Remittances are a vital lifeline for many people in emerging markets, however their provision remains inconsistent and often expensive. How can they be improved?

Remittances provide a significant contribution towards the support of migrants’ family members and communities, especially in Low and Middle-Income Countries (LMICs), defined by the World Bank as those with a gross national income per capita of $12,695 and below.

More than 200 million households (with an average family of four) benefit from remittance flows yearly and the United Nations’ Sustainable Development Goals (SDGs) identify remittances as a lifeline for many struggling households and communities in developing countries. This is because migrant workers have been estimated to send home, on average, $200-$300 every one to two months, a figure that makes up about 60% of a household’s income in a LMIC. According to FXC Intelligence’s market sizing data, remittances to LMICs were $523bn in 2021. In this report, we explore the current state of remittances in emerging markets, and how they can be improved.

The state of remittances today

Remittances are a complex, and often fragmented market, that nonetheless play a hugely important role in the economies of several countries, especially in emerging markets. While increasing digitisation is easing some of that complexity, and assisting with the cost burden of certain remittance corridors, there is still a lot of work to be done in order to increase financial inclusion, reduce remittance costs in line with the UN’s Sustainable Development Goals and encourage the use of remittances for long-term investment.

That work will likely have to be done on multiple fronts, ensuring that both the regulatory and business environments are conducive to improvements. There are some things that can’t be planned for of course, for example the impact of crises such as the Ukraine war on remittance markets, but other challenges are far more addressable.

Macro and micro socioeconomic factors affecting remittances

In receiving countries, local macro and micro socioeconomic factors have a major influence on remittance flows. These factors include inflation, unemployment, economic and foreign policy, natural disasters and political crises. A change in foreign policy in one country can drastically reduce the amount of remittances received.

A typical example of this is Central Asian countries, whose main source of remittance is Russia. With sanctions against Russia for the ongoing invasion of Ukraine causing a fall in the value of the Russian ruble, remittances to Central Asia are expected to fall severely, placing significant pressure on those economies.

On the other hand, just as remittance inflows were crucial during the pandemic, they are currently providing the crucial support needed as rising inflation, energy and food costs cause many families around the world to face financial pressure. There are of course regional differences that depend on the economy of the sending country. Remittance flows, especially to emerging markets with significantly increased cost of living, are expected to increase. The World Bank’s KNOMAD has estimated a 9.1% increase in remittances to Latin America and the Caribbean; 7.1% to sub-Saharan Africa; 6% in the Middle East and North Africa; and 4.4% in South Asia for 2022. More than 70 countries rely on remittances for at least 4% of their GDP.

Financial regulations and policies

Financial regulations targeted at anti-money laundering and combatting the financing of terrorism (AML/CFT) create a bottleneck for easy, transparent and cost-effective remittance transfers in many countries.

Not only has the implementation of these regulations been marred by inconsistencies in definitions and expectations, but issues with the interoperability of mobile systems have made it near-impossible for new entrants to work as operators.

Some receiving countries do not have the necessary infrastructure to support the technology used by the money transfer operators in the sending country, which poses a critical problem for AML/CFT compliance. As a consequence, incumbent players have found it far easier to monopolise the market and the cost of transfer has been increased due to the cost of execution.

In addition, the documentation burden faced by migrants sending remittance in some countries makes it difficult to use formal channels of remitting. For example, in countries such as Japan and South Korea, remitters are required to have residence and other forms of identification documents before they are able to send remittance.

Cost of sending remittances

According to the UN’s Sustainable Development Goals, the cost of sending money needs to be reduced to less than 3% of the remittance by 2030. As of Q2 22, currency conversions and fees on average take up about 6% of the total amount sent, according to the World Bank Remittance Prices Worldwide dataset, which is powered by FXC Intelligence data. The most expensive region to send money to is Saharan Africa, at 7.84% total average cost as of Q2 2022.

There are several challenges causing the cost of sending remittances to remain high. These include the dependence of some remittance corridors on cash rather than digital transfers.

For instance, remittances to the Pacific islands are still quite expensive because cash remittances are preferred by most people in the region. As an example, according to the Asia and Pacific Policy Society, approximately 83% of the individuals who receive international remittances in Tonga use only Western Union’s service, which is among the most expensive.

Government levies and tax in some countries such as Tanzania also makes sending remittances more expensive. Likewise, regulations and policies, such as those seen in Nigeria following the suspension of money transfer operators, make it possible for remittances to only be received in foreign currency, mostly through Western Union and MoneyGram via banks alone. Other challenges include a lack of transparency around costs and low levels of financial and digital inclusion.

Digital money transfer: Uptake of mobile money

The use of digital money transfer methods now allows remittances to get to the last mile even during crises or natural disasters. Funds are increasingly being sent using digital methods, with mobile money technologies helping to reduce the cost of transferring remittances compared to other methods such as bank transfers, cash and informal channels. Mobile transfer costs are already in line with the SDG target of less than 3% total average cost.

There has been a steady growth in the adoption of mobile money across different regions, according to GSMA’s Mobile Money Regulatory Index score. The Index evaluated 92 countries based on the extent to which their regulatory framework enables widespread mobile money adoption using five dimensions: authorisation, consumer protection, KYC, transaction limits and agent network.

Mobile remittances are expected to grow in the coming years, especially in Africa. They have created wider competition and transparency within the remittance market, thanks to an increased number of mobile money users and operators, especially in sub-Saharan Africa where demand for mobile money is high and almost half of mobile money users depend solely on it to access financial services.

Regulatory reforms in LMICs, such as non-banks being allowed to issue mobile money with no strict transaction limit, have promoted mobile money international transfers. This is in addition to improved infrastructure – especially that of mobile networks – which has created expanded reach among vulnerable populations and the offer of cheaper transfer costs due to time saved. The ease of sending and receiving remittances will continue to enable mobile remittances to thrive.

Development partners/agencies

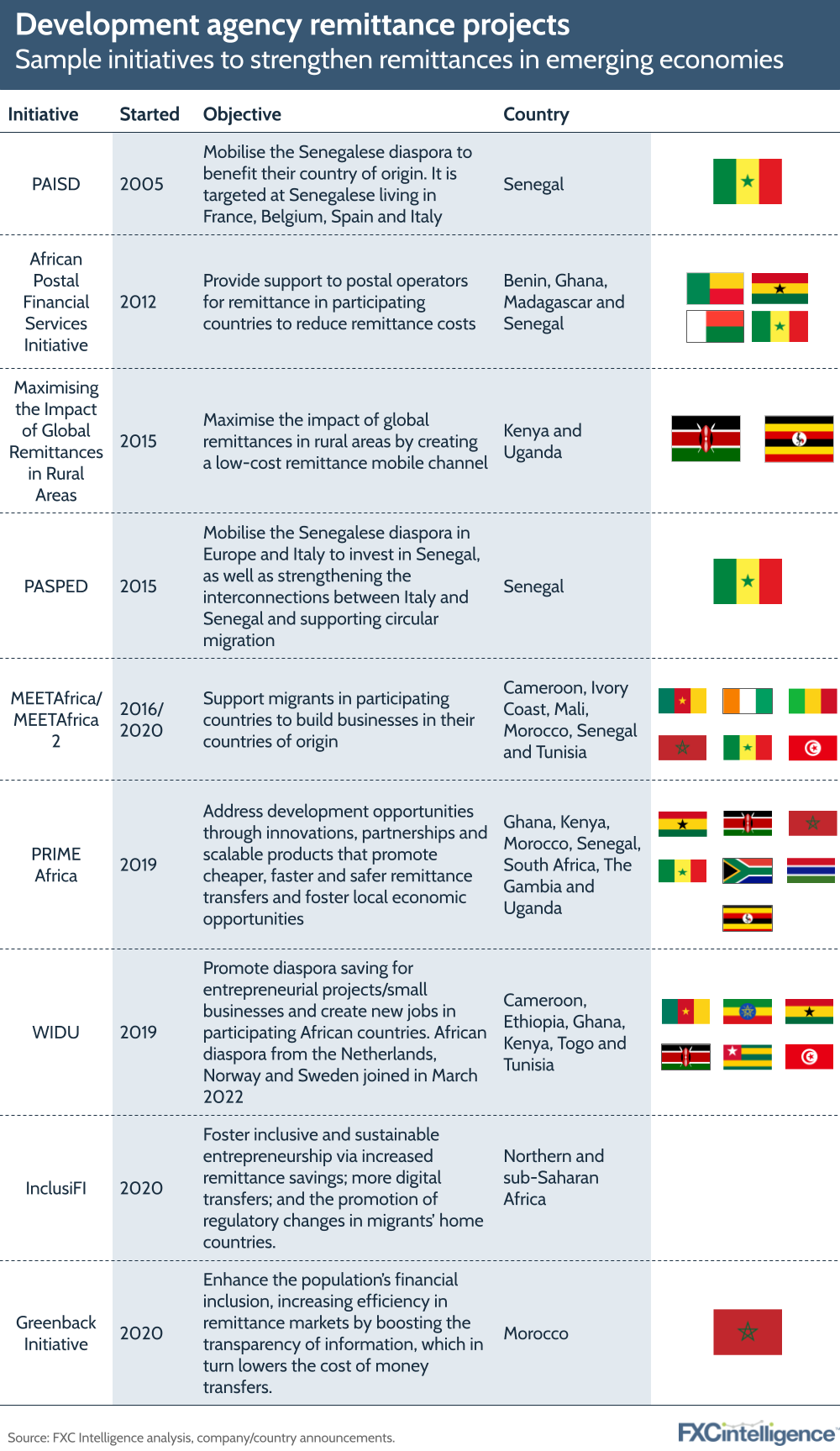

Government initiatives for shaping the productive use of remittances for economic growth are quite scarce, with remittances often spent on immediate family needs and consumption. However, over the years, several development organisations have moved for action to strengthen remittances’ role in long-term investment and supporting economic development and growth in receiving countries.

Two focal areas have been identified and worked on over time: reducing transfer costs and encouraging the use of remittances for longer-term investments. Various development agencies, as well as diasporan bodies, have made significant efforts to contribute positively towards these two identified areas through a variety of means.

Prominent strategies have included promoting economic engagement, especially among women and youths, as seen in some West and East African countries; fostering financial inclusion within rural areas; encouraging savings/investment by receiving households in LMICs; and developing low-cost remittance across the world, which can in turn contribute to the development of migrants’ country of origin.

Strengthening remittances in emerging markets

In order to improve the state of remittances, both the public and private sectors, together or separately, will need to invest in a variety of initiatives. For the most part, this will likely need to stem from governments, if only to prevent an overt focus on profit, but public-private partnerships could play a key role, especially in areas such as improving infrastructure. Approaches may focus on diaspora communities but could also more heavily rely on economic empowerment within migrants’ countries of origin.

An important factor will probably be rural communities, given the prominence of emerging markets, and the means by which they can be brought into digitised and formalised money transfer channels.

It is important to remember, however, that while certain characteristics are shared across markets, each nation faces their own unique mix of macro and micro factors that will shape the remittance market and how it develops. There is no magic bullet or one-size-fits-all approach to strengthening remittances. Below, we explore some of the options that could, however, play a role in emerging markets.

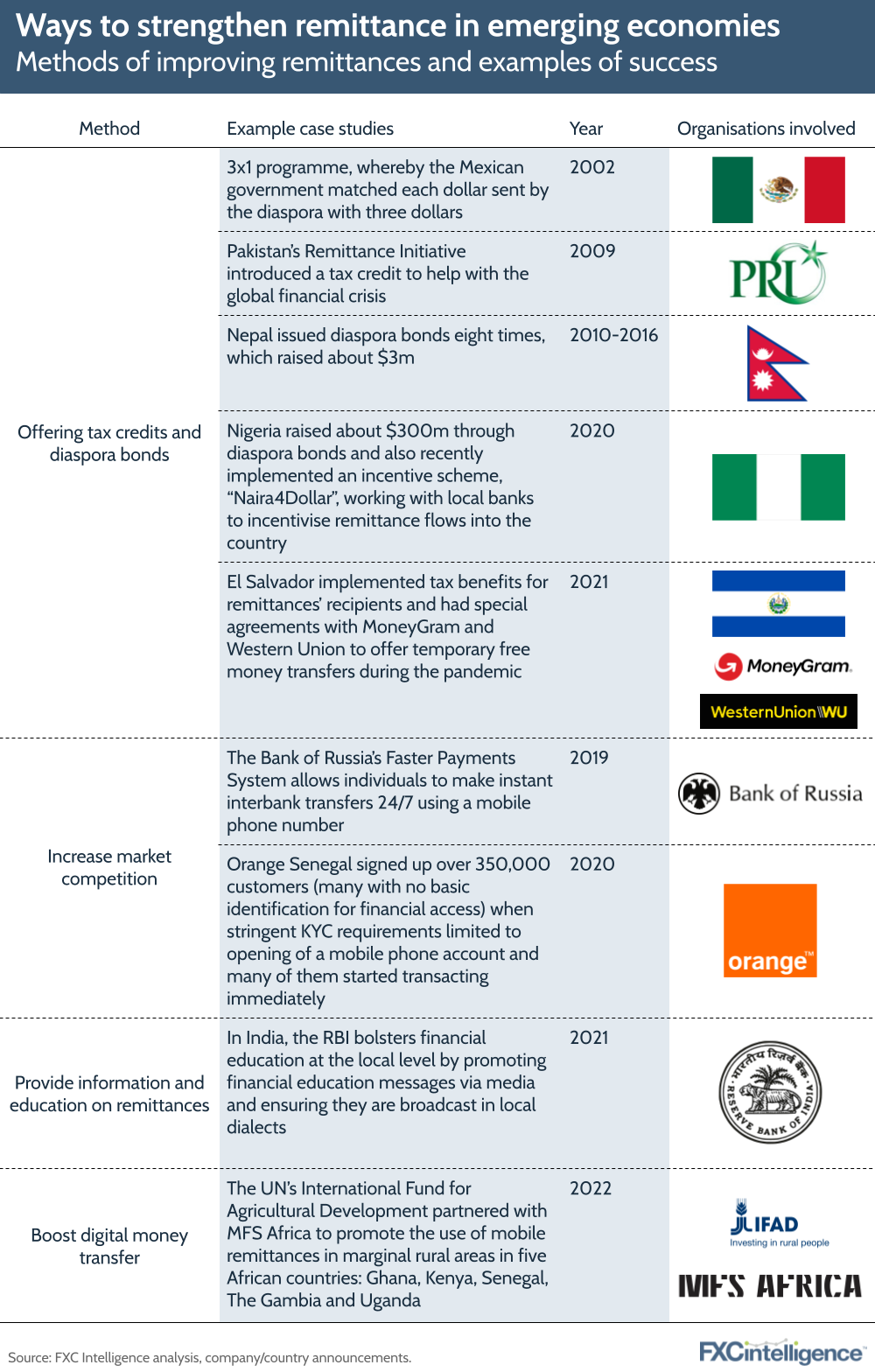

Offering tax credits and diaspora bonds

There are several benefits to countries offering tax credits or incentives; most importantly to remittance service providers, it can help to reduce the fees of remittance transfers. For example, in 2009, Pakistan’s Remittance Initiative introduced tax credits as one of the ways to help with the global financial crisis. A removal of government levies/tax imposed on remittances, especially by sending countries, would also contribute to lower transfer fees.

Having a diaspora bond in receiving countries with high interest rates could also be attractive to migrant workers. Diaspora bonds could be used to finance development projects in emerging economies, as evidenced by countries like Nepal (with an annual remittance volume of roughly $6bn) and Nigeria’s past use of diaspora bonds to raise money.

However, lack of trust in the government, increasing inflation rates and other macro-economic factors makes tangible assets (landed properties) more valuable than securities. This can make diaspora investments in diaspora bonds less attractive.

Increase market competition

Open strategic partnerships between public and private sector stakeholders including national post offices, banks and money transfer operators have increased the number of operators and the interoperability of technologies, which have positive effects on remittance flow, as well as cost. Improved infrastructure for financial payment focusing on rural areas will make it easier for new entrants.

Partnerships with the private sector can promote innovations that pave the way for better digital financial inclusion and access. For the public sector, having relaxed KYC requirements for smaller transactions would encourage the use of formal channels including mobile money and digital banking to transform the markets using low cost, secure and interoperable innovations for money transfer.

If policy makers and regulators provide an enabling environment for affordable, easy and fast remittance transfers, there will be a knock-on effect on financial inclusion, which will benefit migrants and their countries of origin. This will also increase the remittance market’s transparency and competitiveness.

Develop innovative financial services aimed at migrants and their families

Financial policies and programs should be based on an individual country’s needs and observed gaps. For instance, financial inclusion may have been a major focus up until now but the next stage to prioritise may be economic empowerment, in particular the financial independence of people in rural areas. The financial programs would need to be scalable and realistic, with set objectives and tools tied to a timeline.

Introducing financial products such as savings, insurance and financial investments for business services can not only boost the local economies of the communities of origin for migrants and their families but are great ways of maximising remittance flow. Remittances can help initiate self-employment for households that receive remittances through a broader range of financial services to choose from, fostering financial resilience. With relaxing credit constraints, micro-small medium enterprises will be further able to contribute to the GDP of emerging economies.

Provide information and education on remittances

Creating awareness of and providing clear information on alternative, affordable money transfer options for receiving or sending remittances will promote the adoption of digital financial services; boost trust in formal sending channels by improving transparency; and positively change financial behaviours to encourage a culture of saving and investment. The same educational outreach around the benefits of and methods by which consumers (especially those in the rural areas) can easily convert their funds into cash could provide similar outcomes.

One way to provide information on alternative, affordable money transfer options and improve transparency is by providing cost comparison tools for different transfer corridors. In addition, financial literacy on affordable financial services, savings and business investment will enable both senders and receivers to make informed choices about financial empowerment and how it can strengthen financial systems.

Boost digital money transfers

Investing in innovations and initiatives that promote digitisation of the remittance value chain would help close the digital gap in LMICs, opening up untapped markets in rural communities and reducing the costs of remittance transfers, especially with the uptake of mobile remittance .

According to the Asia and Pacific Policy Society, it is estimated that, if a Tongan family received remittances through digital means, they could save up to $960 per year. Boosting digital money transfer will help receiving countries harness the development benefits of using mobile channels to send and receive remittances.

Conclusion

The challenges of strengthening remittance in emerging markets will require careful consideration and deliberately targeted initiatives to overcome, yet they are far from insurmountable. Proof of concept already exists for the improvements brought about by increasing digital infrastructure, as well as financial access, and various initiatives have also shown the benefits that remittance-focused financial schemes can bring to receiving households and low-income economies in general.

However, especially with the importance of remittances to LMICs and their estimated growth, there is still much work to be done, especially around cost reduction.

In order to meet the UN’s Sustainable Development Goals, the cost of sending money needs to be reduced to less than 3% of the remittance by 2030. While mobile transfers are already falling in line with this number, there is still a way to go to reduce the average transfer cost from its current 6% on other transfer methods. Some of this may come from improving market competition and financial regulation, but an important factor will also be education: making sure that consumers are aware of the options available to them and the cost of each.

With the significance of remittance to LMIC household incomes, there is simply no reason not to ensure that the market is working as best it can and that both receiving households and remittance senders are getting the best out of it.