Slightly over a year after it announced the acquisition of PayU GPO, Rapyd has achieved its first profitable quarter and launched a partner programme set to diversify its revenue. We spoke to CEO Arik Shtilman to unpack the company’s strategy and learn what’s next.

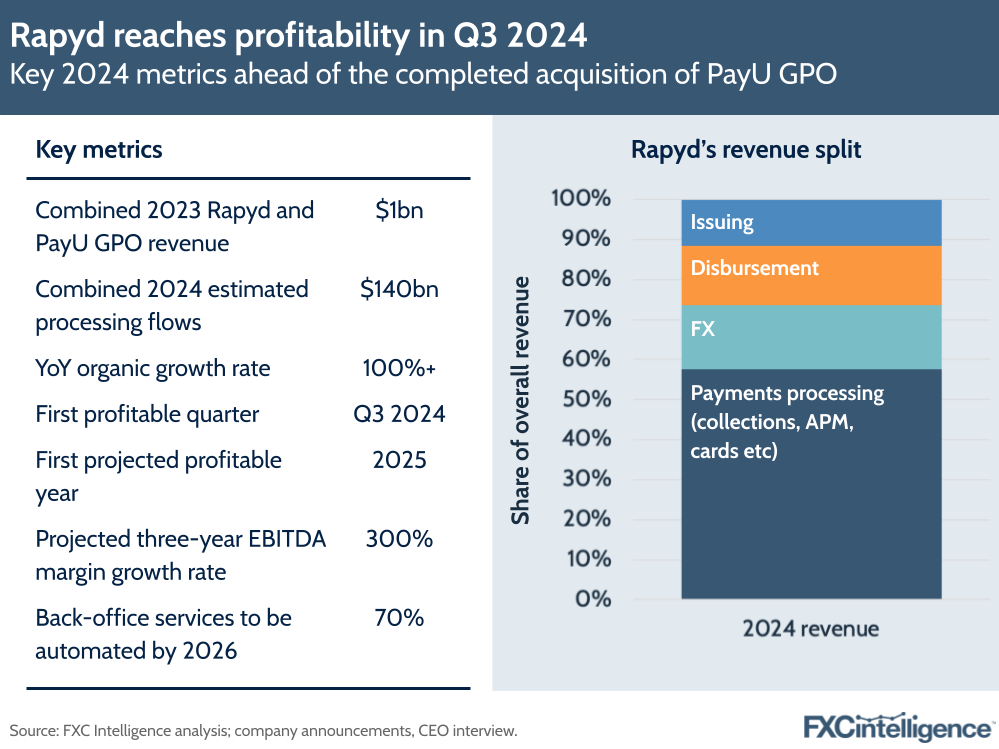

In August 2023, B2B2X-focused fintech Rapyd announced the acquisition of PayU’s Global Payment Organisation (PayU GPO) in a $610m deal designed to super-charge the company’s growth. Now a year later, with the complex acquisition reaching its final stages before closing, the company has achieved profitability for the first time in Q3 2024 and is taking other strategic steps to build on its growth.

The latest move, the launch of the Rapyd Payment Partner Programme, is set to broaden the company’s already significant revenue contribution from referral partners and help build an ongoing base for its future growth.

However, it is one part of a broader strategy for the company as it continues to increase its scale and reach, and also comes amid broader changes in the B2B market. With this in mind, how is Rapyd thinking about its strategy and future? Daniel Webber spoke to CEO Arik Shtilman to find out.

Inside the Rapyd Payment Partner Programme

Daniel Webber:

Let’s begin with the Rapyd Payment Partner Programme. What motivated you to start it?

Arik Shtilman:

In 2022 we had decided that we needed to diversify our client base and work a little bit more with different types of partners, including referral partners, independent software vendors and independent sales organisations. This was because we understood that in order to continue to grow at the same pace that we used to grow, it will have to come from a very diversified partner base and not only from a direct sales team.

We started to implement the different stages of going into partnerships from 2022 with the goal to get to around 30% of our revenue from partnerships in a three-year timeframe. We are almost there. This year, probably around 22% of what we do will come from partnerships.

We’ve built a very strong partnership programme over the years and now we’ve decided to launch the next stage and build a real programme around the referral partnerships with different types of level and ranks.

We have literally hundreds of partners that are working with us and they’re bringing us great business. So in order to be able to provide the partners with the attention that they need and the incentives that they should get, we decided to build this new type of partner programme that explains to everybody where they stand and how they can move between the different stages, so Rapyd can work with them more closely for the next several years.

Generally speaking, partnerships are extremely important in payments and it’s very complicated to get significant scale with direct sales alone, which is why we invested in it [the partner programme].

Rapyd’s PayU acquisition and future strategy

Daniel Webber:

Alongside the partner programme, you’re also near to closing your acquisition of PayU GPO. How are you thinking about Rapyd’s broader strategy?

Arik Shtilman:

From a big picture perspective, we signed the acquisition of PayU in August 2023, and this deal is quite complex because it requires the approval of seven different regulators worldwide for closing, because of how distributed the PayU business is. We went through six approvals and we are in the seventh and last approval. We expect that this will be given probably up until the end of October, and then we’ll be able to close this deal and finally consolidate the two companies.

We are very enthusiastic about getting there and we really think that we’re not that far away. It was challenging because it is a very scalable type of process because of the many different countries, regions etc. that are involved, but overall we’re very positive that before the end of the year everything will come to an end and the acquisition will be completed.

Rapyd continued with very strong growth in 2024 as a standalone business. We even had our first profitable quarter, which was actually this quarter (Q3 2024), and we believe that we will continue and expand our profitability for 2025.

We’re on track to become a very profitable company down the road. The combination between us and PayU will lead to a super scalable business that is extremely profitable, because both PayU and Rapyd are already profitable companies. So we are very enthusiastic about the future.

The changing global merchant opportunity

Daniel Webber:

How have you seen the global merchant opportunity change over the past few years and how has Rapyd responded to this?

Arik Shtilman:

Over the last two years there has been a significant shift from trying to get the lowest price possible to trying to get stability, good technology, fast processing times and high authorisation rates.

The market has changed a lot. From the beginning of 2022 up until today there was some consolidation, some companies disappeared and also clients have understood that the days that VCs subsidised their business by allowing payment companies to provide very low pricing in order to grow are over.

Now the clients are more focused on stability of the technology, good authorisation rates and money movement, and that’s quite a big change. Rapyd was positioned extremely well before and is positioned extremely well now to provide these capabilities.

The fact that we have multiple products as part of our offering – what we call an infrastructure of Collect, Disburse, Wallet and Issuing – and we’re not a one-trick pony focusing on acquiring or disbursement only, allows us to have a really tight relationship with our clients. It also allows us to provide them the best pricing and service that is possible.

Rapyd’s disbursement offering

Daniel Webber:

Disbursements is a really popular part of the market. What is your product positioning and customer focus there?

Arik Shtilman:

Our disbursement product is quite diversified. We do the standard local ACH and Swift transfers and we also have the push-to-card capabilities, Mastercard and Visa.

We also have some of the wallets that we support from an integration perspective and we’re really focused around serving clients that are in the high-opportunity industries that Rapyd is supporting.

If it is gaming companies, if it is online trading companies, affiliate marketing and content creation, these are the places where our product fits the best from a disbursement perspective. We also have quite a lot of payroll-related companies that are clients of ours, but at the end of the day, these industries that I mentioned are the best fit for what we do.

Perspectives on the multicurrency account play

Daniel Webber:

What’s your perspective on the multicurrency business account opportunity?

Arik Shtilman:

I think this is an opportunity that is more consumer-focused or focused on businesses that have a very complicated way to open a regular bank account. I don’t think it is a very profitable offering for the company that offers this service.

I understand why somebody would want to have it: low fee currency, multicurrency account, etc. But I think that for Rapyd, even though we have these capabilities, we have this infrastructure and we used to sell it in the past, the ability to actually generate profit from this type of service is not high. And the regulatory scrutiny that you get from providing this service is enormous because the type of people and businesses that actually need this put you in a situation where you are always exposed to regulators one way or another and you need very sophisticated transaction monitoring and ongoing due diligence capabilities in order to make sure that you’re compliant.

Daniel Webber:

Plus high interest rates to drive extra money.

Arik Shtilman:

But interest rates is a tricky thing because Rapyd plays the marathon game, not the sprint, so in the sprint game, you can take the interest money and you’ll be very happy because you made money. But if you look at the marathon, next year, this money will not exist and you’ll have to explain to investors why your year-over-year performance is not as good and you can tell them that the Fed reduced the rates, but it’s not an excuse for a serious business. That’s an excuse for the bank.

Emerging market approaches

Daniel Webber:

You do a lot with emerging markets. How do you think about the opportunities there while balancing the currency exposure risks?

Arik Shtilman:

Emerging markets are an amazing opportunity for both our Disburse and Collect products because of the additional revenue that we generate from FX, the markups and being able to process the type of currencies for money movement, but not for holding these currencies, and that’s the big difference.

If you don’t hold the currency and it’s only part of the transaction and you’re able to basically move this money in a compliant and legit way in and out from these countries, then it’s definitely an opportunity.

We operate extremely well in emerging markets and probably around 16% of all Rapyd revenue is coming from FX. It doesn’t mean that it’s coming from FX trading, but it’s coming from cross-border transactions, either collecting or disbursing the money.

For the rest of our revenue, around 55-60% of it is payment processing for collection of payments: alternative payment methods, cards and everything that is related to it. You have another 15% that is coming from disbursement fees that are not FX – only the disbursement fee itself – and the rest is our Issuing product.

Rapyd’s use of artificial intelligence

Daniel Webber:

What are the biggest priorities for Rapyd over the next few years?

Arik Shtilman:

AI, AI and AI again. Not because I think that my clients need AI, but I think that I need AI.

The reason why I need it is to reduce the operational overhead that exists in payments and financial services. The number of things that are still done manually in payment companies is insane. You still have compliance operations; compliance and risk; and risk operations and transaction and monitoring.

Yes, you have tools and capabilities and automation, but still when you get to the AI level of actually doing things – and not as a buzzword, but actually things that used to be done in four hours are done in a minute by a machine on its own – this is a game changer for a payment company that scales. Over time the profitability is going to be unprecedented because you will not need to continue to move your workforce at the same pace that you onboard clients.

It’s going to stabilise at a certain stage, and yes, you’re going to have AI-related costs, but the ability to do things dramatically faster and pay significantly less is a big game changer.

I will give you one element of what blew my mind when we did our first AI implementation. We took a task that used to be done in three hours by humans and turned it into a one-minute task, and it’s not something you could have done before the AI that is available these days, either by Google Gemini or OpenAI.

[Implementing AI] is a never-ending journey, but in order to get to a stage where we will be happy with what we have, it’s another two years down the road, minimum.

Daniel Webber:

Arik, thank you.

Arik Shtilman:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.