C2C money transfers had a relatively strong Q3 2023 earnings season, but there are some evolving trends that speak to the ongoing development of the space. We review the state of remittances based on the performance of the sector’s publicly traded companies in Q3 2023.

For many publicly traded players in the remittances and money transfers space, Q3 2023 has been a strong quarter, with most companies reporting positive results this earnings season. However, the industry continues to be in something of a transitionary period, which is reflected in some of the underlying trends among these companies’ results.

In the latest in our report series, we look at the latest and past earnings from key money transfers and remittance players to determine how different companies are performing against one another, and where certain players are pulling ahead of specific metrics.

This report sees us focus on the five biggest publicly traded companies in this space: Western Union, Intermex and Remitly, as well as Wise’s Personal business and Euronet’s Money Transfer division, which includes Ria and Xe. Here we review all available comparable data for each metric for the last 15 quarters to identify trends and divergences between different players. We also perform keyword analysis on earnings calls to identify how different players are prioritising different elements of the business.

Topics covered:

- Revenue growth in Q3 2023 remittances

- Money transfers ARPU for Q3 2023

- Changing transaction rates

- Digital remittances: A focus for all?

- How positive are money transfers players?

Revenue growth in Q3 2023 remittances

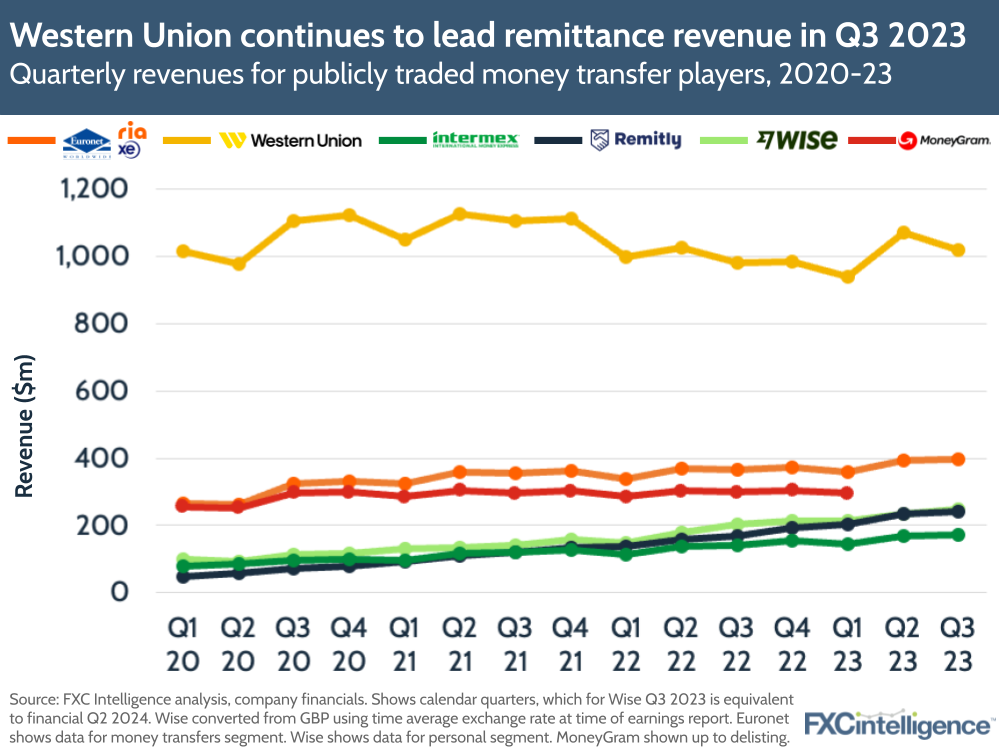

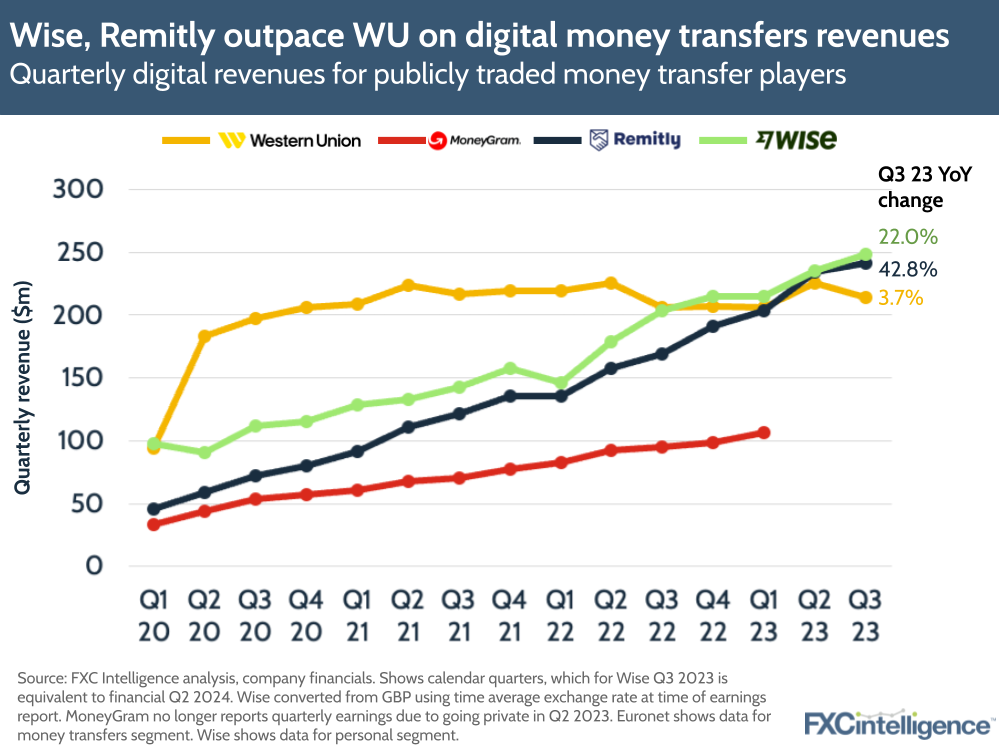

On quarterly revenue among remittance players, Western Union remained in the lead, however the gap continues to tighten, perpetuating a trend that has been going on for some time. While Western Union is set to have a sizeable lead versus its competitors for years to come, there will come a point where it is overtaken if trends continue.

Linear trend projections based on each company’s results between Q1 2020 and Q3 2023 indicate Remitly is currently set to outpace Western Union in early 2034, while Wise and Euronet’s Money Transfer division are set to follow in early 2036. In reality however, significant market changes, as well as adjustments to company activity and strategy, are likely to alter these courses.

In Q3 2023, meanwhile, Remitly was now very closely matched with Wise, having been on a slightly steeper growth trajectory for the past few years, while Euronet Money Transfer and Intermex also continued to to see growth.

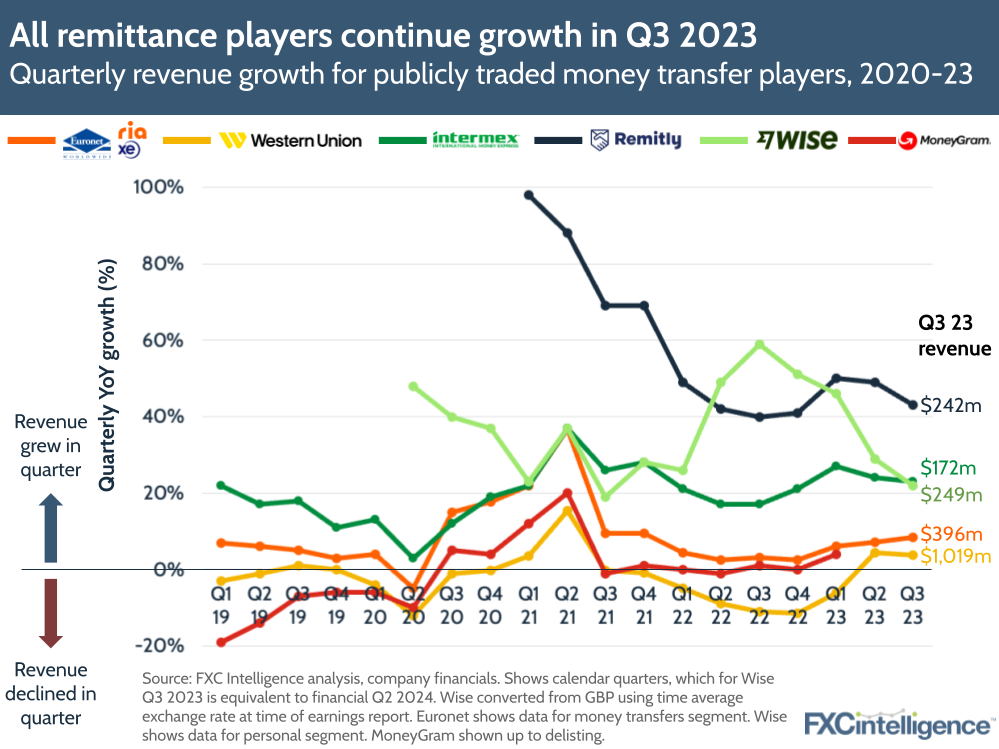

On growth rates, all players again saw positive year-on-year growth this quarter, for only the second time since 2021. Remitly and Wise’s growth rates continued to be significantly elevated, although lower than previous quarters, and Intermex outpaced Wise on quarterly revenue growth for the first time since the latter went public – albeit by a single percentage point.

Euronet, meanwhile, continued to see solid, consistent growth, while Western Union began to see modest results from its attempts to reverse a period of decline.

Last quarter, much of Western Union’s positive revenue growth was attributable to factors that were unlikely to continue in the medium or long term, however there were some green shoots in Q3. While short-term gains from Argentinian inflation and changes to Iraqi monetary policy continued, the company did also see an earlier-than-expected return to growth in digital money transfers, which last increased in Q1 2022.

By contrast, Intermex had a strong Q3 2023, aided by both core growth and the acquisition of two players: La Nacional and I-Transfer. The company also saw an upswing in transactions as it continues to take an omnichannel approach.

Euronet’s Money Transfer division, meanwhile, had a strong enough Q3 to help deliver Euronet’s first billion-dollar quarter. Ria and Xe saw 9% YoY revenue growth and an increase in profits, driven by an increase in international-originated transfers – particularly from non-US Americas markets.

For Wise, this quarter saw continued revenue growth but a surge in profitability, as the company sees gains from both lower FX costs and an increase in interest income from account balances. Meanwhile, Remitly continued to see strong growth, driven by increases in both active customers and send volumes.

How do pricing strategies vary between different money transfers players?

Money transfers ARPU for Q3 2023

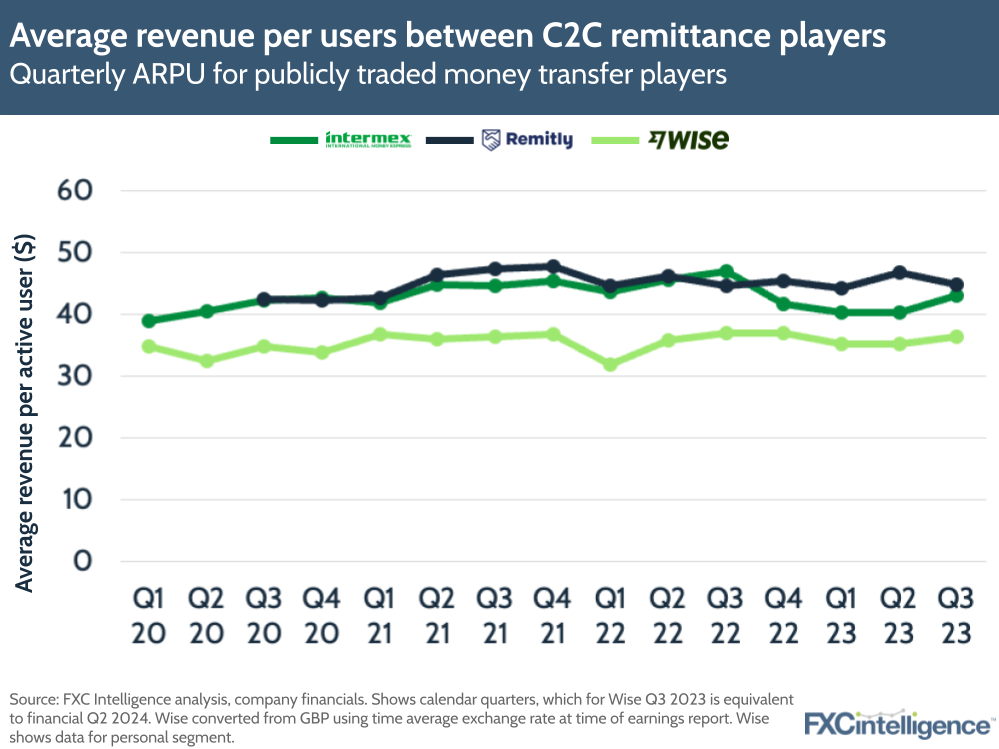

Among the money transfers companies who report sufficient data to calculate average revenue per user (ARPU) – Intermex, Remitly and Wise – trends have been fairly consistent, with Wise continuing to be at a lower level.

However, this quarter has seen the gap between Remitly and Intermex’s ARPU narrow significantly to once again be around the same amount, after several quarters where Remitly was ahead. In Q3 2023, digital remittances player Remitly saw its ARPU at around $1.60 more than Intermex, compared to a $6.60 gap in Q2.

However, in terms of YoY growth in ARPU, Remitly was the only one of the three to see an increase. While the company saw its ARPU grow by 0.5%, Intermex and Wise saw theirs contract by 8% and 2% respectively.

However, send volume per customer, a metric that is only available for Wise and Remily, saw a decline for both companies, indicating that customers in general are sending lower amounts amid ongoing rises in costs of living. In Q3 2023, Remitly saw volume per customer reduce by 4% to $1,889, while Wise saw it reduce by 18% to $3,958.

Changing transaction rates

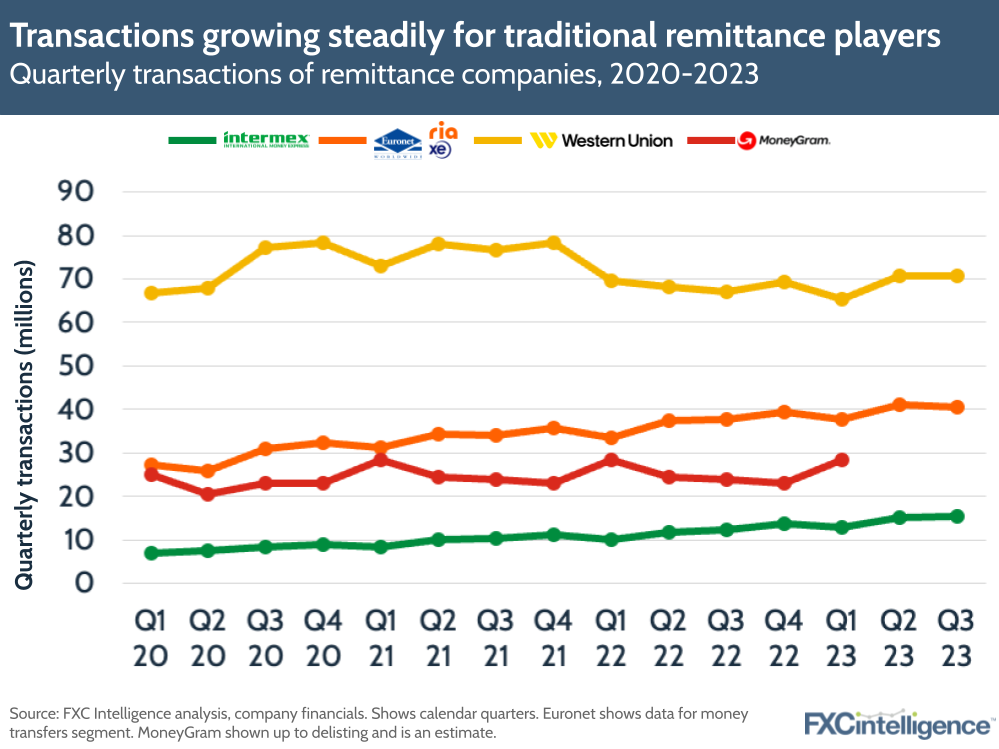

By contrast, transaction rates is a metric only reported by the more traditional remittance players: Western Union, Euronet and Intermex. Here transactions have been fairly flat compared to Q2 2023, although all three players have seen an increase year-on-year. While Western Union saw 6% YoY growth in transactions in Q3, Ria and Xe saw an 8% rise. However, Intermex had the strongest increase, at 26%.

However, looking at the trend lines since Q1 2020 does suggest that Western Union will ultimately lose its current transaction lead without a significant change in momentum. Linear trend projections based on each company’s results between Q1 2020 and Q3 2023 indicate that Euronet’s Money Transfer division is on course to process more transactions than Western Union by the start of 2029, while at current rates Intermex is set to outpace Western Union on transactions by mid-2038.

Western Union is currently working on a reversal strategy to prevent such a scenario, but we are yet to see consistent results that show this is paying off.

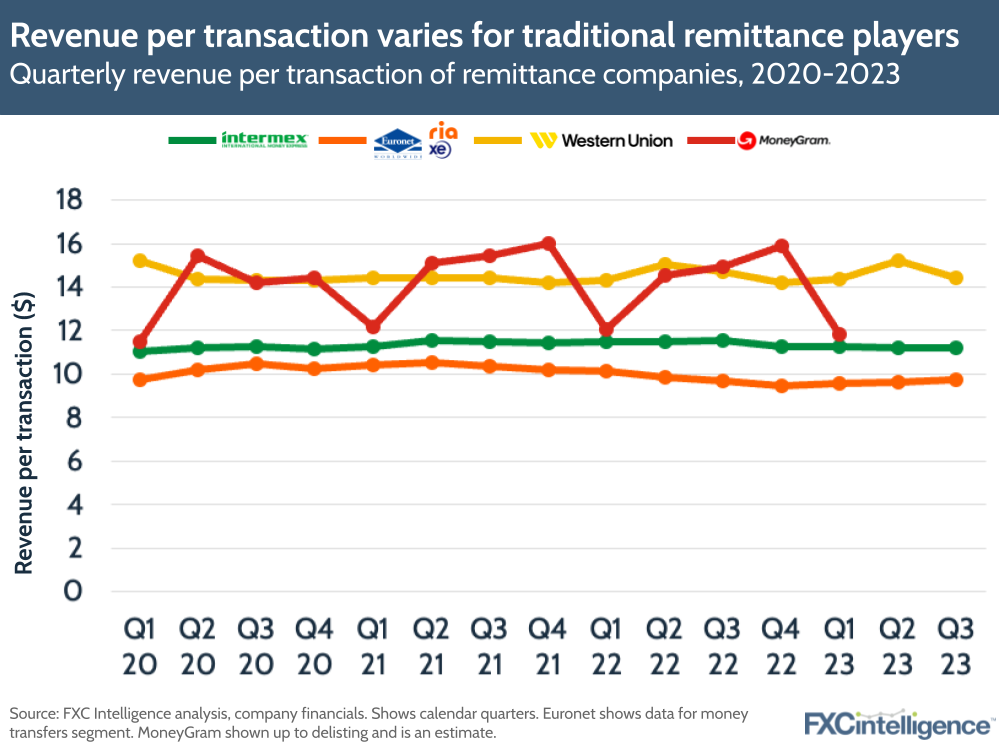

Average revenue per transaction, however, shows a different story. Here the three companies have generally seen more consistently stable numbers, although Q3 2023 is lower for Western Union and Intermex by 2% and 3% respectively. By contrast, Ria and Xe saw revenue per transaction increase 1% YoY.

Here, Western Union remains the leader, at $14.43 revenue per transaction, followed by Intermex at $11.20 and Euronet Money Transfer at $9.75.

Digital remittances: A focus for all?

Digital remittances has been a significant trend for some time in the space, and that is unlikely to change any time soon, as the industry slowly moves towards an environment where digital first becomes the primary sending type in all markets, and – ultimately – becomes the vast majority or only form of remittances. While that is a long way off, all players recognise that this is a generational shift that will not reverse, and so have been working to gain or retain share in this steadily growing market.

For digital-only players Wise and Remitly, this naturally aligns with the companies’ general strategies for money transfers. However, for Western Union, Intermex and Ria, as well as the recently privatised MoneyGram, this has required a continuously evolving digital strategy as the companies look to retain and grow their presence in this market, both from a revenue and mindshare perspective.

Despite returning to digital growth for the first time in several years this quarter, Western Union saw its digital business meaningfully overtaken by both Wise and Remitly – a situation that has not occurred since the start of 2020.

This suggests that the company’s ongoing digital plans still have some way to go before they can start to gain momentum in the space, and that while they falter, their digital-native competitors are gaining steam.

Intermex and Euronet Money Transfers both do not put out detailed enough information to provide a direct digital revenue comparison on the chart above, however they have reported some information on their progress in the space that does provide insights.

Euronet reported a 20% YoY increase in direct-to-consumer digital transactions, while online-only Xe saw an 18% increase in transactions.

Intermex, meanwhile, saw a significant rise in digital transactions, which increased 63% YoY in the quarter. Transactions that are either digitally sent or received also now account for 33% of Intermex’s transactions, up from 28% a year ago.

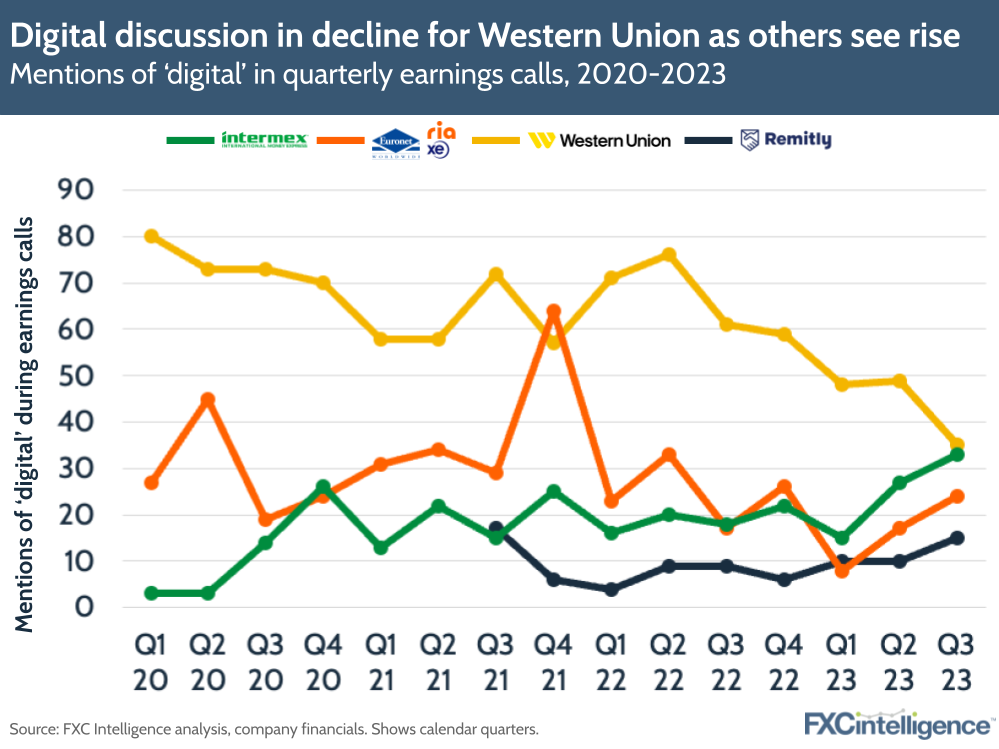

This improvement is reflected in the uptick in mentions of the word ‘digital’ in Intermex’s latest earnings call, with the company making more mentions of the term than Euronet in the latest quarter and almost matching Western Union.

Here, WU continues its downward trend of mentions, suggesting that this continues to be a lower priority for discussion compared to other business areas, while Euronet has seen an increase after a dip in mentions.

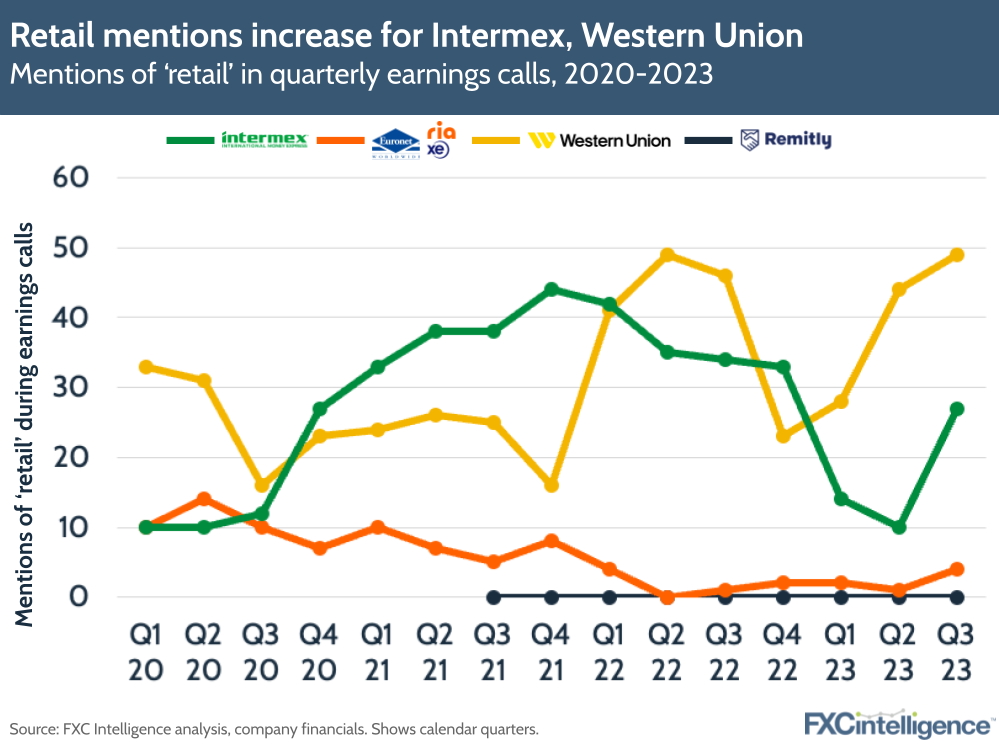

Retail, meanwhile, has also seen an upswing in mentions from both Intermex and Western Union, indicating that this space is not being neglected despite reduced importance in the longer term.

Mentions by the non-retail Remitly unsurprisingly continue to be non-existent, while Euronet did see a slight increase.

The ongoing importance of both retail and digital reflects a continued recognition of a need for a hybrid approach, although the term ‘omnichannel’ has fallen out of use by many players, except for Intermex, where the company made the most mentions of the word in the past three years.

How positive are money transfers players?

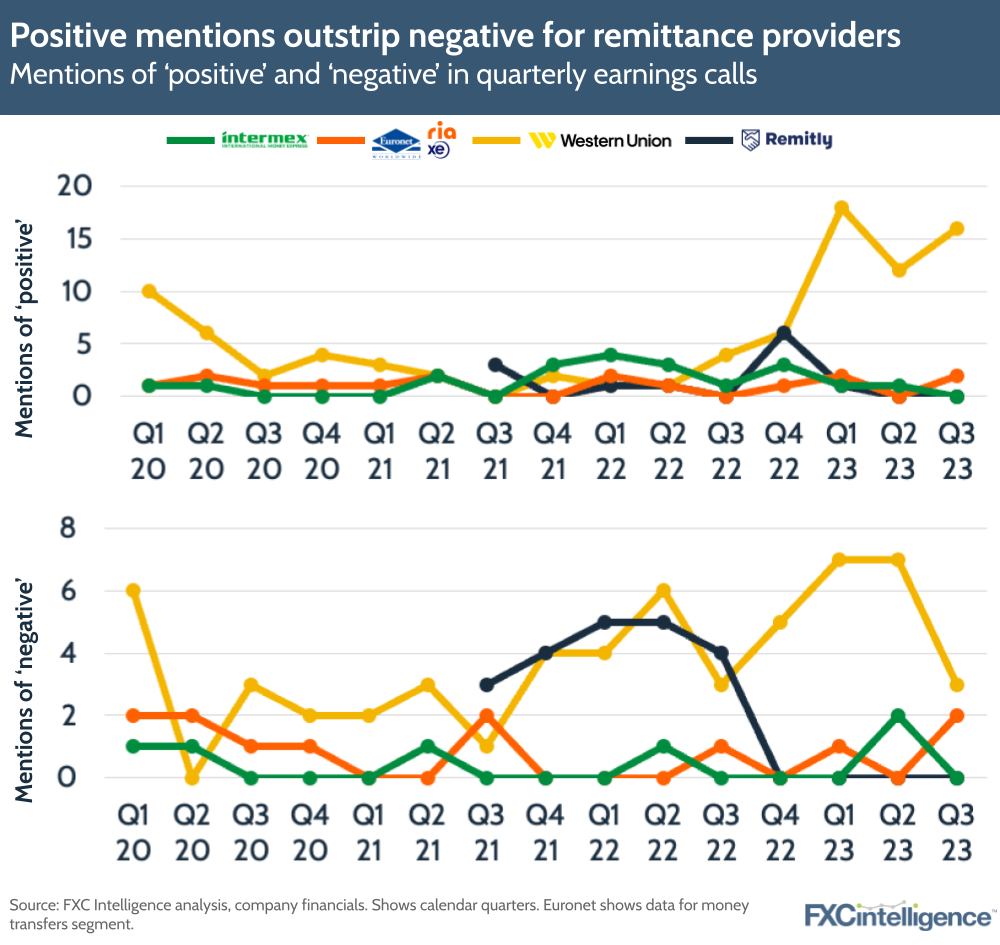

When looking at keyword mention rates in company earnings calls for other terms, we also get a sense of a changing mood for some players.

Despite continuing to be in a fairly tough environment, Western Union is showing signs of beginning to turn a corner, and uses of the terms ‘positive’ and ‘negative’ echo this. The company used the word ‘positive’ the second-most times of any quarter since Q1 2020, while its uses of ‘negative’ dropped significantly. We also saw a similar uptick in use of the words ‘pleased’ and ‘opportunity’.

Use of both ‘positive’ and ‘negative’ was much lower this quarter among Intermex, Remitly and Euronet, in line with previous quarters. However, all three did increase their use of the term ‘opportunity’.

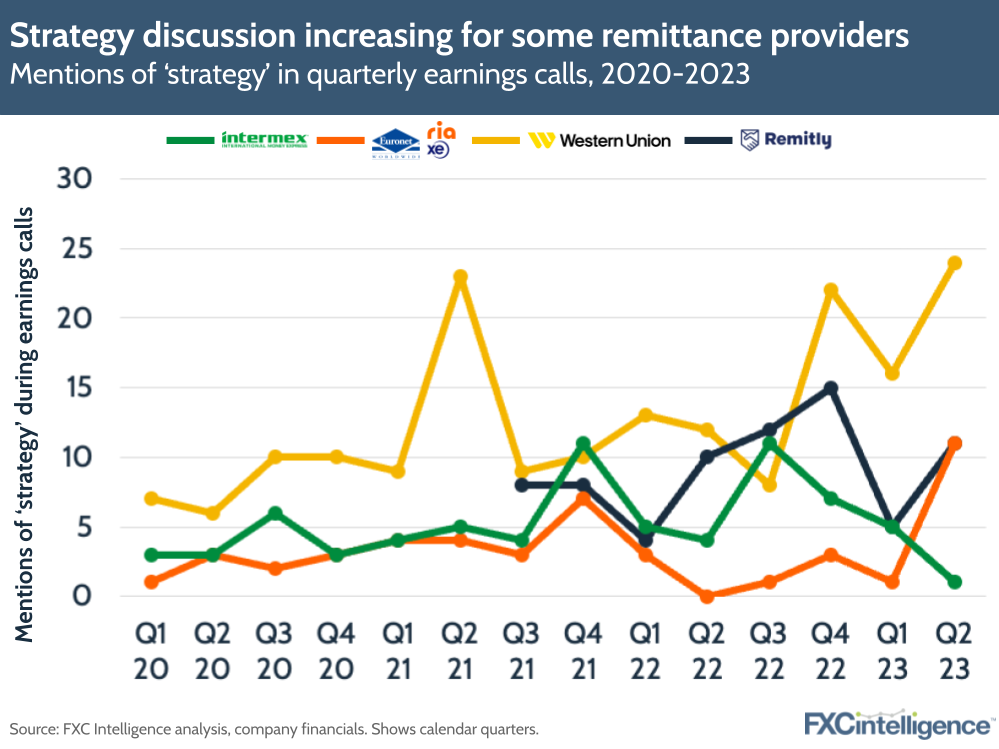

For most players, however, discussion of the term ‘strategy’ was up this quarter, with Remitly, Western Union and Euronet all increasing their use of the word, with the latter two using it more than they have in any other quarter since Q1 2020.

Intermex, however, did see decline its use of the word, continuing a trend we have seen over the past few quarters.

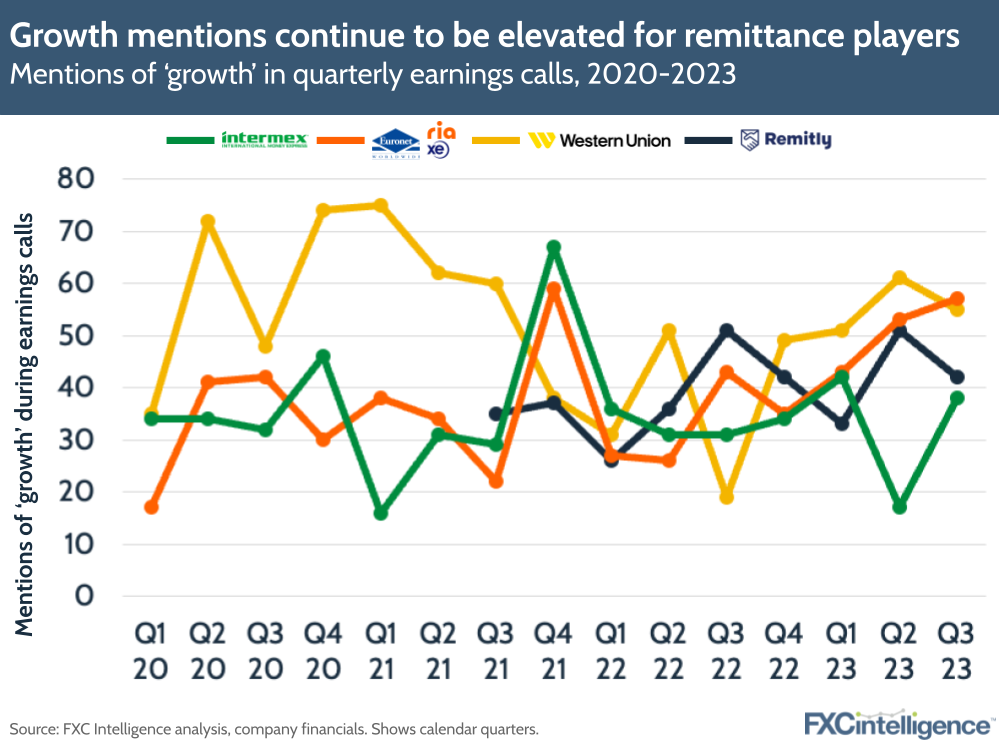

Meanwhile, discussion of growth was generally elevated this quarter, likely a reflection of the generally good performances reported by the companies covered in this report. Euronet passed Western Union on mentions for the first time, while Intermex rebounded from a drop in mentions last quarter. Western Union and Remitly were below last quarter’s levels, although their mentions remained high.

By contrast, mentions of ‘partners’ and ‘partnerships’ continue to be common across all players, with all four seeing an increase compared to Q2 2023.

The remittance industry is set to see challenges for some time to come, however this was a strong quarter for many in the space, with promising signs for FY 2023.

Notably, enthusiasm for the potential of artificial intelligence continues to be absent from the remittances space, despite the technology drawing considerable attention in other parts of the cross-border payments industry. While Remitly made a single mention of AI, it had no mentions at all among Western Union, Euronet and Intermex.