A growing fintech space; real-time payments; financial inclusion and access; and supporting government policies have created fertile ground for Nigeria’s digital economy, which is gaining increasing traction in the payments space.

In recent times, government reforms, technological innovations, new business models and investment in the financial sector have been redefining Nigeria’s payments system. The government is promoting an enabling environment for the creation of payment solutions and electronic payments are increasingly displacing traditional payments, especially for money transfers.

With a population of over 200 million people, empowering regulatory policies and reforms, there has been a tremendous effort to stimulate economic activities at the grassroots, all of which has made Nigeria the largest economy in Africa. Nigeria is seeing nascent interest from foreign investors in its startups, which, combined with the spending power of the country’s tech-savvy youth – 82% of Nigerians have a mobile phone and internet subscribers rose to 153 million as of October 2022 – is making the country ripe for a digital economy boom.

National Digital Economy Policy and Strategy

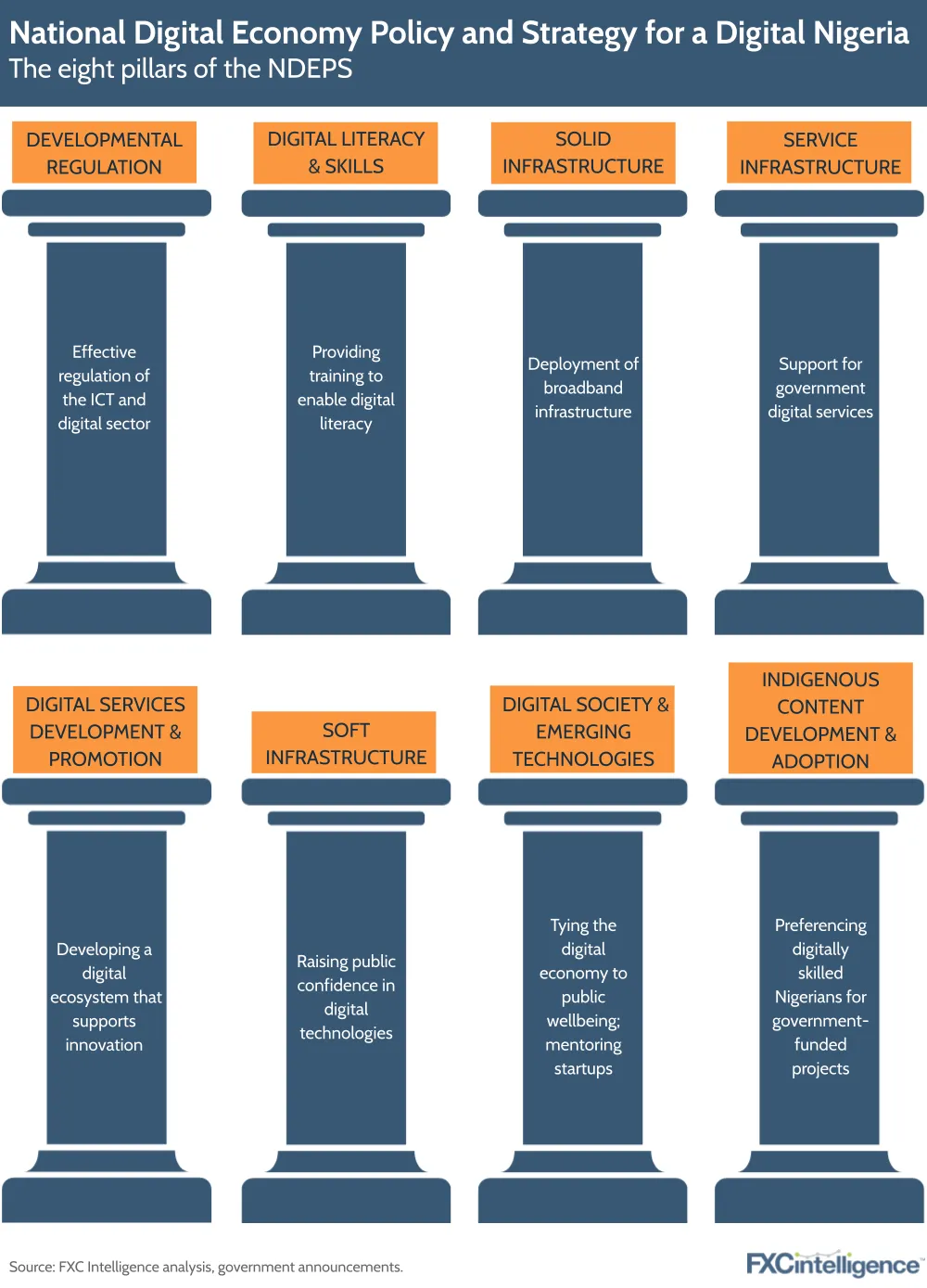

Nigeria’s growing digital strength has by no means been accidental. As digital technologies transform modern life, Nigeria has been developing solutions to drive digital transformation across the country. One such initiative is the National Digital Economy Policy and Strategy for a Digital Nigeria (NDEPS), designed to facilitate the diversification and expansion of the economy.

The Muhammad Buhari administration launched the NDEPS in 2019. The policy is based on eight pillars, which are designed to boost the digital economy’s contribution to GDP by 15% by 2025, through sustainable economic development and increased productivity across all economic sectors.

Despite the impact of the Covid-19 pandemic on the Nigerian economy, within three years of launching NDEPS, the digital sector’s contribution to GDP grew from 13.7% in 2018 to 15.35% in Q3 2022, according to the National Bureau of Statistics. By comparison, the oil sector, which used to be the backbone of the country’s economy, contributed only 5.7% to total GDP in Q3 2022 compared to 40% in 2000.

Initiatives under the National Digital Economy Policy and Strategy for a Digital Nigeria

| Year | Initiative | Purpose | Achievements |

| 2019 | National Digital Identity Policy for SIM Card Registration | Ensure the security and safety of online transitions by using a National Identification Number (NIN) for SIM registration in the country | Over 58 million Nigerians home and abroad have now been assigned NINs |

| March 2020 | Nigerian National Broadband Plan 2020-2025 | Deliver a minimum of 25Mbps data download speeds in urban areas and 10Mbps in rural areas at no more than NGN 390 per 1GB of data (1% of minimum wage) for at least 90% of the population by 2025 | Internet penetration rate up from 33.72% in 2019 to 51% in 2022 Average cost of 1GB of data reduced from NGN 1,000 in 2020 to NGN 330 in 2022 Number of unserved and underserved people reduced from 36.8 million to 31.16 million |

| March 2021 | National Policy for the Promotion of Indigenous Content in the Nigerian Telecommunication Sector | Promote a culture of innovation and entrepreneurship, as well as create jobs | Over 210,000 Nigerians enrolled in online learning platforms, including DigitalNigeria.gov.ng and NITDA Academy for Research and Training Set up of the National Centre for Artificial Intelligence and Robotics Over 300 ICT centres have been established across all States of the Federation and the Federal Capital Territory |

| May 2021 | National Digital Innovation, Entrepreneurship and Startup Policy | Support the development of digital innovation and entrepreneurial ecosystem | Approval of tax relief initiatives for startups to develop the digital entrepreneurial space and create more jobs in May 2022 Signing of the Nigerian Startup Bill into law in October 2022 |

Startups in Nigeria

Over the last five years, Nigeria has been the top venture capital market in Africa, followed by Egypt, Kenya, and South Africa. Over 400 startups have sprung up in sectors including fintech, ecommerce, agri-tech, and waste management.

According to startup news platform Disrupt Africa’s Nigerian Startup Ecosystem Report 2022, Nigerian startups attracted a combined total investment of $747.9m for the first eight months of 2022 up to August. Disrupt Africa’s tech startups data shows 69% of Nigerian investment going into fintech companies in 2022. The biggest beneficiary in that period was Nigerian cross-border payment company Flutterwave, which received $250m in a Series D round in February.

By contrast, the total raised in 2015 was $49.4m. Between 2015 and 2022, investment in Nigerian startups totalled $2.07bn.

Nigerian Startup Act 2022

According to The Tony Blair Institute for Global Change, Africa could attract more than $90bn in funding for tech startups by 2030. However, far-reaching policies covering access to funding, agile business environments and an enabling ecosystem are needed for African startups to reach their potential.

Startups in Nigeria have faced specific challenges over the years, including a lack of adequate funding and infrastructure, as well as challenges with securing licences from relevant agencies such as the central bank and the Securities and Exchange Commission. Many believed that the introduction of a Nigerian Startup Act, which would provide a legal and institutional framework for the development of startups within the country’s tech ecosystem, would tackle these issues by providing a cushion for the new startups and supporting the growth of the startup ecosystem.

The benefit of startup acts has been witnessed in other countries where such policies have served a catalyst for growth. The first of its kind was passed in Italy in 2012 and as a result, over €34m was invested in Italian startups between 2012 and 2015. In Africa, Tunisia introduced its startup act in 2018 and between its induction and 2021, the country has recorded a total of 54 deals, worth $38.2m; the amount of investment in 2021 was 31% higher than in 2018. Other African countries currently at varying stages of enacting startup laws include Mali, Ghana, Ivory Coast, the Democratic Republic of the Congo, Rwanda and Kenya.

On 19 October 2022, Nigeria introduced the Startup Act 2022 into law, having initiated work on the act in May 2021. In order to benefit, Nigerian startups will need to obtain a certificate from the Nigerian Startup Bill Secretariat called a startup label. Eligibility is based on being a registered Limited Liability Company running for no more than 10 years, using digital technology to solve a problem in Nigeria and having at least one Nigerian co-founder.

The incentives available as a result of the Act, for both investors and the companies that have obtained a startup label, are likely to boost investor participation in Nigerian payments, especially for those who were previously unsure about entering the sector. Nigerian payments startups have also had several models for success shown by companies such as Flutterwave that have managed to expand well beyond the domestic market.

Benefits of the Nigerian Startup Act 2022

The Startup Act’s benefits include a fund for early-stage financing, which will be managed by the Nigeria Sovereign Investment Authority, and easing the registration process for startups by fast-tracking business licences at discounted official fees from relevant government agencies.

The Act also provides tax incentives and legislates the establishment of startup innovation clusters, as well as partnerships with international business incubators to create an enabling environment. The aim is to position Nigeria’s startup ecosystem as the leading digital technology centre in Africa.

Startups could also leverage the African Continental Free Trade Area agreement – which looks to eliminate tariffs and create a single, liberalised market for the continent – to ease trade challenges and make use of the Pan-African Payment and Settlement System (PAPSS) for cross-border expansion. PAPSS, which launched in January 2022, will aid intra-Africa payments, as well as provide an integrated economic system and reduce dependence on foreign currencies and other external factors responsible for increasing the cost of cross-border transactions.

Benefits of Nigerian Startup Act 2022

| Tax incentives | Exemption from paying tax for four years, from the date business is issued a startup labelIncome tax relief on up to 5% of profit generated if startups employ entry level talent with no more than three-years of post-graduation experience Employees of labelled startups are entitled to personal income tax relief of 35% of their income for two years after being employed Angel investors, accelerators and venture capitalists will enjoy tax credits of up to 30% of their investment in a startup |

| Startup investment seed fund | Early-stage financing for startups, technology laboratories, accelerators, incubators and hubs from a NGN 10bn seed fund |

| Capacity building | Provision for startups to assess trainings and capacity building Establishment of accelerator and incubator programs for guidance/support system to help startups scale |

| Regulatory intervention | Create a startup portal to help startups work with and fast track securing licences at discounted official fees from relevant government agencies Startups will receive assistance in listing on the relevant board of the Nigerian Exchange Limited |

| Protection of intellectual property | Assistance for startups to protect and commercialise their IP rights, file international trademarks and patents |

| Expanding the startup ecosystem | Establishment and operation of startup innovation clusters and hubs, as well as physical and virtual innovation parks in each state of the Federation Partnerships with local and international business incubators, accelerators and digital innovation hubs to promote startups in Nigeria |

The Nigerian payment system

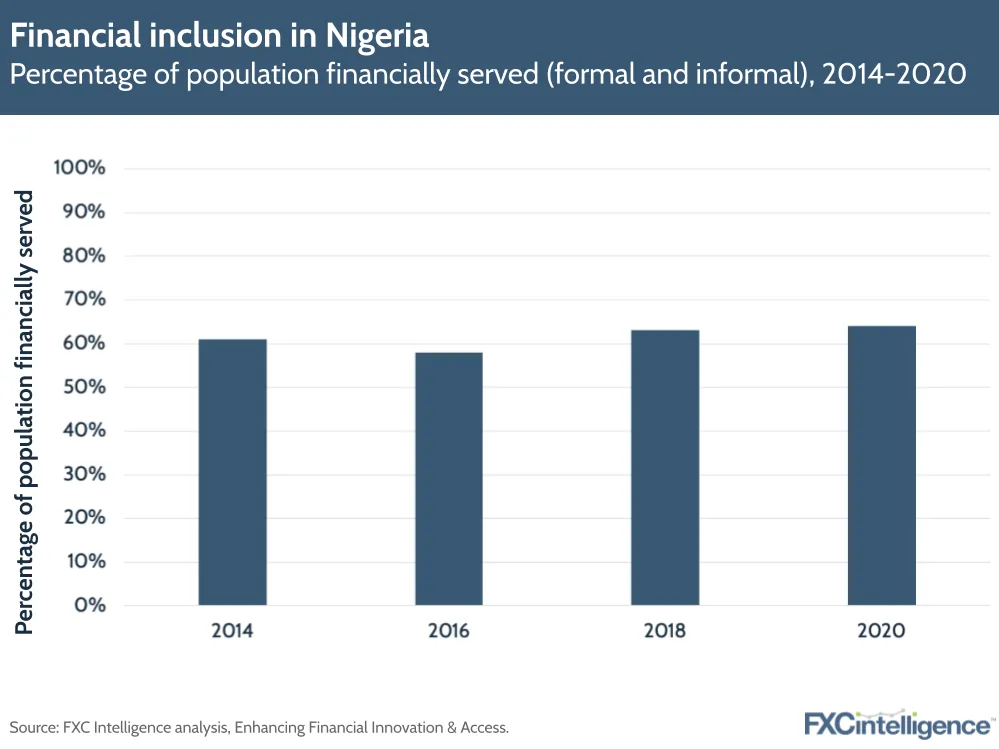

Nigeria has been making concerted efforts to grow economically and its payments system has been identified as an area requiring particular focus. The country’s central bank has been making efforts to increase the resilience of the payment system, boost usage of electronic payment methods and improve financial inclusion. Financial inclusion, in particular, plays an important role in reducing poverty and achieving economic growth. The Deputy Governor of the Central Bank of Nigeria, Aishah Ahmad, said during a summit in May 2022 that financial inclusion in Nigeria was at 64%, up from 45% in 2020; the bank is working towards a financial inclusion target of 95% by 2024.

In 1993, the Nigerian Bankers’ Committee incorporated the Nigeria Inter-Bank Settlement System (NIBSS) as a switching company – a payment processing company that offers infrastructure for implementing electronic transactions. For interoperability and interconnectivity at various levels in the payments value chain, NIBSS became the interface for centralising payment and settlement activities among banks and other financial institutions. Other commercial switching companies licensed to process transactions between payment provider platforms include ARCA, Chams, CoralPay, eTranzact, Interswitch, Unified Payments and Capricorn Digital.

In an attempt to move the country into a cashless economy, as well as boost financial access and inclusion, several initiatives were launched, including Payment Systems Vision 2020 in 2007; Financial System Strategy 2020 in 2009; and the National Financial Inclusion Strategy in 2016.

These initiatives birthed the Central Bank of Nigeria Immediate Transfer Service for effecting interbank payment transactions; the Electronic Cheque Clearing system for same-day cheques-clearing; and the Nigeria Electronic Funds Transfer for automated and electronic settlements, though this is not real-time. There was previously a real-time gross settlement system in the country but it was expensive and typically used for high-value transactions; it has since been replaced by the NIBSS Instant Payments system.

Payments System Vision 2020

In 2005, Goldman Sachs predicted that Nigeria’s economy would be among the world’s top 20 economies by 2025; in 2022 it ranked 27th. Following this prediction, the Nigerian Government launched financial reforms to get the Nigeria payment systems internationally recognised and push the economy into the global top 20.

In March 2007, the Central Bank of Nigeria launched Payments System Vision 2020 (PSV2020), which was later reviewed and changed to Payments System Vision 2025 due to recent innovation in financial technology. The purpose of the Payments System Vision is to promote sustainable economic development by strengthening the domestic financial market; increase the usage of electronic payment methods; reduce financial exclusion; and improve payment system infrastructure by opening up alternative banking channels.

As part of PSV2020, the central bank also launched its Cashless Nigeria policy in 2020 to promote electronic-based transactions. The policy specifies a 3% processing fee charge on daily cash withdrawals that exceed NGN 500,000 for individuals and a 5% processing fee charge on daily cash withdrawals that exceed NGN 3m for businesses. This policy has been reviewed again following the redesigning of NGN 1,000, NGN 500, and NGN 200 notes. Effective from 9 January 2023, cash withdrawal by an individual was capped at NGN 100,000 a week, while businesses had their withdrawal limit capped at NGN 500,000 a week.

Electronic payments in Nigeria

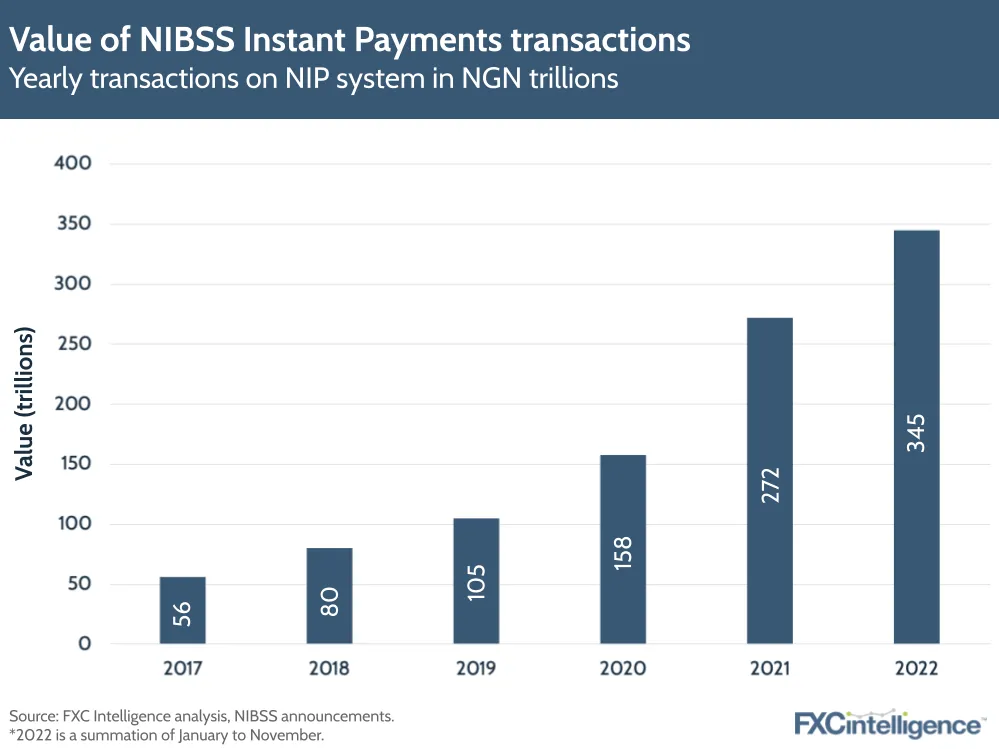

The PSV2020 initiative’s Cashless Nigeria policy has led to impressive growth in electronic payments and a gradual shift away from cash payment. According to NIBSS, August 2022 saw e-payment transactions reach an all-time high, with a 50% year-on-year increase in value of transactions through NIBSS’ Instant Payments (NIP) platform. This growth has been helped in no small part by recent policy frameworks – including NIP; the Nigeria Quick Response (NQR) Code; Mobile Money Payments; eNaira; and NIBSS M-Cash – designed around delivering a sophisticated electronic payments system.

Industry statistics from the NIBSS show that cashless transactions (from point of sale terminals, instant payments and mobile channels) to the value of NGN 318.66tn were recorded in the first 11 months of 2022, a more than 40% increase compared to 2021’s NGN 286.45tn.

The government is also benefiting from the growth of electronic payments in Nigeria through the Electronic Money Transfer Levy (EMTL): a one-off payment of NGN 50 on electronic receipt or transfer of money deposited in any bank on sums of NGN 10,000 and above. In 2021, the government generated NGN 111.84bn in revenue from digital payments through the EMTL.

NIBSS Instant Payments

In 2011, NIBSS launched NIBSS Instant Payments (NIP), a real-time payments scheme supported by all commercial and microfinance banks, as well as mobile money operators. NIP is a platform for payment services such as fund transfers, recurrent debits, balance enquiry, merchant payments and several others.

The system has been a major cash substitute in a country that used to be predominantly cash based. Not only did the Covid-19 pandemic help cashless transactions in Nigeria gain traction but NIP is the financial industry’s preferred funds transfer platform that guarantees instant transfer to the beneficiary. The availability of a 24-hour fund transfer service has led to high adoption rates of NIP as a payment solution of choice.

An April 2022 report from real-time payments company ACI Worldwide, ‘Prime Time for Real-Time’, showed that Nigeria had the sixth-highest real-time transaction volumes globally in 2021, ahead of both the US and Japan. With 3.7 billion real-time transactions, Nigeria ranked behind just India, China, Thailand, Brazil, and South Korea. According to the report, the uptake of real-time payment services helped Nigeria unlock $3.2bn of additional economic output in 2021 (0.67% of the country’s GDP), with real-time transactions forecasted to rise to 8.8 billion annually by 2026.

With Nigerian banks such as Ecobank having presence in other African countries, there have been recent attempts to facilitate cross-border payments through Pay Africa – a combination of the localised NIP platform and a broader intra-bank funds transfer solution. This solution is an account-based cross-border payment partnership between NIBSS and Ecobank that allows customers of banks in Nigeria to send and receive money to and from banks in other African countries via NIP and the Ecobank Cross-Border Capability platform.

According to NIBSS, there are on-going discussions too with international money transfer operators (IMTOs) on the use of the NIP platform for international remittances, starting with Africa and then expanding to other parts of the world.

Mobile money payments

In 2010, the government sought to increase the number of adult Nigerians with access to digital payment services: the goal being to raise the figure from 21.6% at the time to 70% by 2020. Mobile money, defined by GSMA as using a mobile phone to transfer money and make payments, was identified as the primary tool.

In 2011, the Central Bank of Nigeria started issuing mobile money licences and it has been issued to 21 mobile money operators. In 2015, mobile money was further clarified into two models: bank-led, with a bank as the lead initiator or in partnership with other approved organisations, and non-bank-led, with a corporate organisation licensed by the the Central Bank of Nigeria to deliver mobile money services to customers.

Being a primarily bank-led market, mobile money is still developing in Nigeria but it is gaining momentum. NIBSS revealed that mobile transactions by bank customers rose from NGN 4.86tn in the first four months of 2022 to NGN 9.2tn by July.

The slow progress of mobile money services in Nigeria (only about 6% of Nigerians had a mobile money account between 2014 and 2018) can be ascribed to the initial exclusion of telecommunication companies from mobile money operator licences. This is unlike other African countries such as Kenya, Tanzania, Ghana and Uganda where telecommunication companies have contributed to the increased adoption of mobile money services. Telecoms have a high number of subscribers and agent networks that spread across remote places where banks and other financial services may not have a presence.

NIBSS M-Cash

In November 2016, NIBSS introduced a service called M-Cash, a payment solution that is accessible to payers for various transactions even if the user lacks internet access. The solution leverages the NIP infrastructure by using unstructured supplementary service data (USSD), a communication protocol for mobile phones, to facilitate instant retail payments to merchants’ accounts. M-Cash, which can be used for mobile, web-based or point of sale payments, drives e-payment benefits to both merchants and customers operating at the local level.

However, M-Cash has not received the immediate quick adoption and progress as other types of electronic payments launched in Nigeria. Several reasons have been offered by observers as to why M-Cash had this slow uptake, including potential customers having an affinity with their current banks that already have unique USSD codes and that initial efforts to raise awareness were targeted more at merchants rather than users.

Nigeria Quick Response Code

One of the recent payment solutions launched by NIBSS and the Central Bank of Nigeria is the Nigeria Quick Response (NQR) Code, which was rolled out in January 2021. The NQR Code helps to expand the adoption of electronic payments, especially for instant P2B and P2P payments, through scanned QR codes on a smartphone.

The NQR Code came shortly after Ghana introduced a similar solution in 2020 and has added value to the digital payment system by facilitating efficient, faster, safer and cheaper payments for businesses. It also allows customers to send or receive money without asking for a bank account number, which helps to improve financial inclusion. The Small and Medium Enterprises Development Agency of Nigeria highlighted that the NQR code will ultimately benefit about 37 million SMEs in Nigeria that will no longer be limited to just PoS terminals to receive payments.

eNaira

The Nigerian central bank digital currency (CBDC) known as the eNaira was launched in October 2021. Three months after the launch, 600,000 eNaira wallets had been created, with over 35,000 transactions completed. The digital currency was created to boost financial inclusion, as well as making payments quicker and cheaper without the involvement of intermediaries.

In August 2022, the Central Bank of Nigeria introduced the use of unstructured supplementary service data (USSD) to include non-smartphone users who do not have an internet connection or bank accounts. With the USSD, new users can set up an eNaira wallet and use it for transactions by dialling a four-digit code on their phones. To promote the adoption of eNaira, in October 2022 the Central Bank of Nigeria offered a 5% discount to motorised rickshaw drivers and passengers who use the eNaira.

Despite all government interventions to increase eNaira use, it is yet to gain traction, with less than half of the country using it. The next initiative to increase usage, as mentioned in a Central Bank of Nigeria policy document titled Nigeria Payments System Vision 2025, may be the government adopting the CBDC to pay taxes and other related payments.

Agent and informal banking in Nigeria

Despite the various financial reforms and efforts to boost financial inclusion, there are still limited access points to banking in rural areas and high maintenance costs for existing ones. There is also low awareness of financial services and access channels, as well as poor digital literacy among unbanked populations.

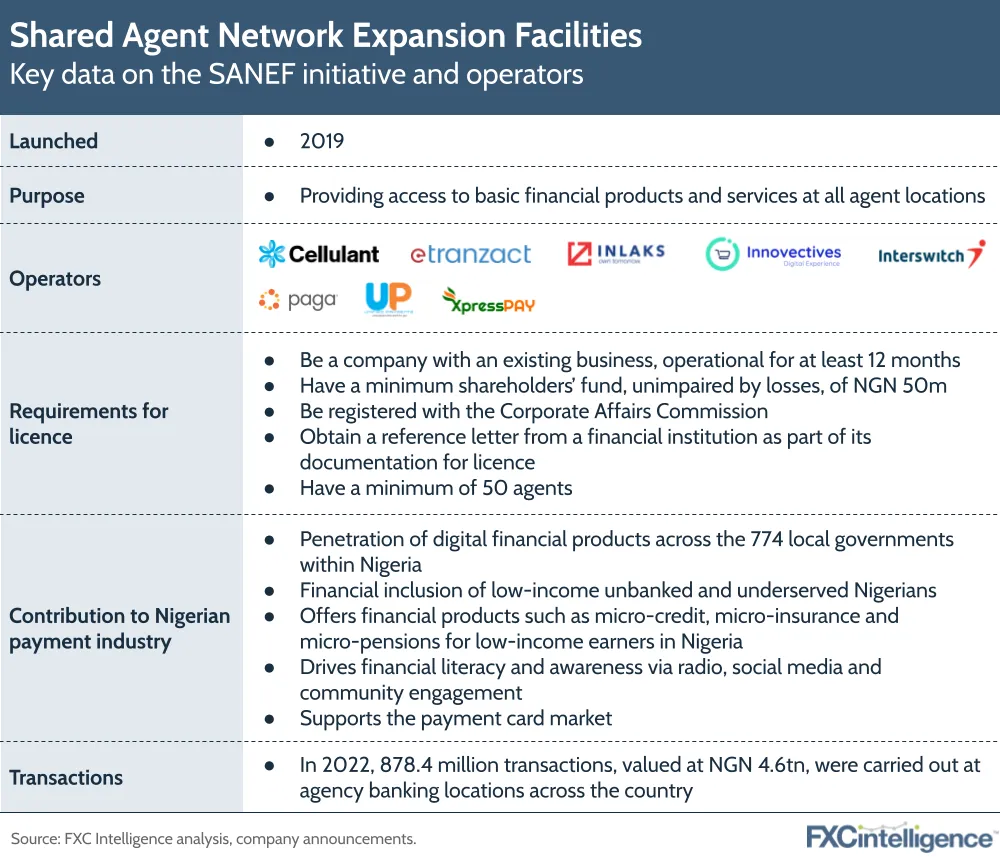

In 2013, the Central Bank of Nigeria launched the first regulatory framework for agent banking to promote last mile financial services and this has continued to evolve since. Agent banks are retail outlets used by financial institutions or mobile network operators to process customer transactions on the institutions’ behalf. They now operate as shared agent network expansion facilities (SANEF). Informal banking operations called payment services banks were also introduced in 2019 to get financial products and services to the unbanked and hard-to-reach locations at low cost.

Payment service banks

Due to the initial low uptake of mobile money, and to boost financial inclusion, in 2018 the Central Bank of Nigeria launched the payment services bank (PSB) licence, which allows an organisation to carry out smaller-scale banking operations. This was modelled after India’s payment banks, which were set up to close the existing financial gap.

The functions of PSBs include account opening (current and savings); payments and remittance services (inbound cross-border personal remittances inclusive); issuing debit and prepaid cards in partnership with existing card schemes (not eligible for foreign currency transactions); operating electronic wallets; and other technology-enabled banking services. The licence also permits holders to sell foreign currencies realised from inbound cross-border remittances to licensed foreign exchange dealers.

Banking agents, mobile network operators, retail chains, mobile money operators and switching banks are all eligible to establish PSBs. Mobile network operators were included because they have more penetration than most financial institutions, especially in rural areas, and can leverage their existing technologies to drive cashless payments at lower transaction costs. Currently, four of the five PSBs are mobile network operators – Globacom (Moneymaster PSB), MTN (Momo PSB), Airtel (SmartCash PSB) and 9mobile (9PSB).

PSBs have helped to mobilise deposits and facilitate transfers from unbanked Nigerians (small businesses, low-income households and other financially excluded entities) in rural regions and other locations with limited banking activities, as well as being a platform to receive diaspora remittances. PSBs are also offering employment opportunities to Nigerians, especially youths, who serve as the agents.

PSBs have led to the rise of agent networks and are recognised as one of the key drivers of financial inclusion, offering offline channels for cash in, cash out and bill payment, as well as other financial services. However, PSBs are limited from performing other activities, such as granting loans or insurance products; accepting foreign currency deposits; and any closed scheme electronic value, including airtime, as a form deposit or payment.

Shared agent network expansion facilities

The Central Bank of Nigeria launched the SANEF platform in 2019 to deepen financial inclusion in Nigeria by broadening access to digital financial products/services such as account opening, bank verification number enrolment, cash deposit and withdrawals, airtime recharge, bills payment and nationwide funds transfers.

In order to reduce the cost of platform maintenance and agent management, and to improve liquidity management, the Central Bank of Nigeria is supported by deposit money banks, NIBSS and licensed mobile money operators/shared agents. This is done through an interoperable system that allows agents to connect to the various commercial bank platforms to set up accounts, deposit and withdraw money in places where banks are not readily available. This has contributed to the growth of payments volume and value.

As of September 2022, a Central Bank of Nigeria report stated that there are 1.4 million SANEF agents in the country contributing to banking penetration. SANEF has helped drive PoS transactions across the country, with the volume of PoS transactions rising to 878.4 million as of September 2022, from 706.8 million in 2021. The value of PoS transactions stood at NGN 4.6tn in the first seven months of 2022, up from NGN 3.5tn in the same period in 2021.

Fintech in Nigeria

Beyond government initiatives, the payments space has also expanded with the impressive growth of the local fintech industry over the past few years. The growth opportunity in African fintech seems to be concentrated in 11 countries: Cameroon, Côte d’Ivoire, Egypt, Ghana, Kenya, Morocco, Nigeria, Senegal, South Africa, Tanzania and Uganda. These countries account for 70% of Africa’s GDP and half of its population.

The Private Equity & Venture Capital Association, Nigeria – a trade body for venture capital and private equity in the country – estimated that the Nigerian fintech industry would reach $543m in revenue in 2022. In that same report, fintech was found to be the leading sub-sector of the Nigerian startup space on measurements such as volume of investment and number of unicorns. This has been reflected in the larger financial ecosystem as incumbent banks, which are not allowed to operate pension or asset management under the same company, are restructuring to compete with fintechs. For instance, GTBank metamorphosed into a holding company to drive innovative financial solutions that go beyond banking.

Payments are driving innovation in the fintech space in Nigeria with the likes of Interswitch; Flutterwave; Paystack, which is owned by Stripe; and Paga taking giant strides in creating a vibrant payment ecosystem.

They are also spreading beyond the shores of Africa. Flutterwave, which is now regulated by the US Securities and Exchange Commission and may soon be listed on the New York Stock Exchange, was mentioned as a potential buyer of Railsr, the British fintech offering embedded finance. Kuda, meanwhile, is about to power digital banking services in Pakistan through a partnership with Fatima Group and The City School Group that will see it offer electronic payment solutions, especially in the energy, agricultural, manufacturing and trading sectors.

Cross-border payments in Nigeria

With cheap digital payment solutions for domestic payment readily available and gaining traction in Nigeria, the same may be assumed of cross-border payments. However, despite having a large remittance market – according to FXC Intelligence’s market sizing data, inward remittance flow to Nigeria is estimated to have been $19.5bn in 2022 – the reverse is the case.

Nigeria has been experiencing a foreign exchange crisis for some years now. There are two foreign exchange rates in Nigeria: the official rate (used by the Central Bank of Nigeria and licensed banks) and the parallel rate (used by the black market). Individuals and businesses that need forex purchase from informal channels at the parallel rate, thereby increasing the discrepancy between the official and parallel market rates.

To tackle this scarcity, the Central Bank of Nigeria is using remittances from the diaspora to increase the inflow and deposits of foreign exchange currency. On 30 November 2020, the Central Bank of Nigeria introduced a new remittances rule that makes it mandatory for all incoming foreign exchange payments to be paid as cash in USD from bank branches or into domiciliary accounts (USD-denominated bank accounts). All bureau de change were suspended and all outward remittance through international money transfer operators has since been put on hold.

However, to receive foreign exchange payments as cash or into domiciliary accounts, all KYC requirements must have been fulfilled, including having a bank verification number. A large proportion of Nigerians do not fall into this category, making it difficult to receive remittances.

Sadly, not many alternatives exist. Some international platforms are either completely unavailable or limited. For example, PayPal allows Nigerian users to send money capped at the local bank card limitation (local cards can no longer be used for transactions in foreign currencies) but restricts them from receiving money. WorldRemit allows Nigerians to receive money but restricts them from sending.

Apart from invisible remittances – such as international school fees, airline tickets, payment for professional exams and others that are done through the Nigeria Trade Monitoring System platform as a SWIFT transaction – Pay Africa is the only option available. The partnership between Ecobank’s Cross-Border Capability platform and NIP allows payment to Ecobank locations in other African countries or to other banks using the local Real-Time Gross Settlement System/Automated Clearing House. However, this cross-border service is limited to the African continent.

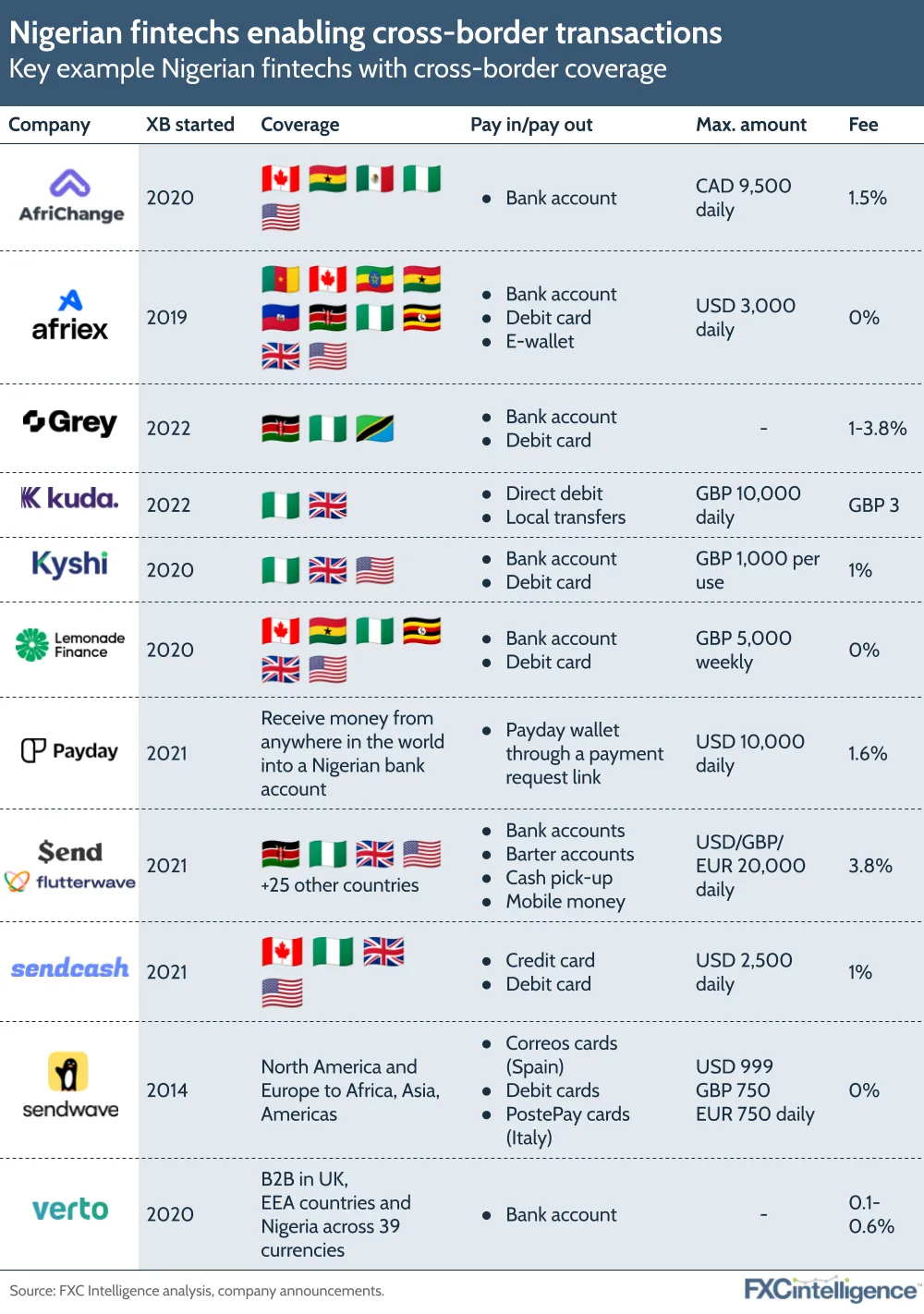

According to FXC’s pricing data, the total average cost of sending money from the UK and US to Nigeria was between 2.8% and 4% of the amount being sent in 2022. The biggest impact on remittance will be fintechs providing a cross-border solution that is easy to use and at a reduced cost. There are some fintechs – including Afriex, Lemonade Finance, Kyshi, Grey Finance, Payday and Kuda – that offer cross-border services without restriction.

These fintechs allow transfer of money to and from Nigeria, including vouchers and online purchases, bypassing existing restrictions through means such as virtual dollar cards or cryptocurrency. For instance, SureRemit, a non-monetary remittance service provider, uses a crypto token to enable people in the diaspora to send shopping vouchers; buy mobile airtime top-ups; and pay bills in Nigeria, Kenya and Rwanda. Meanwhile, Klasha offers virtual dollar cards for international transactions to shop from global brands like H&M and Zara. Card holders pay in local African currencies and get doorstep delivery of their purchases. However, the rate used by many of these fintechs is the parallel rate, which is almost double the Central Bank of Nigeria’s rate.

A major hindrance to cross-border payment growth and innovation in Nigeria is the government’s regulations around remittances, with inconsistent licensing requirements and money transfer processes worsened by moves such as the aforementioned payout mandates and the closing of bureaus de change. An improved regulatory process that allows new market entrants, especially fintechs, will drive increased digital remittances to more corridors.

Nigeria’s national domestic card scheme

Nigeria recently joined India, Turkey, China and Brazil in launching a domestic payment card. This is a card issued and processed in the currency of the country, so there is no currency conversion. Africa’s first central bank-driven domestic payment card was launched in Nigeria on 16 January 2023 under the National Domestic Card Scheme, with the aim of promoting financial inclusion and increasing competition within the cards market in the country.

Before the addition of the new domestic card, there were three card payment providers in Nigeria: Mastercard, Visa and Verve by Interswitch. As of 2021, the value of card transactions in Nigeria from the three card providers was $18.2bn, with an annual growth rate of more than 18%.

The domestic payment card was launched by the Central Bank of Nigeria in collaboration with NIBSS, the Bankers Committee and other financial ecosystem stakeholders. The national domestic card combines a fully domestic infrastructure with future cross-border interoperability built in that is targeted at reducing the use of foreign exchange to mitigate the ongoing forex scarcity in the country.

Payments using the domestic card scheme are in naira, which helps to reduce card charges for customers and the cost of operating cards for issuers. Banks currently charge between NGN800 and NGN1,100 to issue Mastercard and Visa debit cards; card cost and operational charges for the domestic card are still unknown but it is expected to reduce significantly.

About Nigeria’s National Domestic Card Scheme

| Launched | Launched by the the Central Bank of Nigeria on 16 January 2023 |

| Operation | NIBSS acts as central switchAll payments in Naira Supports debit, credit, virtual, loyalty and tokenised cards |

| Purpose | Promote financial inclusion Reduce the use of foreign exchangeIncrease competition within the Nigerian cards market Support micro payment and credit Deepen the growth of the digital economy |

| Benefit | Make payment services more accessible to the unbanked and underbanked Offers data sovereignty Lower the cost of payments services Has capacity for international interoperability Reduce card charges for customers and the cost of operating cards for issuers |

Open banking

Banks in Nigeria operate in a closed ecosystem where each bank’s customer information is kept by them and is not shared with other banks. A customer with multiple bank accounts will have to manage their financial activities on different platforms/apps. A new entrant into the Nigeria financial sector always has to start from scratch when gathering customer data or merge with an existing financial institution to make the process faster.

The new Open Banking Framework, launched by the Central Bank of Nigeria on 17 February 2021, seeks to encourage banks to share customer-permissioned data with each other to promote financial transparency and easy access to financial services in the country. Leveraging the shared data will foster innovations for efficient financial operations among traditional banks and fintechs across Nigeria.

Open banking will provide an enabling environment in the fintech space to make Nigeria a market accessible for doing business with ease. It will support customer-centric products and also create an established credit-scoring system in Nigeria that enables lenders to easily obtain credit history and other information.

Concerns have been raised about data protection and confidentiality, however, the CBN Open Banking Framework stipulates that all participants comply with data privacy laws and regulations, as well as consumer protection obligations in their dealings with customers. It is possible this will prove more challenging in the future, but open banking’s newness, along with the fact that it is yet to be widely implemented, means there have not been any significant privacy failings thus far.

Open banking in Nigeria

| Launched | Framework launched by the Central Bank of Nigeria on 17 February 2021 |

| Operation | Regulator: Central Bank of Nigeria – offers licences to API providers API providers: banks, insurance companies and other related financial institutions API consumers: fintech companies – use or have access to the data released by the API providers Customers would have to give consent to API providers to transfer their data before it can be accessed or used |

| Purpose | Encourage banks to share customer-permissioned data with each other Foster innovations for efficient financial operations Support financial transparency Enhance access to financial services Deepen the growth of the digital economy |

| Benefit | Improve financial services and increase product options Create a credit-scoring system in Nigeria Increase access to credit facility and create more profitable loan terms Make Nigeria a more accessible market Reduce data friction in the finance industry |

The private sector’s contributions to Nigeria’s digital economy

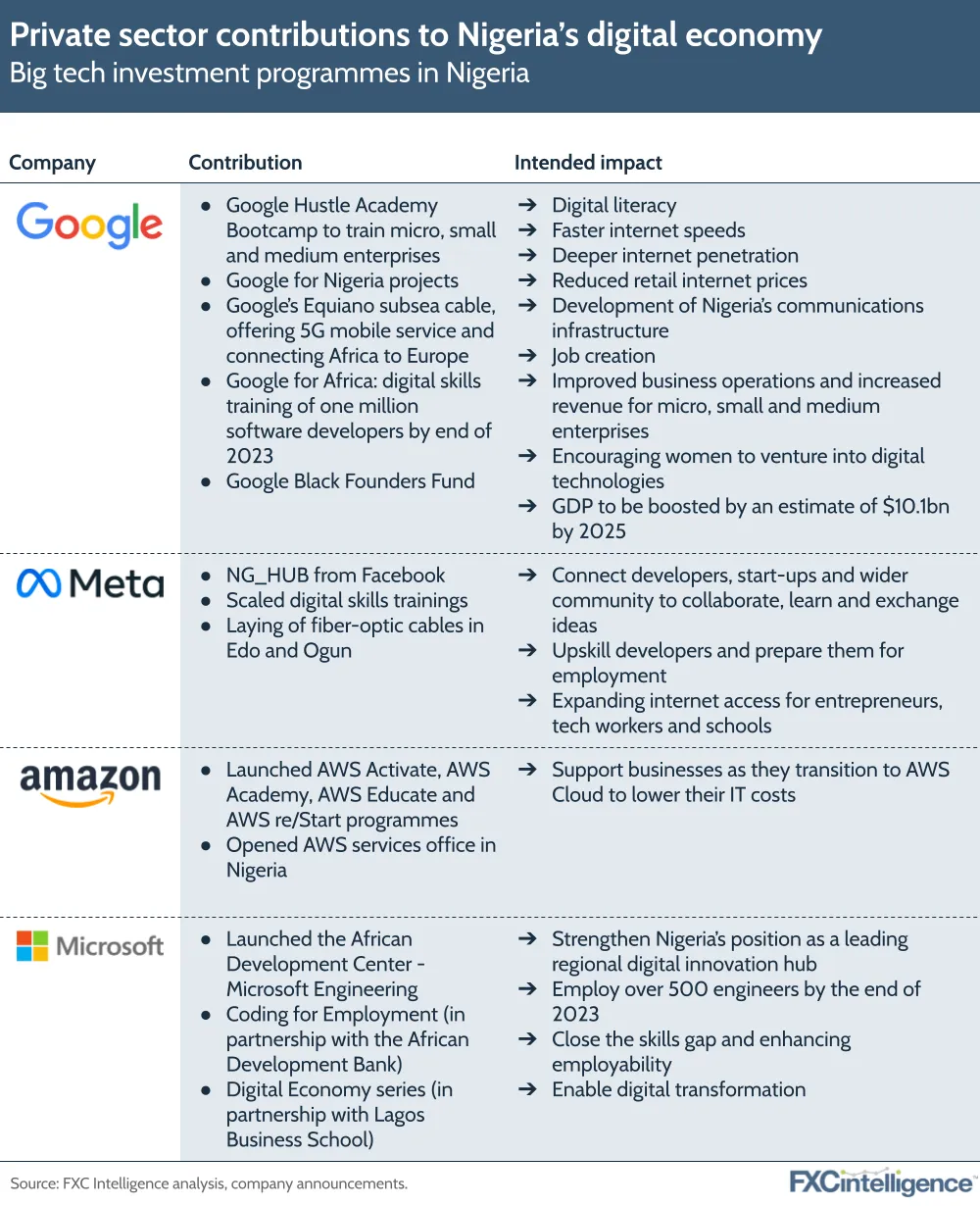

The various investments and contributions from the private sector have been driving digital literacy and transforming the digital experience for individuals and businesses in Nigeria. The various collaborations of organisations such as Google, Amazon, Microsoft and Meta with businesses, as well as the Nigerian government, have helped to increase revenue for micro-businesses, create more jobs, foster the development of better communication infrastructure and boost the economy.

Google has been working collaboratively with the Nigerian government in various forms, including a target to train five million Nigerians in digital skills; Google for Africa – an initiative to invest $1bn in Africa over five years in the form of low-interest loans for small businesses, equity investments into African startups and skills training; and a subsea cable connecting Africa to Europe. The Equiano cable offers a 5G mobile service that runs from Portugal to Africa; along the West Coast connecting Togo, Nigeria, Namibia and South Africa. There is also the Google Black Founders Fund with about 50 African startups funded so far; 23 of the 50 beneficiaries are Nigerians.

Meta has also been scaling digital skills training, especially for IT developers in Nigeria. The company has worked to connect developers, start-ups and the wider community to collaborate, learn and exchange ideas. Elsewhere, Amazon launched AWS Activate and AWS Academy alongside their Lagos, Nigeria office to support businesses as they transition to AWS Cloud and lower their information technology costs. Microsoft has also launched Coding for Employment in partnership with the African Development Bank, as well as Digital Economy workshops in partnership with Lagos Business School to close the skills gap and enable digital transformation.

The future of payments in Nigeria: Embedded finance

Embedded finance is the latest sector gaining traction in Nigeria and seems likely to be the future of the country’s financial services industry. With an expanding startup ecosystem, increased adoption of various cashless payment options and new financial innovations being birthed in quick succession, embedded finance seems to be the next attraction. According to Research and Markets, embedded finance had an estimated market value of $1.6bn in 2022. With a 54.5% annual growth rate, its market value in Nigeria is likely to reach over $8bn by 2029.

Embedded finance is the integration of financial services into non-financial solutions. It is a simplified process for addressing consumer pain points – making financial services readily available at the point of sale. By embedding fintech into their business model to create an omnichannel experience, companies will be able to reach a wider range of customers, resulting in more revenue.

In Nigeria, the ecommerce sector is currently benefiting from embedded finance by offering customers easy access to financial services with minimal human intervention. Ecommerce companies such as Jumia have mobile money options (JumiaPay) and other payment methods on their checkout page to simplify the buying process for customers. Jumia received a Payment Service Solution Provider licence from the Central Bank of Nigeria to process payments in December 2021 and according to Jumia’s Q3 2022 earnings release, 32% of orders placed on the company’s platform in the quarter were completed using JumiaPay.

Another fintech company in the ecommerce sector is Credpal. Credpal offers a point-of-sale financing solution called CredPal Payin. CredPal Payin is an omnichannel suite designed to allow merchants to conveniently offer buy now, pay later to their customers and receive orders via a number of channels. Many Nigerians have been benefiting from this solution at Hubmart (ecommerce), Slot (online phone store) and others.

Aside from the ecommerce sector, there has also been collaboration in the transport sector in the form of Credpal’s partnership with Bolt Nigeria: Bolt users can take as many trips as they want in a month by choosing to pay with Credpal’s pay later offering, allowing them to pay Credpal at the end of the month. Credpal also has a Fly Now, Pay Later offer available to Nigerians for domestic and international flights, which allows subscribers to book flights and pay in instalments within the Credpal app.

There are some other B2B collaborations in the agricultural, pharmaceutical and fast-moving consumer goods (FMCGs) sector that are making use of embedded finance as well. For instance, DrugStoc, an e-health B2B pharmaceutical distribution startup, is offering financial access to registered hospitals, clinics, pharmacies and healthcare providers and links them to over 400 manufacturers.

Another Nigerian B2B marketplace offering embedded finance is TradeDepot that connects micro-retailers with distributors and manufacturers in the FMCG sector. TradeDepot has an exclusive credit risk scoring engine that analyses retailers’ purchase behaviour including frequency of purchase, repayment performance and other related data to assess the retailers’ credit allocation.

Embedded finance is presenting a new value proposition to Nigerian legacy banks; through collaboration with fintech players and businesses, these banks can leverage their existing infrastructures and create a broader ecosystem centred around the customer. Embedded finance has the potential to deepen the digital economy – empowering more startups to launch new products quickly and increasing foreign direct investment – though no clear operating guidelines yet exist for embedded finance in Nigeria.

Conclusion

There have been several government policies in Nigeria, including placing charges on cash withdrawals above a certain threshold, that have been fostering quick development of the digital ecosystem. This is in turn stimulating the growth of the payment system; promoting financial inclusion; creating an enabling environment for businesses; boosting economic efficiency; and building a digital economy.

In addition, traditional payments (cash, cheque and debit card) have gradually been easing out and digital payment solutions are taking over. Nigerians yearn for quick, easy financial services and several fintech companies are springing up to offer business and consumer financial solutions, making the payment space notably more competitive than it used to be.

However, despite the increase in cashless payments, most transactions in rural areas are still done through cash. This produced its own issues early this year, with the introduction of new naira notes, and the deadline to replace them (first set for the end of January before being rolled into February), seeing long queues at ATMs across various parts of the country.

Cashless payment is also yet to reach small, informal enterprises such as local public transport, from bus companies to rickshaws, or street corner retailers who deal only in cash, even in urban areas like Lagos.

That said, the success of digital payment solutions in Nigeria continues to be a constant driver for other innovations to build upon and many are pushing for these solutions to be extended to cross-border payments especially with Africa’s free-trade area, according to the Brookings Institute, having the power to boost economic output by $29tn by 2050. Though the Central Bank of Nigeria hopes its eNaira digital currency will solve current cross-border payment issues, it is still trying to gain momentum. If and when it matures, it could be a reliable low-cost payments solution for consumers and businesses that would help create more value in the economy.

Looking at the payments landscape in Nigeria, there has been a substantial shift towards a digital economy but the country is still behind in some expected milestones. Goldman Sachs predicted at the end of 2022 that, by 2075, with the appropriate policies and institutions, Nigeria could be among the world’s largest economies. There is clearly a path ahead for Nigeria’s economic success, but it will take concerted effort to maintain that development.