Full-year financial data from social media giant TikTok’s European arm provides some insights into how much the company is earning from creator gifts. But with global flows in the billions, how much should we be thinking about it as a payments company?

As the leading international arm of Chinese social media giant ByteDance, TikTok has gained immense popularity as a key social media player, particularly among younger Millennials and Generation Z consumers across the world. Built on its central offering of short-form video content, the company has evolved to include livestreaming, with revenue coming from advertising, in-app shopping and, increasingly, user-funded gifts to content creators.

The latter of these has become increasingly significant, potentially representing a form of payment flow in the billions of dollars each year globally. However, determining exactly how much money flows through TikTok in the form of such gifts is challenging, as the company remains unlisted and therefore is not compelled to publish its accounts.

The exception to this, however, is subsidiary TikTok Information Technologies UK Ltd, one of the company’s global segments. Headquartered in the UK, this oversees the company’s European operations, as well as those in Africa and South and Central America, with the majority of revenue coming from the UK and EU. As a result, the financial data the company shares through this subsidiary gives us some of the best insights into the company’s performance, and therefore into the question of its payments flows.

With its 2023 financial statements having been published at the start of October, we dig into the numbers, as well as supporting data from other key sources, to determine what gifting flows TikTok is currently handling, how much of this it is retaining as a margin and whether we should be thinking about the company as a payments player.

Climbing revenues but mounting losses: TikTok Europe’s 2023 performance

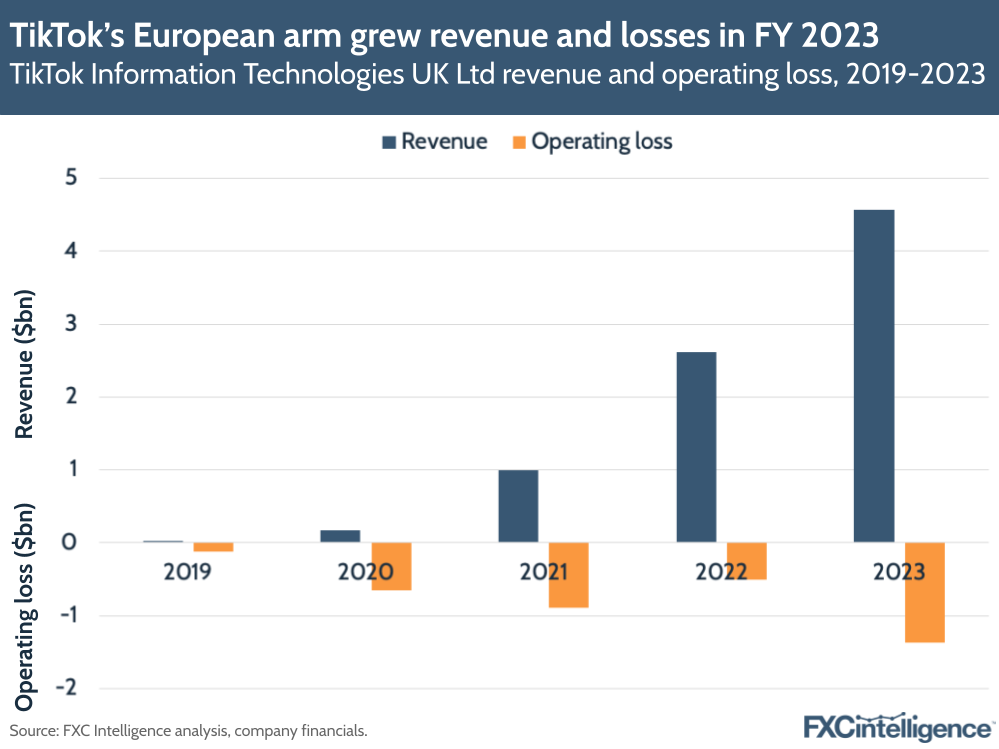

In FY 2023, TikTok Information Technologies UK, which we will refer to informally as TikTok Europe, saw revenue increase 75% to reach $4.6bn. While a significant uptick on the previous year, this represented more muted growth than was reported in 2022, when the group saw revenue climb by 164% – likely a reflection that it is becoming a more mature presence in key markets within the region.

TikTok attributed this growth to a combination of an increased user base and “enhanced monetisation tools” for advertisers, including ecommerce-focused solutions. However, it also noted that livestreaming revenue – that is, revenue derived from creator gifting through TikTok Live – “increased significantly” during the year, and was an “important contributor” to the company’s year-on-year revenue growth.

However, while the company’s top-line growth continued to be strong, TikTok Information Technologies UK also reported a sharp upswing in operating loss, which climbed by 167% to reach $1.4bn for the year. Crucially, around $1bn of this was attributed to money set aside to cover legal costs associated with anticipated regulatory fines associated with European data privacy laws. This includes a $370m fine issued in late 2023 by Ireland’s Data Protection Commission, as well as other penalties related to ongoing investigations under the Digital Services Act. If TikTok were to face the full potential fines associated with these, the charges would be in excess of the $1bn set aside.

TikTok has reported that its operating losses were in part offset by increasing revenue and cost efficiencies, as well as reducing spending, although the group’s total employees did grow from 7,009 in 2022 to 8,503 in 2023. Without the $1bn legal costs, TikTok Information Technologies UK would have seen losses reduce slightly from 2022 levels.

How much does TikTok take from creator gifting?

While advertising remains a key contributor to the company’s revenues, TikTok is seeing an increasingly significant revenue contribution from creator gifting.

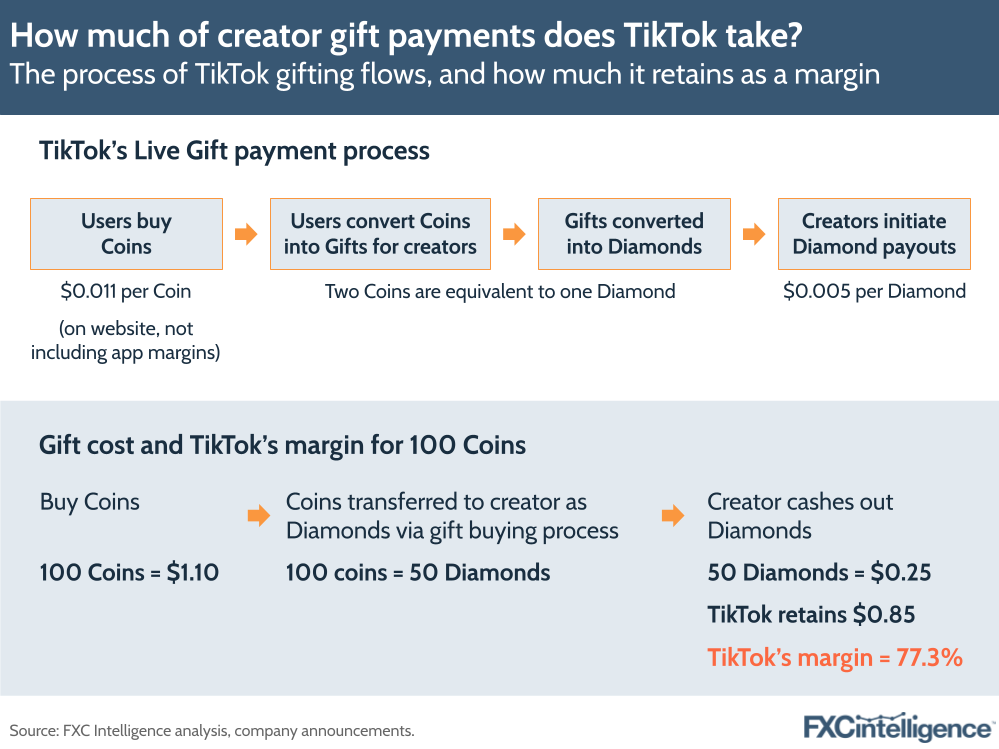

This takes the forms of virtual gifts that users send to creators during livestreams on the platform. Such gifts are purchased with Coins, which users buy using their local currency either via the company’s website or through the app. Coins can also be earned through promotional events, although the majority are acquired through purchases.

Gifts are available for a broad range of Coin values, and are used to show appreciation to creators, fund their work and increase the chances of a creator engaging with a particular user. Some creators also utilise gifts to make their streams more interactive, by responding to particular gifts with specific responses.

Once a creator is given a gift, it is converted into Diamonds, the in-platform currency for creators. While Gifts are a common way to earn Diamonds, they can also be earned through other activities, including running adverts or other sponsored content and participating in creator programmes run by the platform.

When received from Gifts, a creator receives one Diamond for every two Coins a user has spent to purchase the Gift in question. For example, if a Gift costs 10 Coins a creator will receive 5 Diamonds.

This use of dual currencies makes it difficult for users to know how much of the money they spend on a Gift will ultimately end up in the recipient’s bank account, a situation that is also made less clear by the pricing involved. TikTok allows users to buy Coins in a wide range of quantities, but consistently charges $0.011 per Coin, or $1.10 for 100 Coins, for those purchased on its website. Those purchased through its apps cost slightly more, with the difference being the cut the app store in question takes. On iOS, for example, Coins cost $0.015, with the additional $0.004 representing Apple’s fee for transactions handled through apps on its platform.

Meanwhile, Diamonds are cashed out at a rate of $0.005 per Diamond, or $0.25 per 50 Diamonds, equivalent to 100 Coins. As a result, for every 100 Coins purchased and sent to a creator as gifts, TikTok will retain $0.85 of the $1.10 spent, for a margin of 77.27% – significantly higher than any platform whose primary focus is sending money directly to creators.

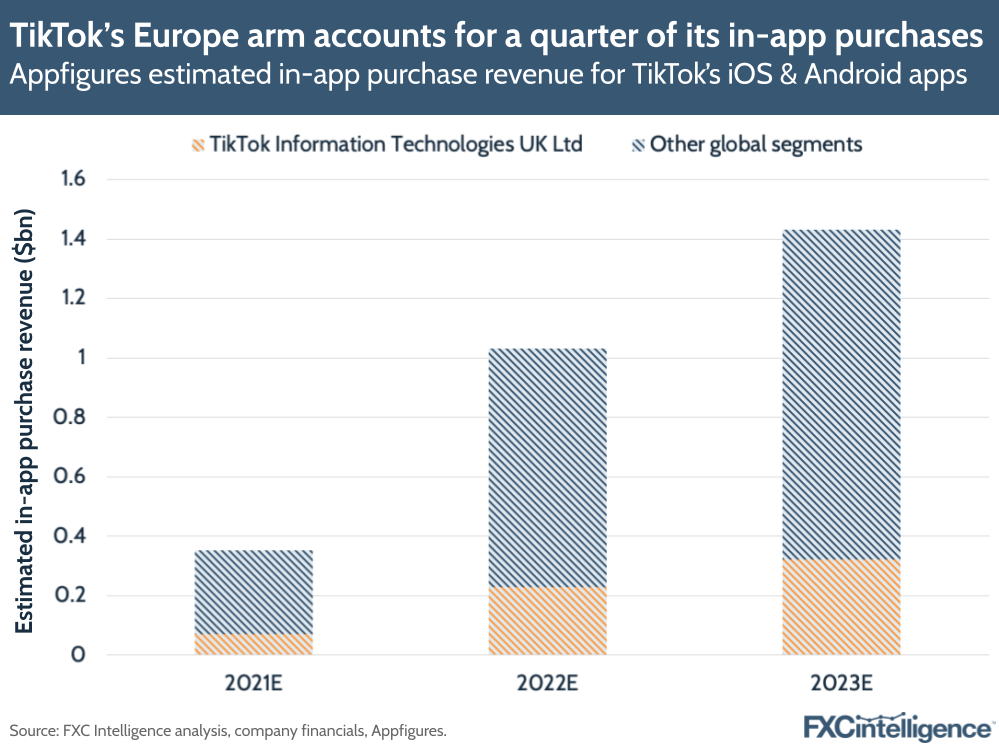

While a significant portion of Coins are likely to be purchased through TikTok’s website, particularly given the lower cost for users, app purchase data does indicate that Coin purchases have increased significantly in recent years.

For the countries where TikTok Information Technologies reports that it yields revenue from livestreaming, namely those in the European Economic Area, as well as Switzerland and the UK, in-app revenue from TikTok’s iOS and Android apps is estimated to have increased by 42% YoY to around $320m in 2023, according to app intelligence platform Appfigures. This compares to an estimated 38% YoY increase worldwide to around $1.4bn.

How much revenue is TikTok earning from creator gifts?

Up until 2022, TikTok Information Technologies UK reported its earnings from creator gifts directly under its livestreaming category. Revenue in this category is described as being derived from the sale of virtual items to the group’s users that are then gifted to creators.

Crucially, TikTok does not recognise revenue in this category until Coins purchased by users have been used to purchase Gifts and therefore converted into Diamonds. As a result, revenue recognised in this category is reported after the 77.27% margin the company takes on creator gifts has been applied, rather than the amounts initially spent by users to purchase the gifts.

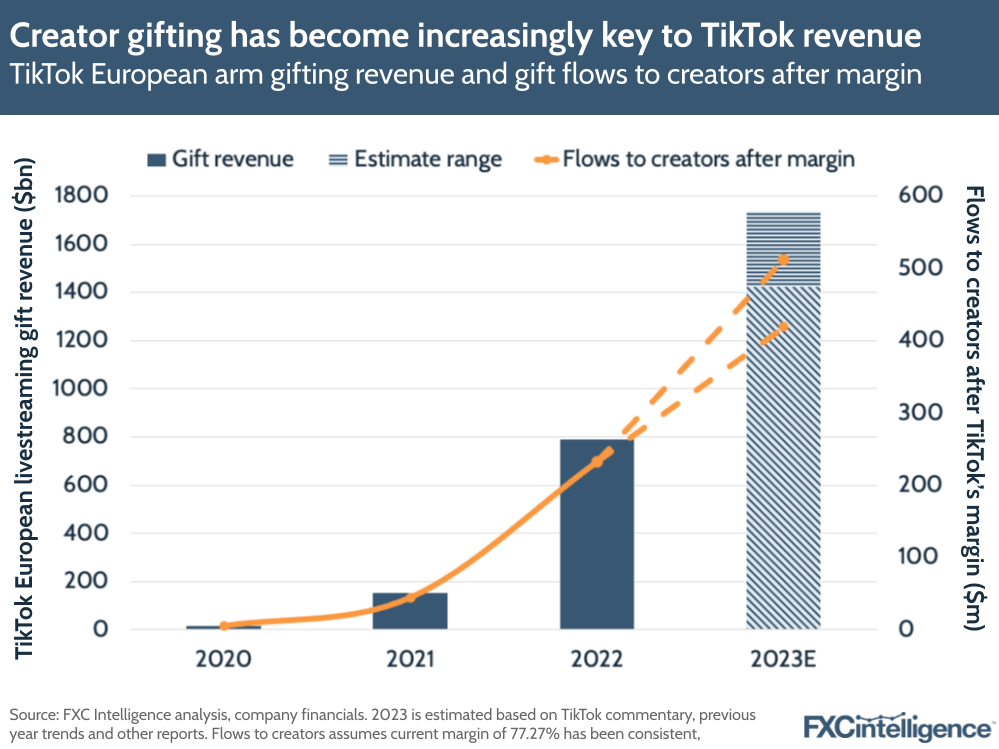

In 2022, TikTok Europe reported that this revenue had increased by 422% YoY to $790m and accounted for 30% of revenue, up from 15% the previous year, making it the second biggest contributor after online advertising.

However, in 2023 the group has for the first time opted not to report its revenue segmentations by business type or geographical segment, arguing that “it would be seriously prejudicial to the interests of the company to do so”. As a result, for this report we have attempted to estimate revenue from livestreaming gifts in 2023.

This year, TikTok used the same language for the segment around its contribution to overall growth as it did in 2022, namely that it “contributed significantly” to top-line growth. This suggests that the growth rate for the segment is once again above the top-line growth rate of 75%.

If the segment maintained the same ratio of growth rate that it did to top-line growth in 2022, this would see growth of around 190% YoY. However, this would see it account for 50% of all revenue for TikTok Information Technologies UK, which would require online advertising to have seen a significant slowing of growth to less than 30% YoY, down from 2022’s 106%, which does not reflect how the company has discussed its performance in this area.

As a result, we have opted to work on a range of 80-120% YoY revenue growth for livestreaming gifts revenue, with the lower end being just above the top-line growth level, while the upper end sees livestreaming maintain its outsized growth curve without requiring such a sharp slowing of online advertising. This is a conservative estimate – the real growth may be more pronounced – but without further data from the company it is not possible to identify this more accurately.

This sees 2023 estimated livestreaming gifts revenue for TikTok Europe of between $1.4bn and $1.7bn, which would account for 31-38% of revenue as a whole for 2023.

Such data also enables us to calculate the total quantities being spent by users on creator gifts, and how much ends up as flows being received by the streamers after TikTok has taken its cut. Assuming TikTok’s 77.27% margin has remained consistent, as of 2022 users spent $1bn on creator gifts, of which around $232m was received by creators as flows. This represents an increase on 2021, when around $196m was sent, with around $45m received by creators after TikTok’s cut.

Based on our estimates, 2023 is likely to have seen between $1.8bn-2.2bn sent by users, with creators receiving around $418m-511m.

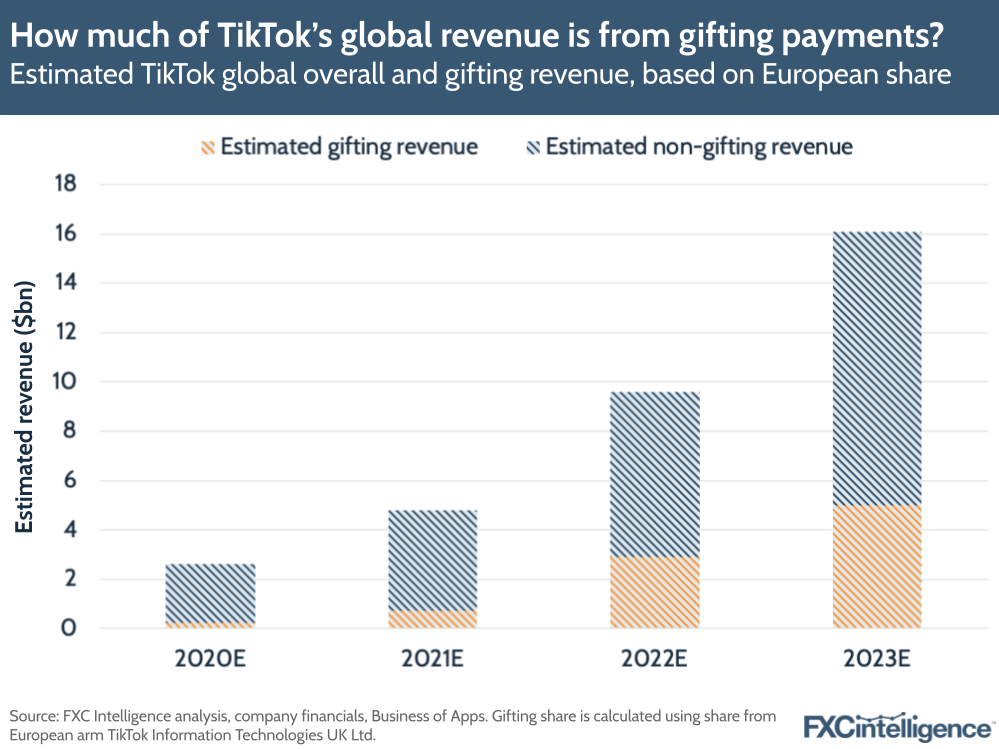

Looking at TikTok globally, if we assume livestreaming gift revenue accounted for the same share each year as it does for TikTok Europe, this therefore represents sending values in the billions. Using estimated global TikTok revenue provided by Business of Apps, this would see gift revenue reaching around $2.9bn in 2022, meaning a total spend by users of around $3.7bn, with gift flows received by creators reaching $0.8bn.

For 2023, using our lowest estimate puts total global revenue for livestreaming gifts on TikTok at around $5bn, with the total sent at $6.5bn, meaning creator flows from gifts of $1.5bn. However, given our estimates here were conservative, this may be an underestimation.

Should we be thinking about TikTok as a payments company?

It’s clear that the amount of money being transmitted between consumers and creators over TikTok is significant, and has seen a sharp upswing in the last few years. However, whether this means TikTok should be considered a payments company is another matter.

The margin TikTok charges would be unthinkable for any company overtly promoting itself as a payments provider, and the multi-layered process through which the company transmits the service is clearly designed in part to obscure quite how much of the flows it takes from its users.

In some senses, users are sending gifts for reasons beyond a simple transfer of value. In doing so, they often hope to increase their interaction with a creator, or otherwise improve their engagement experience with them. In this sense, the experience is closer to in-app purchases on other types of apps that are designed to enhance the experience of the product in question.

However, for others, gifting on TikTok is seen as a means to tip or otherwise reward a creator, and those with large numbers of followers who are earning significant amounts of money from the process are widely publicised as examples to emulate by would-be creators. In this sense, TikTok is in competition with other platforms used to reward creators more directly, including specialist players such as Patreon and Ko-Fi as well as broader payment providers such as CashApp and PayPal.

Ultimately, though, TikTok would not be able to charge the margins it does on these payments if it didn’t have the social media platform attached to it, meaning that opportunities to emulate its approach remain limited. With more than $1bn in estimated flows between users and creators globally, TikTok is a company that handles a significant amount of payments, but it is not realistic to consider it a payment company in the truest sense of the term.