OFX had a mixed H1 2025, citing a tough macro environment as a key headwind. We spoke with CEO Skander Malcolm to discuss how OFX is navigating the challenging small and medium-sized business (SMB) space, and the company’s ongoing shift towards the B2B market.

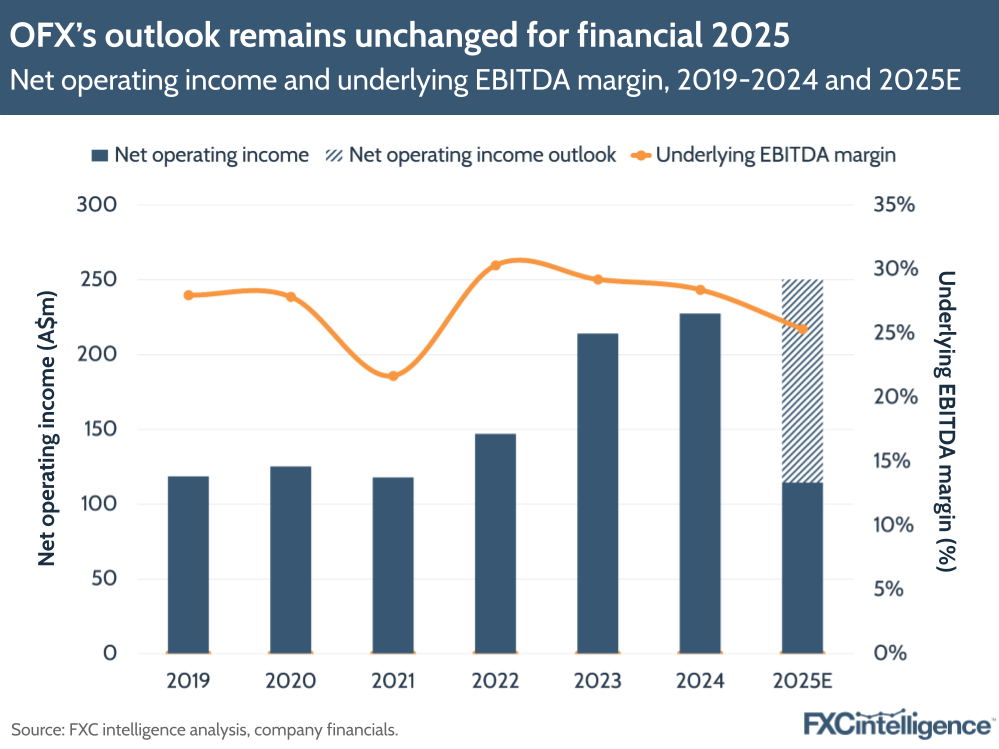

OFX has reported results for its H1 2025 (covering the six months ending 30 September 2024), with fee and trading income declining -0.09% YoY to A$114.5m and net operating income (NOI) decreasing -3.5% YoY to A$111.2m. This means the company missed its NOI outlook, which was reflected in the -43.4% drop in share price on the trading update’s release day.

The company also saw a decrease in underlying EBITDA by -8.8% YoY, reaching A$29m, while the underlying EBITDA margin fell to 25.3%. However, OFX expects a recovery in H2 2025, with underlying EBITDA margin returning to its full-year outlook of 28-30%.

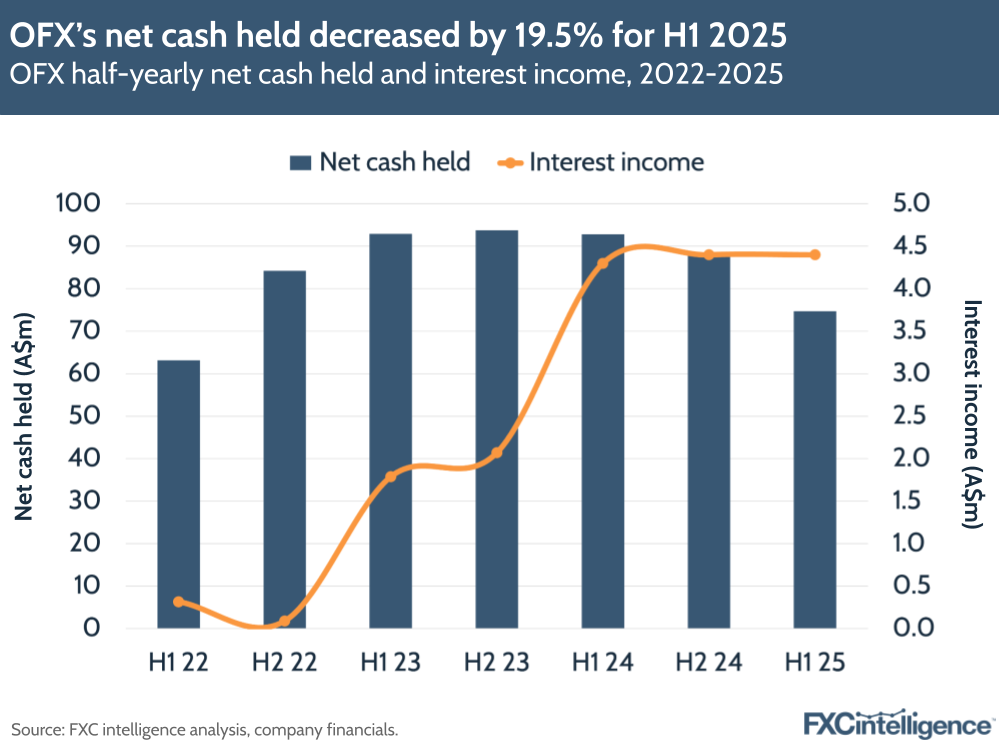

In terms of cash balance, OFX’s net cash held decreased by -19.5% YoY to A$74.7m, mainly driven by an active capital management strategy, which included a A$3.3m share buyback and A$11.5m debt repayment. Meanwhile, for net interest income, OFX maintained flat growth of 3.8% YoY to A$4.4m, the same level as H2 2024.

OFX cited a “challenging macro environment” as a major headwind in H1 2025. The company’s top-line results, particularly in Q2, were negatively impacted by market conditions that fell short of expectations. Interest rates differed from the company’s assumptions, with the easing cycle delayed in the US, Canada, the UK and Europe, and no easing in Australia.

However, there were some bright spots: OFX saw significant growth in the Corporate segment, with regional revenue for Europe increasing by 77.6% YoY. Meanwhile, the Enterprise segment continued to grow, with revenue up 6% YoY to A$4.4m, achieving a three-year compound annual growth rate of 24.5%.

In June, OFX also launched its New Client Platform (NCP) for Australian corporations, providing borderless transactions and global spend management, which is expected to introduce new income streams. We spoke with CEO Skander Malcolm to learn more about how OFX is approaching small and medium-sized businesses (SMBs) with its products, as well as how the company is continuing to shift towards the B2B market.

OFX’s performance in H1 2025

Daniel Webber:

Can you walk us through OFX’s performance in H1 2025?

Skander Malcolm:

We published our first-half results a week or so ago. The top line was below expectations and the share market reacted pretty strongly. In fact, we put out a trading update on 18 October, so that’s really when the market was updated.

Fundamentally, the business is still in excellent shape. We generated around A$17m of underlying cash flow. We generated over A$111m of net operating income. We still have strong EBITDA margins. We find that our new revenue is growing, strong double digits.

The underlying health of the business is very strong. We just didn’t see growth, which is what the market was expecting and what we had guided to. In this market, if you miss your expectations, the reaction can be strong.

Daniel Webber:

What do you think were the key drivers?

Skander Malcolm:

We pivoted the business to focus more globally and more on B2B, starting three or four years ago. Today, around two-thirds of the revenue is B2B, and around two-thirds of the revenue is global, which I define as non-Australia.

What happened was, we were seeing pretty good growth on expectations through our first quarter and into the second. In fact, 1 August was the largest-ever revenue day in the company’s history, things were on track, but around mid-August, we started to see a slowdown in the larger value transactions. In September, we saw a drop in those transactions around the world from our corporate clients.

Interestingly, when you look at the median transaction value and the clients who provide us with this type of business, it actually grew and continued to grow through the half. We didn’t see a drop in transactions, which we would typically expect in larger value ones, and those were the ones withheld in September. It was temporary. In October, we bounced back, with revenue up by 14%. October, September and November have carried on in that fashion. But it was mostly corporate, mostly larger value transactions that we didn’t see.

OFX remains committed to medium and long-term outlook

OFX’s medium and long-term outlook was not revised in H1 2025. The company remains committed to a medium-term outlook of 10%+ NOI annual growth and 28-30% underlying EBITDA margin, as well as long-term outlook of 15%+ NOI annual growth and 30% underlying EBITDA margin.

However, OFX expects a stronger performance for H2 2025, supported by improving market conditions and increased client activity. The company projects an underlying EBITDA margin of 28%, mainly driven by effective cost management. The company also plans to update its medium-term outlook at the FY 25 results in May 2025, following the assessment of the NCP.

The company launched the NCP for Australia in June, introducing a new platform for digital wallets, accounts payable workflows and employee expense management. OFX is currently migrating existing Australian corporate clients to the platform, while accelerating the rollout in Canada and the UK.

Against this backdrop, OFX’s collateral and bank guarantees increased by 46.2% QoQ to A$28.8m, representing the additional collateral required for the NCP. The company also spent A$10m on a tangible investment to accelerate the Canadian and UK launch. This is expected to result in total product spend of A$19m for FY 25, A$1m higher than the original guidance.

Regional growth and development

Daniel Webber:

There was significant growth in some regions. What factors were driving this performance?

Skander Malcolm:

Europe has strong growth off a small base. The US was good, just under 25%, from a more mature base. In these places, Europe’s small base naturally leads to strong growth.

But what we are seeing in the US, corporate confidence is just higher. Corporate clients who we perceive as SMBs, with A$1m-10m of revenue, are feeling better about their prospects. They’re buying inventory, they’re adding employees, they’re more confident than others.

As I said, the underlying transaction strength is still there, but in other parts of the world, there’s a drop in corporate confidence.

Solving challenges in the SMB market

Daniel Webber:

Let’s talk about OFX in the SMB space. How are your products and acquisitions shaping outcomes in this challenging market?

Skander Malcolm:

The SMBs are difficult in some respects, because there is a great variety of industries in which they operate. They can vary between small businesses, which might have 5 to 10 employees, to mid-sized businesses, which might have up to 100 employees. They’re importing, they’re exporting, they don’t have a ton of time, and they’re not experts in moving money around the world.

Our developing products and value proposition would simplify SMB operations, while delivering great value. What’s clear is that, if we can digitise SMB’s workflows, particularly around spend management, and add risk products, we’re really saving the company time and money.

We’ve always believed in combining digital and human support. Our 24/7 service is complemented by a strong digital platform. This combination of digitising workflows, adding risk management for security and offering great price and service is resonating very well. We launched our New Client Platform in June, which is bringing the three aspects together. The initial results have been exceptionally encouraging.

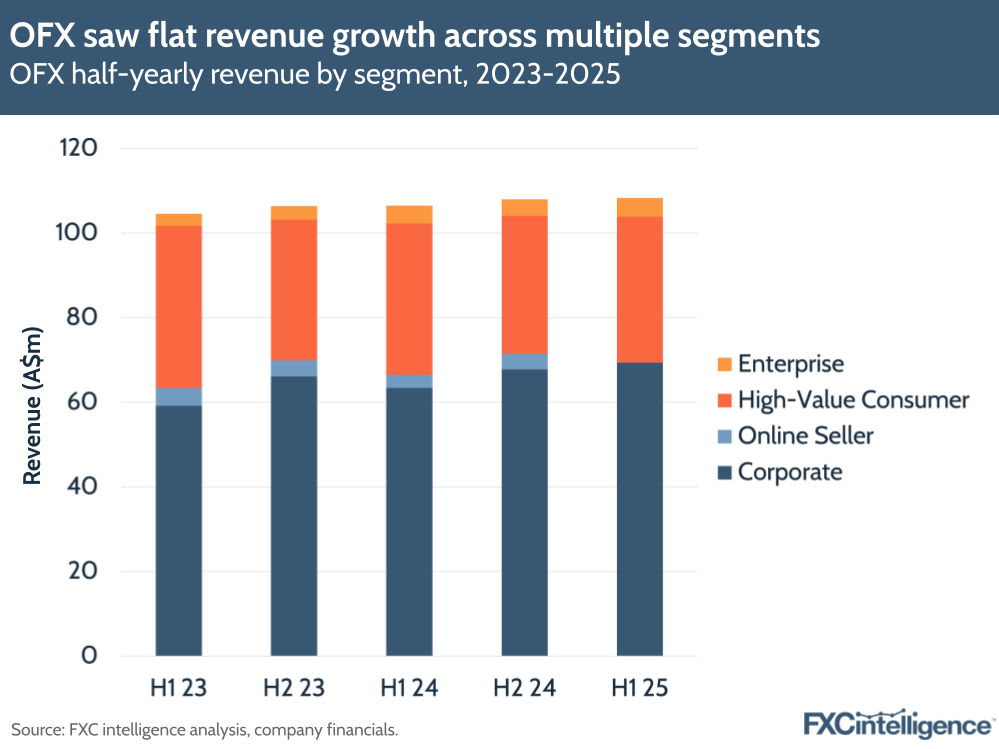

OFX’s revenue growth by segment

The Corporate segment remains a key driver for OFX, achieving 3.5% YoY revenue growth to A$69.4m. The segment performed particularly strongly in Europe and the US, generating 77.6% and 24.8% YoY revenue growth respectively. Corporate transactions per active client also increased by 11% over the past 12 months. Notably, OFX’s Online Seller revenues are now reported under the Corporate segment as of H1 2025.

The Enterprise segment, meanwhile, saw 6% YoY revenue growth to A$4.4m, driven by the addition of seven new prospects, bringing the total pipeline to 84. The segment also achieved a 24.5% 3-year compound annual growth rate, highlighting its potential for long-term growth.

On the consumer side, OFX saw a revenue decline of -3.6% YoY to A$34.5m, along with a -7.1% drop in transaction volumes. The segment’s average transaction values grew by 1.3% YoY, which represented an ongoing recovery in high-value use cases such as wealth transfers and property purchases.

OFX’s risk management for SMB

Daniel Webber:

On the topic of risk management, how does this differentiate OFX from competitors in the market?

Skander Malcolm:

I’ve been in financial services for over 30 years and I’ve never seen a successful financial services company that is not good at risk management. We’ve definitely seen some new entrants who digitise transaction flows, but once you start working with SMBs, you see that it’s good business for SMBs to lay off foreign currency risk, and we’re not talking about highly sophisticated risk products.

If you are a small business and you are buying 10 million of inventory, even USD or Euro can drop 20% in a year. It doesn’t make sense for business to have 20% of your inventory cost at risk and it doesn’t cost that much to de-risk it.

In terms of humans versus digital, having humans is a massive support, because oftentimes it does require a conversation. But with our new platform, we’re ingesting invoice data. We can aggregate and anonymise data, showing small business clients that they’re hedging 50% of their USD invoices, and offer a digital version of that.

Our clients can talk to us for guidance, with data, trust in human support and the ability to deliver it digitally anytime. Risk management is a pivotal part of the value proposition when working with SMBs and we will continue to develop our product and service around the area.

OFX reported flat growth in interest income

The company highlighted delays in the interest rate cycle as a major headwind, particularly affecting results in Q2.

Several interest rates differed from the company’s predictions, including the delayed easing cycle in the US, Canada, the UK and Europe, and no easing occurring in Australia. This contributed to subdued corporate confidence in Canada and the UK, while the Australian consumer business was also impacted by lower volatility.

Relatedly, OFX’s net cash held declined by -19.5% YoY to A$74.7m in H1 2025, which includes both cash held for the company’s use and deposits due from financial institutions. The company also saw a decrease of -49.9% YoY in underlying net cash flow from operations, reaching A$17.1m.

However, the NCP offers wallet functionality, enabling clients to hold cash with OFX. This could expand the company’s net cash available and increase its ability to generate interest income.

OFX’s long-term strategy: shifting towards B2B

Daniel Webber:

What factors do you believe will drive OFX’s long-term growth? And how does your shift towards the B2B market contribute to that growth?

Skander Malcolm:

At the core, there’s all our DNA around delivering cross-border payments quickly, cheaply and securely, with the risk management overlay. But as I mentioned, small businesses also have workflow expense management at the heart of their businesses, and that creates time, cost and difficulty for them. By providing those workflow management tools, spend management, we can access more transactions.

In our new platform, clients can manage their domestic payments, as well as international payments, which is valuable for the CFO or accounts payable team in a small business. We are providing wallets and cards. Those wallets are attractive to small businesses because they make it easier to manage transactions productively.

All small businesses nowadays are exposed, one way or the other, to some form of cross-border payments. For example, many of our SaaS providers bill in USD. The cards can be used as purchasing cards, offering better value than having an AP clerk handle it. It’s remarkable to see how clients are actually using corporate cards when we discuss the potential of corporate expense cards. All of the ancillary products bring new revenue streams; it comes back to generating more top-line growth.

I know that your newsletter is read by many people around the industry. You can look at the peer data sets, where most of their growth is coming, not from cross-border FX margins, but from ancillary products.

We can also see that in our New Client Platform, about half of the revenue is already coming from products beyond cross-border payments. So, we’re very committed.

The client’s reaction has also been incredibly enthusiastic. It surprised me really how enthusiastic CFOs and accounts payable teams can be. It’s a game changer for them. We’re getting very positive responses from them. I think that’s what underpinned growth with returns.

Daniel Webber:

Fantastic. Skander, thank you.

Skander Malcolm:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.