After the number of IPOs fell in 2023, speculation is growing about whether 2024 could see a return – including in the cross-border payments sector, bolstered by this week’s news about Klarna. In this report, we explore the current state of recent and upcoming IPOs in this space.

An unstable economic landscape, high interest rates, inflation and geopolitical turmoil – none of these factors made initial public offerings (IPOs) an attractive prospect in 2023.

After a boom in IPOs in the early 2020s, many companies have since held off from going public amidst a shaky investment environment. This situation has been reflected in the cross-border space, which saw a number of high-profile IPOs in 2021 but has since seen fewer noteworthy public listings and even some companies returning to private ownership.

However, with central banks looking to cut interest rates and several players announcing strong profitability, speculation is growing about whether we could soon see IPOs making a return for the sector. Just this week, the Financial Times reported that BNPL payments provider Klarna was lining up a number of major banks – including Morgan Stanley, JPMorgan and Goldman Sachs – as potential advisors for an IPO in 2025.

This report explores the current state of IPOs within the cross-border payments sector specifically, clarifying how the lay of the land has changed over the past few years, as well as looking to upcoming potential IPOs to ask: what role are IPOs playing in the cross-border space, now and in the future?

The current cross-border payments IPO landscape

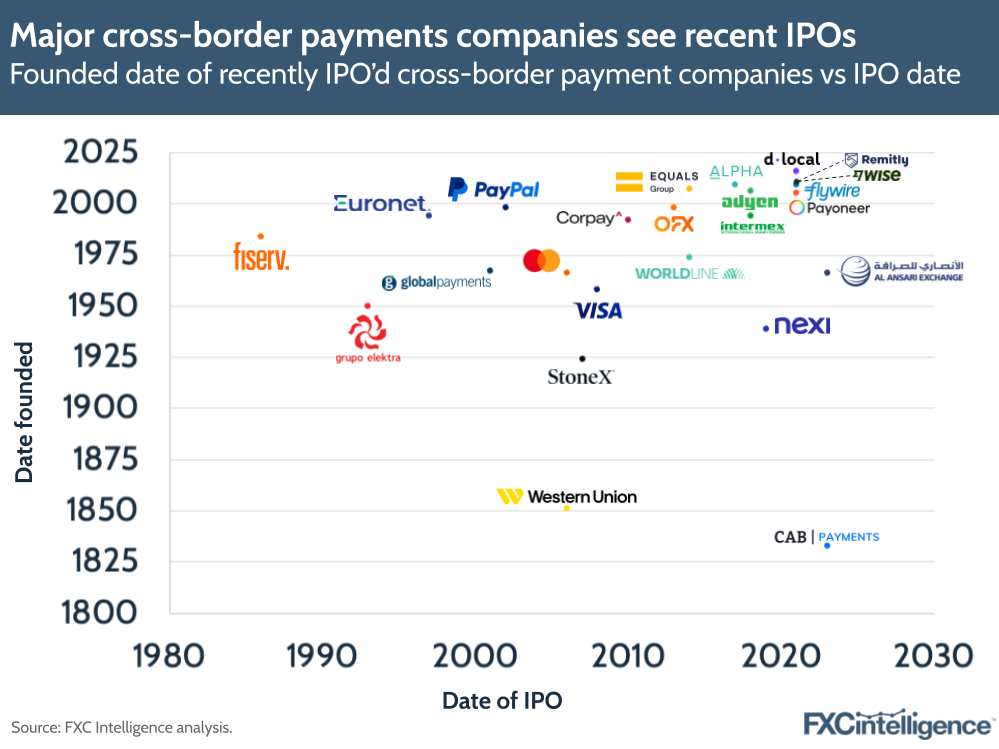

IPOs helps companies scale their businesses by selling off shares to public investors, who in turn get a chance to profit from growth. A number of long-term incumbents in the cross-border space went public years ago – including PayPal, Visa and Mastercard. However, the most recent flurry of activity for IPOs in the sector was in 2021, with Remitly, Wise, Payoneer, Flywire and dLocal all going public that year.

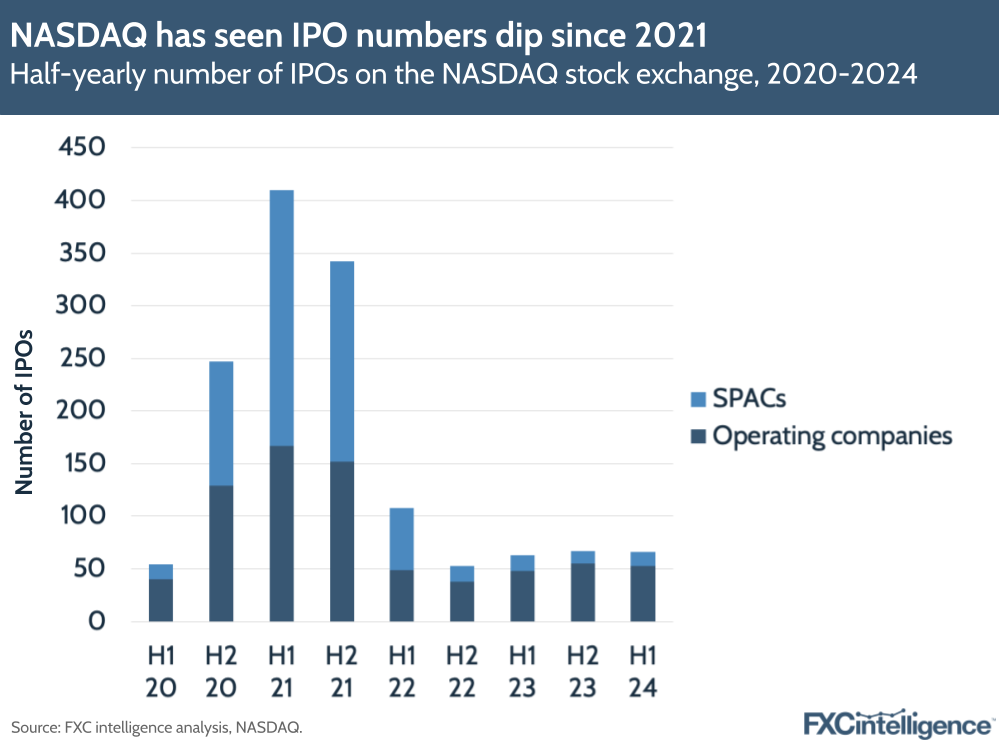

2021 saw the particular influence of special purpose acquisition companies (SPACs) – companies without commercial operations that are created specifically to help raise capital through an IPO for the purpose of acquiring or merging with an existing company.

Markets were also less volatile in 2021 than the previous year, providing a less unpredictable backdrop for IPOs and therefore an environment in which people were more willing to invest. However, the IPO market began to drop off in 2022 as a result of a number of headwinds, including Russia’s invasion of Ukraine, emerged.

Looking at the NASDAQ – one of the largest stock exchanges by market cap – the number of companies that publicly listed declined by 79% to 156 in 2022, and by a further 20% to 125 in 2023 as economic uncertainties persisted. While other stock exchanges may have varied, the NASDAQ gives a sense of how background factors affected the IPO market over the last few years.

However, there has been speculation that, as the macro environment stabilises, 2024 could be set to see a turnaround for IPOs. This could also be aided by growing interest in technology stocks, partly being driven by a push towards generative AI – though as we’ve found for cross-border payments specifically, this technology is either being used in a nascent way, isn’t being mentioned or is being looked at with regards to potential future applications.

NASDAQ IPOs on a half-yearly basis show a 5% increase compared to H1 2023, following a 26% YoY rise in H2 2023.

Which cross-border payments companies have listed publicly in recent years?

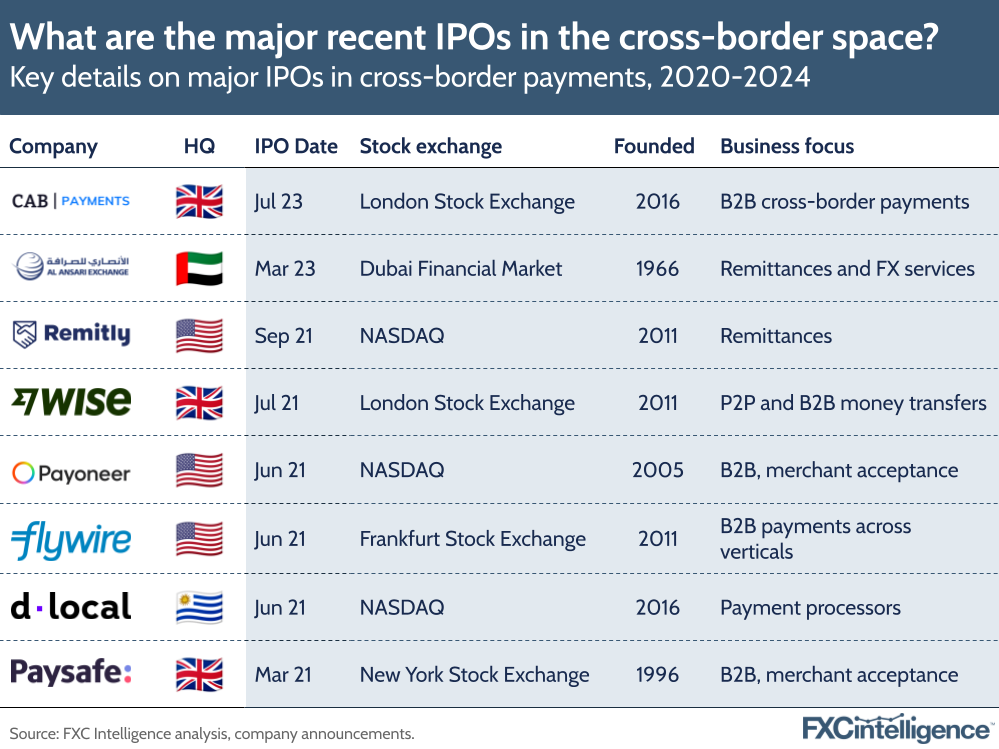

2021 saw a swathe of companies IPO all at similar time, with a variety of focuses – Wise and Remitly, which are both focused on consumer money transfers and remittances; Payoneer, which went public through a SPAC deal and is focused on cross-border ecommerce; Flywire, a US-based processor handling cross-border payments across education, B2B, healthcare and travel; and dLocal, a payment processor focused on the Latin America, Africa and Middle East markets.

The purpose of IPOs for these companies hasn’t just been additional cash injection and scaling business, but also growing exposure and in some cases bolstering companies’ reputations. Wise, for example, opted to join the London Stock Exchange via a direct listing (i.e. without raising any capital), which the company said it was doing as a “fairer, cheaper and more transparent” way of coming to market.

Analysing cross-border payments IPOs from 2020-2024

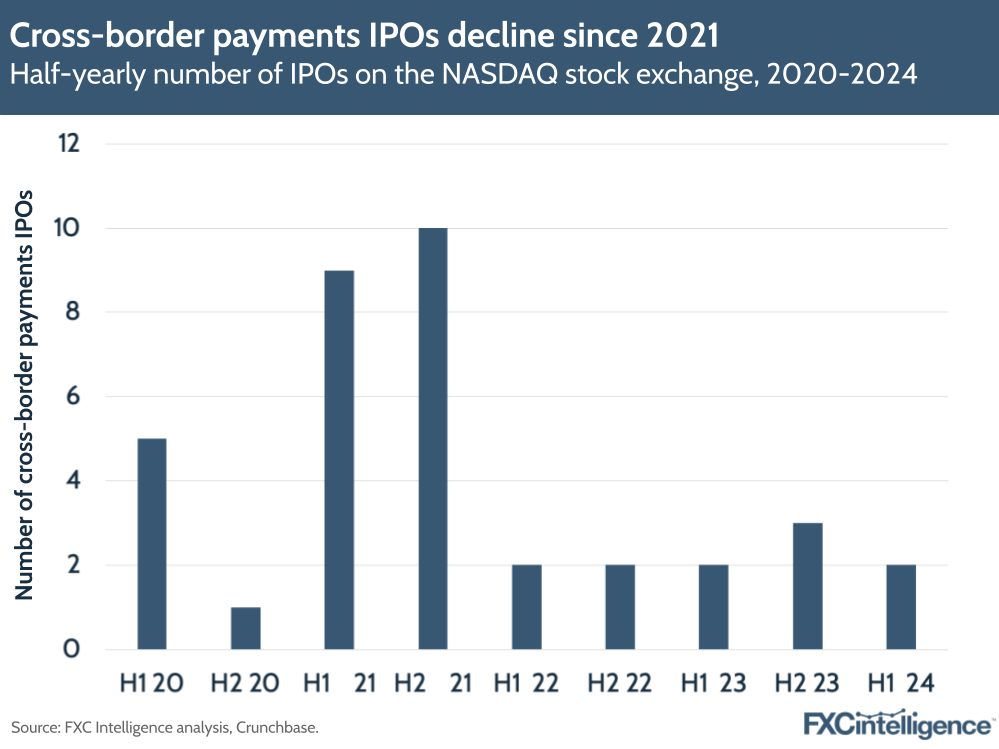

In the period from start of 2020 to end of June 2024 (to track the pre-pandemic period to now), there were more than 5,200 IPOs listed on Crunchbase across all industries, with just over 100 of these being linked to payments.

Further analysis of these found that more than 30 of these were companies that were either focused on cross-border payments or included them as a significant part of their offering (e.g specifically mentioning cross-border payments on their websites).

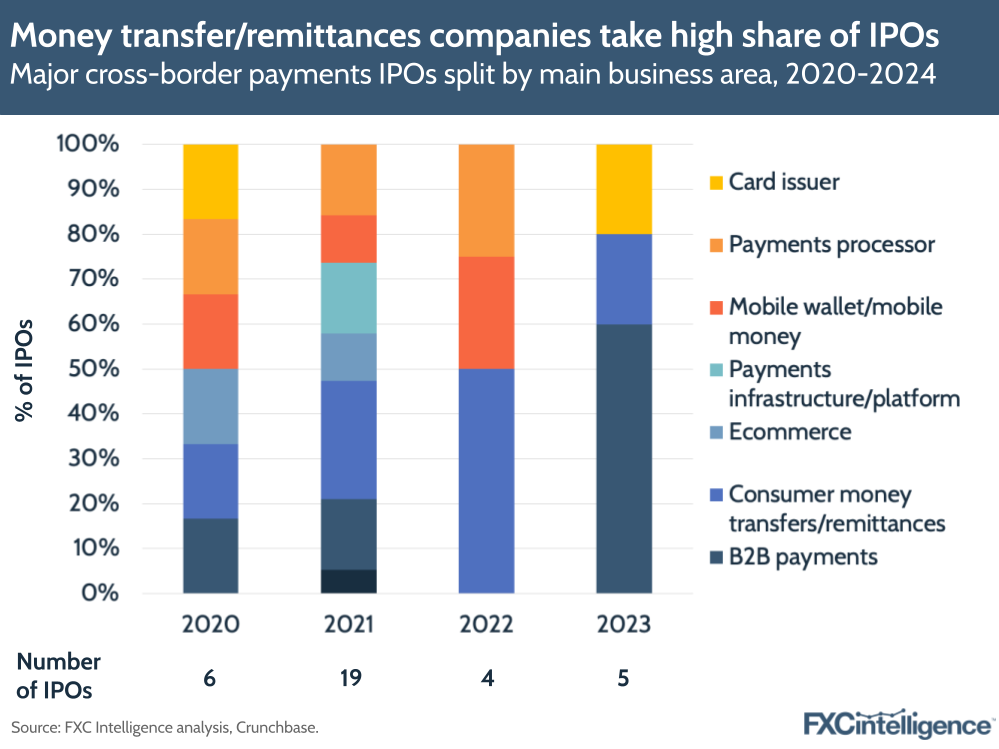

Looking at this dataset, the number of cross-border payments IPOs has declined since 2021 but on a half-yearly basis has remained relatively steady over the last two years. Companies included in this data span a full range of cross-border payment operations, including card issuers, payment processors, mobile wallet/mobile money providers, payment infrastructure or platform providers, ecommerce-focused companies and providers of consumer money transfers/remittances.

What types of companies have announced IPOs recently?

Looking at IPOs over the last few years shows that a high percentage of them have been in the consumer money transfers and remittances space – with some more obvious examples including Wise and Remitly, but also includes players like Al Ansari Exchange, which has existed in the UAE since 1966 but only announced its IPO in March 2023. Another example is Blockchain Venture Capital, which offers cross-border transfers using digital currencies.

Notably, a number of companies focusing on B2B payments saw an IPO in 2023, including CAB Payments – which joined the London Stock Exchange in July 2023 but saw its share price plunge just months later – as well as India-based Zaggle, which offers spend management services, and XBP Europe, which facilitates cross-border payments for SMBs, enterprises and governments.

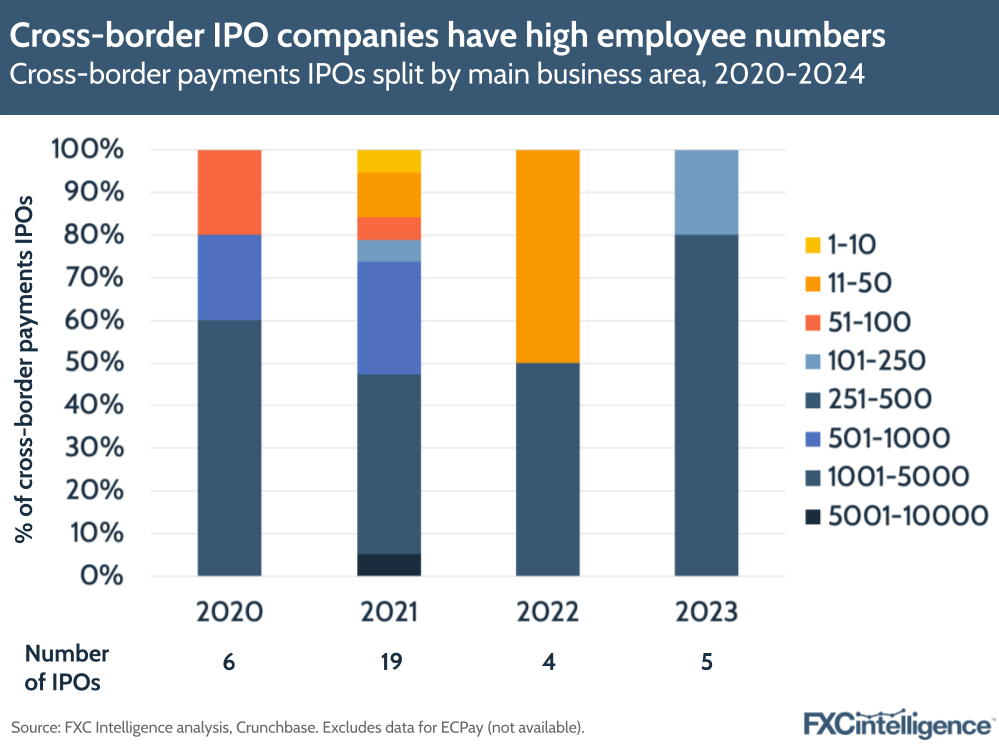

Breaking down recent cross-border payment IPOs by number of employees shows, predictably, that companies have tended to have employee counts on the higher end of the spectrum (in ranges from 101-250 to 5,001-10,000), with just over half of the number having more than 1,000 employees when they announced their IPO.

However, there were still some IPOs from companies with employee numbers fewer than 100 in the mix, with one of these include AppTech, which is powering payments channels with new technologies such as text-to-pay.

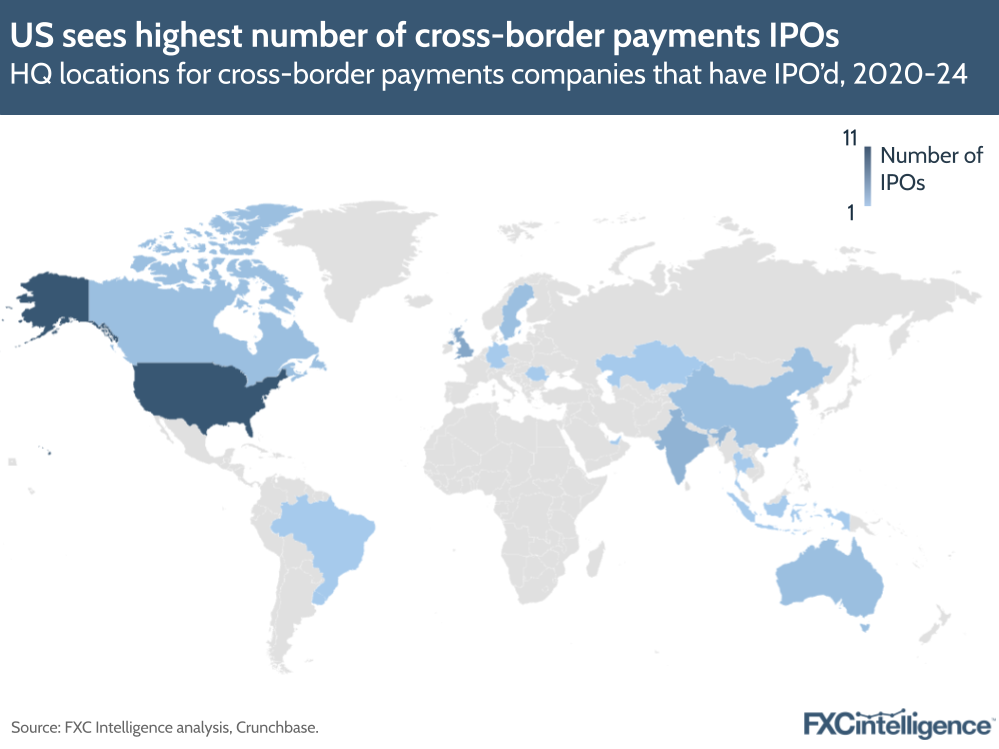

With regards to where companies that have announced a recent IPO are based, the majority (by a significant distance) are in the US, followed by the UK and India.

Some companies have opted to list on stock exchanges that are outside of their HQ location. For example, UK-headquartered payments processor Paysafe has listed on the New York Stock Exchange, as has Nubank, based in Brazil. Listing abroad can help aid expansion and attract new customers in new markets.

Which companies could announce an IPO in the future?

A number of companies in the cross-border space are at various stages of gearing up for an IPO – whether that’s merely suggesting the likelihood of this move at some point in the future, or actively creating a roadmap towards it as a goal.

Revolut, the neobank that offers international transfers as part of its myriad offerings, fits firmly in the first camp. In its recently released annual report for 2023 – in which it shared a 95% revenue increase to £1.8bn – Revolut said that it would bring its “financial processes in line with the standards expected from publicly listed companies”, while the company’s Chair Martin Gilbert told the Financial Times that an IPO was still at least a year away.

Similarly, Rapyd CEO and Co-Founder Arik Shtilman told TechCrunch last July that the B2B payments infrastructure provider was looking at a number of factors – such as market conditions, investor motivation and potential funding for global initiatives – to decide on the best time to go public.

In the case of payment processor Stripe, a recent drive towards profit has dampened any necessity for an additional cash injection (e.g. through an IPO), with the company’s Co-Founder and President John Collison saying to the FT in March that Stripe was in “no rush” to go public after returning to positive cash flow. This was after the company said in January 2023 that it would decide on an IPO within a year.

Some companies have proffered similar rough timelines, only to have these change later. Valentin Stalf, CEO of German neobank N26, had previously predicted the company would IPO in 2023, but in February this year projected the timeline as actually being three to five years away, on the basis of N26 moving towards monthly profitability (the company reported that it had halved its losses in 2023, but these still amounted to €100m).

Meanwhile, BNPL player Klarna – which offers cross-border ecommerce BNPL services to international customers through a partnership with Global-e – is lining up major banks as advisors for a potential IPO which could come as soon as H1 2025, according to insiders cited by the Financial Times this week. Reports from earlier this year indicated the company could seek a valuation of around $20bn – which is up from the company’s $6.7bn valuation in 2022, but still down from its $45.6bn valuation in 2021.

Singapore-based B2B player Nium is also reportedly looking towards an IPO despite a recent 30% cut to its valuation, with an anticipated go-public date in Q2 2025. This was on the back of new $50m funding, which would be put towards mergers and acquisitions, the company’s CEO and founder Prajit Nanu told CNBC. Nanu added that the valuation change wasn’t a concern and that because markets are volatile, the share price that the company lists at is subject to change anyway.

Another interesting example meanwhile is Ebury, the Santander-backed B2B payments provider, which Bloomberg reported in March 2024 was investigating a London IPO.

Why has going private become more popular?

Amidst concerns around consistently showing profitability to investors, a number of companies in the cross-border payments space have returned to being private companies in the last few years.

Most recently, Nuvei, which had listed on Canada’s stock market for $833m, announced it was being taken private by Advent International. Similarly, in 2023, FIS sold Worldpay to GTCR and MoneyGram was taken private through an acquisition by Madison Dearborn Partners.

As we’ve found in reports and interviews we’ve conducted on these matters, the benefits of going private can stem from investing in opportunities that can lead to growth in the long term without having to show investors consistent growth in revenue and profits every quarter.

The majority of companies that we track earnings for – spanning payment processors, remittance players and B2B companies – tend to show revenue growth YoY each quarter. However, when that growth doesn’t match up to expectations or a company is anticipated to do worse than expected, this can concern investors. Aside from CAB Payments, another example of this is Adyen’s efforts last year to grow employee numbers when other players were curbing hiring, which led to a dip in its share price.

The additional cash injection from private equity investors can also help businesses pay off debts, as in the example of Nuvei, which wanted to return to its M&A strategy and also reward its employees with stock options.

While IPOs can offer companies additional publicity, help them raise funds and create a valuable out for venture capitalists, the strict regulation costs involved, the need to show investors consistent quarterly returns and the increased public scrutiny can actually serve to stall companies’ aspirations. In a difficult macroeconomic environment, the risks of an IPO have driven some cross-border payments companies to delay or otherwise shelve their public listings.

The fact that some companies have exited the market is further evidence that, for some players, the cons of IPOs are currently outweighing the pros. Having said this, previous years have shown that IPOs can often have a domino effect, and with a market continuing to stablise, it could be a case of waiting for the first domino to fall.