Banks form a critical part of the cross-border payments industry, but how have they fared in 2024? We look back at charts from across the year to highlight key trends and developments.

The banking industry is central to cross-border payments, particularly when it comes to the B2B side of the industry, but over the last decade it has often been seen as a follower, rather than an innovator, in the space. However, some of our analysis from this year shows that isn’t always the case, with certain banks in particular driving key cross-border payments-focused change.

In this report, we review some of the key charts and findings we unearthed over the past year to identify key cross-border payments trends for the banking industry in 2024.

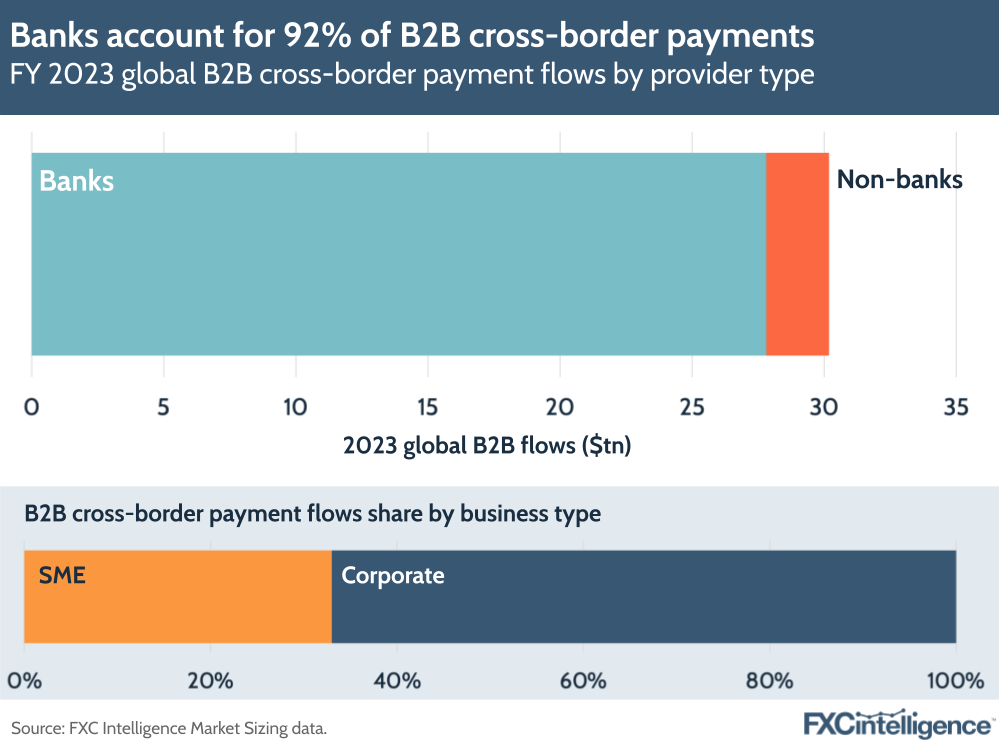

Banks lead B2B cross-border payments – but non-bank players are taking share

Banks have always dominated B2B cross-border payments, and our own market sizing data showed that this continues to be the case. Data we released in September for full-year 2023 shows that banks accounted for 92% of B2B cross-border payments globally, handling total flows of $27.8tn over the course of the year. Meanwhile, the remaining 6% was split 2:1 between non-bank corporate payments and non-bank SME payments. By contrast, analysis of our remittances market sizing data conducted at the same time found that banks accounted for around a third of consumer remittances over the same period.

This remains an immense share of the global B2B payments market, which itself is growing each year, however it is a lower share than we have measured in the past, with many non-bank B2B-focused players taking much of their new business from banks, rather than other competitors.

Cross-border payments still not a priority for some transaction banking players

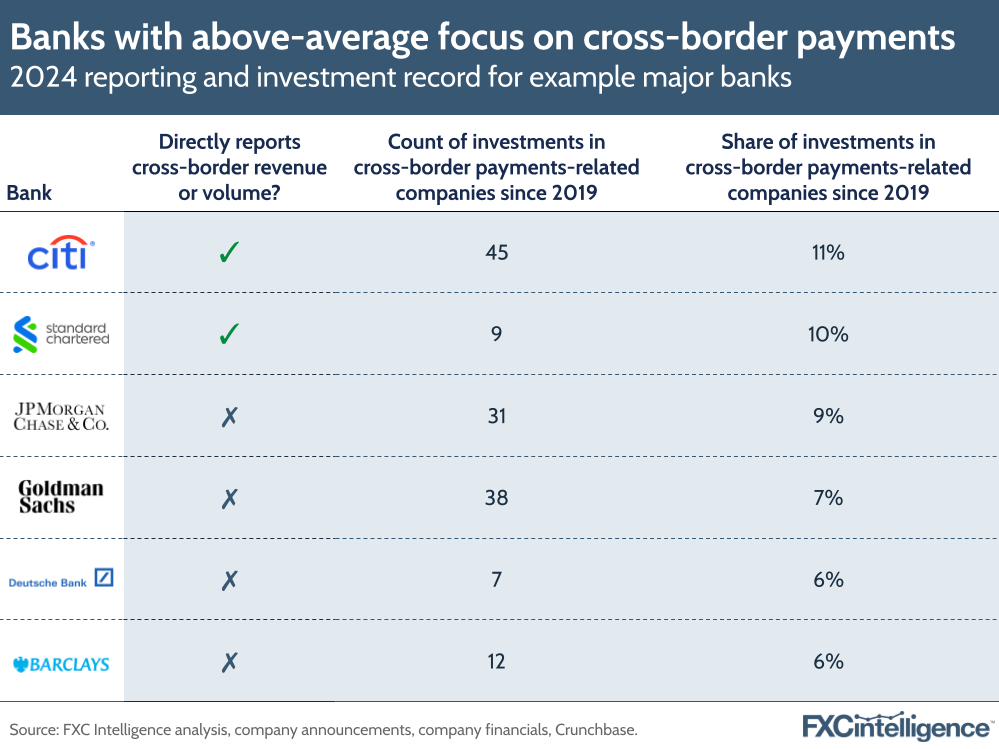

Our analysis of the earnings reports of 13 different global banks this year showed that while cross-border payments is a central focus for some, for others it is barely mentioned as part of reporting. While both Standard Chartered and Citi break out some direct metrics for cross-border payments within their transaction banking, many do not report on it directly, with some including it only as a far broader unit.

While several – including Barclays, Goldman Sachs and HSBC – report the performance of transaction banking segments where cross-border plays a major role, others including JPMorgan Chase and Wells Fargo only report a broader payment segment. Some, including Deutsche Bank and Societe Generale, only report at a level above this, increasing the opacity around their performance in cross-border payments related fields.

While this is one of only a number of indicators of a bank’s focus on cross-border payments, it does speak to the amount of board-level interest in the space, and therefore may in some cases indicate how much top-level investment or support there is for that side of a bank’s operations.

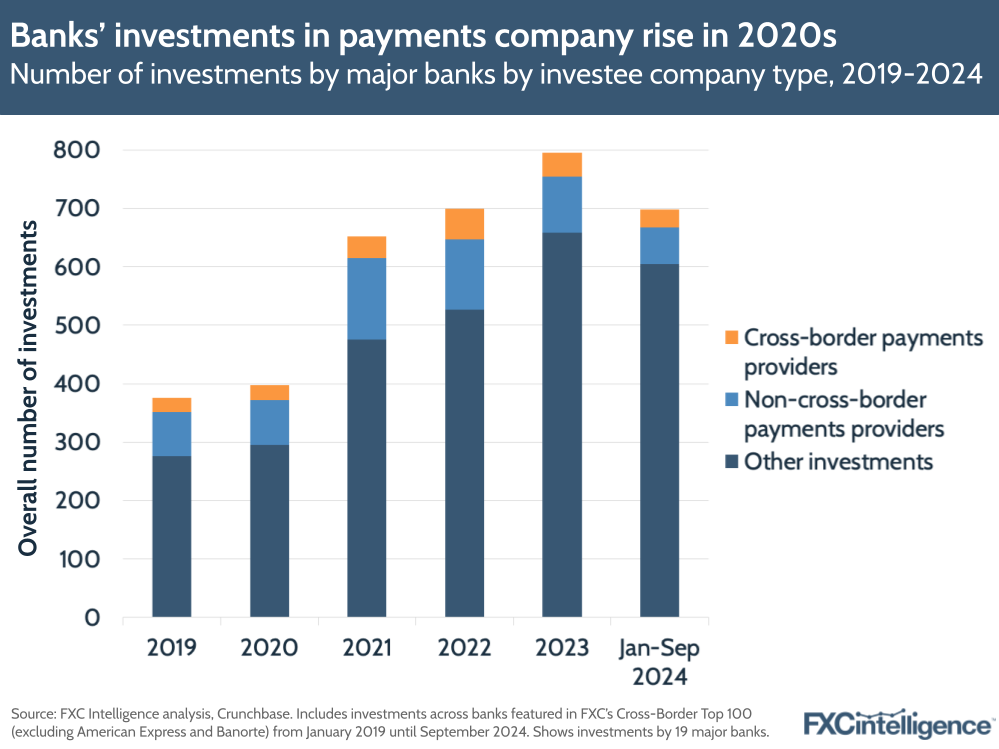

A separate report released in Q4 also shed some light on the varying levels of bank interest in cross-border payments from a different perspective, this time focusing on their levels of investment in external cross-border payments companies. Banks may invest in external companies due to perceived long-term potential of the business in question, but also as part of deals to utilise their technology, which in some cases can ultimately result in the bank acquiring them. Investment focuses therefore speak to the levels of interest in a given space a particular bank has, and so provide a sense of where a given bank’s interest lies.

Here we found that over a five-year period between 2019 and 2024, 6% of investments made by 19 of the world’s biggest banks were in cross-border payments-related companies. However, there has been a lower rate in recent years, with 5% of investments across 2023 and 4% of those in Q1-Q3 of 2024 being in cross-border payments. In both years, a far greater share was in non-cross-border consumer financial services companies, while in 2023 7% of investments focused on blockchain and crypto-related companies.

But some banks are increasing focus on cross-border payments

Notably however, there were some banks who were putting a greater emphasis on investments in cross-border payments companies. BNY Mellon, for example, only invested in 35 companies over the five-year period, but made 17% of its investments in cross-border payments-related organisations.

Citi – a far more prolific investor with a total of 409 investments – had the second highest share at 11%, meaning it made the most investments in cross-border payments companies out of all 19 banks over the period. Standard Chartered, meanwhile, had the third highest share, at 10% of 91 investments.

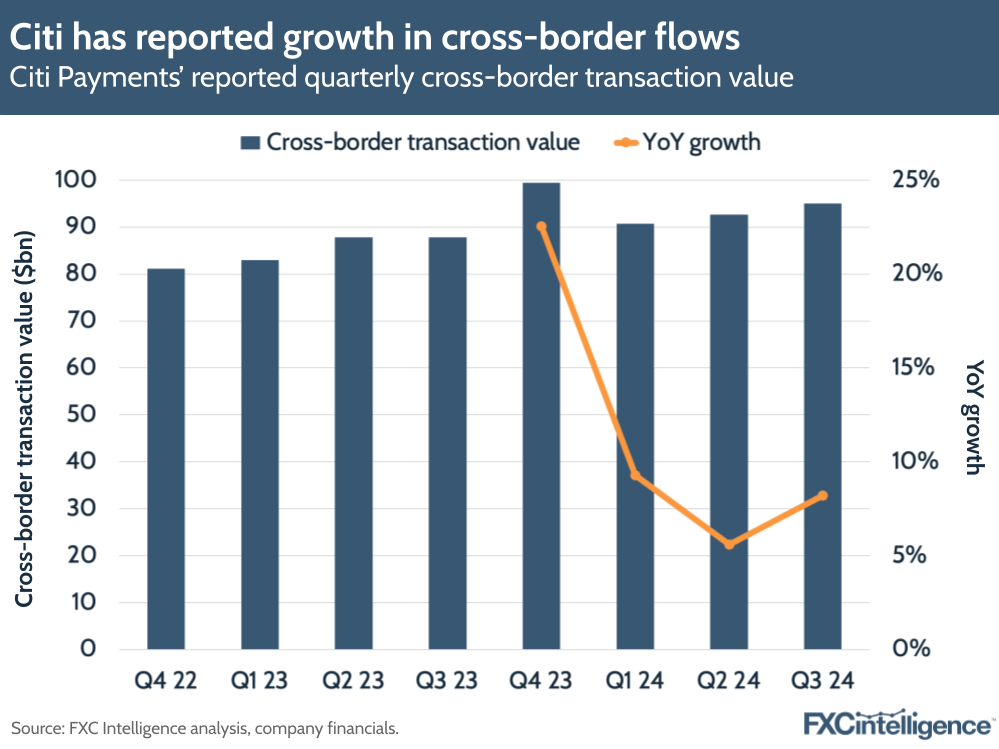

For banks that do report cross-border payments more explicitly, this year also provided some insights about the ongoing approaches and evolving strategy of the space. Citi, for example, regularly reports cross-border transaction value, although has only broken out revenue as a one-off during an investor day at the start of the year. However, its most recent earnings saw it report an 8% rise in cross-border transaction value that puts it comfortably on course to surpass its 2023 full-year performance in FY 2024.

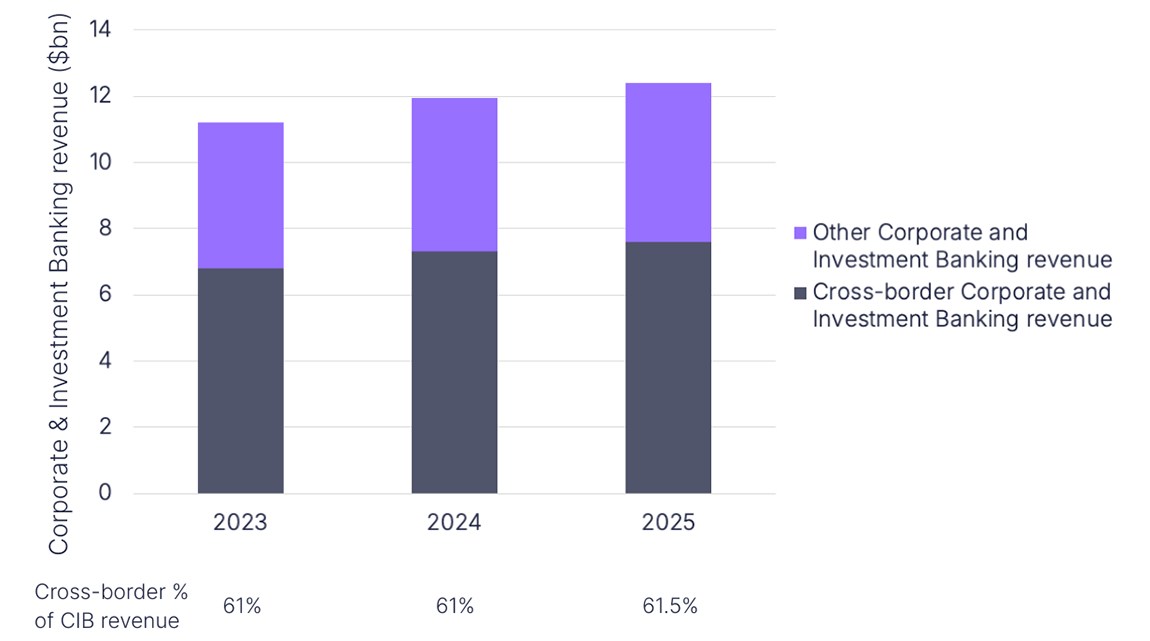

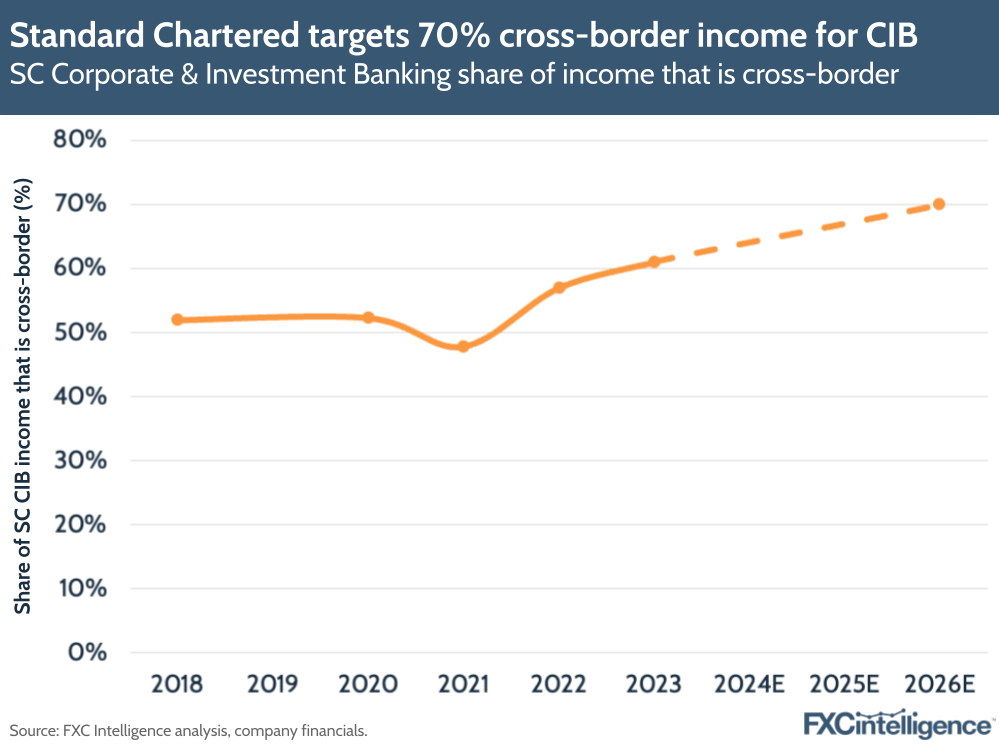

Meanwhile, Standard Chartered is the only bank to consistently report cross-border payments revenue, although it only does this on a half-yearly basis. However, Q3 2024 saw it update its strategy for its Corporate and Investment Banking (CIB) segment, with the bank targeting 70% of the segment’s income to come from cross-border in the “medium term”, up from 61% in FY 2023. This would see it increasingly prioritise the needs of larger international-focused clients and in doing so exit around a quarter of the segment’s clients who do not “play directly” to these strengths.

In taking this approach, Standard Chartered is doubling down on its position as a cross-border-first bank. However this strategic refocusing on global strengths is something we may see from more banks in different directions over time, and this may ultimately result in more banks explicitly focusing on cross-border payments, while others increasingly generalise the service with support from B2B2X players and other external partners.

B2B2X partnerships broaden capabilities

Crucially, Citi also highlighted its recently announced partnership with B2B2X platform Mastercard Move, which, according to Mastercard, makes it the first global bank to enable cross-border payments to Mastercard debit cards.

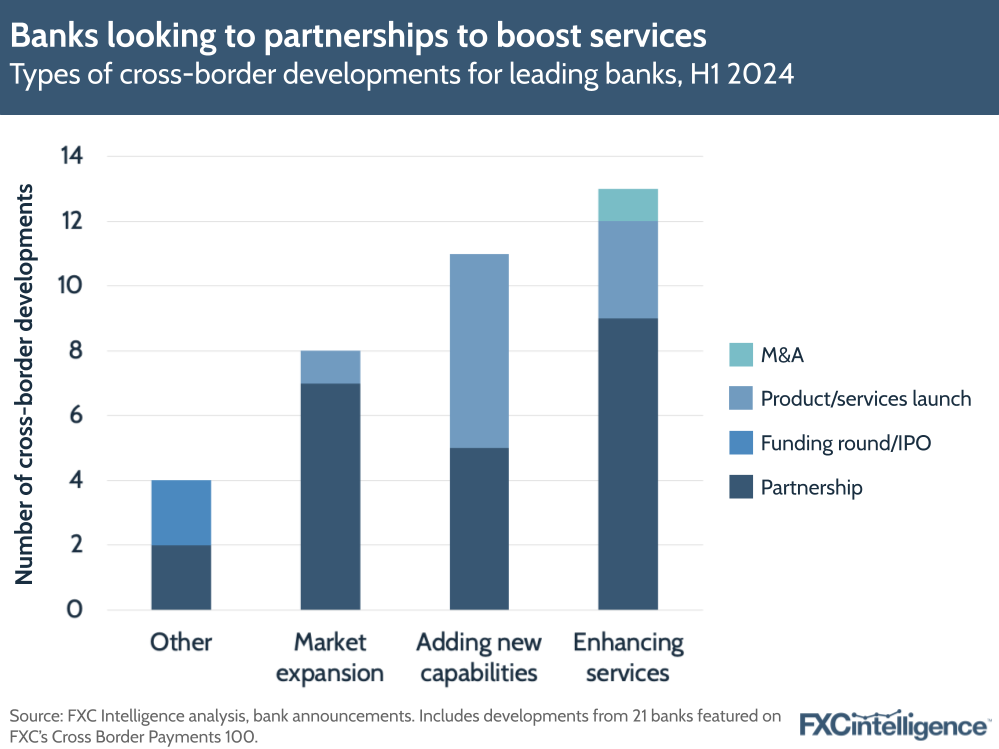

Our roundup of B2B2X payments this year shows that banks were a key focus for such partnerships this year in general, as banks increasingly look beyond solely relying on correspondent banking services to improve their offerings and therefore better compete with enterprise-focused B2B payments players.

This was also echoed by an analysis of cross-border payments news stories featuring banks that we conducted in the first half of the year, which showed that partnerships were being harnessed in a variety of ways to increase cross-border payments services.

This is a trend that while on the rise this year, still has considerable headroom, and we expect it to continue to develop into the new year.

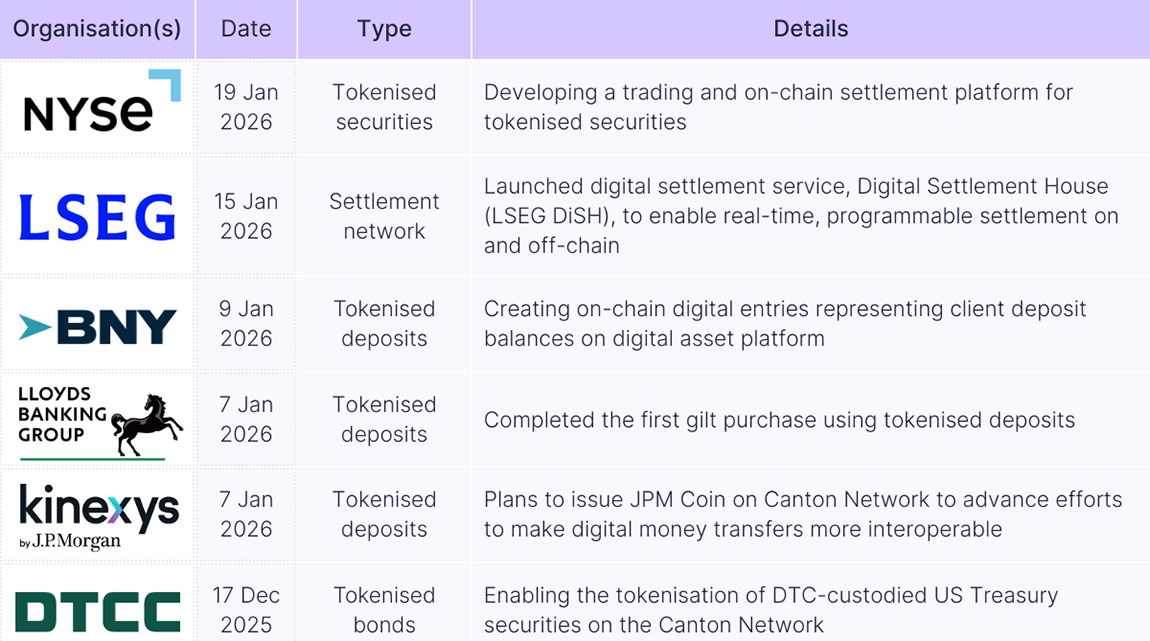

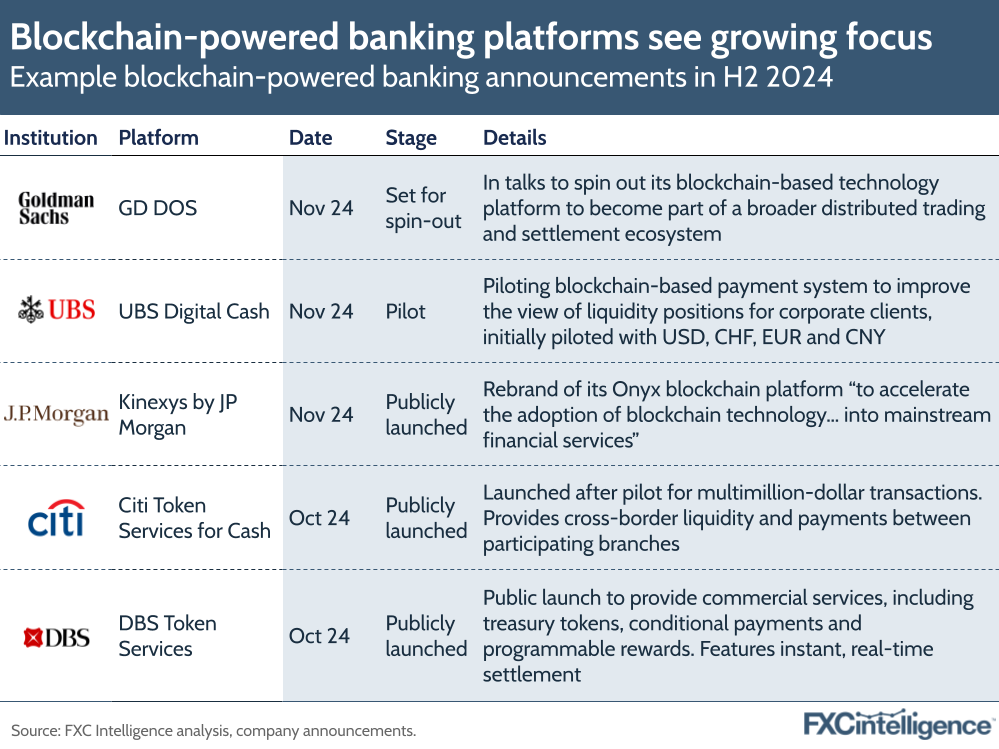

Blockchain-powered banking platforms are attracting development

While many banks have looked to partnerships to grow their capabilities in 2024, technological advances have also played a key role. Blockchain, which has attracted considerable attention across many verticals within cross-border payments, has seen growing interest in the banking space too, particularly towards the latter half of the year.

Here one of the main focuses has been on the development of in-house blockchain-based platforms, which can provide internal cross-border liquidity as well as providing similar solutions to major external clients. Here blockchain technology can provide some advantages, including having the potential to make settlement instant.

J.P. Morgan was an early pioneer in this space with the development of its blockchain platform, originally known as Onyx. In Q4 the company took a further step by relaunching this as Kinexys, a platform supporting digital payments and digital assets targeting mainstream financial services. Currently handling around $2bn transaction volume a day, it is likely that we will see Kinexsys expand over the next few years.

Several other banks have moved into this area this year. In October, Citi Token Services for Cash, Citi’s digital ledger technology-based platform to facilitate multimillion dollar transactions for institutional clients, moved from being a pilot programme to a live commercial solution. The same month, DBS’s suite of blockchain-based banking services DBS Token Services also went live, including features such as instant, 24/7 real-time settlement.

Other banks are looking to follow suit, with UBS announcing it had successfully piloted its own platform, UBS Digital Cash, in November, in trials that included cross-border transactions with multinational clients in US dollars, Swiss francs, Chinese yuan and euros. Meanwhile, having established its own solution as part of its digital assets business in 2022, Goldman Sachs is now exploring the spin out of its blockchain platform GS DAP, to broaden its applications and ultimately enable it to form part of an industry-wide distributed ecosystem.

AI sees growing banking interest

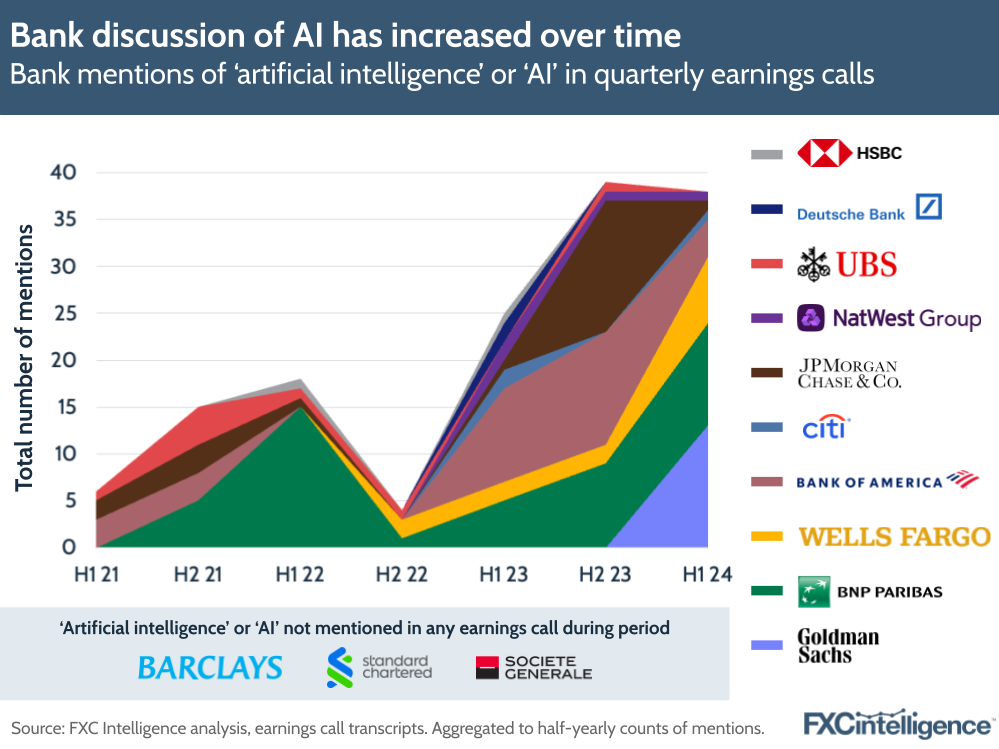

Away from blockchain, the inevitable other major technology trend this year has been artificial intelligence (AI), with generative AI in particular helping to fuel growing interest.

Our analysis of discussion in bank earnings calls earlier in the year showed that mentions among many major banks had climbed across 2023 and 2024, as the rise of large language model-based solutions in particular raised new possibilities for the technology across a host of industries.

We have also seen AI applications discussed in a host of bank announcements and press releases, with the technology being incorporated into a broad range of operational areas.

Regulatory compliance, fraud and related areas have long been a key application for AI, and this has continued to be the case in 2024. Several banks have announced updated systems that include AI, with Raiffeisen Bank among those to announce such an approach this year, while Swift also launched an AI-based anomaly detection service to help banks combat fraud.

AI has also found its way into many banks’ in-house toolsets, with Morgan Stanley launching an AI-powered assistant to support its institutional securities staff, while Caixabank has created a 100-strong multidisciplinary generative AI task force to harness the technology and BBVA has created a training programme for its top executives focused on using genAI to improve productivity.

Enthusiasm for AI is also translating into significant technology investments, including Citi’s multiyear agreement with Google Cloud to access its Vertex AI platform, while the Commonwealth Bank of Australia has partnered with AWS to build what it is calling an AI Factory for innovation and development.

Notably, these moves have not gone unnoticed at a policymaking level. In September, the Bank of England called on financial services firms to join its AI consortium designed to oversee use of the technology, with other central banks taking similar approaches.

As the sector continues to get to grips with the possibilities, we are likely to see far more use cases for AI in banking in 2025. However, we may see regulatory moves as well.