Payoneer has reported strong earnings results for Q3 2023 as it continues to deliver on a profitability-focused strategy built around a refined regional and customer-based approach. In our latest post-earnings discussion, CEO John Caplan and CFO Bea Ordonez discuss the company’s latest performance and ongoing approach.

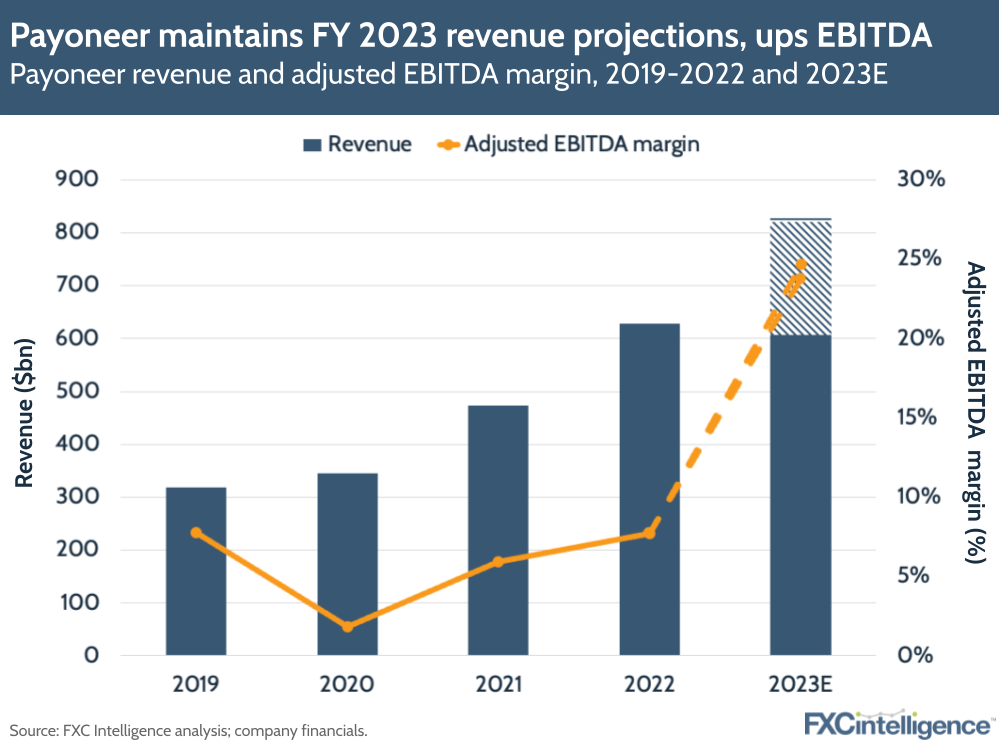

Payoneer has reported its latest earnings, with strong results for Q3 2023 that include a 31% YoY increase in revenue to $208m. This includes a renewed focus on profitability, with a 357% climb in adjusted EBITDA to $58.2m, which gives it an adjusted EBITDA margin of 28% – 20 percentage points up on Q3 2022.

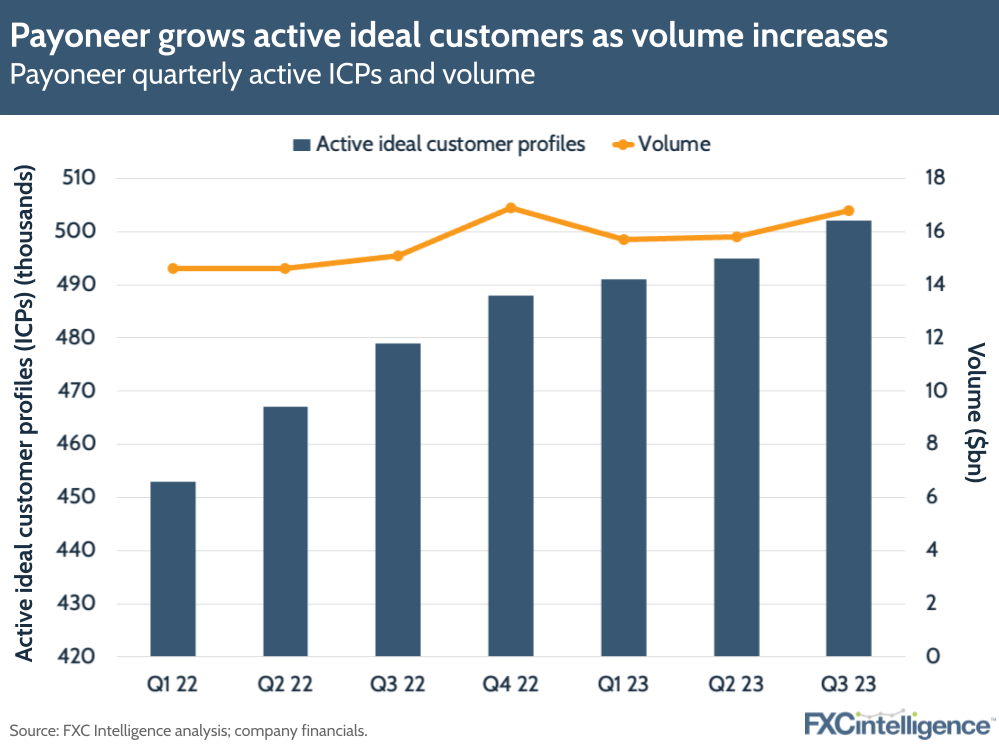

Coming less than two months after the company’s first Investor Day, the results see Payoneer continue to deliver on its strategy of growing ideal customer profiles (ICPs), with active ICPs growing 5% YoY, while high-value ICPs – those with over $10,000 a month in volume – increased by 17%. The latter group now represents around 10% of all ICPs but contributes over half of Payoneer’s top-line revenue.

The company has also been focused on growing its customer base in APAC, SAMEA and LatAm, where it has a higher blended take rate of above 2%, with customers in these regions increasing by 12%. This has been aided by a collaboration with Etsy Payments to expand into emerging markets, and Payoneer also saw its B2B business volume in these regions increase by 23% YoY.

Its March 2022-launched Checkout product is also beginning to produce gains for the company, with volume increasing 50% QoQ to pass $1m daily volumes in September.

In light of the earnings, Payoneer has maintained its FY revenue guidance of $820m-830m, but has significantly increased its adjusted EBITDA guidance from $160m-170m up to $195m-205m. It now anticipates achieving a FY adjusted EBITDA margin of 23.8-24.7%.

To find out more about the drivers of Payoneer’s latest results, as well as the company’s ongoing strategy, I caught up with John Caplan, CEO, and Bea Ordonez, CFO.

Drivers of Payoneer’s Q3 2023 results

Daniel Webber:

A very nice set of results for Q3. Let’s start by talking through what’s driving it.

John Caplan:

The first thing that’s critical to say is that Payoneer is an extraordinary company and the resilience, hard work and determination of our community, of our colleagues in Israel, has been… We have not missed a beat as an organisation, despite the ongoing war and the result of the terrorist attacks on Israeli citizens.

The business highlights are equally positive. We had 17% growth of our best ICP customers over $10,000. It is abundantly clear that Payoneer is well positioned to provide a full financial stack for cross-border businesses.

We shared at Investor Day, 21 September, that our biggest customers use the most of our AP tools, in addition to our AR tools, and we’re generating nearly $8,000 a quarter in ARPU from those customers. This is a pretty remarkable population of people, and it’s growing 17% year over year. Big highlight.

Another is Etsy joining the Payoneer marketplace community. As the leading marketplace payouts firm, Etsy chose Payoneer particularly to drive the modernisation of their payment strategy in high-growth emerging markets, and we’re thrilled about that relationship.

Our B2B business grew 23% in APAC, Latin America and SAMEA; we’re just getting started on that business, and that is a positive trend for us.

Our card business at $1bn of quarterly AP: again, proof that we’re not a toll booth on the money highway, we’re a full stack of solutions for our customers. Because our AP tools are so good, we now enable people to load funds into their Payoneer account directly from their banks, so they don’t need to use our AR flow to get access to our AP tools. It’s not yet ubiquitous around the globe – it’s in an early small rollout – but it’s been better uptake than we expected in a very short period of time, which I think speaks to the strength of our AP tools.

We shared on the earnings that we launched a light version of Payoneer’s account, and the reason we did that is, our formula for growth is ICPs times ARPU minus cost to serve, and we saw our cost to serve, our cost-per-ticket, decline by 25% year-to-date. Part of that is, we’re bundling just the products you need for some of the smallest customers, which should drive our engagement and drive down our cost to serve.

So Q3 of 2023 was a solid quarter for Payoneer, strong work across the board. Bea can talk about the October trends we’re seeing, and I think our ability to drive profitability speaks to the strength of Bea’s leadership in our organisation and our approach to the P&L.

Bea Ordonez:

As you said, a strong quarter of results for us. We continue to execute on the strategy that we’ve laid out since the early part of the year, including at Investor Day. As John said, we continue to drive ICP acquisition. We’re continuing to cross-sell those high-value services to our customers, and to really deliver the full and comprehensive value of the financial stack that we are building and have built.

From a headline perspective for Q3, as you saw, we delivered revenue growth of 31%. We’ve seen accelerating gross in our volumes throughout the quarter, from strong ecommerce trends that I think you’re seeing in the market more broadly, from continued rebounds in travel spend, and for us most importantly, and I think most impressively of all, from accelerating volumes in our B2B business. [We’ve seen those volumes] especially in those service-oriented regions and economies that we’ve highlighted in the past – SAMEA, APAC, LatAm – where we delivered really strong 23% volume growth year-over-year. We are continuing to drive really impressive ICP acquisition in those regions, 20-30% across those three regions in ICP acquisition year-over-year.

John also mentioned our Checkout business as part of that broad financial stack. We continue to penetrate: roughly half of the customers that are coming to Checkout, we acquire through cross-selling, roughly half are new to Payoneer. We hit an important milestone in Q3, $1m in GMV per day; that’s since launch roughly 18 months ago.

We’re really excited by this product and the potential that it has. We think our local service model delivers real value, real differentiating value, and we think the integration into our financial stack is a key differentiator as well.

Overall, from a revenue and volume perspective, we see nice accelerating trends. We saw 20% volume growth in October. We saw roughly 17% B2B volume growth in October as we drove ICP acquisition, lapping the terminations that we talked about at the end of ’22.

Then we saw 19 basis point year-over-year take rate expansion. Certainly interest income is a factor there, as we’ve continued to grow balances year over year, but also a factor is continued growth in B2B, as we’ve highlighted, and in our other high-value services and high-value regions.

We’re seeing improving transaction margin trends, up 300 basis points year-over-year, and we’re seeing expanding profitability. We reiterated our full-year ‘23 revenue guidance, we raised our full-year 2023 EBITDA guide. At the midpoint, we’ll deliver roughly four times the adjusted EBITDA in 2023 that we delivered in 2022. So we’re continuing to unlock operating leverage while driving growth at the top line.

Delivering profitability alongside growth

Daniel Webber:

Your profitability has started to fundamentally change recently, and you’re now showing that a business with this scale can drive profitability. What does your focus on profitability mean going forward?

Bea Ordonez:

For 2023, at the midpoint, we’re going to deliver an EBITDA margin of 23%. At Investor Day in September, we outlined a medium-term target of getting to 25% adjusted EBITDA margins. We’ve demonstrated in Q3, and with our guidance for the full year, that that is within our reach.

We can focus our acquisition and our service model on those high value customers. We’re going to continue to drive accelerated growth by growing faster in those higher take-rate regions. And we’re adjusting our operations model, and our model more broadly, to one, focus on those high-value customers, and two, to drive real automation and innovation.

There’s considerably more value to unlock over the longer term as we scale, as we drive more self-serve capabilities, as we integrate the benefits of generative AI at the top of the funnel and throughout our operations system; as we continue to adjust our operating model for the more segmented approach to our customers that we’ve outlined, vis-a-vis our pricing strategy.

As we really adjust our product, our bundling, our service model, to just be more nuanced and meet the needs of our customers, we can unlock greater revenue potential, but also greater operating leverage.

Payoneer’s emerging market focus

Daniel Webber:

Let’s talk about your emerging market focus. There are many people focused on B2B, but far fewer are focused on B2B cross-border payments and very few with the capabilities you have are catering to emerging markets. How are you developing products across APAC, SAMEA and LatAm?

John Caplan:

One of the things that is important for people in the fintech community to understand, but even more broadly globally, in the banking industry, is that Payoneer is the lifeblood of our customers’ businesses. If you’re a business in the US, there are a lot of ways to make payments, there are a lot of ways to get paid. It’s a knife fight for those companies that are trying to get share and you can see it in the data of those businesses.

For us, with what we’ve built for our customers in the Philippines or in Latin America or in other regions around the globe, their alternatives are awful, frankly. Having the ability to have a trusted, regulated platform, with simple-to-use tools – to invoice their customers, get paid, hold those funds in a multicurrency wallet and connect it to their international AP – fundamentally means that they can rely on Payoneer to be their financial operating stack for all of their international businesses.

That is different from the way most of the B2B payments companies are thinking. Those B2B payments companies are thinking, “There’s a big volume here, I’m just going to go take share from the local bank”.

The reality is, if you’re in the US, you don’t need to move. But if you’re in Pakistan or in the Philippines, or Bangladesh, or places where we have people on the ground, strong momentum, a top brand, we actually provide a solution that’s unlike any other.

We’re seeing it with marketing companies, we’re seeing it with business process outsource companies, we’re seeing it with technology service companies, that they rely on Payoneer to both get paid by their customers, and then pay their contractors. They use us for both purposes.

That’s also important. The business process outsourcer who’s got 500 contractors is invoicing their customers and paying their contractors from the Payoneer application. That is something the competitors don’t offer, and there isn’t a local alternative that comes close.

New product strategy

Daniel Webber:

You’ve rolled out a number of products recently, including Checkout and your card product. How are you thinking about your new product strategy?

John Caplan:

We had a number of releases in the last quarter. The ability for our customers to add funds to the account is a significant indication of the strength of our AP tools. The momentum of our card products and the innovation that we’re driving there is an example of the breadth of utility we’re seeing in our AP capability.

If you look at our pricing strategy, as we think about each of our customer segments and having the right products to meet their needs, it continues to show that there’s this universe of about 80 million businesses internationally that need a Payoneer account; we have two million of them today and we’re growing our best customers 17% year-over-year.

It feels like this team is executing, and we can grow and grow profitably in lockstep and grow take rate at the same time. Growing take rate, growing revenue, growing profitability, all at the scale we are, will end up separating us from the rest of the folks in the market.

Maintaining marginal profitability

Daniel Webber:

How do you make sure that you maintain that marginal profitability as you grow?

Bea Ordonez:

It comes from really articulating the focus and the strategy. So long as you start from that point, then you keep the organisation pulling in that same direction.

When we articulated that focus on ICPs, and on larger ICPs, it wasn’t just a talking point. We’ve infused that through the organisation. We have streamlined our go-to-market efforts to align to that objective. We have looked at our operational model to say “we will serve these customers in this way” and make adjustments throughout.

It’s really about aligning the organisation to that overall profitability-minded growth model, and we’re going to continue to do that and find more opportunity, while also investing. We’re going to invest prudently in areas of growth, in adjacent areas, in parts of our financial stack that deliver additional value to our customers and allow us to become a stickier product, a more embedded product, and to drive up ARPU, the other side of the formula.

We think we’re in a good position as we see that expanding profitability, the tailwind from interest income and so on, to continue to make investments in our platform and in our product stack.

Daniel Webber:

We’re almost at time. Is there anything else you want to mention?

John Caplan:

I would say what I said to our team this morning, which is I’m proud of our team and it’s delivering in every way on the strategy we’ve laid out.

The best people in the world work at Payoneer, and it’s been demonstrated both how we’ve handled the disruption of the war and the community we’ve built, and how we’ve focused on our customers. I am proud to be here right now, really proud to be here.

Bea Ordonez:

The resilience of our team in general across the board is really just exceptional. We’ve delivered across a range of initiatives, and really just continue to focus on serving our customers. I’m really proud of the team.

Daniel Webber:

John, Bea, thank you.

John Caplan and Bea Ordonez:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.