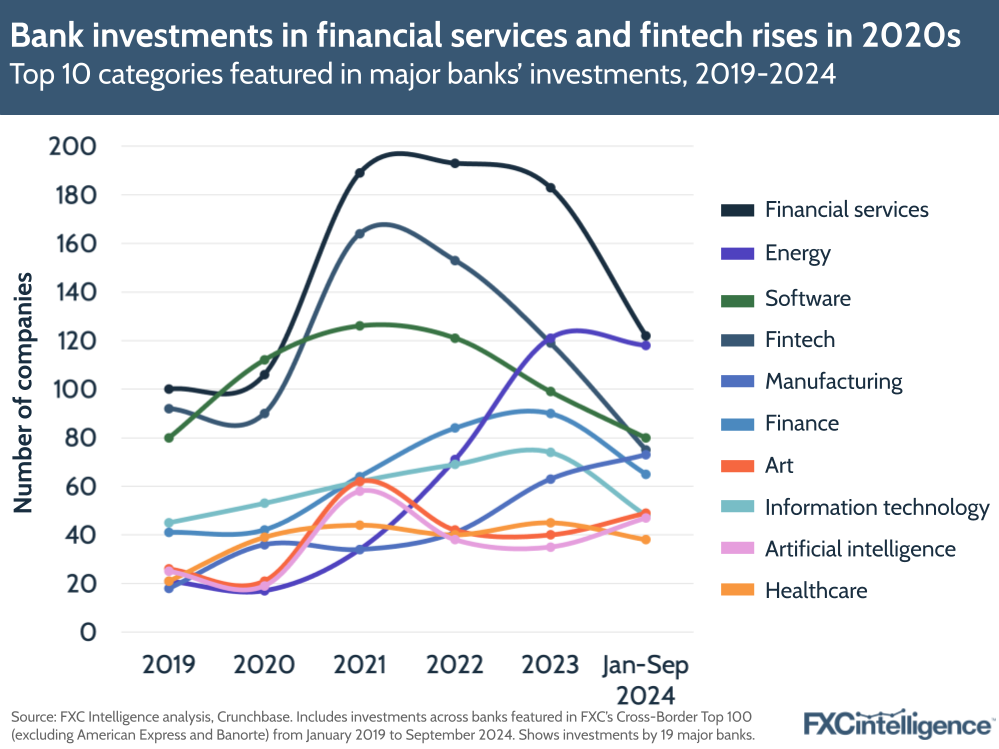

Looking at how investments have changed over time shows a significant shift in the number of investments made during and after the Covid-19 pandemic. In 2021, total investments across all banks grew by 64% compared to 2020, with payment provider investments rising 72% and cross-border investments rising 42% YoY.

In recent years, 2022 was the strongest year for cross-border investment, with 53 investments in cross-border payment companies accounting for 8% of total investments across the banks that year. Compared to 2019, cross-border investments were also up 112% compared to 2019 and up 43% YoY, with over half of the banks on the list investing a higher number of times in cross-border payment providers in 2022 versus the previous year.

Having said this, the number of cross-border investments declined in 2023 by 23% YoY. Cross-border’s total share of investments also dropped from 8% to 5%, while payments providers overall saw the number of investments decline by 20%. This was against the grain of a 14% rise in total investments that year overall.

The implication is that while the number of investments for payments providers has risen compared to a few years ago, this may have been due to an overall increase in investments, spurred potentially by macro factors, rather than a drive to invest more in payments companies specifically. This is best shown when visualising the actual share of investments occupied by payment providers in 2023 (17%) versus 2019 (27%).

Which banks have invested the most in cross-border payments?

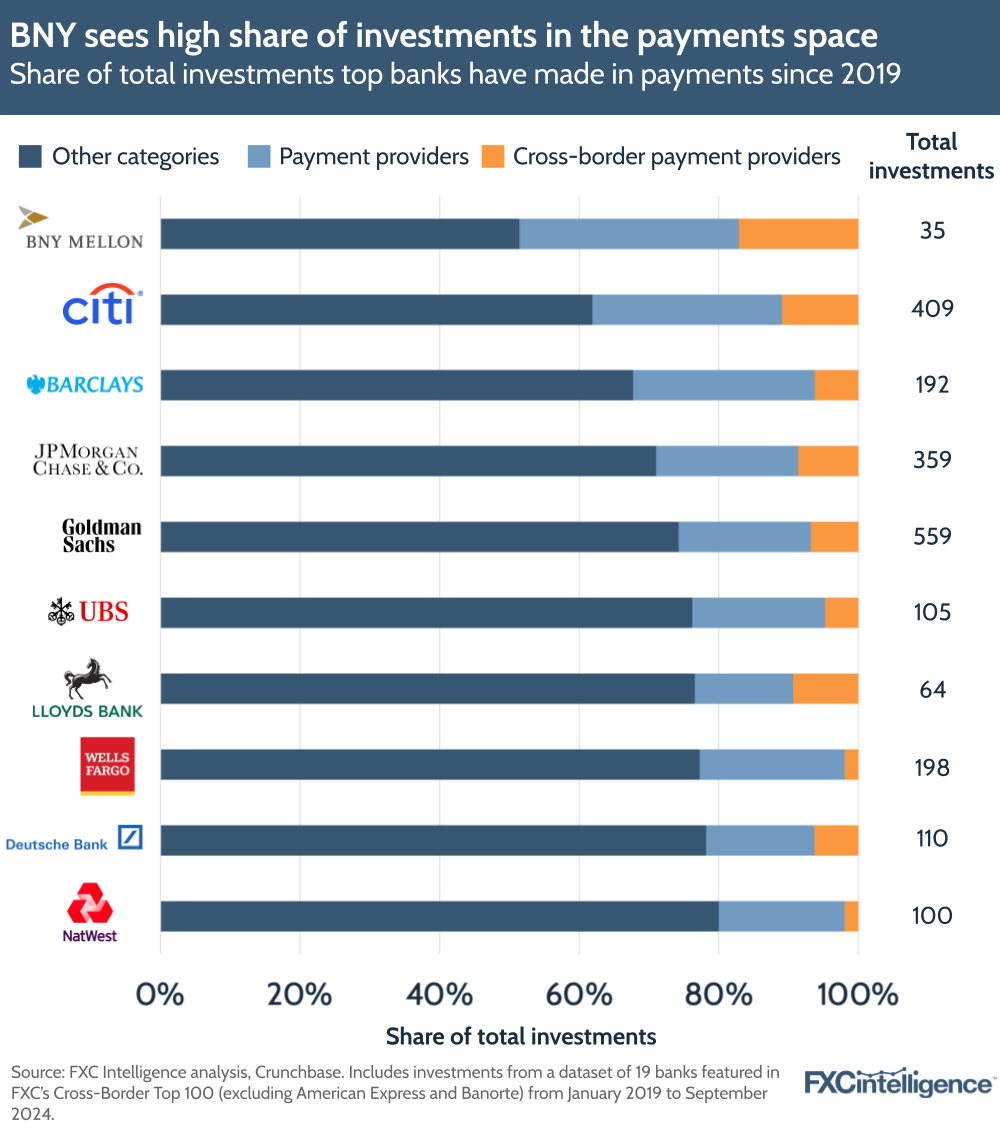

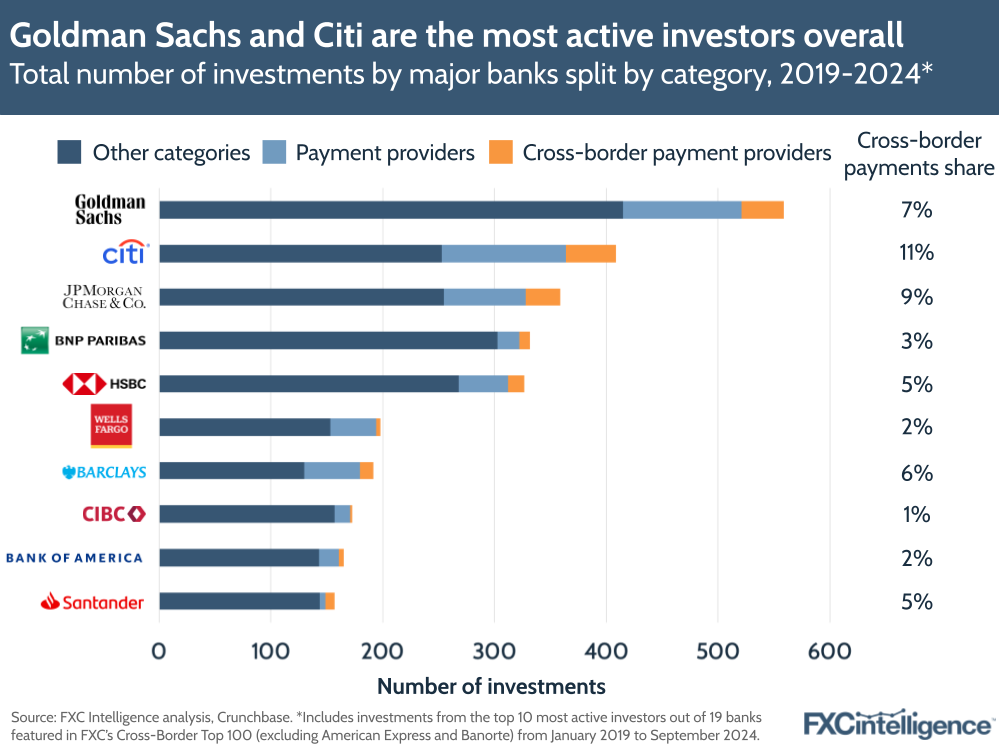

In terms of total investments made across major banks during the period from 2019 to the end of September 2024, Goldman Sachs was the most prolific investor, with 559 investments, followed by Citi (409), JPMorgan Chase (359), BNP Paribas (332) and HSBC (327).

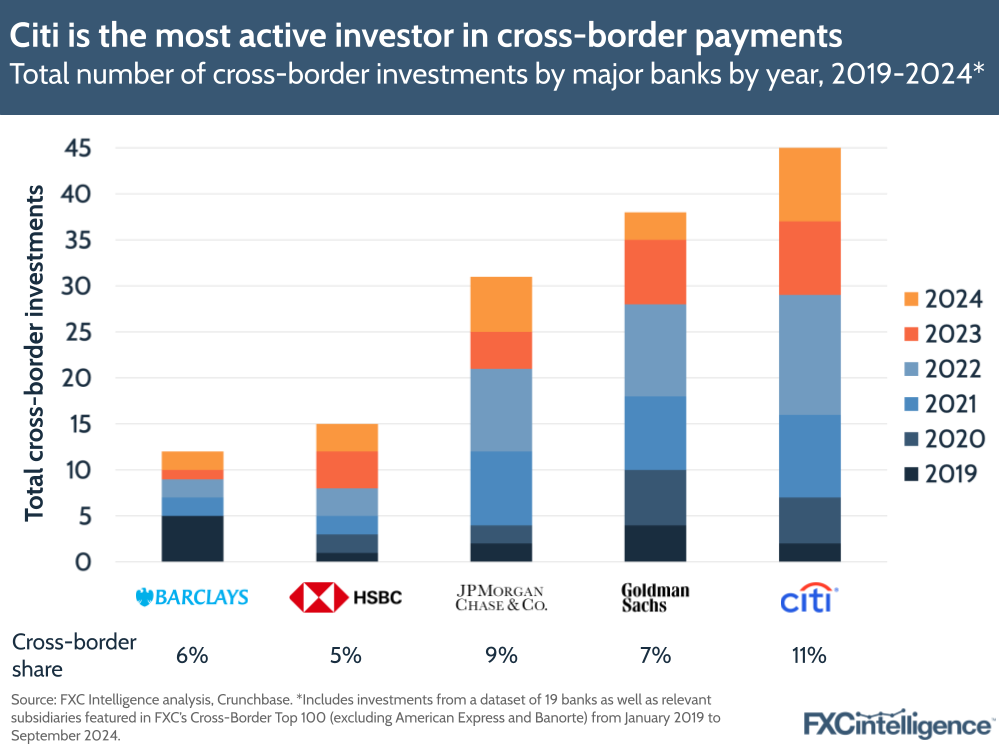

In terms of cross-border investments specifically, the order is different, with Citi making the highest number of cross-border payments investments overall at 45, followed by Goldman Sachs (38), JPMorgan Chase (31), HSBC (15) and Barclays (12). We’ve gone more in-depth into each of these players below.

However, in terms of share of investments overall across the banks we tracked, including repeat investments, BNY Mellon is the leader, with 17% of the company’s investments in cross-border payment companies, while almost half of the bank’s investments are in payments companies more widely.

Having said this, at 35, the total number of BNY Mellon investments on Crunchbase is significantly lower than other players on the list, with players such as Citi and J.P. Morgan having far greater numbers of cross-border investments, even if they represent a smaller share of their total investments.

Other active investors in terms of cross-border payments share specifically are Citi with 11% of investments in companies marked as cross-border; Standard Chartered with 10%; and Lloyds and JPMorgan Chase each with 9%.

Which company types are banks investing in the most?

Crunchbase classifies companies across a number of different categories, with companies more often than not being tagged with more than one category (i.e. both financial services and software). While it would be nigh on impossible to try and classify each company into one definitive category, highlighting how often companies are tagged with a specific category on Crunchbase yields interesting results.

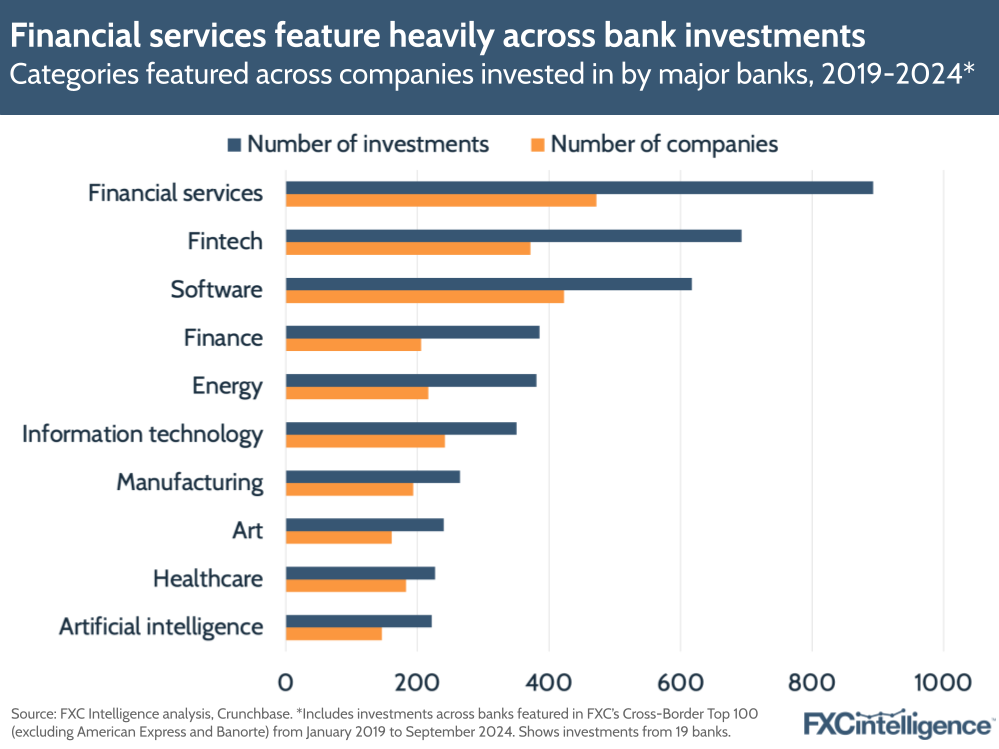

Across all of the companies that banks have invested in since 2019, the most common category that companies have been tagged with is financial services, followed by fintech, software, finance, energy and information technology.

Note that numbers for software and similarly broad categories don’t include the different varieties of this category available, though it is notable with this example that 115 companies on the list are categorised as enterprise software, which is much higher than other types of software, such as embedded software and meeting software. This jibes with a strong focus from banks on business and finance-related investments.

Other prominent categories that have been applied to companies invested in include finance, manufacturing, healthcare, art, software-as-a-service (SaaS) and artificial intelligence. The last of these topics has been a particularly interesting example, as we discovered in our report on the state of cross-border payments in banking earlier this year.

Looking at the actual number of investments that banks have made over time, we see that with some variance in order, the top categories (financial services, fintech, software) are all represented, with some interesting results. Reflecting the overarching growth trend for investments discussed earlier, the number of investments in financial services, fintech, banking, finance and payments companies all rose significantly in 2021, though some have declined in following years.

In terms of the number of times categories were featured on company profiles, payments was 21st out of 721 categories that appeared on profiles in the period from 2019-2024. The number of investments in companies marked as payments grew by 39% YoY to 32 in 2023, and had reached 23 in the period from January to September 2024.

Investments in artificial intelligence companies were a notable trend in 2021, rising by 205%. Though this number trended down in 2022 and to a lesser extent in 2023, there has been a renewed vigour in AI investments from banks in Q1-Q3 2024, with investments in AI companies during this period already seeing 34% growth over the entirety of 2023. This may be linked to renewed interest in the space given the ongoing hype around generative AI.

It’s also worth noting that the data period assessed also cuts off just before OpenAI’s $6.6bn funding round announced at the start of October, which featured participation from several banks on our Top 100, including Citi, Goldman Sachs, HSBC, JPMorgan Chase, Santander, UBS and Wells Fargo.

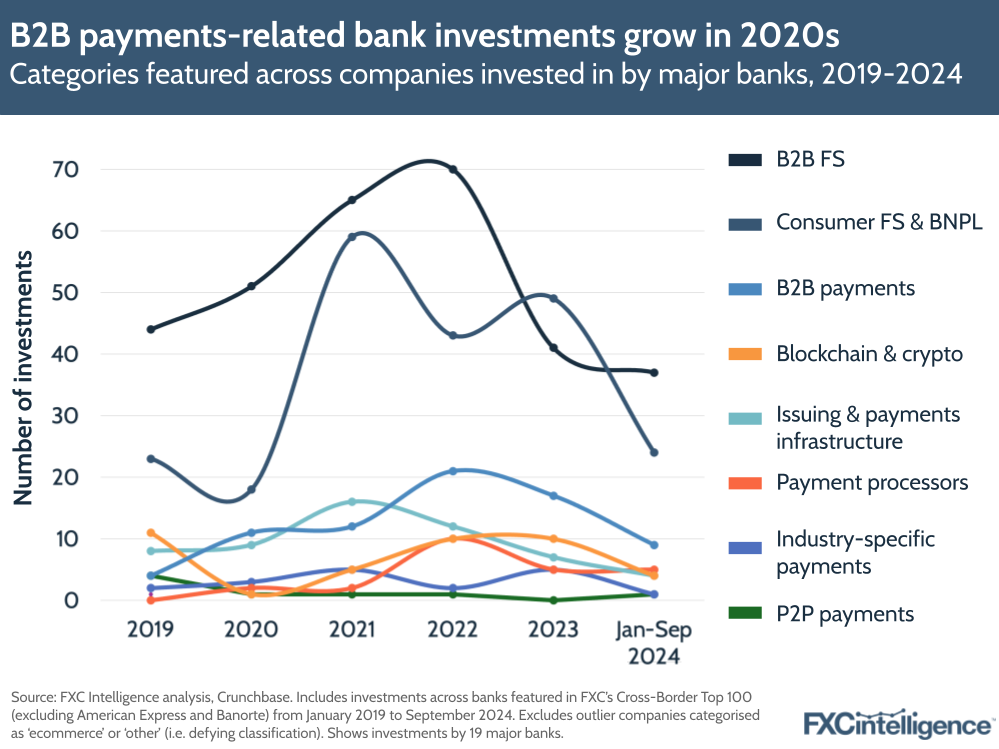

In addition to using categories on Crunchbase, we also went through payments provider investments – both cross-border and non-cross border – to categorise them by their primary business and give a better sense of the kind of payments customer bases banks appear to be targeting with investments.

These were split across a number of categories, including ecommerce, P2P payments, B2B payments, issuing & payments infrastructure, processors, industry-specific payments (e.g. focused on a specific sector(s) like maritime or education), or blockchain & crypto payments. We also included a category for B2B financial services providers, spanning wider but relevant categories such as business banking, financing or lending services, as well as consumer financial services, including consumer banking, buy-now-pay-later solutions, loans or investment products.

B2B and consumer financial services accounted for the highest share of payment provider investments during the overall period, at 39% and 28%. Having said this, there have been some interesting shifts in other categories over time. B2B payments & payroll investments accounted for 9% of investments overall and grew by 75% YoY in 2022 to 21 investments, though it has seen less interest in the following years. Meanwhile, blockchain & crypto-focused investments dipped in 2020 to a single investment (having seen 11 in 2019), but grew the following year to five and then again to 10 in 2022, staying at 10 in 2023.

Which cross-border payments companies received the most investment?

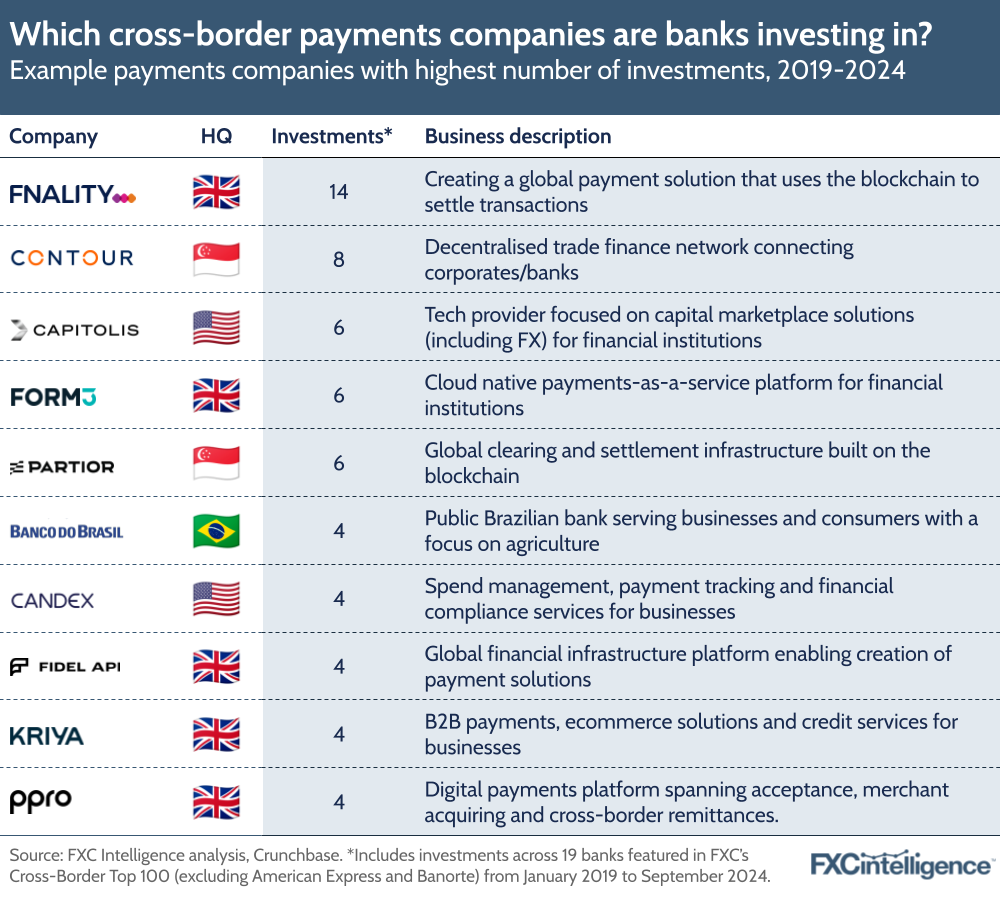

Cross-border payments companies that received the highest number of investments across all banks varied across a number of categories, spanning blockchain, B2B, payments infrastructure and banks.

Leading the pack in terms of overall investments was Fnality International, a company that is aiming to create a network of decentralised financial market infrastructures to support wholesale banking transactions. The company received 14 investments from banks overall across multiple funding rounds, with backers including Santander, UBS, BNY, Lloyds, CIBC, Barclays, BNP Paribas and Goldman Sachs.

Other top performers in terms of recipients over the period include two companies that have featured on FXC’s Most Promising list in the last years: Form3, a cloud-native payment infrastructure platform, and Partior, which delivers payment infrastructure services using blockchain for major financial institutions.

Where are recipient companies based around the world?

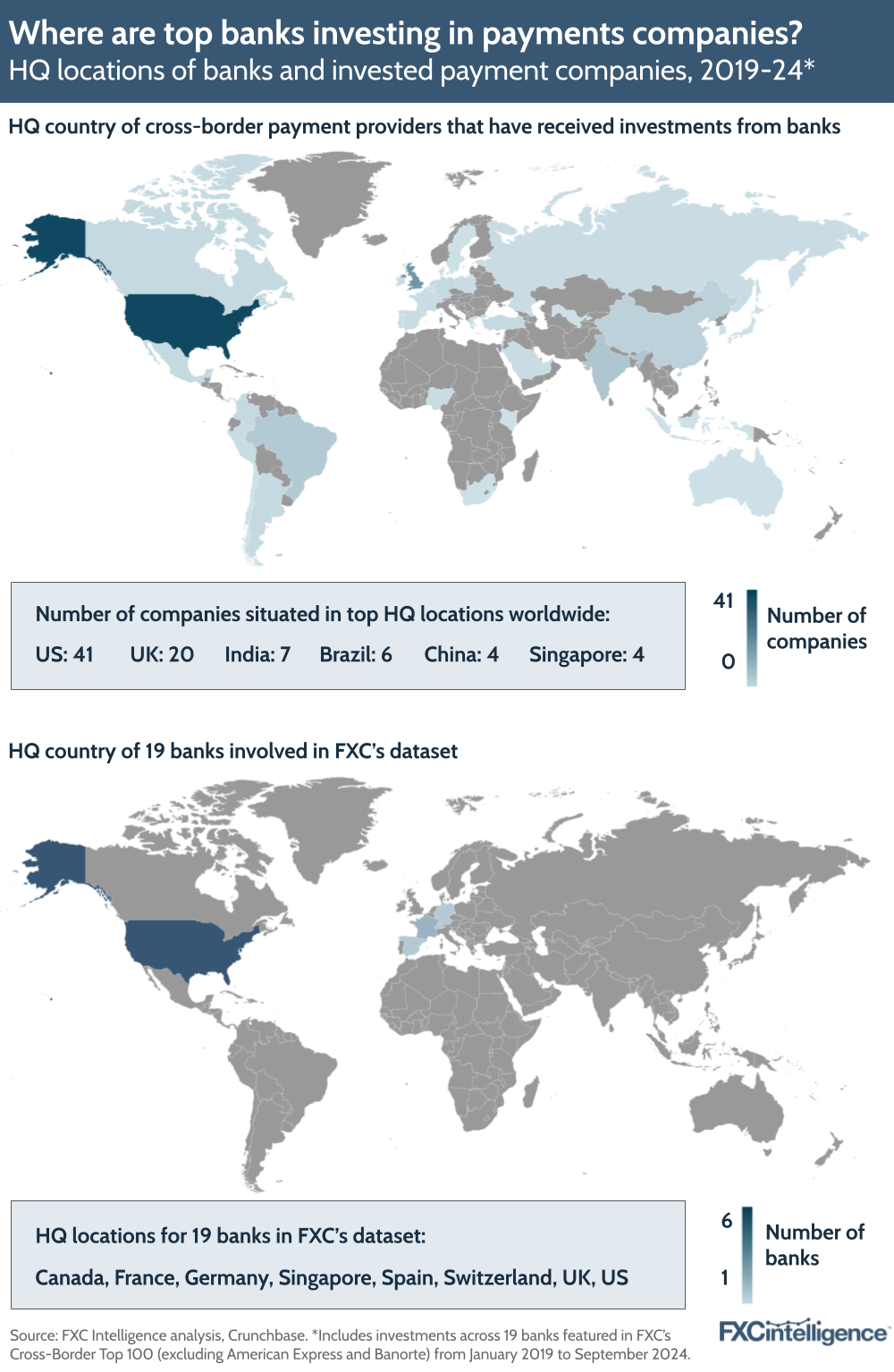

In total, investments in all categories were spread across more than 60 countries, with 30 of these countries containing cross-border payment companies that received investment.

Though many countries were home to companies that only received one investment overall, countries were still well distributed globally, with banks making investments across Europe, the Americas, the Middle East and APAC over the last five years.

The US and the UK were the most prominent sources for investments overall. Across all companies invested in, 41% were based in the US with 17% based in the UK. The next biggest HQ locations were France, where 8% of companies were based; Canada with 6%; and India with 5%.

Looking specifically at cross-border payments companies, 36% of companies were based in the US, while 18% of these companies were based in the UK. Other leading countries were India with 6% of cross-border payments companies; Brazil with 5%; and China and Singapore both with 4%.

Bear in mind that across the 19 parent banks included in our research, six of them are based in the US, with five in the UK, two in France and Canada, and one apiece in Spain, Germany, Switzerland and Singapore.

In terms of cross-border investments, other top performing countries included Singapore, which accounted for 9% of investments, Brazil with a 6% share and India with a 5% share of investments. Argentina was next on the list, seeing five cross-border investments, while China and Turkey each saw four cross-border focused investments.

Given the Western focus of banks on our list, the regularity of LatAm and APAC countries across the top countries for investments reflects some of the recent trends we’ve seen in the space across these areas, particularly the growth of financial inclusion and digitalisation.

Interestingly, though in most cases the highest share of investments from each bank tended to be in the same country as that banks’ parent country, this wasn’t always the case, with cross-border payments investments seeing some variation in where banks are investing. BNP Paribas for example, saw 49% of its investments up to the end of September 2024 in its home country of France, but its 10 investments in cross-border payments were all made in other countries: China, Israel, Italy, Singapore, the UK and Turkey.

When do banks invest in cross-border payments companies?

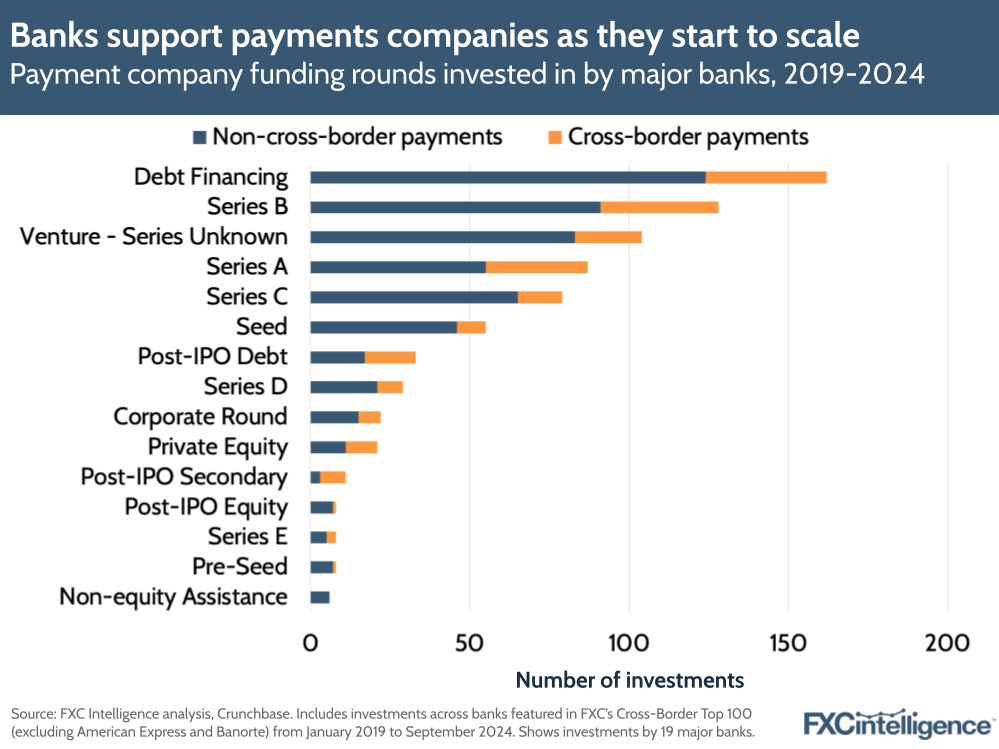

Aside from where banks are investing in companies, Crunchbase also classifies the funding round or stage for each investment, which gives a sense of the maturity of a company when a bank has opted to invest in it.

The most frequent investment stage seen across all investments was debt financing (i.e. loans from banks), which accounted for 30% of all investments from the start of 2019 to October 2024, including 21% of payment provider investments and 18% of cross-border payment related investments.

Excluding the significant number of investments where the funding series level was marked “unknown”, the next most frequent categories amongst payments providers specifically were Series B (16%), Series A (11%) and Series C (10%) funding rounds. Seed investments accounted for 7% of payment provider investments, while Pre-Seed investments accounted for just 1%.

The upshot is that banks appear to be prioritising investments in payments companies that are likely mature enough to have established a consistent revenue stream and are ready to scale, but haven’t yet reached the point where they are going public or in the later stages of venture capital investment.

Insights on top bank investors

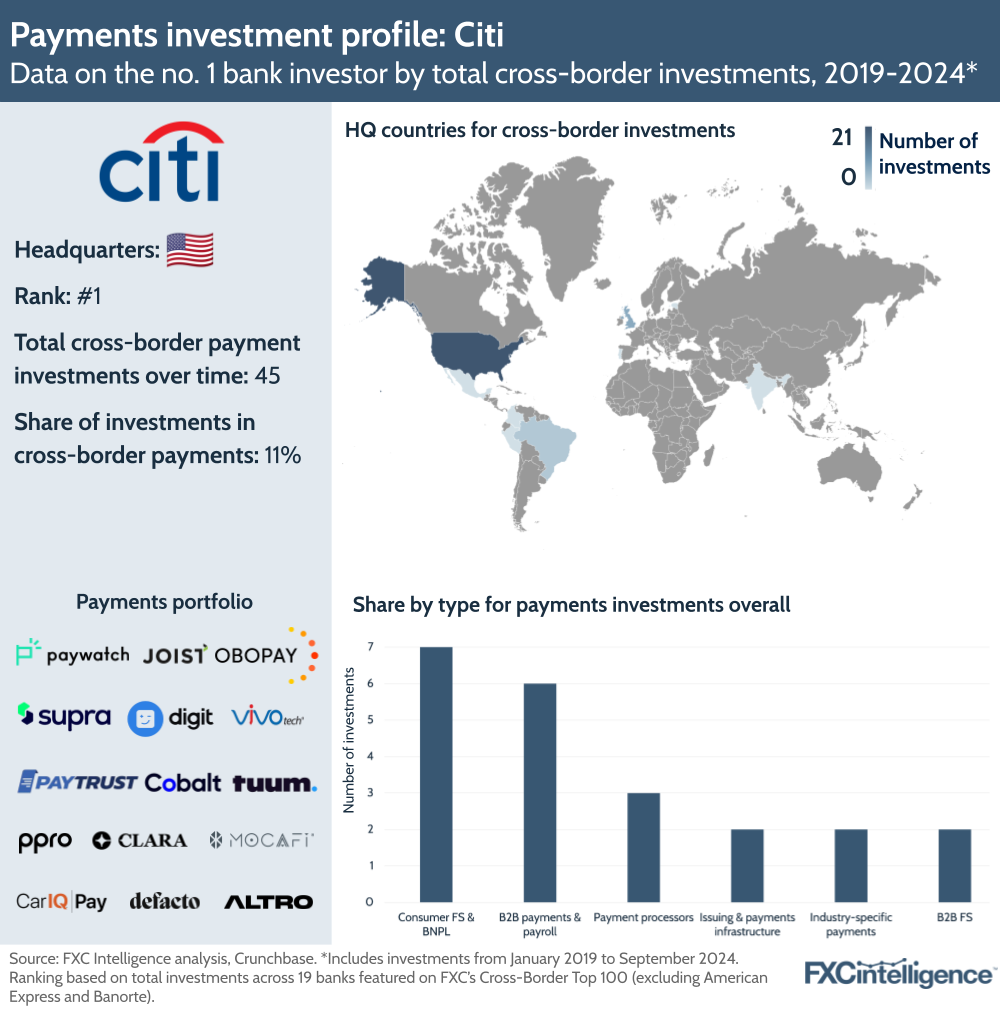

1. Citi

Citi (or Citigroup) currently has the largest investment portfolio in the payments space. The bank invested in 45 cross-border payments companies between 2019 and 2024, which accounted for 11% of its total investments.

In the fintech space, Citi was the first institutional investor in the UK-based company United Fintech, which focuses on acquiring and partnering with fintech firms to create a technology platform. United Fintech facilitates collaboration between fintechs, banks, hedge funds and asset managers. Citigroup led the corporate funding round in February, alongside BNP Paribas, for an undisclosed amount.

Within Citi’s investments in payments companies, the bank focuses primarily on the US market, accounting for 45% of its total transactions, while the UK contributes an additional 18%.

However, Citi reportedly plans to expand its presence in China’s financial markets, launching a China-based investment banking unit by 2025. The bank obtained conditional approval for a brokerage licence in 2023, allowing it to begin hiring staff for the new unit.

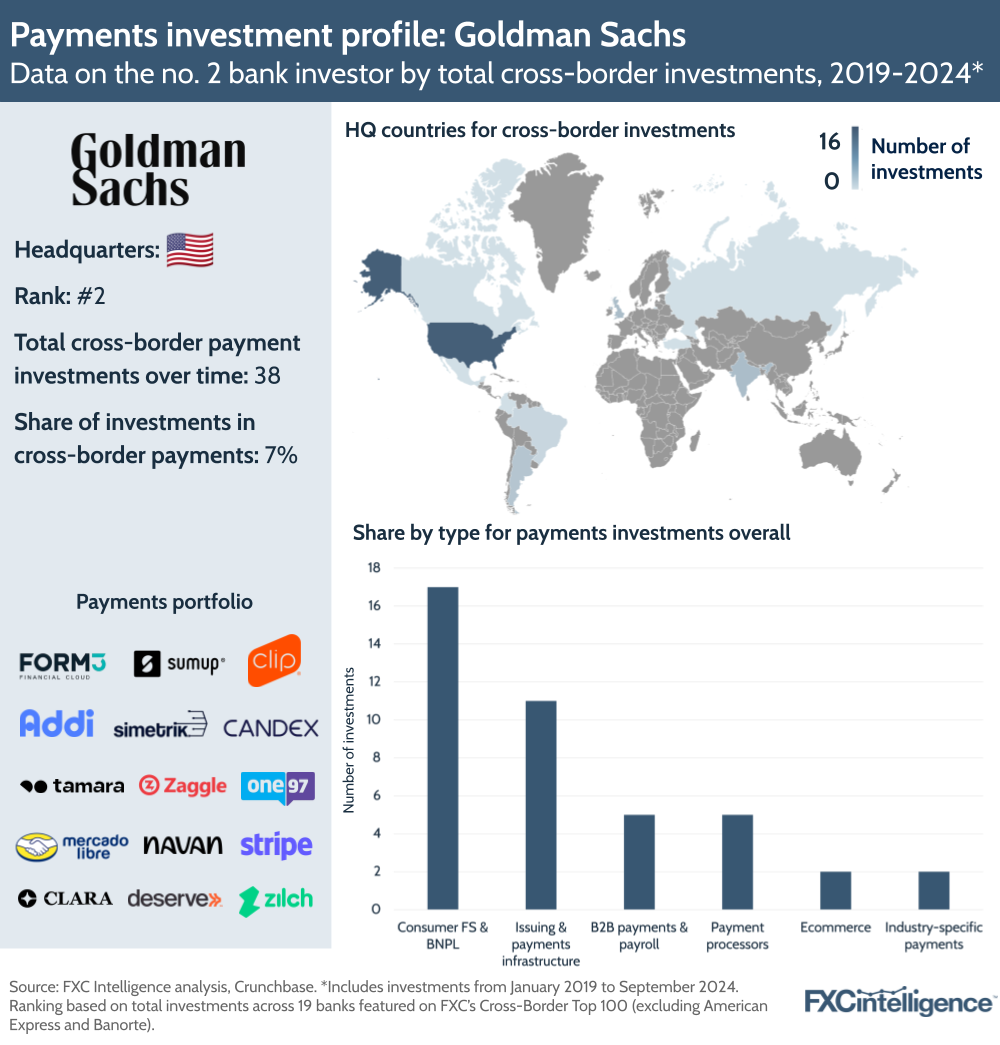

2. Goldman Sachs

Goldman Sachs is the second largest investor in the landscape, with 38 investments in cross-border payments companies over the past four years. Investments in these companies represented 7% of total investments. While the bank mainly invested in the US and UK, it is now showing significant interest in the APAC market, particularly India and China.

Notably, one of Goldman’s biggest deals was the funding for payments processing giant Stripe in 2023. Goldman’s investment contributed to the total $6.5bn raised in Series I. In February, Goldman Sachs’ growth equity fund, along with other investors, agreed to purchase more than $1bn of Stripe employees’ shares, a deal attributed to Stripe’s $65bn valuation in 2024.

Looking at the wider picture, Goldman Sachs saw the number of investments in payments providers overall decline from 26 in 2022 to 16 in 2023, though the company has made 14 investments in the space from January to September 2024. In terms of cross-border investments, these also declined from 10 in 2022 to seven in 2023, with just three investments so far this year.

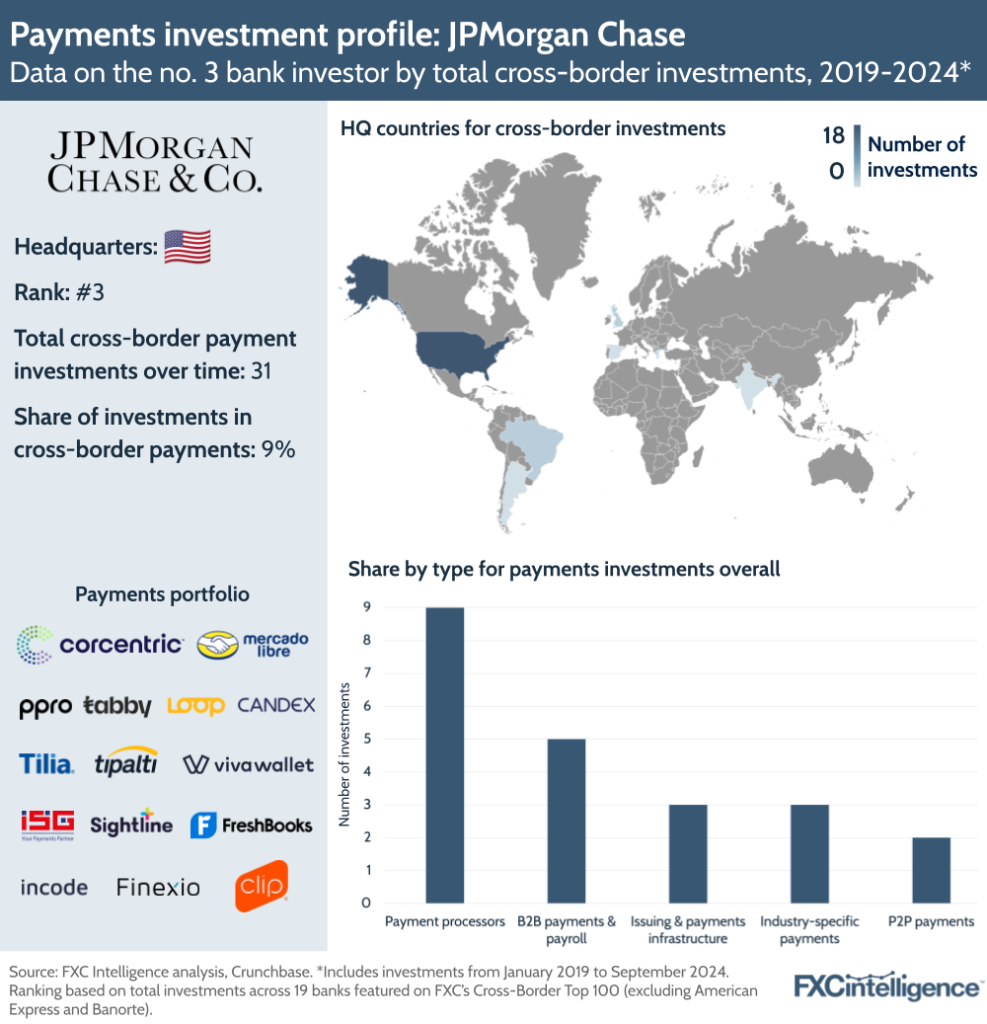

3. JPMorgan Chase

The third largest investor was JPMorgan Chase, with 31 investments in payments companies from 2019 to 2024. J.P. Morgan focuses on investments in the US, which made up 52% of its total investments in payments companies.

Among JP Morgan’s investments, the fintech company iCapital Network has been one of the most frequently backed companies over the past five years. iCapital Network is a US-based digital platform, offering access to private market investments. J.P. Morgan became an investor in iCapital in 2018 and participated in both a venture round in 2020 and the Series C round in 2021. In March, J.P. Morgan Asset Management and iCapital announced a partnership to open up access for private wealth investors in the APAC region.

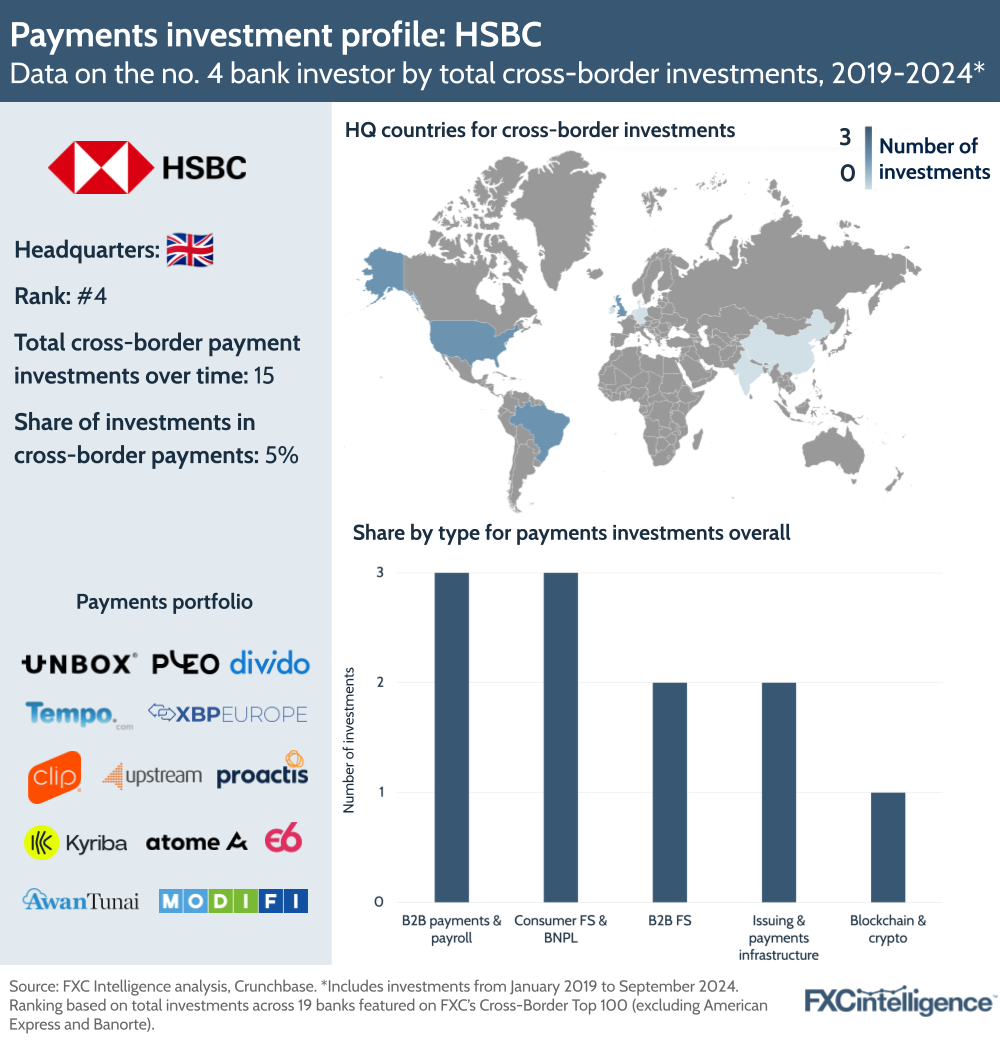

4. HSBC

Since 2019, HSBC has invested in 15 cross-border payments companies, which is equal to 4.6% of total investments. Despite its diversification of investments, the bank remains focused on the UK market, which accounts for 15% of its total investments in payments companies.

Zing highlights HSBC’s significant interest in the UK payments market. The application is a partnership between HSBC and Visa, offering low-cost international money transfers services. HSBC’s Zing launched in the UK in January 2024 and became a direct competitor to fintech remittance companies, particularly Wise and Remitly.

However, HSBC also recently wrote off its remaining $5.86m stake in another UK-based fintech, Monese, two years after investing $35m into the company. The investment started as a partnership to integrate Monese’s BaaS technology into HSBC’s banking services, but the fintech faced significant headwinds from its competitors, including Revolut, Monzo and Starling, as well as growing pretax losses and admin costs that dampened revenue growth. It is now being acquired by UK-based fintech Pockit.

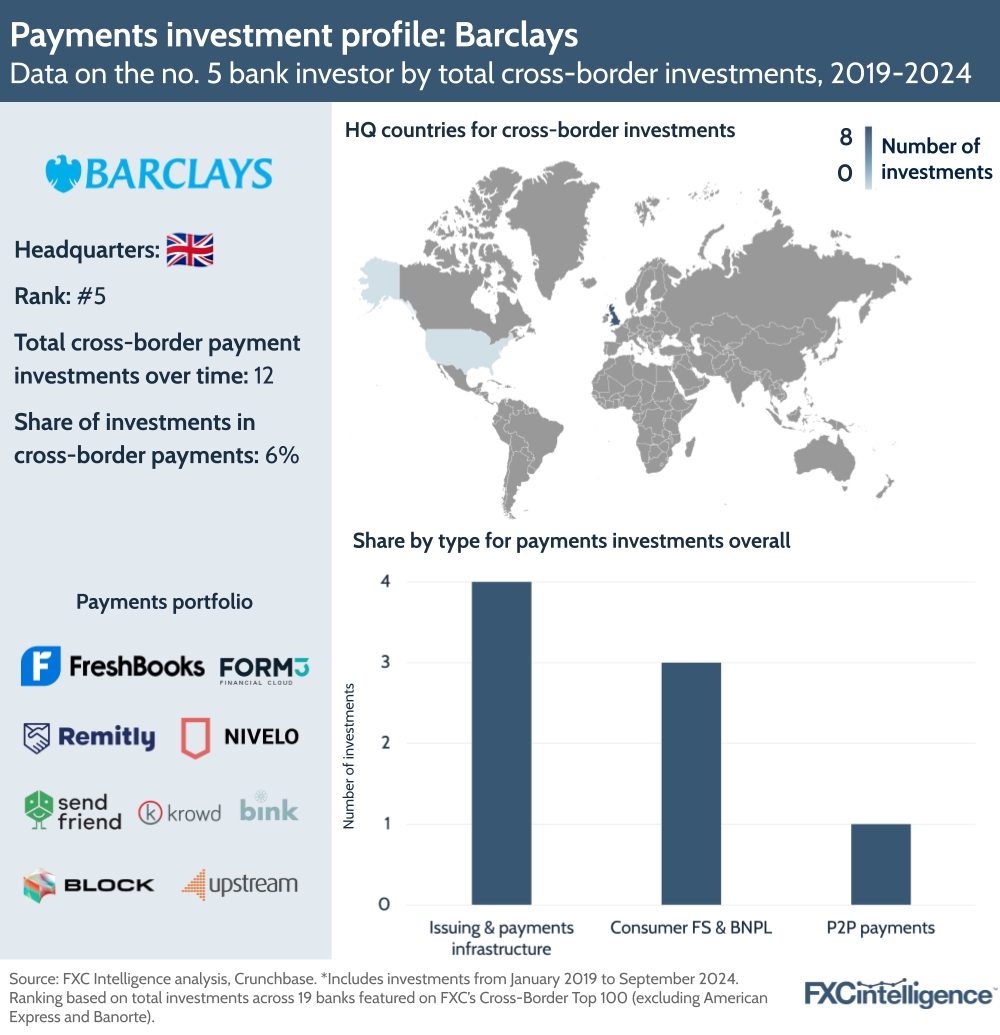

5. Barclays

Barclays has invested in 12 cross-border payments companies over the past four years, accounting for 6% of its total investments. The bank particularly invested in payments companies based in the US and the UK. Notably, Remitly received $85m in debt financing from Barclays in 2019.

The majority of Barclays’ investments focus on B2B financial services, particularly loan and credit companies. The loan data company Versana is one of Barclays’ latest investments, alongside Citi, JPMorgan Chase and Bank of America. Versana offers real-time data on banks’ corporate loans, covering 4,800 corporate loan facilities totaling $2.7tn in commitments. Besides investing capital, Barclays also participated as a subscriber and provider of Versana’s agented corporate loan data.

In the fintech space, Barclays announced its goal to invest up to $1tn by 2030 in green companies to support its transition to sustainable finance, targeting funding for renewable energy, green mortgages and affordable housing. Barclays also announced its plan to increase investments in climate startups through Barclays’ Sustainable Impact Capital initiative, contributing up to £500m by 2027.

Conclusion and the future of bank investments

To recap, across our dataset, banks’ investments in payment providers – spanning banking, payments (including mobile payment providers) and fintech providers – have accounted for around 22% of total investments from the start of 2019 up until the end of September 2024, with cross-border payments accounting for 6%.

Considering that this spans more than 3,600 investments across companies spanning hundreds of different services, this is a solid show of faith in the space, and one that underlies banks ongoing deals, partnerships and even acquisitions of cross-border payments companies in order to boost and modernise their own services in this area. However, it is notable that investments in cross-border payments fell in 2023, against the grain of an overall rise in investments, and it will be interesting how FY 2024 compares.

As financial inclusion has proliferated, banks are investing in payments providers in a variety of other countries and at various levels of maturity, but are seemingly focused on startups that are ready to scale, with financial services, fintech, software and AI all becoming growing topics of interest.

As our recent report on the FSB’s G20 Roadmap showed, the industry still has some way to go when it comes to making payments faster, cheaper and more streamlined. As non-traditional players and digital banks continue to disrupt the space, banks will need to continue to stay on top of trends such as AI, real-time payments and digital currencies to compete as policymakers scrutinise the industry and try to bring costs down.