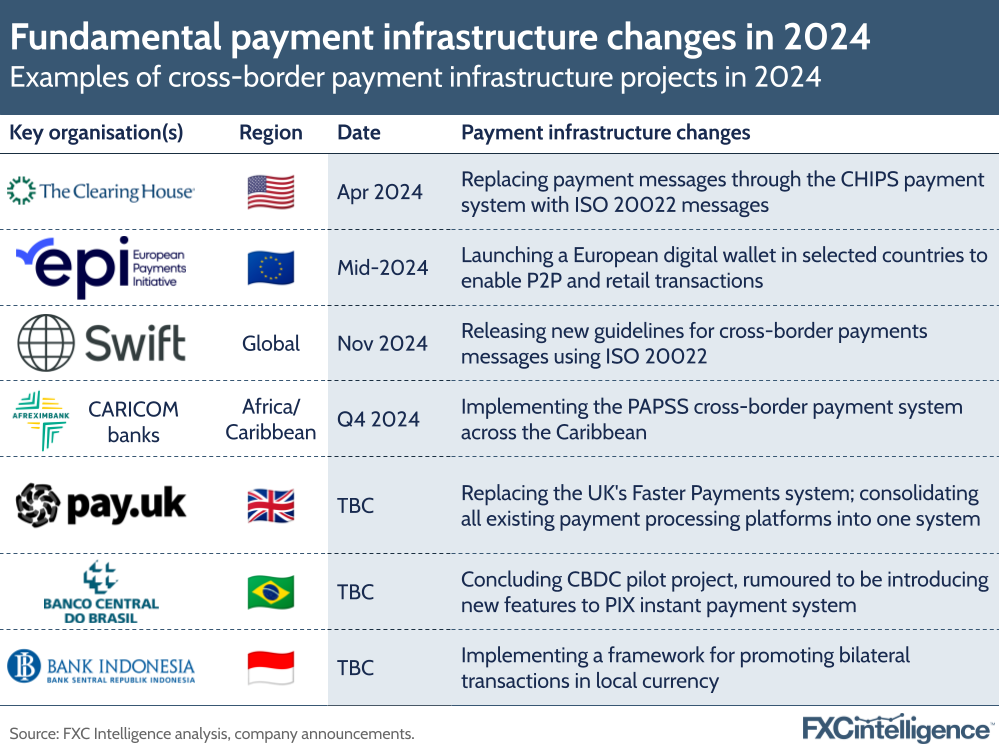

Payment infrastructure – the networks instituted by financial organisations to enable money movement worldwide, also referred to as payment rails – are continuing to evolve in 2024. From launching new consumer-friendly solutions to central bank digital currencies (CBDCs), the graphic below shows how a number of national payment rails are changing in 2024.

In 2024, financial organisations are adding new products and features that tie in with growing fintech trends. For example, the European Payments Initiative (EPI) aims to deliver ‘wero’ – a digital wallet for P2P and retail payments that the EPI hopes will form part of a pan-European payment system. The European Central Bank-backed initiative is gearing up to officially launch wero in Belgium, France and Germany in 2024, with more countries pending.

This year is also set to see further moves to link up payment infrastructure across borders to drive trade, support financial inclusion and also move away from a reliance on the US dollar. For example, the Pan-African Payment and Settlement System (PAPSS) speeds up cross-border payments in Africa by eliminating the need to send local currencies abroad for currency conversion. Developed by African Export–Import Bank, PAPSS has been selected by governors from all 11 central banks in the Caribbean as their preferred system for processing intra-regional payments.

Furthermore, as we found in 2023, the move towards CBDCs continues to heat up, with speculation that Brazil and India could both launch their digital currencies (the Drex and the Digital Rupee, respectively) this year. Several countries have already launched CBDCs, including Nigeria, Jamaica and a number of Caribbean countries, while around 20 countries are currently in the pilot stage, according to the Atlantic Council’s CBDC tracker.

Beyond new digital currencies, some payment infrastructure are upgrading legacy systems by implementing ISO 20022 payment messages. ISO 20022-compliant messages will allow financial institutions in the participating payment infrastructure to benefit from richer data, more transparency about where payments are coming from and more efficient processing.

This is the case with CHIPS – the US-based clearing and settlement system for high-value payments – which delayed its ISO implementation from November 2023 to April 2024. Meanwhile, the UK is upgrading its longstanding instant payment infrastructure, Faster Payments, with a new ISO 20022-compliant system known as the New Payments Architecture.

Which parts of the cross-border payments market are growing fastest?