In our latest report in our Post-Earnings Call Series, Western Union CFO Raj Agrawal discusses the company’s future plans and Q3 2021 earnings.

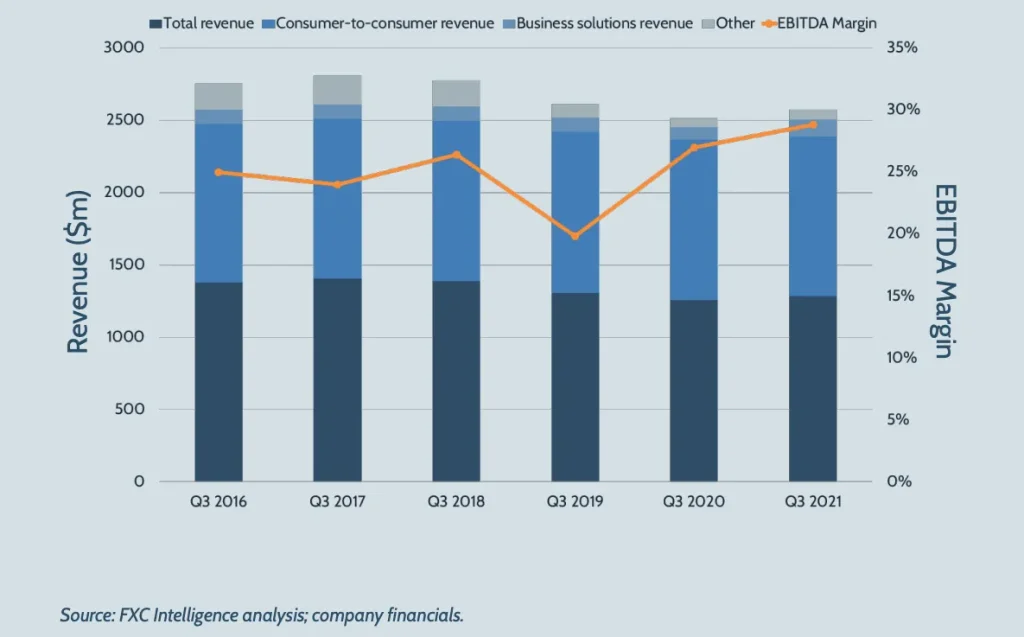

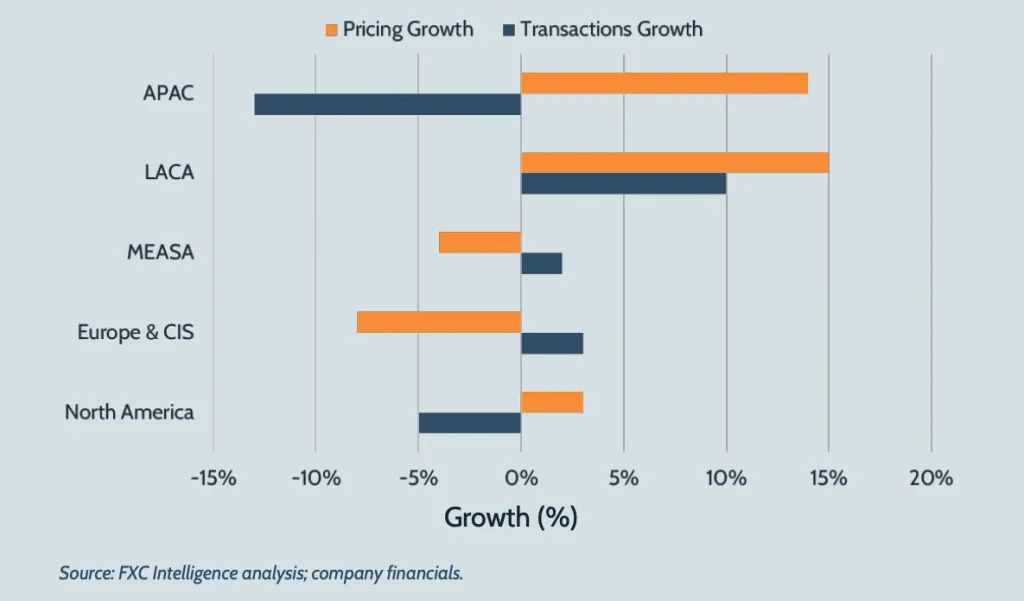

Western Union had muted success in Q3 2021, reporting 2% overall revenue growth year-on-year, with C2C revenues flat and a 1% decline in transactions. However, the company did see a 4% increase in C2C principal and a 15% overall increase in its digital business.

Against this mixed backdrop, Western Union also launched a number of key initiatives beyond its core remittance offering, aimed at providing additional financial services to its customers, namely WU Plus and WU Shop.

Given the landscape the company finds itself in, how does it see these products contributing to its overall strategy, and does it see a threat from cryptocurrency? Daniel Webber spoke to Western Union CFO Raj Agrawal to find out.

Headwinds to revenue growth

Daniel Webber: Let’s start on the top line. I know there have been some headwinds, particularly on the retail side, which isn’t unique to Western Union, as well as growth in some parts of the business. What’s driven that?

Raj Agrawal:

For the third quarter, I would say that we had decent revenue growth. Clearly it was a little bit lower than we had expected given the continued soft economic data and that’s really what I would attribute the retail softness to.

As you may have seen over the last few months, the GDP growth estimates, the labor force participation, even the foreign border employment levels here in the US are well below 2019 levels. The consumer spending levels have all been coming down, so they’re not ticking upward as much as we had expected for the second half of the year, which is the reason why the retail business has not been performing as well.

That economic data and those data points are more reflective of the pressure on our retail consumers. Less so in other parts of the business, but more reflective of the impact to our retail consumers.

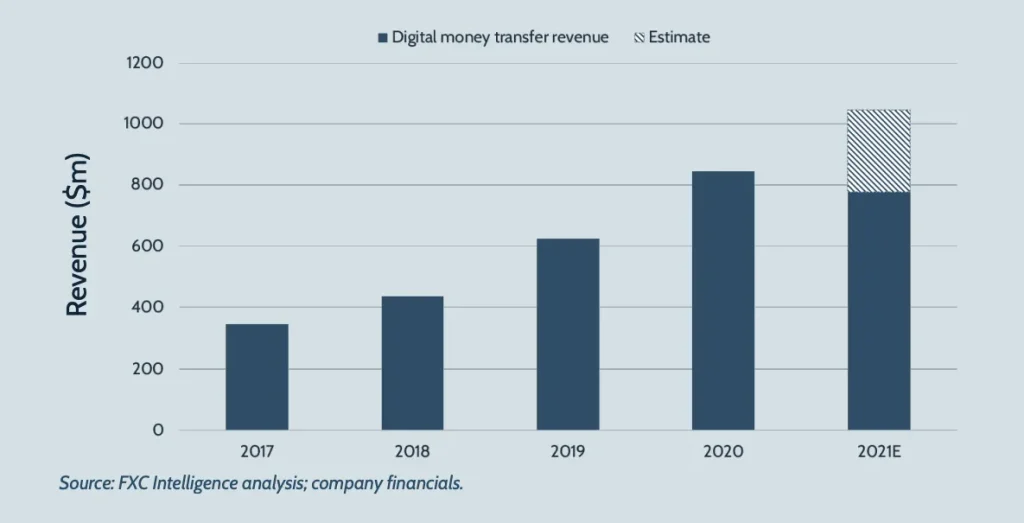

With all of that, our digital business continues to hit the objectives. We had revenue that was right on top of where we were in the second quarter, $266m of digital revenue. We’re on track to exceed a billion dollars of digital revenue, which is really nice to have because it gives us a good platform for growth in the future.

Cross-border principal growth has also been doing extremely well. We believe that we’re continuing to gain share overall, because we are up 19% through the first nine months of the year or up 17% constant currency.

Then our B2B business did well this quarter as well. A lot of it is related to continued improvement in the global trade environment and then rollover impacts from last year’s declines in the B2B business, but we’re happy that it’s getting some traction.

With all that, we were still able to expand margins. Margin performance was very solid. We’re producing significant cashflow, almost $700m a year to date, through the third quarter. We are paying a very healthy dividend; it’ll be almost $400m this year.

We’re using our excess cash to buy back stock. At the same time, we’re looking for the right kind of M&A opportunities. It doesn’t necessarily have to be a revenue-generating acquisition. It could be a capability or a technology or some other sort of thing that can help to advance our payment strategy.

Figure 1

Western Union’s Revenue and EBITDA Margin

Growth in account-to-account remittances

Daniel Webber: Let’s talk about account-to-account, which you identified in the earnings call as your fastest growing segment. What’s the evolution of that now, and where does that go next, particularly given how competitive an area it is?

Raj Agrawal:

With respect to the account-to-account business, if you think about our digital business, which is over a billion dollars in size this year, we have about $200m of revenue on an annualized basis going from an account to an account, so purely digital transaction and it is the fastest growing part of our digital business. I think that compares very favorably to the other players in the market that are digital-owned.

Daniel Webber: Do you have your year-on-year growth for that?

Raj Agrawal:

Although we’re not going after the same customer set, it’s growing faster than Wise’s numbers were in the most recent quarter. I think they may have said something like mid-twenties type of growth, but we’re above that for our account-to-account business. We’re not at the same size as they are, but it just gives you a sense that we’re growing really well in the account-to-account segment.

The other thing I would say is that the yield on our account-to-account business is not going to be where the Wise yield is, because Wise is sending a higher principal amount for their customers, maybe it’s a few thousand dollars. Our principal in our account-to-account business is higher than our retail principal or our traditional principal, but it’s not several thousand dollars. It’s probably double the normal principal amount, $600, $700, that kind of range, but our yield is lower than the rest of our business and it’s more comparable to the other account-to-account-only businesses in the market. Our yield is probably a little bit north of 1% right now for the account-to-account business and I think Wise may have quoted something like 70 basis points.

Figure 2

Western Union’s digital business

Facebook’s Novi and cryptocurrency in remittances

Daniel Webber: Let’s talk about the launch of Facebook’s Novi. What’s your view on that?

Raj Agrawal:

First of all, I think the market has overreacted to that announcement and it’s the broader payment space that was impacted by that announcement, not just Western Union, it’s digital-only players. Us, Moneygram, anybody you want to talk about, they were all impacted with that announcement because of the implications that it has.

I do think it was an overreaction, because when you look at what our customers want to do, and this is Western Union only, if a customer has a need to move $200 or $300 from point A to point B, the number one thing on their mind is to get the money there as fast as possible with as much efficiency as possible, low cost, transparent. They want their money in the hands of their loved ones.

When you start to add in the complexity of maybe opening, creating a wallet, having another wallet on the receiving side, converting from a digital currency of some kind to a fiat currency, and then having to do it again on the receiving side, that adds a lot of complexity to an otherwise very simple transaction that somebody’s looking for.

They want the money in their hands. They want someone to be able to pay for their medical expenses, education, whatever else there might be. Today, from what I understand, to get it paid out to an account on the receiving side, it takes an extra day. That’s what I understand, based on the testing we’ve done and right now, or at least as of last week, it was not available to pay out to a retail location. It puts in a lot of hurdles for the kind of transaction that people are really looking for in our business.

The reason I talked about the yields on our account-to-account business is for a $200 or $300 transaction, maybe somebody will end up paying $2 or $3 or $4 depending on where they’re sending money to. That’s not a reason enough for them to think about adding all this complexity to doing a money transfer to another country.

So we think it’s premature. Facebook has tried for many years to be in this space, to try to do something there. People are just not looking to go into their social media channel to go do a money transfer in the time that is being done in our business. That’s what I really believe and we’ll let time play out and we’ll let them do their testing and see what happens there.

It’s good that people are trying to produce new technology and new ways of doing things. We’re very open to new ways of evaluating our business, but we don’t think that is the replacement for money remittances, the way they’re being done today. If somebody really wants to use an account-to-account transfer or digital-to-digital, we have that, and it’s a relatively low cost.

You know that El Salvador has allowed Bitcoin to be legal tender now. So you might ask what’s happening to your business as a result of that being available for your legal payout and being able to move money there. The answer is that nothing has happened.

I think that people need to just step back and understand what this is. I’m surprised that some of the other money remitters are not coming out stronger on this point.

If you try to build in the volatility that may come with a cryptocurrency, you will not likely see people using the real cryptocurrency for money transfer purposes because when you’re sending $300, you cannot have the currency moved by 10% or 20% in a day, which is what happens as we’ve seen in the last two days with Bitcoin.

Now sometimes it could go in your favor, but it could also go against you at some point too. So the volatility is not something consumers that are sending hard-earned money to their loved ones are going to want to take on.

Western Union’s real-time payments offerings

Daniel Webber: Let’s talk about real-time payments, because you have built up a great network of being able to move money virtually instantly around the world, and a lot of people are trying to build something that possibly you already have.

Raj Agrawal:

First of all on Visa, we use that as a supplemental channel for our customers to be able to deliver money around the world to more than a hundred countries onto a debit card using the Visa rails. MasterCard Send is a similar kind of thing that we have. We’re using that as a supplemental add-on to fill in the gaps in our account payout network.

I would say on our own account payout initiatives, we are not at end of the job yet. We certainly have a lot of broad geographic coverage, so over a hundred countries on a real-time basis, but we want to add more use cases more efficiency; more principal flexibility through our system. We want to be able to send any amount, any time, for anybody, anywhere in the world.

We’re not quite checking the box on all those components. We can do it for our main use cases, which is somebody has a need to send a few hundred dollars to an account or $1,000 or $2,000. That’s easy to do through our network to most countries on a real-time basis, but we want to do it for a broader array of use cases, which is the direction we’re going and that’s not going to take too much time, but it’s going to take us some more time to continue to expand.

The way I would describe it is that we want to improve the quality of our network. We have the distribution network, but we want to improve the quality of it now, which also includes lowering the cost of distribution, making it easier, making it even faster, allowing other kinds of customers to use our rails, those sorts of things.

Ultimately we would like to make it as simple for you to send $1,500 as it is to send $25,000. Make it as flexible as possible, make it real-time for all of those use cases, as much as possible and make it very broad in nature in terms of geographic coverage. We went very fast on geographic coverage. We have a great account network and real-time network, but we want to keep adding to that quality component as much as we can.

Figure 3

C2C pricing and transactions dynamics by geography

WU Plus: Western Union’s multicurrency bank account

Daniel Webber: Which of the new initiatives do want to start with first? There’s actually a number of them, so I’m going to let you pick.

Raj Agrawal:

A couple of them are somewhat connected, so lets start with the consumer financial services test that we’re doing in the fourth quarter. We’ll be offering to consumers in Germany and Romania, a multicurrency bank account, a debit card that’s connected to that bank account and a seamless money transfer experience.

Why is it called WU Plus? Because it’s giving you everything we do already as a company, plus the digital bank account, the debit card as a starting point. We think it’s quite exciting and we’re going to be launching it very soon in Germany and Romania.

It’s Germany and Romania, because we wanted to have one sending market and one receiving market. It’s really important to find out the dynamics between a sender and receiver, as we create this ecosystem opportunity, because as I described last time, we want customers that are sitting in Germany and Romania to be able to interact with each other, to move money between each other and to buy other things maybe from WU Shop, which I’ll talk about in a second, but move money seamlessly between each other.

If they want to get value out, they can move it into a retail location to get cash out, or they can buy something with their money, a lot of different use cases there. Maybe the recipient in Romania would like to set up automatic withdrawals for the sender that the sender allows them to do.

Those are the kinds of things that we will eventually add functionality around. Right now, it’s really creating the opportunity for people to download this WU Plus mobile app, which will be available to those customers in those markets and to start experiencing what we have to offer on a seamless basis. We’re excited about it.

Daniel Webber: Germany to Romania is one of around 20,000 corridors that you have. If this works, how do you communicate that and roll it out quickly to other corridors?

Raj Agrawal:

Let’s assume that, by the end of the first quarter, we have some data that proves that it works really well. We’re going to make a big deal of it externally, and we will go fast and heavy at doing more expansion. The beauty of what we’re doing right now is that it’s leveraging our Western Union traditional bank license in Austria that gives us access to the entire European Union.

We would have some localization to do in each market. Have you ever watched, many years ago, probably dating me now, The Bionic Man? We have the technology, we have the capability, we just have to go do it.

We could go very fast and heavy on the European Union, if we find that this is successful, which we all believe it will be. Then it becomes a question of time to market. Each market has some localization that’ll be required, some local language localization, some compliance rules, other things that have to be done, but it’s doable. Then we’ll certainly expand and think about other key markets like the US, at some point in time. If we can show some really positive results here, I think the market would be very supportive of us doubling down or tripling down.

We have the sale of our B2B business coming up soon. Our issue has never really been cash.

WU Shop: Gifting beyond remittances

Daniel Webber: You’ve also announced WU Shop. Tell us more about that and how it intersects with WU Plus.

Raj Agrawal:

WU Shop is, right now, live in Germany, Austria, the US, Canada, France and Romania. If you’re a My WU customer, you now have access to go shop at up to 12,000 online retailers in more than 60 countries and 12 different languages, to go send goods and services to your loved ones in that market.

It’s a gifting use case. Part of our remittance business is related to gifting. People are sending the gift of money in our business right now. This gives them another option to go shop at an online retailer to send money to your loved one in that market.

It could be a gifting use case. It could be for specific need. It could be services of some kind that you might be buying online. Again, this is another engagement tool to drive deeper engagement with our current customers and create more stickiness with customers; give them another reason to stay within our ecosystem.

Daniel Webber: We’ll all be waiting over the next quarter or two to see how it plays out. I guess what we don’t know yet is what proportion of people need multiple things and there’s a subset of people that just want to send money. So it will be interesting to see what the mix is.

Raj Agrawal:

We want to make it easy for you regardless of your needs, so you can download this WU Plus app and be just a traditional money transfer user or you can start some banking with your recipient and you can engage in a different way with Western Union.

The whole beauty of this is that we don’t want to alienate the customer who just wants to move money from point A to point B. We not only want to provide that service, we want to make it a nicer, more modern app, which is coming to market and in WU Plus, plus we also want to make it easier to do other things with Western Union.

It’s a cashback rewards program you get for WU Shop, if you shop online and you buy something going through the Western Union channels, you will start to earn cashback and build up money ultimately to keep using within the WU ecosystem.

Western Union has not ever done this before, but we think we’re uniquely positioned to go target the migrant customer that has a need for these products and services because customers have told us in our consumer surveys. They trust Western Union with their money, so they would love to use us for other kinds of things that are financially oriented, which is what we’re about to do.

Daniel Webber: Raj, a pleasure as ever. Thank you and happy holidays.

Raj Agrawal:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.