For the last 18 months, the Reserve Bank of India has been publishing data on cross-border payments from the country using credit cards, debit cards and prepaid payment instruments, including digital wallets. We dig into the data to uncover key trends.

As the world’s most populous country and a rapidly growing economy, India is quickly becoming a powerful force in retail cross-border transactions. And due to the publication of a dataset by the Reserve Bank of India, we now have the most exhaustive view into the country’s India-originating cross-border transactions by payment instrument that has ever been available.

The dataset, which has now been published monthly since November 2022, comes at a time when India’s payments system is seeing significant development. Central to this is the country’s Unified Payment Interface (UPI), an instant payment system first launched in 2016 and covers both P2P and person-to-merchant transactions. Supported by a wide range of cards and digital wallets, it has transformed the digital capabilities of India’s domestic payments system. It is also increasingly building cross-border capabilities through a broad range of partnerships, with the number of countries supporting UPI in some form now in double figures.

Given this, what does this dataset tell us about India’s division of payment instruments, including credit and debit cards and prepaid instruments (PPIs) such as cards and digital wallets, and how they are used in cross-border payments? In this report, we dig into the data to see how use is evolving.

Cards and digital wallets in India: The share of issued payment instruments

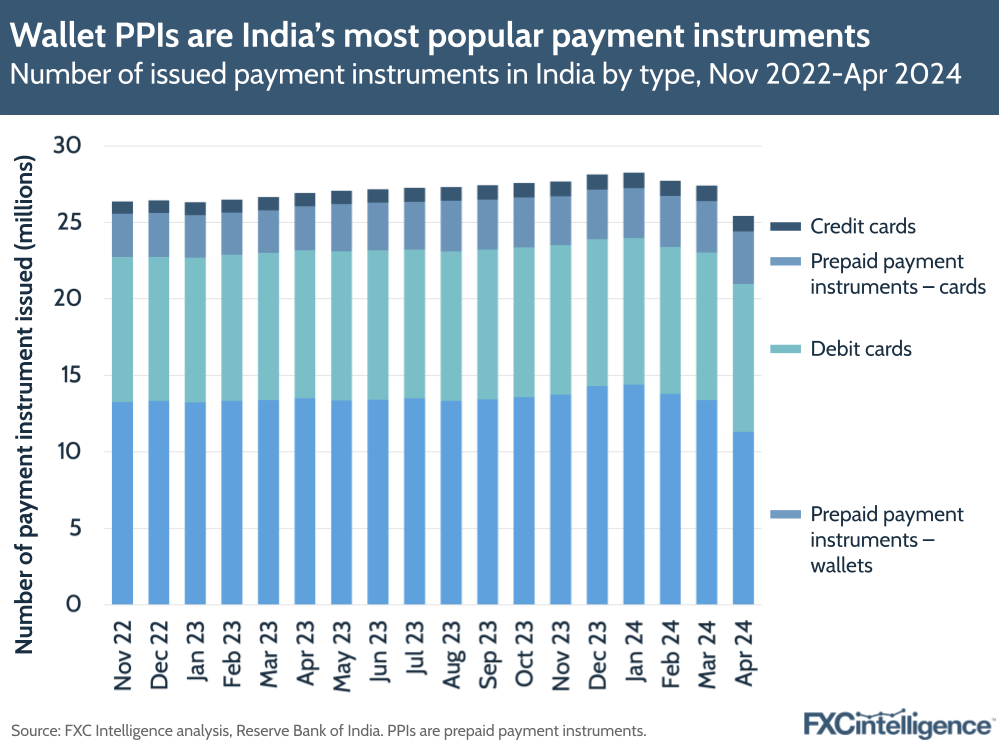

Looking at the number of payment instruments issued in India regardless of whether or not they are used cross-border, the majority (58%) are some form of PPI as of April 2024, the most recent month data is available for. Such PPIs – where the user loads the payment instrument with value to then spend – are mostly digital wallets, which accounted for 77% of PPIs, and prepaid cards, which make up the remaining 23%.

Among cards, which make up 42% of payment instruments issued in India, 10% are credit cards and 90% are debit cards.

Overall, digital wallets are the single most popular form of payment instrument, accounting for 44% of the total, followed by debit cards, which make up 38%. This is followed by prepaid cards, which account for 14%, and debit cards, which make up the remaining 4%.

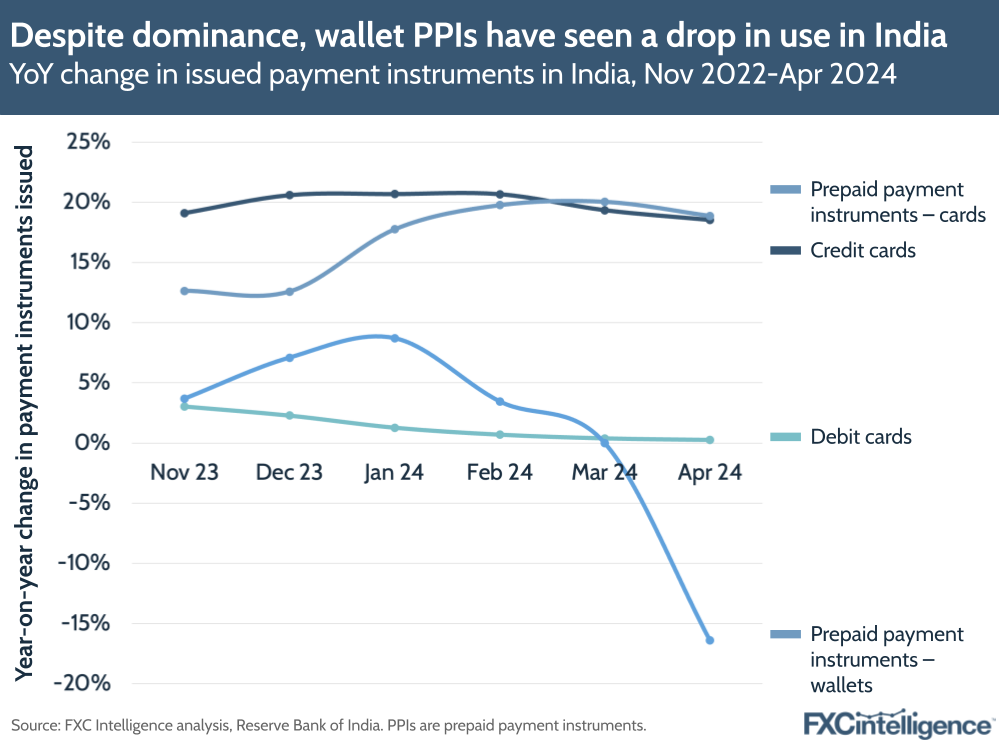

However, there are some interesting trends when it comes to year-on-year changes in numbers issued, which we can calculate for the most recent six months. Here, credit cards have led growth in almost every month, sitting around the 20% mark, and have only recently been slightly outpaced by prepaid cards.

By contrast, the number of issued debit cards has almost been flat, with signs that the limited growth in late 2023 has slowed to almost zero in Q1 2024. However, the biggest change has been in the number of issued digital wallets, which have seen a sharp decline in the most recent month. This is likely to be the result of the intervention of the Reserve Bank of India on the activities of Paytm in February 2024, which prior to this had more than 330 million users.

Cross-border flows from India over time

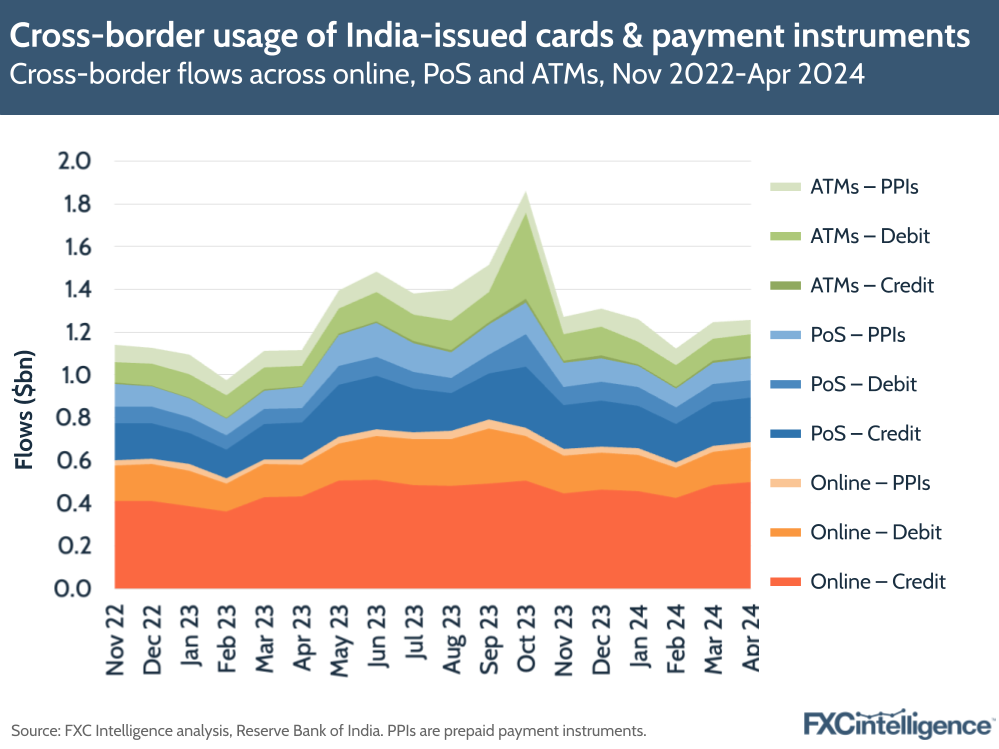

Meanwhile, cross-border flows from India using credit cards, debit cards or PPIs reached ₹10,495 crore in April 2024 – equivalent to almost $1.3bn. In the most recent 12 months, this totals a combined ₹136,785 crore, or $16.5bn.

There is evidence of some seasonality in the country’s outbound cross-border payment flows, with summer months seeing greater numbers, particularly in point-of-sale and ATM withdrawals that would require an in-person presence.

Notably, online flows accounted for more than half (55%) of all cross-border flows in April 2024, compared to point of sale’s 31% and ATM withdrawals’ 14%.

The dataset does suggest that October 2023 saw a sharp increase in cross-border flows, particularly for ATM and point of sale transactions. However, it is not immediately clear what the cause of this is. While it may be reflective of a one-off event, it is also possible that there is an issue with the data for this month.

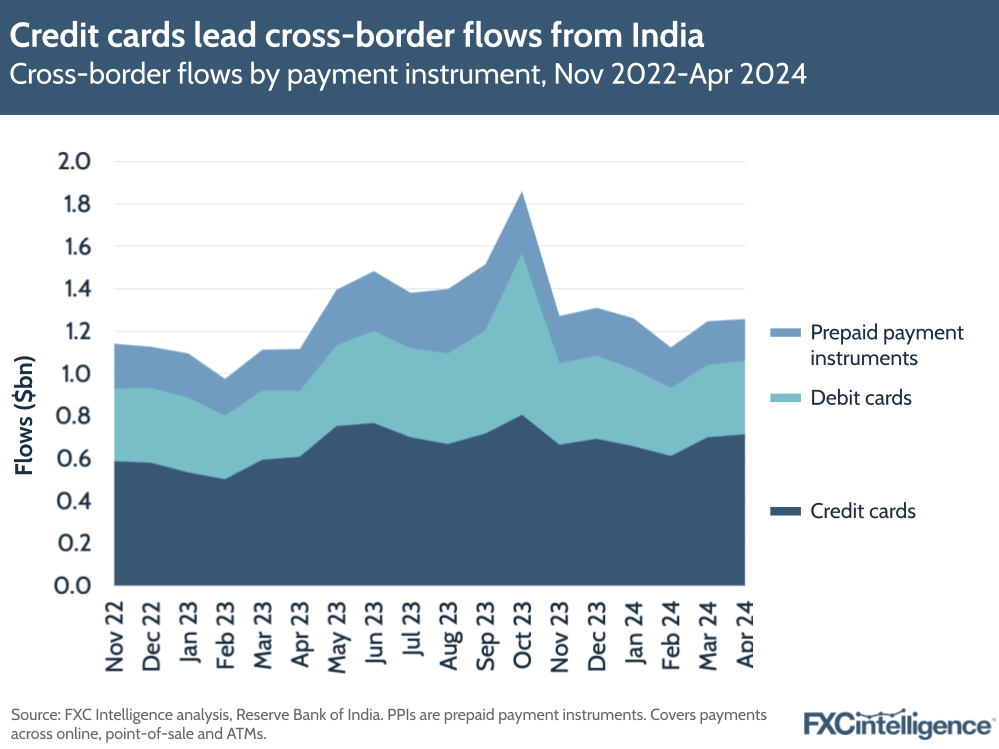

Meanwhile, credit cards accounted for 57% of flows across all channels in April 2024, despite taking the smallest share of payment instruments issued, while debit cards accounted for 28%.

PPIs, which make up the largest share of issued instruments, accounted for the smallest share of flows across all channels, at 16%.

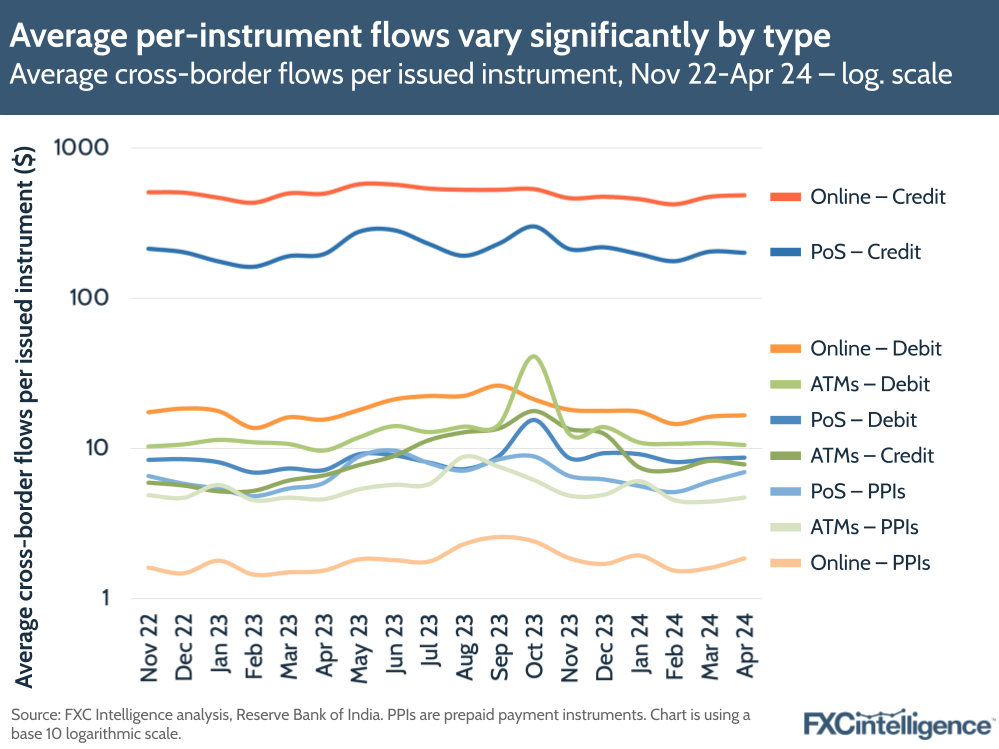

Looking at the average flows per individual payment instrument issued in India brings this into sharper focus, with such severe variation that we needed to display the data on a logarithmic scale (as shown below) in order for it all to fit onto a single chart.

Here, online use of credit cards is the clear leader in terms of flows, with each issued credit card averaging the equivalent of $485 in cross-border flows spent online in April 2024. Credit cards used in cross-border point of sale transactions are the next closest, at $201 per card issued, however after this the amounts drop dramatically.

All others are under $20, with point of sale debit cards, point of sale PPIs and all forms of ATM withdrawals under $11. Online PPIs are the smallest, at around $2 per instrument issued.

When combining all payment channels, credit cards saw by far the highest average flows per instrument issued, at a combined $694, versus debit cards’ average of $36 and PPIs’ average of $14.

Crucially, this does not indicate that the average purchase on these cards was this amount. As we outline below, most of these instruments are not used in cross-border payments at all, meaning the typical flows are considerably higher for those that are; however, it does reflect the sharp divide between different types of payment instruments and their use for cross-border payments.

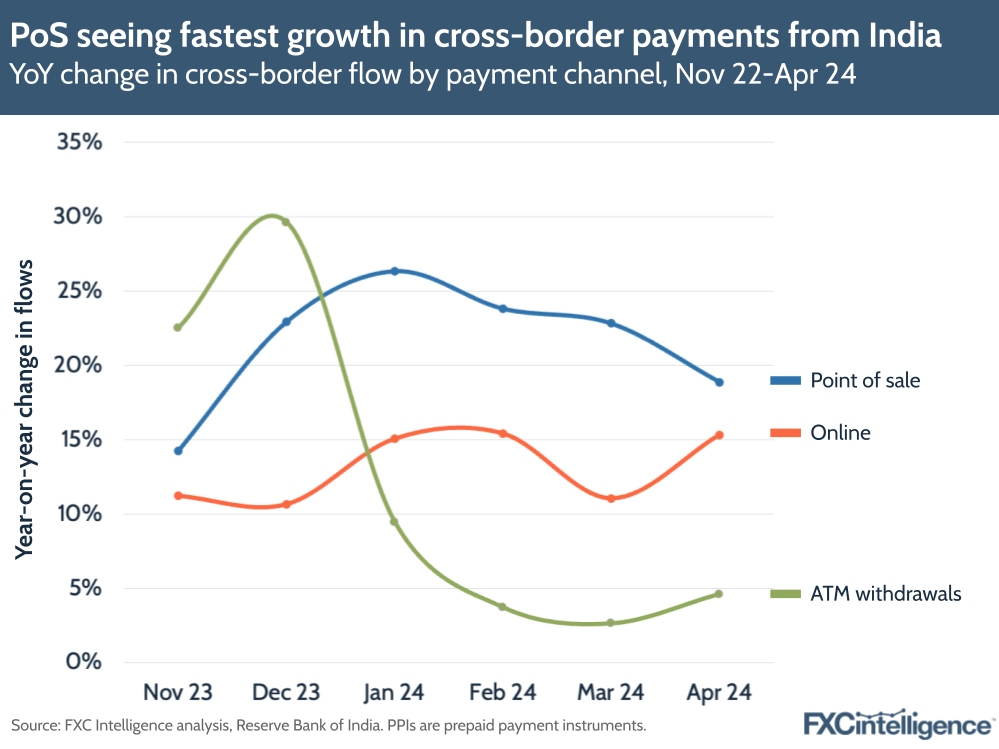

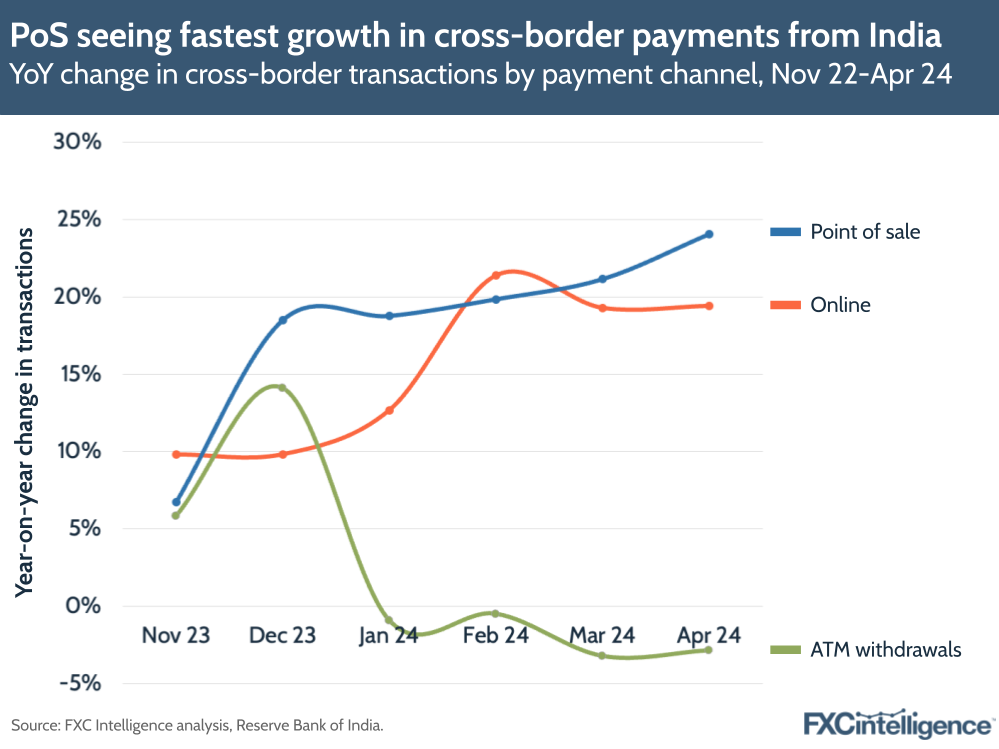

While there are differences in the flow amounts by payment instrument, there is also significant difference in growth rates when it comes to payment channels for cross-border flows. Point of sale has seen the highest rate of growth over most of the past six months, followed by online, which has consistently grown at over 10% YoY each month.

However, ATM withdrawals, while still seeing YoY increases, have had much more muted growth in recent months. While this channel had the highest growth rates in November and December 2023, in 2024 they dropped significantly, with YoY growth below 5% from February onwards.

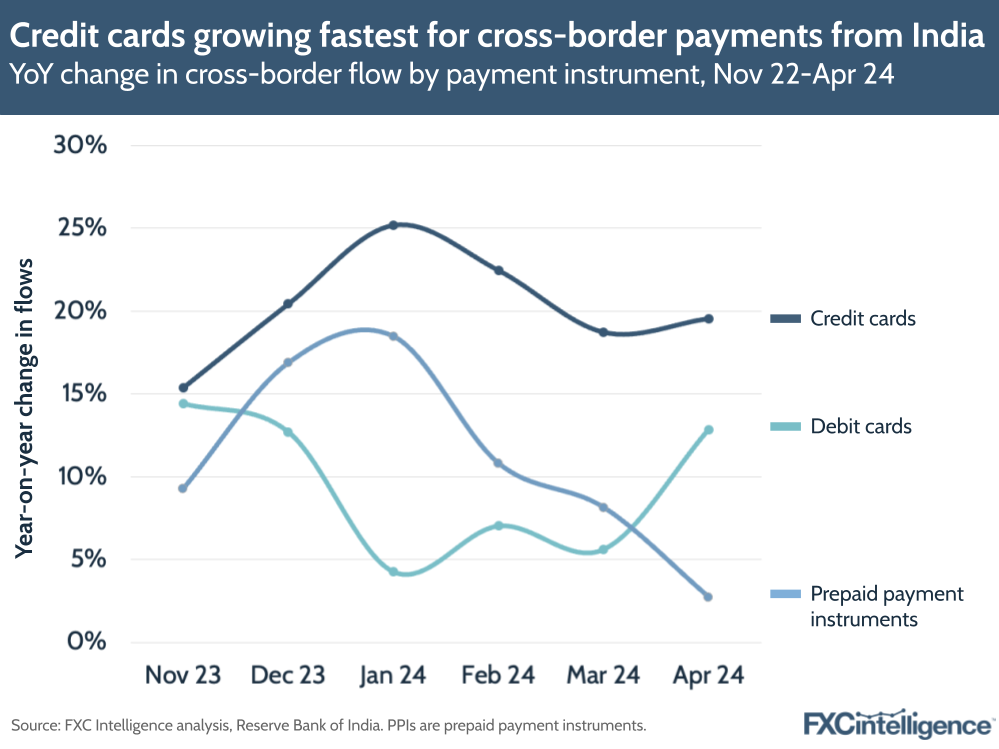

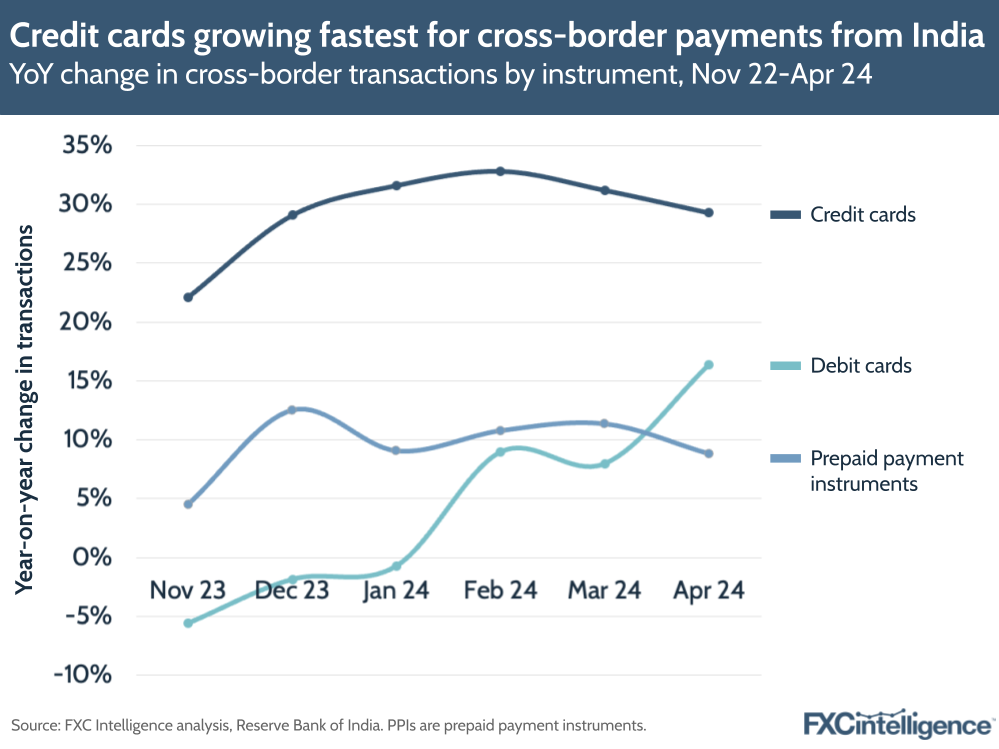

Meanwhile, credit cards have consistently seen the highest rates of YoY growth when it comes to cross-border flows by payment instrument. PPIs, on the other hand, have seen growth slow over the past few months, while debit cards have seen the pace of growth increase over the same period.

Cross-border transactions from India

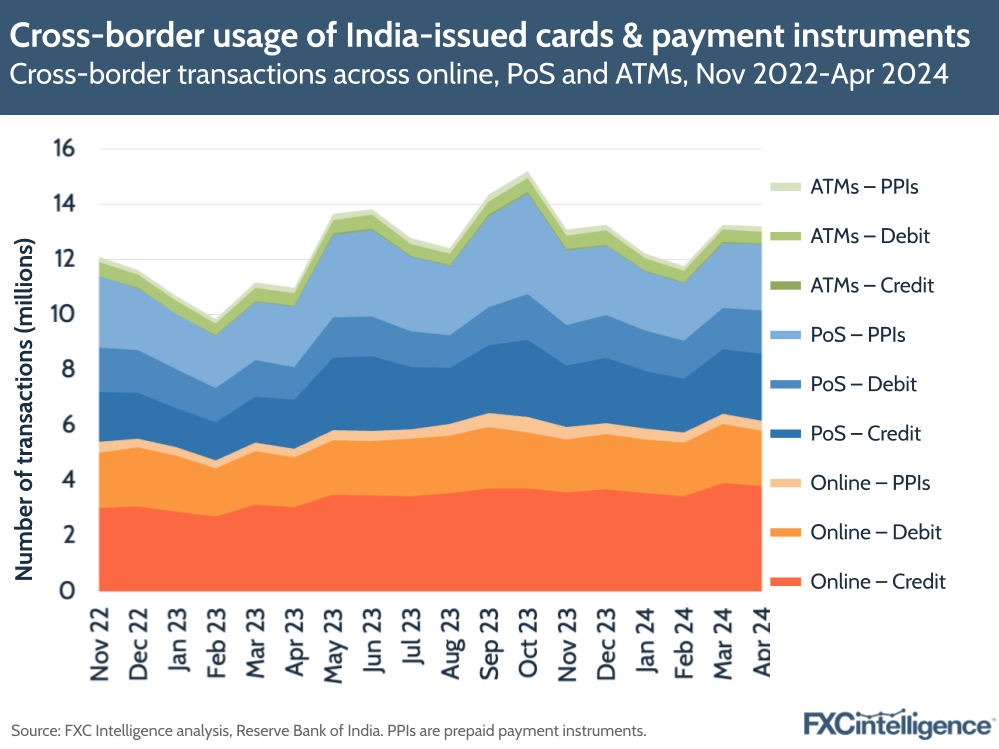

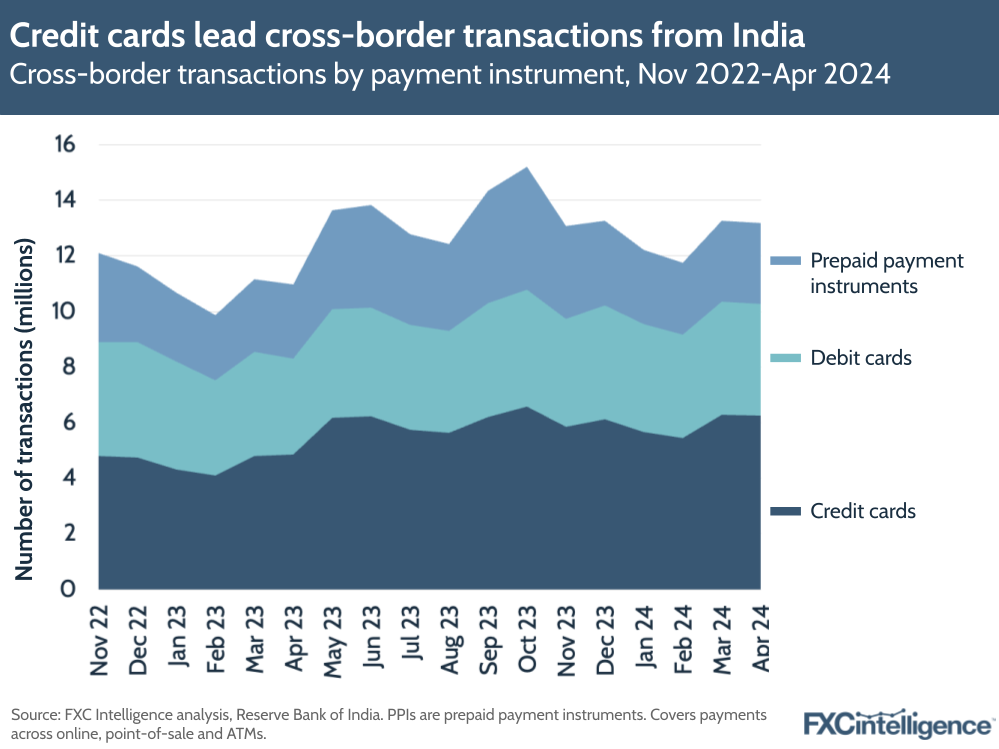

Looking at the number of cross-border transactions made across all payment channels and instruments, total transactions reached 131,880 in April 2024. Of this, the vast majority were across point of sale and online channels, which accounted for 48% and 47% respectively of all transactions, with ATM withdrawals making up the remaining 5%.

Within this, the single biggest category was online transactions using credit cards, which accounted for 29% of all transactions. PoS transactions with credit cards came in second (18%), followed by PoS transactions with PPIs (18%) and online transactions with debit cards (15%).

ATM withdrawals using credit cards accounted for the lowest share of transactions in April 2024, at 0.3%.

By payment instrument across all channels, credit cards saw the highest number of transactions. In April 2024, credit card transactions had a 47% share of the total, with debit card transactions in second at 30%. PPIs, meanwhile, had the smallest share of transactions at 22%.

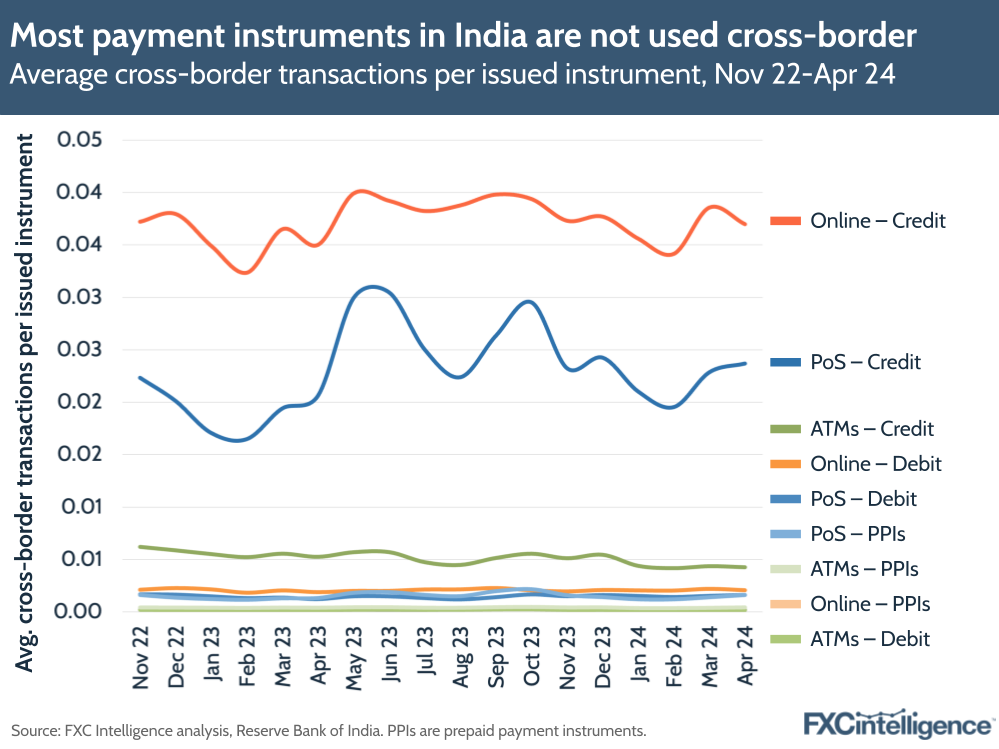

However, it was notable that when calculating the average number of transactions per individually issued payment instrument – i.e. the number of cross-border transactions each card or digital wallet issued in India was used to make in each month, the numbers across the board were significantly lower than one. This means that the vast majority of all payment instruments issued in India are not regularly used to make cross-border payments, and that a small minority are instead producing all the transactions and flows.

However, there was significant variation within this, indicating that a greater proportion of some payment instruments are used for cross-border payments than others.

In line with other metrics, credit cards saw the highest average number of transactions per instrument, at 0.06 in April 2024. By contrast, debit cards had an average of 0.004 and PPIs an average of 0.002.

Split by individual channels as well as instruments, online use of credit cards saw the highest rate of transactions, at 0.04, with PoS use of credit cards in second at 0.02.

Debit cards at ATMs had the lowest, at 0.00017, followed by PPIs online, at 0.00024.

When it comes to growth in the number of transactions, point of sale has for the most part seen the highest growth year-on-year, with this climbing every month since the start of 2024. Online has also seen high growth rates, at around 20% YoY for the past three months.

However, while ATM withdrawals saw significant growth in December, this has contracted sharply in 2024, with every month this year showing a YoY decline. This may be an indication that digital payment methods have become more accessible for cross-border transactions using India-issued payment instruments, particularly in light of increased cross-border UPI partnerships.

Looking to growth by instrument, credit cards are again seeing the highest growth in terms of transactions, with growth rates in months sitting at around 30% YoY. However, PPIs have also seen consistent positive YoY growth, albeit mostly at around 10% YoY.

Meanwhile, while debit cards ended 2023 at consistent YoY decline in terms of numbers of transactions, the instrument type has seen increased growth for the last few months.

Average transaction values for India-originating cross-border payments

Calculating average transaction values (ATVs) for each payment instrument and channel provides critical additional information.

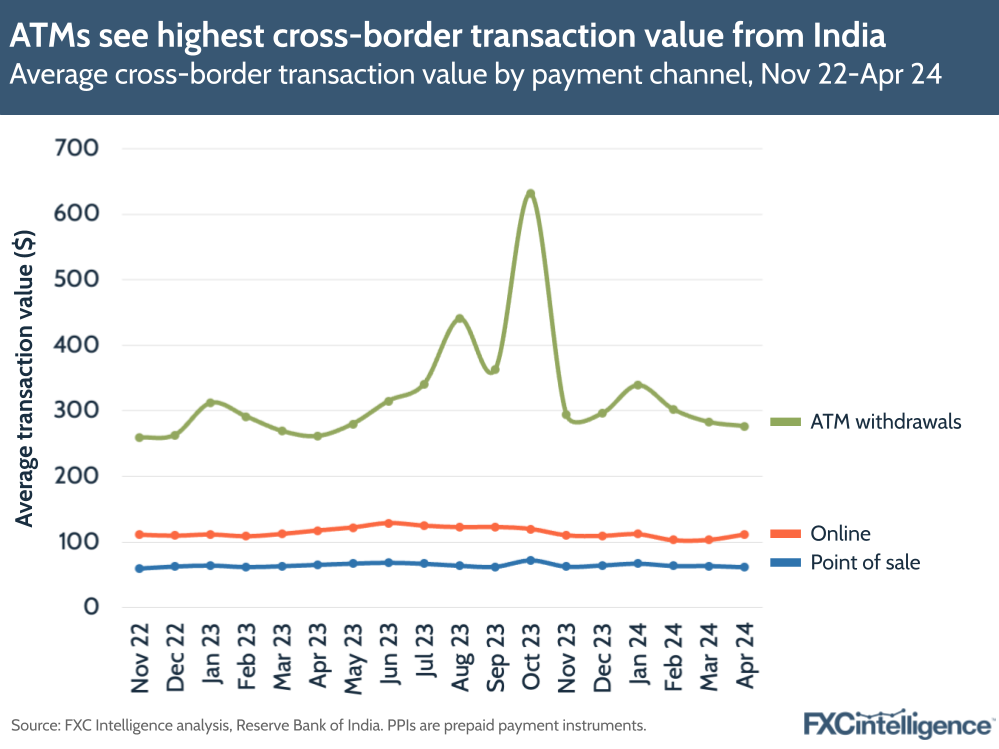

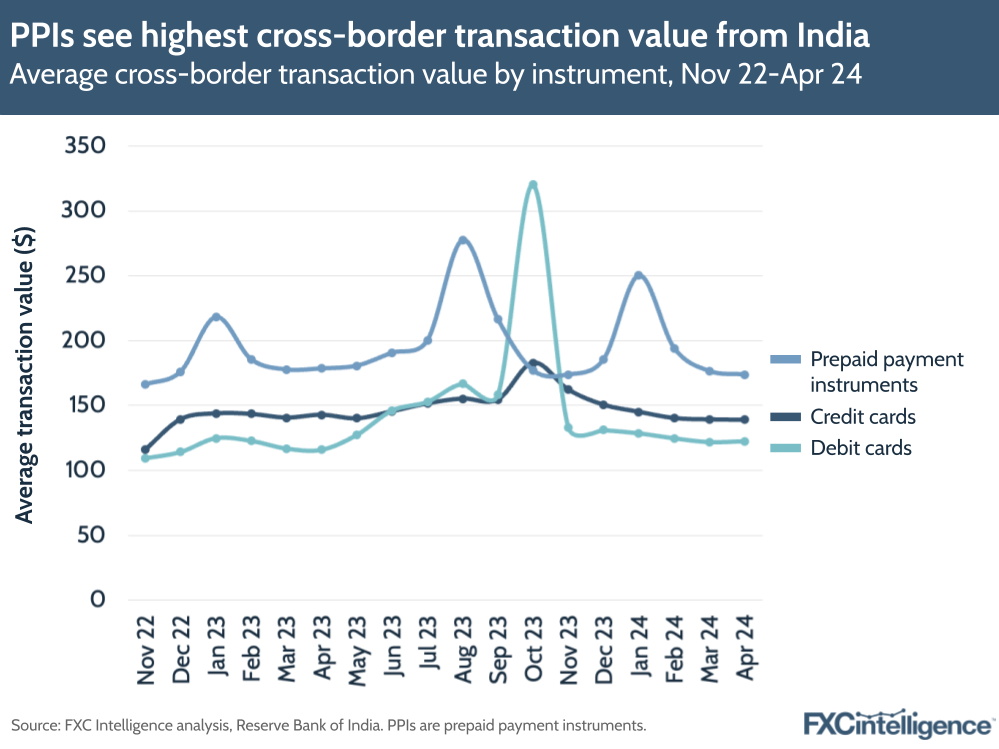

Despite making up the smallest share of flows, ATM withdrawals have by far the highest average transaction value, which in April 2024 sat at $277. There is some variation in the payment instrument used to make the ATM withdrawal, however. While PPIs lead with an ATV of $403 for ATM withdrawals, credit cards trail on $201 and debit cards are at $234.

By contrast, online ATV is $111, led by an online credit card ATV of $131, while PoS ATV is $62, led by a PoS credit card ATV of $85.

For ATV by payment instrument overall, with the exception of the anomalous October 2023 data, PPIs consistently lead, with an ATV of $174 for April 2024. By comparison, credit cards had an April 2024 ATV of $139 and debit cards saw an ATV of $122.

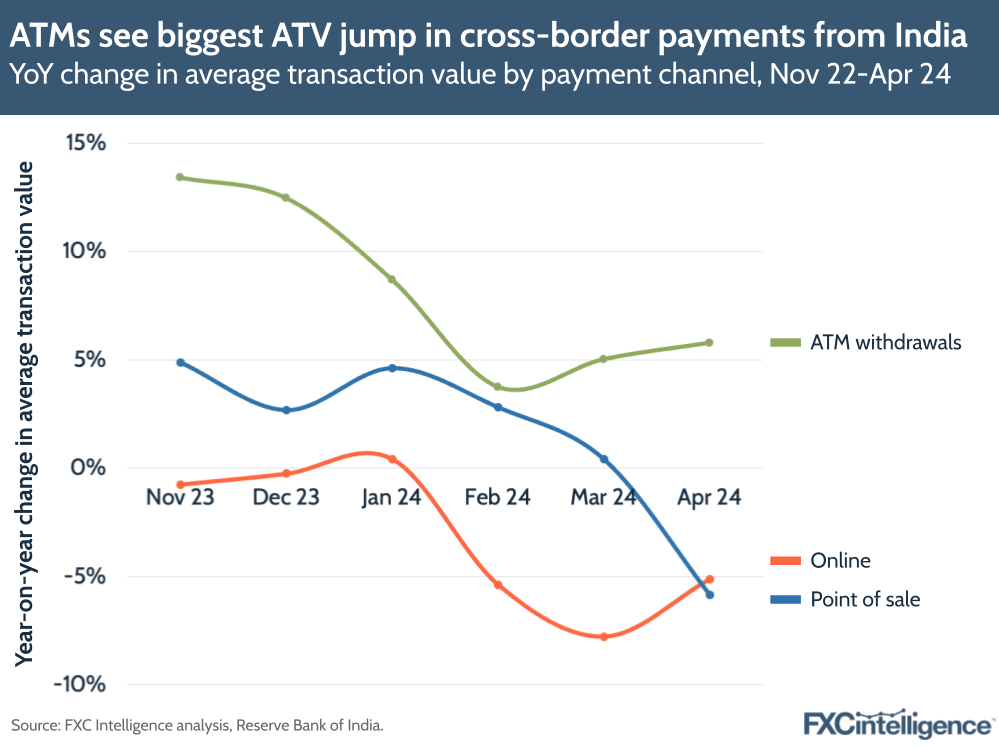

ATV has seen some interesting trends when it comes to YoY change. ATM withdrawals have seen consistent growth in ATV YoY, although this has slowed from its peaks in late 2023. By contrast, while online and point of sale both saw YoY growth in late 2023, in the last few months this has shifted to a YoY decline, particularly for online, where ATV has dropped by more than 5% YoY every month since February.

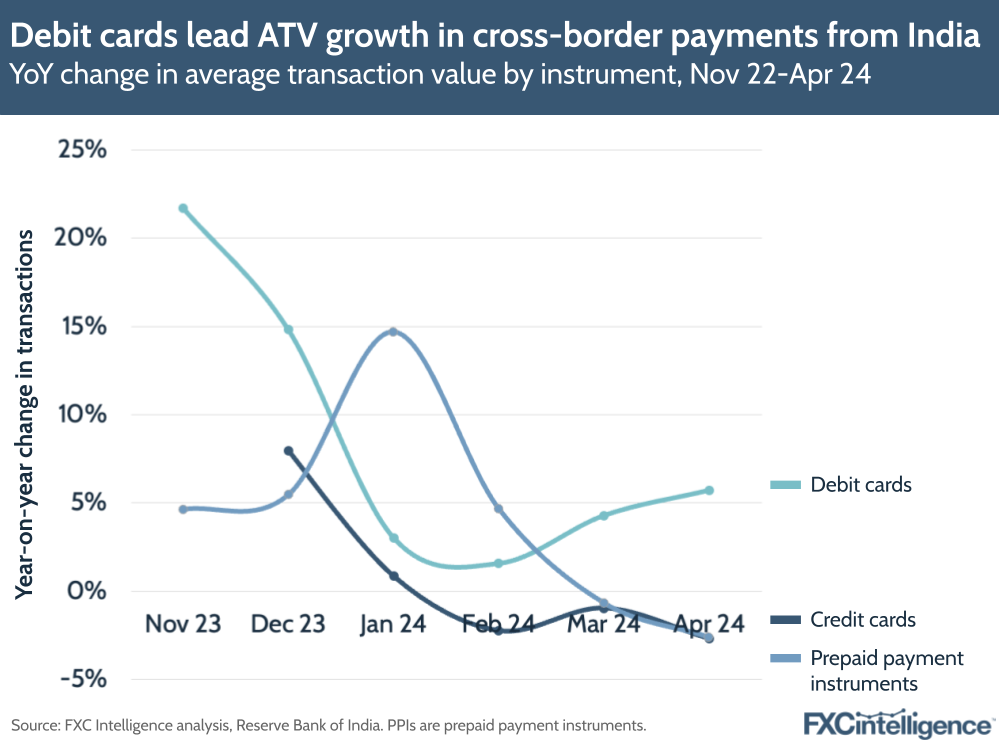

There are similar growth trends by payment instrument. Debit cards are still growing, but not at the rate they were in late 2023, while credit cards and PPIs have both seen ATV growth drop into the negative in the last few months.

There is notable variation between specific payment instrument and channel pairs. In April 2024, ATM withdrawals using debit cards were the only pair to see double-digit YoY growth in ATV, at 13%, while ATM withdrawals using credit cards were the only other pair to see growth in that month, at 5%.

All others contracted in April, with PoS payments using credit cards and debit cards seeing the biggest declines, at -11% and -9% respectively. Online also saw drops across all instrument types, with online PPIs and online credit cards both seeing -8% YoY growth in ATV, while online debit cards saw -3% growth.

Key takeaways and future developments

It’s clear that personal cross-border transactions using a card or digital wallet remain the activity of a minority of people in India, who are likely to skew wealthier than the general population.

The use of credit cards in cross-border transactions in particular is significantly higher relative to the number issued, and they are at present the leading payment instrument for all forms of cross-border payment. They are particular popular for online transactions, accounting for 73% of flows in April 2024, while for point of sale they account for 52% of flows. ATMs are the only channel where they do not dominate, accounting for 6% of transactions.

However, a rise in debit cards, both in terms of use and transaction value, is interesting. This may indicate a greater use of the payment instrument, but may also speak to a change in who is making cross-border payments, suggesting that a broader range of people are beginning to make purchases abroad.

Meanwhile, the use of prepaid payment instruments, particularly digital wallets, remains limited cross-border relative to their widespread use domestically, although the closure of large numbers of accounts earlier in the year warps the data and is likely to prove to be a blip in broader trends occurring over too long a timescale to be clear in 18 months-worth of data.

Over time, we can expect the impact of UPI and other changes to India’s payment landscape to continue to shape trends in cross-border payments, and a longer period of data is likely to unearth greater shifts in how Indians are using their cards and digital wallets abroad.

Some of the trends around credit card use, which generally attract greater average transaction values across most payment channels, will also pose some interesting questions in the long term, and may reflect the wider financial landscape in India.

It is likely that as time develops, the number of transactions will increase, as more people travel or otherwise make purchases internationally. As a result of this, it is likely that the number of flows and transactions per issued instrument are going to increase. With such a small percentage currently being used internationally, there is significant room for growth here.

Following this, we would also expect the average transaction values to increase, resulting in a bigger climb in overall flows. With so many issued instruments, and the country seeing ongoing growth, India’s total market for card and digital wallet-based cross-border payments is only at a small percentage of where it can ultimately grow to.