Wise’s latest earnings, H1 2024, show a company that has seen a sharp increase in profit, amid continued growth across multiple business areas. We caught up with CFO Matt Briers and Roisin Levine, Head of UK and Europe Partnerships, to find out how the company is building on its strategy.

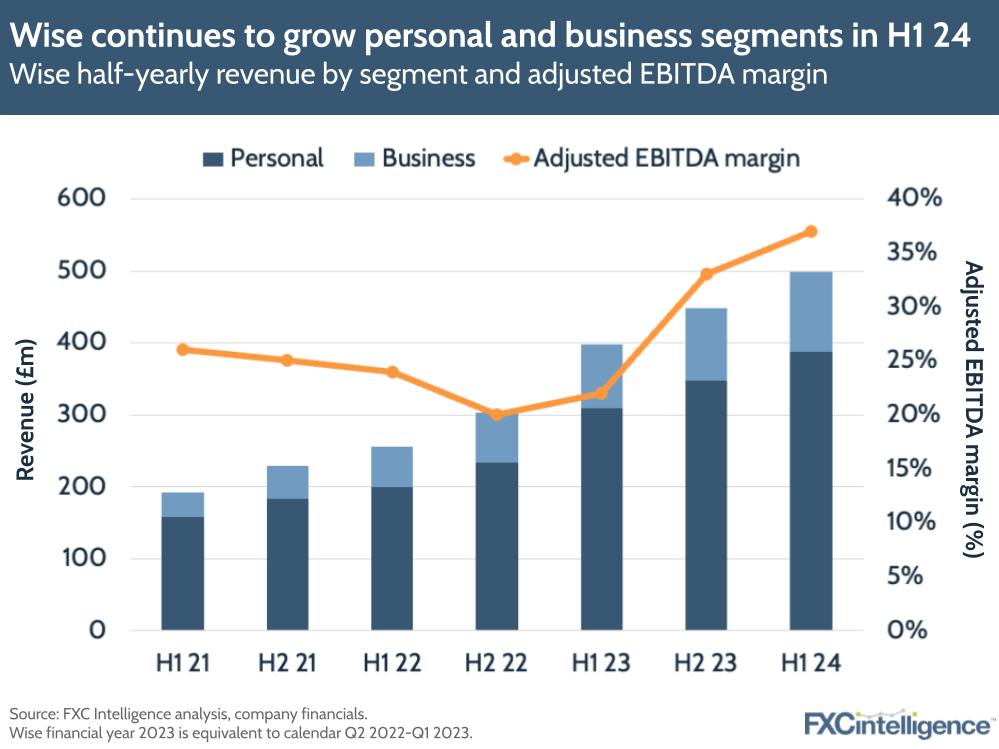

Wise has once again reported strong results in its financial H1 2024, equivalent to calendar Q2 and Q3 2023, with a 25% YoY rise in revenue for the period to £498.2m. Notably, the company has seen a surge in earnings, with adjusted EBITDA growing 163% YoY to £241.1m for the half year. This has resulted in an adjusted EBITDA margin of 36.7% in H1, up from 22% in H1 2023.

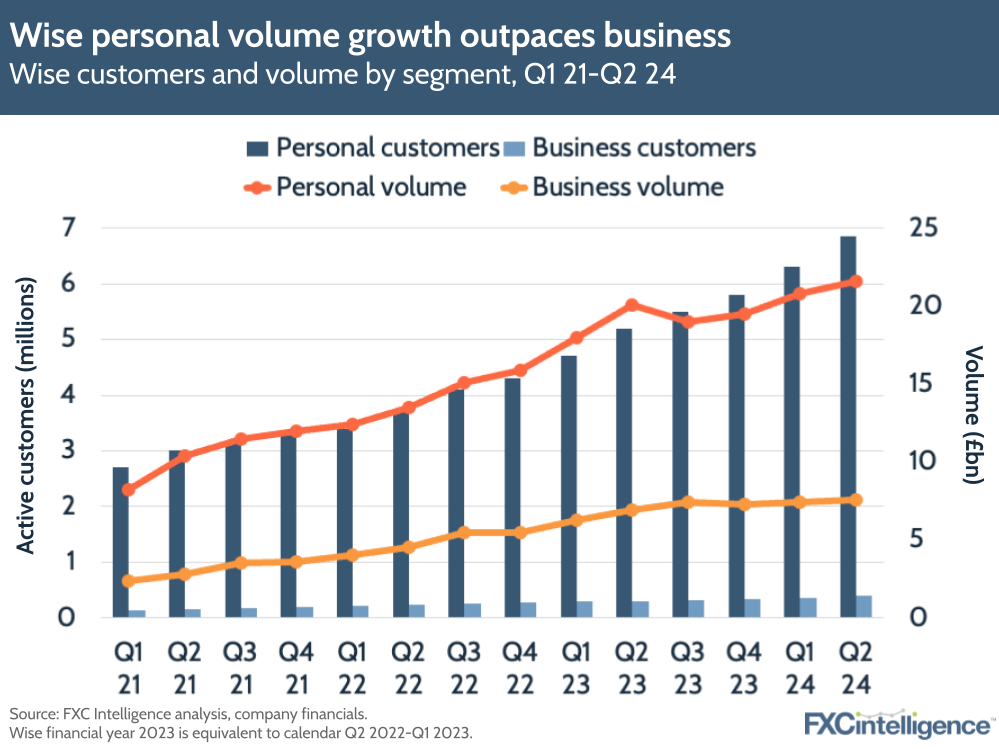

Active customers were key to this increase, growing 32% YoY overall in financial Q2 2024 (32% for personal and 28% for business), primarily driven by word of mouth. Meanwhile, send volume increased by 8% in Q2, or 12% in H1 2024. However, this does translate into a reduction in volume per customer, which shrank by 19% YoY for personal customers and by 14% for business customers in Q2 2024.

Cross-border volume, however, saw a 12% increase YoY for H1 2024, while cross-border transactions increased by 30% to $384m for the period. Meanwhile, Wise Card spending increased 90% YoY and multicurrency account balances have grown 33% to £12.3bn. The company is also seeing increasingly broad use of its Wise Account product, with 44% of personal customers and 58% of business customers using multiple account features as of Q2 2024.

Wise also provided an update on the pausing of new business customers in the UK and Europe. While it has resumed onboarding in the UK, European onboarding remains paused, with the company acknowledging that it did not fully predict demand and citing the need to maintain quality.

On the Platform side, the company has added nine new partners in the last quarter, including HSBC subsidiary Saudi Awwal Bank. It also launched its Correspondent Services product, which is based on a collaboration with Swift.

The company continues to build on its speed goals, delivering 60% of payments in Q2 2024 instantly, while 81% arrived within an hour and 94% within 24 hours. This was in part aided by the completion of an integration with Australian domestic payment system New Payments Platform.

A combination of lower FX costs and higher interest income from increased account balances has resulted in gross profit increasing by 86% YoY in H1 2024 to £489m, while the company saw a gross profit margin of 75%. The company is hoping in the long run to return some interest income to customers, but is currently limited here due to its banking status. It may also consider lowering prices to reflect lower FX costs, but is waiting to determine to what extent these changes are temporary. While it doesn’t expect its gross profit margin to remain as high throughout the remainder of FY24, Wise does expect its FY24 gross profit margin to be above that of FY23.

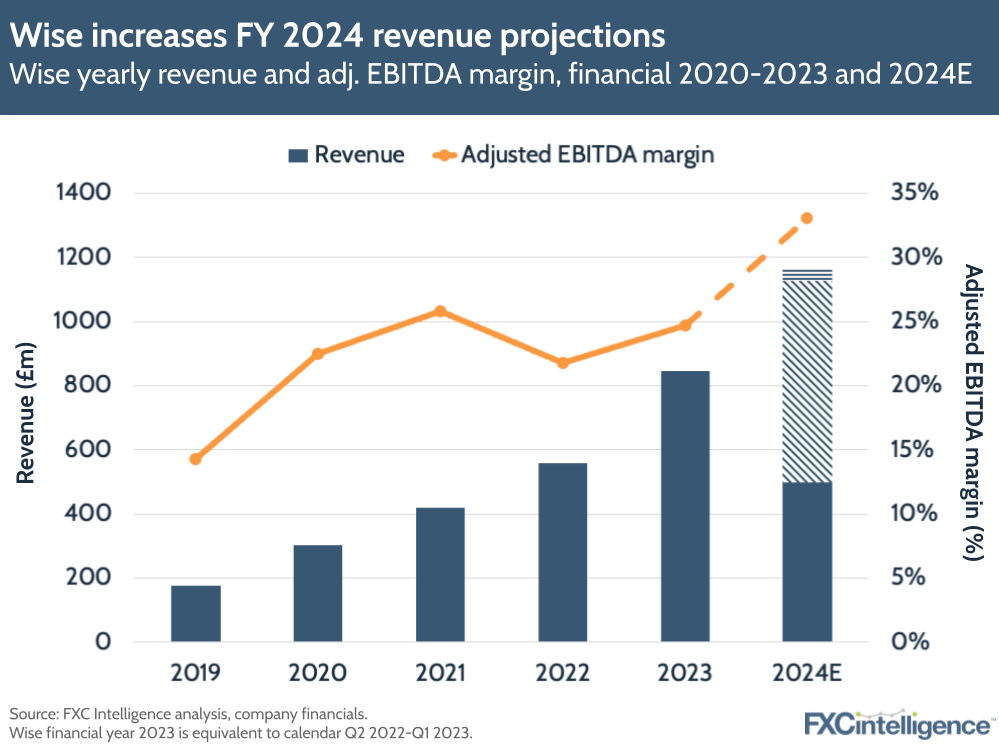

Nevertheless, the results have prompted Wise to increase its FY24 revenue projections to 33-38% (a five percentage point increase), and while it still expects medium-term adjusted EBITDA at around or above 20%, it anticipates this being “considerably higher”.

I caught up with CFO Matt Briers and Head of UK and Europe Partnerships Roisin Levine to find out more about the company’s ongoing strategy.

Drivers of Wise’s growth rates and profitability

Daniel Webber:

You’re one of the few players outperforming on both growth and profitability. What’s driving both of those?

Matt Briers:

What you’re seeing with us that’s a little bit different is it’s underpinned by customers coming to us to maybe move their money around the world, but the drivers of our growth start with customer growth. As you can see, 30% more active customers, and those are customers that have done a cross-border transaction.

But actually there was a page in the deck that said it’s what they’re doing that’s really giving us a diverse and pretty robust growth rate. Yes, they’re moving money. We see VPC [volume per customer] is down, but volume growth: they’re still coming and still moving a lot of volume.

They have a card where they can spend domestically or internationally, and the spend on the cards is growing 90%. That’s a very different business to most money transfer companies, having accounts and cards. They’re also holding balances with us – that’s growing 30%. Then if you included the assets product – our assets product we’ve got in the UK, we’ve got a similar but different product in the US and we’re scaling this around other countries – it’s a really diverse set of things that customers are doing on Wise now. We think about this Wise Account rather than just TransferWise.

At the scale we’re at, that’s really important now, because we see customers come to us, not just to move money, send money home, move money from A to B. They want to receive money, they want to hold money, they want to spend money when they go overseas.

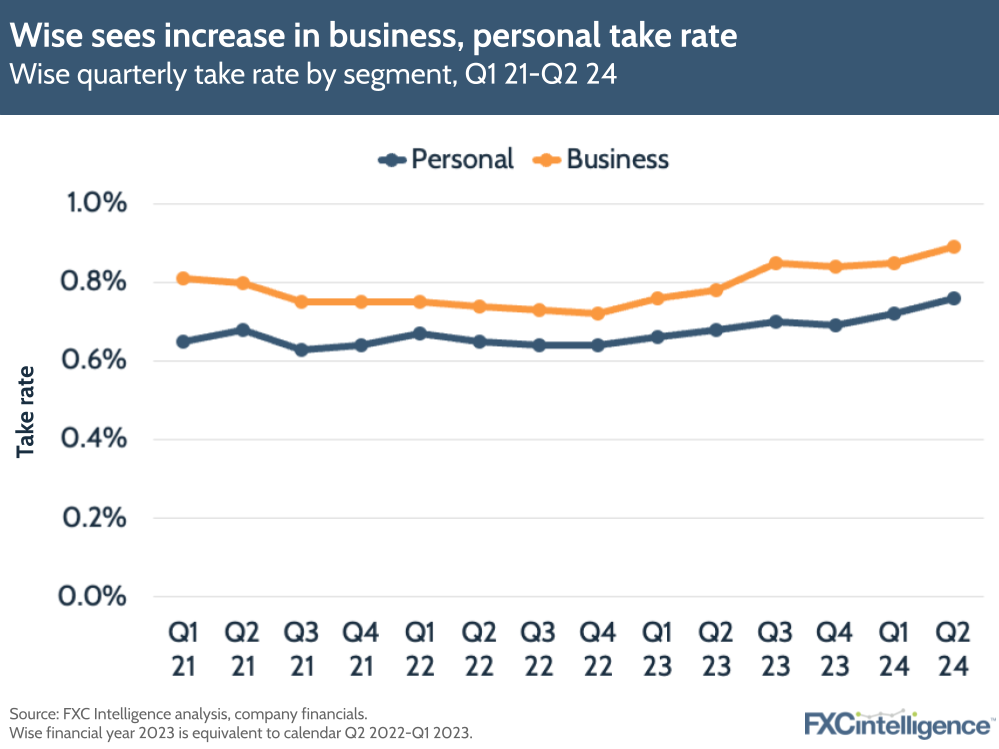

Fundamentally it’s customer growth, but if you look at what these customers are doing, that very much drives the growth. Revenue growth is at 25% and income growth is at 58% because of the interest we’re seeing on the balances, but even at a very moderate interest rate, we’re seeing very healthy top line growth.

There’s plenty of companies that are still growing okay, but that’s turned into a very high profit margin for the quarter at 37%. We target 20, but that’s with 1% [interest income]. You can see that that 37% is a function of a number of things. One is that, underpinning the business we’ve done, we’ve got a very healthy underlying margin. If we just had 1% net interest rate, we’d have a 25% EBITDA margin, which is well above what we target.

That’s awesome, we’re growing a very strong business with all these features without becoming dependent on interest income really at all. We then have a margin benefit from the 20% that we’re going to withhold and hold to EBITDA, but actually we still couldn’t return back to customers at the rate that we wanted to. We still only returned £50m of the interest to customers, which means that we actually had a very high margin.

It’s been very hard for us to pay interest in many markets. But you can see, structurally, we’re growing really healthily and compounding. We’ve got an EBITDA margin that’s probably nearer 30% on an underlying basis right now, with a profit margin underneath that’s well above 20%, and then this 4%+ benefit because of the interest rate environment.

As people start to look at interest rates, higher for longer, we’re not building a business dependent on it, but you can start to see that this will contribute materially to our profits for some time, to cashflow generation and the ability to create value for shareholders.

The evolution of Wise’s business product

Daniel Webber:

Your business product was originally developed from your consumer offering. How different is your business product suite and the behaviour of the business customer becoming, compared to the consumer product?

Matt Briers:

We tried to fork the business product as late as possible in the experience. It runs on the same infrastructure, but fundamentally for a business you need multiple users, different user profiles.

The basics is really running this workflow on the software. You also need to be able to integrate it into your accounting software. There’s many different accounting softwares around the world. These are the table stakes basics of getting that right.

There’s other businesses out there that have built good AP and AR businesses that do cross-border backend somehow, and ideally we’d partner with them. Roisin’s probably closed a bunch of these.

There are some that build this software as well for CFOs like me rather than CFOs of small to medium-sized businesses who are also the owner, the founder, etc. So, there’s a crossover where we can build software for small businesses, definitely micro businesses, but as soon as they start to get medium and larger, we start to compete against people who are building really good software.

In that situation, that’s the crossover where we may end up just partnering with those businesses and providing the rails, and then they can build the software on top of Wise.

Profitability in Wise’s Platform business

Daniel Webber:

How are you thinking about your Platform business from a margin and profitability perspective?

Matt Briers:

It will vary by partner, but we do different things for different partners. Sometimes we do pretty much everything for the partner, maybe apart from the marketing. Obviously, sometimes the partner does more of the onboarding, some of the servicing and then sometimes we have just a part of the stack. So it depends. Then we also have different terms negotiated with different partners.

But fundamentally we look for a contribution profit margin on each of the deals that we do. We ask the partner where they’re offering our product directly just to make sure they’re transparent in how they price. If they’re going to put a markup in there, we’d ask for them to do this. Increasingly we are not co-branded. Roisin, what would you say? By and large, we started very much Powered by Wise, would you say that’s transitioned now mainly?

Roisin Levine:

Yes, we probably see more of the newer partners that may not be so fully powered by Wise and the brand, it’d be quite so evident. That comes with what we’re now offering with the Correspondent Services solution, where we’re more like a correspondent, but we still obviously do the Powered by Wise solution as well for lots of other fintechs. But for banks, it’s much more the correspondent service that they’re looking for.

Wise’s Correspondent Services play

Daniel Webber:

Talk us through the correspondent offering you announced at Sibos and where that complements some of the other parts of the platform offering.

Roisin Levine:

For a while, Wise Platform has offered what could be termed Correspondent Services. We have a send money API, and lots of players across Europe and the world have used that. Some of the big names that people know us for powering are things like N26 and Monzo, some of the really good neobanks, and then more recently some more traditional banks like Shinhan Bank and Bank Mandiri.

The announcement at Sibos was us really listening to our customers, which in this aspect are actually more banks and FIs, so not end customers using Wise Account, and hearing them say that they love the idea of all these enhancements and using something like Wise to help their customers move money in a faster and more lower cost way.

But one of the challenges, and it’s the same for any very large financial institution, is often being able to do an integration, being able to do integration at speed and using APIs, and that often means standing up an engineering team and putting a fair amount of resource and money into something.

There is a certain way they are set up today, one where they are using Swift messages to initiate payment instructions to correspondents around the world in order to help their customers move money. What we simply have done is we’ve listened to that and said, “Right, okay, can we interpret Swift messages in that case and use that as a communication layer rather than an API in some instances?”

This is what the collaboration with Swift is all about. In some ways nothing really changes from the correspondent service that we provide. We’re still doing the local payouts and allowing customers to move money really quickly and at low cost and all those nice benefits, but it simply helps some of the larger banks work with us in a much quicker fashion with less integration effort from them. That’s something that has been really helpful.

Daniel Webber:

How do you think about the positioning of your correspondent offering, given that the platform part of the market is quite competitive?

Roisin Levine:

We always have the slight differentiator in the sense that the network that we’ve built, working on local payouts, having 60 plus licences, holding liquidity globally, being able to offer those domestic rails, is something that is somewhat unique to Wise.

All we’re really saying is, “You can collaborate, integrate with us in a way that feels quite similar to the current way that you’re set up with other correspondents. So leverage all the benefits, the ways that we can make 60% of payments instant, but you can still do that through a fairly simple config change.”

In that sense, it’s a good advantage for anyone who wants to work with us and ideally also someone who wants to get set up quickly. A new partner now can look at doing that in a much shorter timeframe than before. Whereas if you are a very big financial institution, getting something like this on your roadmap, a big API integration, requires a fair amount of planning and investment.

This is where we’ve been able to position ourselves in a good way to say, “You can get up and running, use us for some payouts and currencies,” and that way we can go to market quicker with any new partner. It’s using their language, the language they’ve always used with correspondents, rather than talking in just API terms.

Daniel Webber:

Matt, Roisin, thank you.

Matt Briers and Roisin Levine:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.