Visa is transforming its B2B2X offering Visa Direct, bringing its full suite of Money Movement brands into a single portfolio for the first time. We talk exclusively with Chris Newkirk, President, Commercial and Money Movement Solutions at Visa, to find out more about the move and how it fits into the brand’s wider strategy.

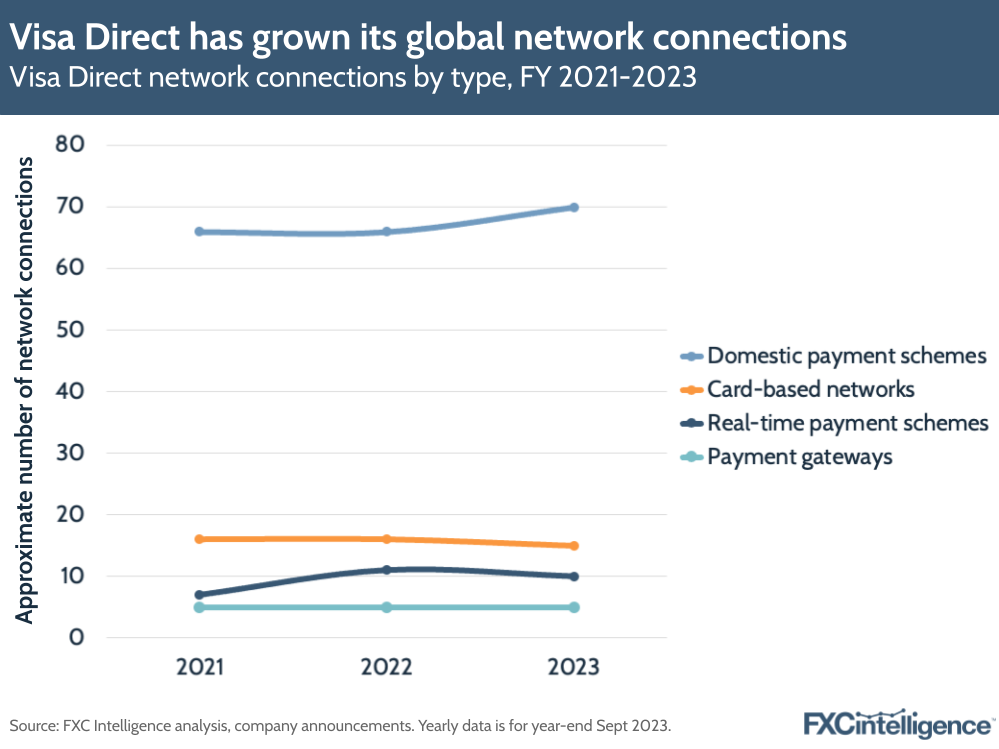

While known best as a card issuer, Visa has increasingly become a highly significant player in the B2B2X part of the cross-border payments space. This has been spearheaded by its Visa Direct brand, through which the company provides domestic and cross-border payment network capabilities to organisations including banks, money transfer companies and other payments players.

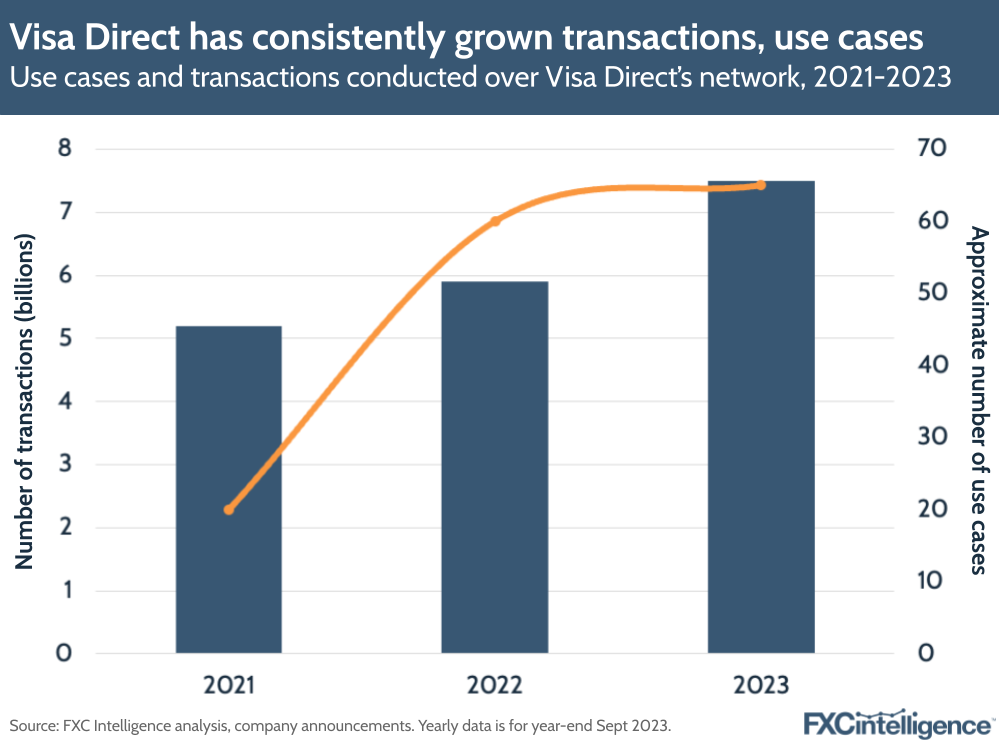

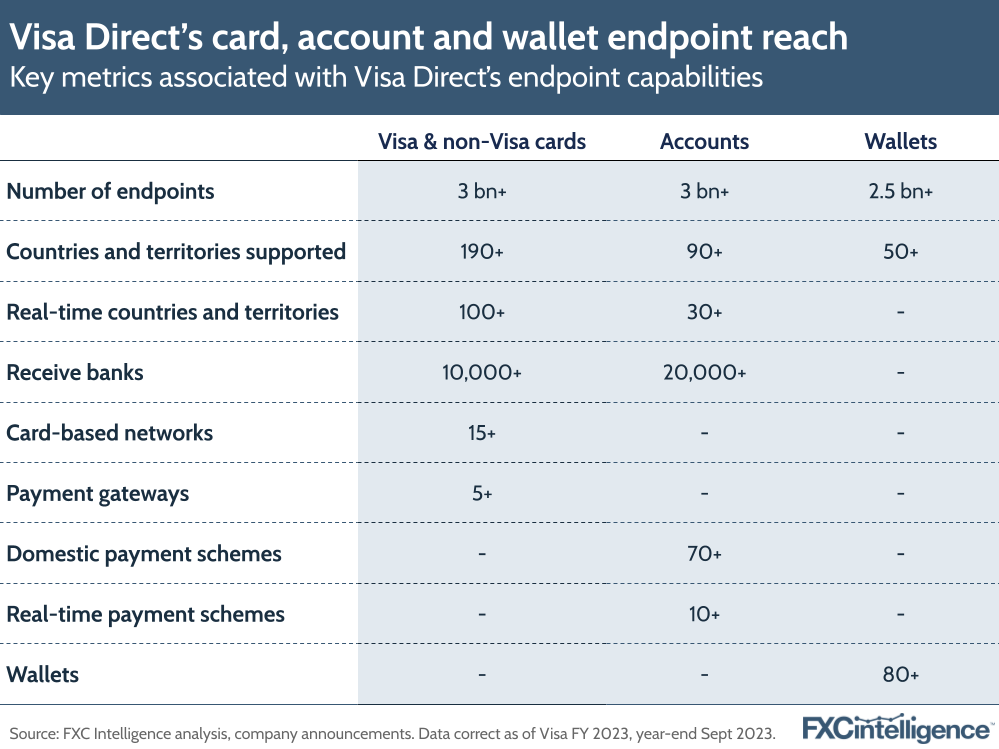

Visa Direct has grown significantly in recent years, with yearly transactions increasing by 27% in 2023 to reach 7.5 billion, while endpoints grew by over 1.5 billion – to more than 8.5 billion – in the same year. The company also regularly announces new partners, with recent announcements including Revolut, J.P. Morgan and Crown Agents Bank.

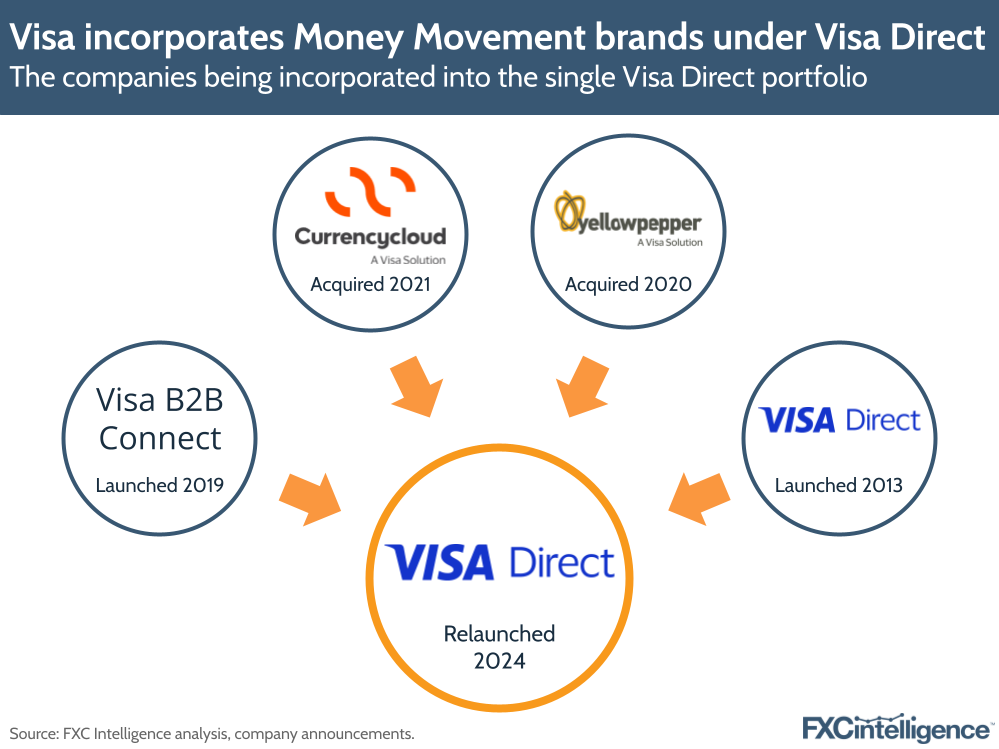

However, Visa Direct is not the only brand under Visa’s Money Movement solutions. It provides B2B cross-border payments under its Visa B2B Connect brand, and has also acquired other B2B2X-focused cross-border payments brands Currencycloud and YellowPepper in recent years.

Today, however, the company is changing its offering, by bringing together its four Money Movement brands – Visa Direct, Visa B2B Connect, Currencycloud and YellowPepper – under a single, relaunched Visa Direct. Serving as a single point of entry for all clients with domestic and cross-border payments needs, this updated Visa Direct will enable organisations including businesses, financial institutions, governments and fintechs to access a broad range of capabilities, including receiving, collecting, converting and holding funds.

The rebrand, which is set to evolve over time, will see no current impact to services and solutions currently provided by any of the four brands, but will see greater integration over time. This includes the launch today of Visa Direct Connect, which serves as a single API integration to Visa Direct Account, Visa Direct Card and Visa Direct Wallet, with further integrations to Currencycloud and Visa B2B Connect over the next year.

To find out more about the brand transformation and how it feeds into Visa’s overall strategy, we caught up with Chris Newkirk, President, Commercial and Money Movement Solutions at Visa.

Drivers of the Visa Direct transformation

Daniel Webber:

What drove the decision to combine Visa’s Money Movement capabilities into a single portfolio under the Visa Direct brand?

Chris Newkirk:

The way we think about it is that Money Movement is the new and growing category that lets consumers, businesses and governments collect, hold, convert and send money digitally to almost anyone anywhere. Moving money, especially across borders, is far from the experience today that it could and certainly will be in the future. It’s slow, expensive and not always transparent.

What we’re doing at Visa is creating a global solution. Doing so is quite complex and demands significant resources, risk management capabilities and expertise, and a really solid tech backbone and global reach.

Since 2013, when we first launched Visa Direct, we’ve continued to expand the utility and the use cases that Visa Direct can address. Working with thousands of clients, developing our own capabilities, doing a few acquisitions based on listening and learning from clients about what’s needed.

What we’ve done is continue the evolution of what Visa Direct means in the market, combining the reach, expertise, acquisitions, technology and capabilities for what were once four related Money Movement capabilities in the original Visa Direct, the Currencycloud acquisition, our own proprietary Visa B2B Connect platform that we’ve built and the YellowPepper acquisition.

What we’re doing is combining those into a single solution suite under the Visa Direct brand. And that will bring collect, hold, convert and send capabilities to 8.5 billion endpoints around the world under a new, supercharged Visa Direct to help clients shape the future of how governments, businesses and people move money around the world.

Visa Direct’s market differentiation

Daniel Webber:

There are many players now offering B2B2X solutions in cross-border payments. How does Visa Direct differentiate itself beyond the noise?

Chris Newkirk:

There’s five key attributes where we can offer differentiation. One is reach: we really do have the ability to serve end users in their channel of choice worldwide. The second is simple, intuitive user experiences both for end users and our clients who serve those end users.

Third is speed: the world we live in is moving increasingly to real-time, not just in money movement but across all of our consumer lives, so we’re continuing to drive innovation around the breadth of real-time or near-real-time delivery.

Fourth is trust, ensuring the security and compliance of the platform and the participants in the platform, where we have an unparalleled record. And the last is clarity of what our business model is. We are a B2B2X business model where we’re an infrastructure provider to our clients, enabling our clients to focus more and more of their time, energy and investments serving end users, and we’re incredibly clear and consistent and committed in that B2B2X model of ours.

Visa Direct Connect: Launching a new API solution

Daniel Webber:

As part of the overhaul you’ve launched your single API solution Visa Direct Connect. Talk us through the use cases and customer types for that.

Chris Newkirk:

Today we’re announcing the availability of Visa Direct Connect, which is a single API integration into Visa Direct, be it to Visa Direct Account, Card or Wallet through that single integration. So our clients can avail themselves of a full suite or some subset – or start with a subset and grow into a full suite. On the roadmap for later in 2025, that single API integration will incorporate access into B2B Connect and Currencycloud as well, which is on the journey to the continued evolution of Visa Direct into a broader solution set.

For Visa Direct Card, Account and Wallet, it’s for every use case that we support, be that domestic P2P, cross-border P2P (aka remittances), gig economy, payouts to any endpoint (be that account, card or wallet), other corporate disbursements, insurance disbursements, government disbursements. Every use case that we support in the send category will be available through Visa Direct Connect.

[The API is] going to be a simpler integration. For our existing clients, it’s backwards compatible. If they’re already integrated, there’s no new work for existing clients to do, but for new clients, we’re quite confident that it’ll simplify integration.

Our mission is to put the power of Money Movement into our client’s hands and to make that real and tangible; that’s about continuing to deliver all the capabilities that are needed and doing that in a way that’s as simple as possible for our clients to access, so this is really about the simplicity piece.

Opportunities in the consumerisation of the cross-border payments landscape

Daniel Webber:

How are you seeing the cross-border payments landscape continue to change and evolve, and where do you see Visa Direct fitting into that?

Chris Newkirk:

There’s going to be quite a lot of change over the next several years, and maybe it’s one of these things that will be subject to Bill Gates’ observation that “we always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10”.

I’m not quite sure what the timing will be, but I’m quite confident that we’re in the midst of the consumerisation of all of these experiences. What I mean by that is the amazing consumer experiences we have – we have some amazing experiences today in consumer banking, consumer travel, etc. – those amazing consumer-like experiences are coming to all of these cross-border money movement use cases, be they consumer or business or government.

I’m quite sure, both because users demand it and because the technology is here to provide it.

That’s the major macro trend that we’re going to see coming to life and we are looking to be a key player in providing the infrastructure to enable our clients to provide those kinds of amazing experiences to their end users. With that will come greater speed, greater transparency, probably lower cost for end users, and we’ve got an important role to play in all of that. Then, another key role for us is to deliver security and compliance, etc. That is a hallmark of the trusted Visa brand.

Daniel Webber:

A lot of innovation in cross-border payments started in the consumer space. Why do you think it always starts on the consumer side first before being rolled out to the business world?

Chris Newkirk:

Broadly speaking, and I’m not really speaking about money movement, the innovations often come to consumer use cases first because there’s large TAMs in addressing consumer problems where if the consumer problems aren’t totally homogeneous, you can fashion quite large addressable segments that are quite homogeneous. Enterprise business use cases and government use cases tend to be a bit more heterogeneous, and so therefore a bit harder to go after.

But the power of modern technology and the acceleration of what, frankly, very small engineering and product teams are capable of doing today is changing that. They’re solving problems for business and enterprise users in a way that’s scalable beyond what used to be attainable. So as a business person, you say, “Consumer is a sensible place to start. It’s a large market. I can go after a relatively large segment.” Then the evolution naturally is to the use cases that require more specialisation, maybe deeper integrations, etc.

Cross-border payments’ future potential for Visa Direct

Daniel Webber:

What do you see as the biggest opportunities in cross-border payments over time, particularly for Visa Direct?

Chris Newkirk:

There are so many opportunities to improve cross-border payments and money movement for end users. Just think about how wide that gap is between our consumer payment experiences when we’re making a purchase, either because we’re travelling overseas or engaging in cross-border ecommerce. When I do that, I use my Visa card, and it’s as seamless as using my Visa card at the local corner shop.

There’s a big gap between how seamless and easy that experience is versus in general when either a consumer or business is trying to make cross-border payments. That gap is going to close down.

We’re hugely excited to be working, not just in Visa Direct but participating in other proofs of concept with industry to try to improve money movement, especially cross-border. We’re participating in the regulated liability network alongside UK Finance and 10 other members. We’re exploring the possibility of a common platform for innovation across multiple forms of money, including commercial bank deposits, a UK CBDC and a shared ledger for tokenisation of commercial bank deposits.

The Regulated Liability Network is one. The Regulated Settlement Network is another where we’re participating alongside SIFMA [Securities Industry and Financial Markets Association] in an industry proof-of-concept using shared ledger technology to upgrade liquidity management for US dollars and treasury securities.

We’re also participating in Project Agorá with the BIS [Bank for International Settlements] and IIF [Institute of International Finance] to explore how tokenisation can enhance wholesale cross-border payments.

We’re really committed to this cross-border space and improving and working with the right sets of partners to improve those end-user experiences. For Visa Direct, there’s just an enormous opportunity in all the segments that we’re targeting. You and I spent probably the most time talking about consumer, but it’s the smallest TAM by orders of magnitude.

Cross-border business transactions, supporting import and export, small businesses, buyer-supplier payments, all the way up to enterprise, is a massive opportunity, and we think Visa Direct is incredibly well positioned to support our clients today and to grow into that opportunity in the future.

Responding to expectations from the G20 Roadmap

Daniel Webber:

The latest update to the Financial Stability Board’s (FSB) G20 Roadmap for Enhancing Cross-Border Payments, which as you know has FXC Intelligence data underneath it, is due to be published next week. How do you think about the Roadmap’s targets?

Chris Newkirk:

The roadmap aims to make cross-border payments faster, cheaper, more accessible and transparent. From Visa’s perspective, the two biggest opportunities to achieve that vision are large-value B2B payments and high-velocity P2P remittances.

From a volume perspective, B2B is far, far and away the largest and the most ripe for innovation. 60% of wholesale payments are credited to the beneficiary accounts within an hour of receipt by the beneficiary bank, and this is where we think that Visa solutions can be a game-changer. So instead of an unpredictable sequence of corresponding banking hops, Visa Direct – the new Visa Direct inclusive of B2B Connect – enables fast, multilateral money movement at global scale.

On remittances, according to the FSB the average global cost of sending $200 is above the 3% targets, and our own report from earlier this year, Money Travels, highlighted some of the drivers of the high costs and sometimes hidden costs.

What we aim to do with and through our clients is to provide digital infrastructure that can make the cost to serve lower on both the pay-in and the pay-out side. And we’re really proud of the work that we’re doing with our partners to help drive access to digital-first, lower cost, higher speed, higher transparency user experiences.

Daniel Webber:

Chris, thank you.

Chris Newkirk:

Thank you.